Overview

Korea is a country with intense, demanding, and eager consumers. Also, Korea’s retail sector is popular among tourists visiting Korea every year. Although the number decreased due to Covid 19 in 2020, it has rebounded since 2022 as Covid restrictions have been lifted. U.S. companies wanting to sell into this market should endeavor to follow these guidelines:

• Adapt company products and procedures to Korean tastes and conditions.

• Communicate regularly with both your Korean business partner and customers.

• Exhibit a consistent, firm, and long-term commitment to the Korean market.

• Work at building long-term relationships.

• Augment the efforts of your local representative by visiting Korea frequently.

• Invite Korean representatives back to the home office periodically to ensure they are fully informed, motivated, and current on your company and its offerings.

• To the extent possible, allow the distributor/agent to select from all the U.S. company’s product lines, as not all products may be marketable in the Korean market.

• To the extent possible, consider utilizing an exclusive distributor for the entire Korean market in order to prevent price competition between distributors. This can lead to damaging profitability and disputes between distributors.

• Hold demonstrations, seminars, and exhibitions of products in Korea.

• Increase the distribution of technical data and descriptive brochures.

• Assist local representatives with follow-up on sales leads.

Trade Promotion and Advertising

The U.S. Government’s primary trade promotion agency in South Korea is the U.S. Commercial Service. Located within the U.S. Embassy in Seoul, it is an agency of the U.S. Department of Commerce, International Trade Administration. Please consult our website for more information on the services we provide. (https://www.trade.gov/south-korea)

In Korea, Commercial Service works with numerous trading and commercial entities, including:

• The Korea International Trade Association (KITA): KITA organizes overseas trade missions, conducts market surveys, assists potential foreign buyers or sellers, and offers consultation and personalized advisory services regarding trade rules and regulations, export and import procedures, business management, market research, technology development, and taxation. KITA has three offices in the U.S. (Washington, DC, and New York) and seven offices in other countries.

• The Korean Chamber of Commerce and Industry (KCCI): KCCI is Korea’s most prominent private economic organization, with 73 regional chambers and approximately 180,000 members. Since its establishment in 1884, KCCI has contributed to the growth and development of the national economy and the enhancement of Korea’s status in the international community.

• The Korean Importers Association (KOIMA): KOIMA is Korea’s primary import association and represents over 8,500 businesses.

Korea hosts many trade shows and exhibitions each year. Historically, many of these shows are highly focused on B2C activities and, thus, have not been attractive to U.S. firms interested in meeting qualified companies, versus end-users. The following trade facilities and event schedules may be of interest to U.S. firms:

• COEX: Korea’s largest full-service trade show organization has 36,027 square meters of exhibition space. Hundreds of shows (B2B and B2C) are held throughout the year. (https://www.coexcenter.com/)

• SETEC: The Seoul Trade Exhibition Center is operated by the Korea Trade-Investment Promotion Agency (KOTRA). (https://www.setec.or.kr/front/index.do#firstPage)

• KINTEX: Located in Ilsan, Gyeonggi-do, near Seoul, KINTEX has the largest exhibition space in Korea, with 108,566 square meters. (https://www.kintex.com/web/en/index.do)

• BEXCO: Located in Busan, the second largest city of Korea located southeast of the peninsula, BEXCO holds dozens of B2C and B2B national exhibitions and features 26,446 square meters of exhibition space. (https://www.bexco.co.kr/eng/Main.do)

Commercial Service works closely with the American Chamber of Commerce to support U.S. companies.

• American Chamber of Commerce (AMCHAM): Based in Seoul, AMCHAM provides strong support for U.S.-based companies (and some Korean companies with significant interests in the U.S. market) doing business in Korea via seminars, advocacy, and meetings with important U.S. and Korean government officials. (https://www.amchamkorea.org)

Below are some services Commercial Service also provides.

• Provide online advertisement on our trade.gov website for exporters (Featured U.S. Exporters – FUSE) and service providers (Business Service Providers – BSP).

• Conduct promotional services for single U.S. companies (Single Company Promotion – SCP)

Advertising

A geographically small country, Korea is an exciting place to launch effective, sophisticated, state-of-the-art advertising. Korean advertisers are highly creative and utilize a host of media to capture consumer attention.

