ITA CODE: PR REQ

Overview