Particular aspects of Korea’s advertising market include the following:

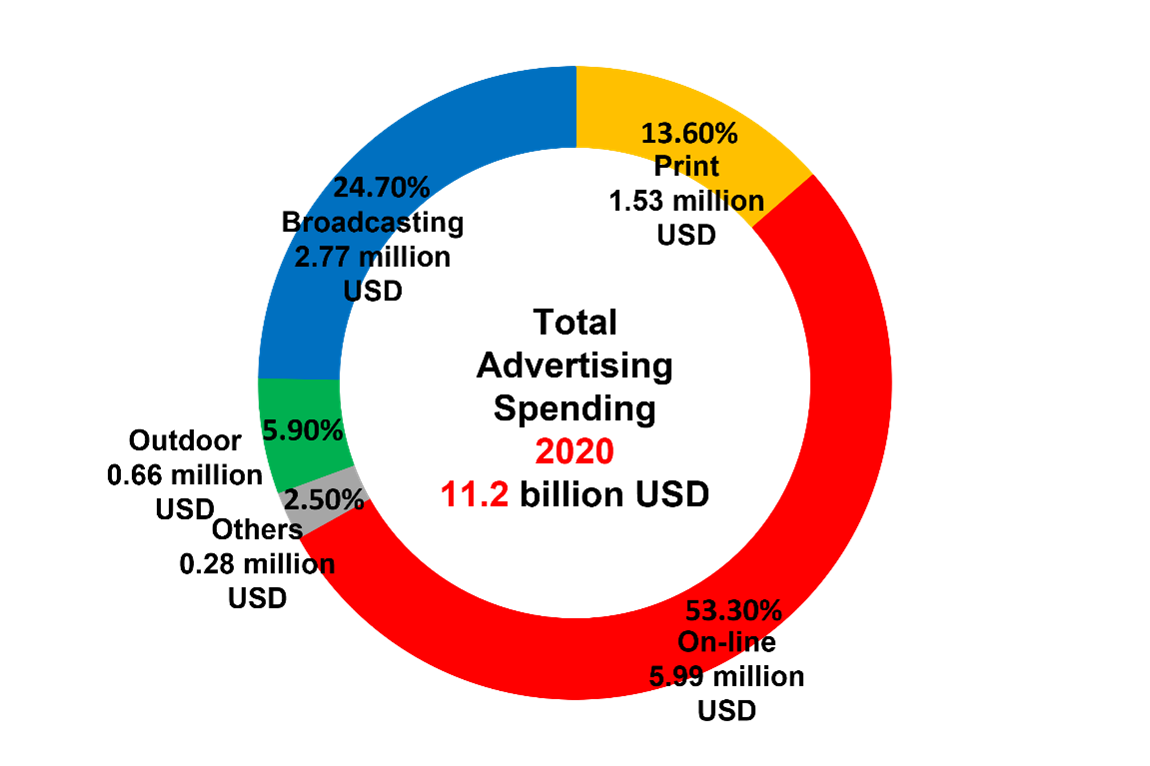

• The total spending on advertisements in South Korea in 2020 was approximately $11.2 billion, marking a 2.1% decrease from 2019. The broadcasting advertising spending, viewed as traditional media, decreased 7.6%, when compared to the previous year, and has shown a continuous decline since 2016. On the other hand, online advertising continues to show remarkable growth, with an increase of 15.4% when compared to the previous year, due to the growth of mobile advertising.

(Source: Korea Advertising Expenditure Research, December 2021 by Korea Broadcast Advertising Corporation / Ministry of Science and ICT)

• More than 80 mega-LED screens strategically pepper commercial areas (in Seoul and other cities) with 24/7 promotions. Monthly advertising opportunities exist.

• Thousands of excellent promotional sites at/in Korea’s well-used bus stops, subway stations, railways, and airports should be considered by U.S. firms.

• The presence of over 3,200 foreign (to include all major ad agencies) and Korean advertising agencies. Foreign equity participation is permitted at 100 percent.

Hundreds of TV and radio stations, including:

• KBS I, KBS II: TV and radio stations owned/operated by the Korean government

• MBC, SBS: Independently operated, but with ROK government influence

Consult: https://www.kobaco.co.kr/site/eng/home

Comprehensive Programming Channels:

Launched on December 1, 2011, four new nationwide networks supplement existing conventional free-to-air TV networks like KBS, MBC, SBS, and other smaller channels. Unlike land-based television channels, new comprehensive programming channels can broadcast for 24 hours and commercial breaks are allowed. In Korea, over 90 percent of the population watches cable or satellite TV, so the influence of these comprehensive programming channels is strong.

Channel A www.ichannela.com is managed by Dong-A Media Group. The Dong-A Media Group consists of twelve affiliate companies, including Dong-A Ilbo, the leading newspaper in Korea since 1920.

TV Chosun, also known as Chosun Broadcasting Company, is owned by the Chosun Ilbo-led consortium. Chosun Ilbo is one of the major newspapers in South Korea, with a daily circulation of over 2,200,000.

JTBC is managed by the JoongAng Media Network. JoongAng Ilbo is one of the major newspapers in South Korea.

MBN, also known as Maeil Broadcasting, Inc., is owned by Maeil Business Newspaper. MBN was formerly a news channel, between 1993 and 2011. It transitioned to a general programming cable TV channel after 17 years of operation.

• The Korea Advertising Review Board (KARB) is responsible for advertising regulation & compliance.

• The Korean Fair Trade Commission (KFTC) assures accuracy in advertisement.

• Korean Cable TV Association (KCTA).

• The Korean cable TV industry serves 34 million subscribers, with 99 system operators offering over 200 programs. Korea Digital Broadcasting (KDB), a subsidiary of Korea Telecom (KT) broadcasts more than 150 satellite channels to over 93 percent of the households.

• There are seven leading shopping channels in Korea: GS, Hyundai, CJ, Lotte, Shinsegae, NS and Home & Shopping. In 2020, Korea’s market scale of the home shopping industry reached USD 18.3 billion.

Pricing

In Korea’s export-driven economy, price competitiveness is a key factor. Korean manufacturers try to purchase lower-priced, quality raw materials or equipment.

Korean buyers generally consider U.S. goods:

• Have an overall good reputation.

• Are of high quality and good performance.

• Are relatively expensive, especially because of shipping and other logistical costs.

• According to the Korean Act on Consumers, consumer items are required to be labeled with the following (with specifics varying among products):

• Denomination, use, ingredients, material quality, performance, size, price, capacity, permitted number of goods, and contents of services.

• Name (including address and telephone number) of the enterprise that has manufactured, imported, sold or provided goods, etc., and the origin of the goods.

• Method of use, caution, and warning in use and keeping.

• Date of manufacture, quality guarantee period or, in the case of goods such as foods, medicine, etc., which are apt to be altered during distribution, the validity period of such goods,

• Dimension, location, and method of indication, and Organization (including its address and telephone number) and method of settlement for any complaint on goods etc., or any consumer’s damage due to goods, etc.

A 10 percent value-added tax (VAT) is included on services and products.

Commissions in Korea are dependent upon the type of product and the transaction amount. For larger contracts, commissions generally decline as the contract value for a major purchase/acquisition/contract increases.

Sales Service and Customer Support

Considered secondary to product and price considerations, after-sales service in Korea by foreign suppliers is often found lacking. After-sales service and customer support by Korea’s big conglomerates, such as Samsung and LG, are often better than global enterprises or international SMEs. Korean consumers are very demanding in terms of customer support. After-sales service and customer service in general should be managed closely, especially given the competition of third countries in this market. Servicing is/should be an important component of the “sale.”

The best approaches for after-sales service and customer support include:

• Resident or offshore engineers (Japan or Taiwan) working with local engineers; service contracts should be considered.

• Establishing a regional servicing facility that can effectively service and support equipment sold in Korea.

• Training service and customer service personnel via U.S.-based programs.

Local Professional Services

Korea has a highly developed economy with a full range of professional services:

• Law firms: https://uscskorea.wixsite.com/businessservice/law-firms

• Major accounting companies: https://uscskorea.wixsite.com/businessservice/accounting-firms

• The “Featured U.S. Exporters” (FUSE) site provides information on how to advertise products on our worldwide website in various languages for a small fee. Visit https://www.trade.gov/all-services for more information.

Principal Business Associations

• For principal business associations in Korea, please see the link below:

https://www.trade.gov/south-korea-useful-links

Limitations on Selling U.S. Products and Services

It can be challenging to understand and comply with U.S. and foreign regulations for your international sales. Some products require an Export License before shipping. Countries have product standards that have to be met, and there are a few countries that you cannot sell to. There are also considerations when shipping to U.S. free trade agreement countries. These resources introduce you to compliance issues and useful tools to protect your business. Get the basics before you ship your product. https://www.trade.gov/comply-us-and-foreign-regulations

With the signing of the U.S.-Korea Free Trade Agreement in 2012, in general, U.S. companies will not face formal limitations. However, there are special circumstances where formal or informal limitations may exist. For additional information, please contact a Commercial Specialist from the U.S. Commercial Service in Seoul: https://www.trade.gov/south-korea-contact-us.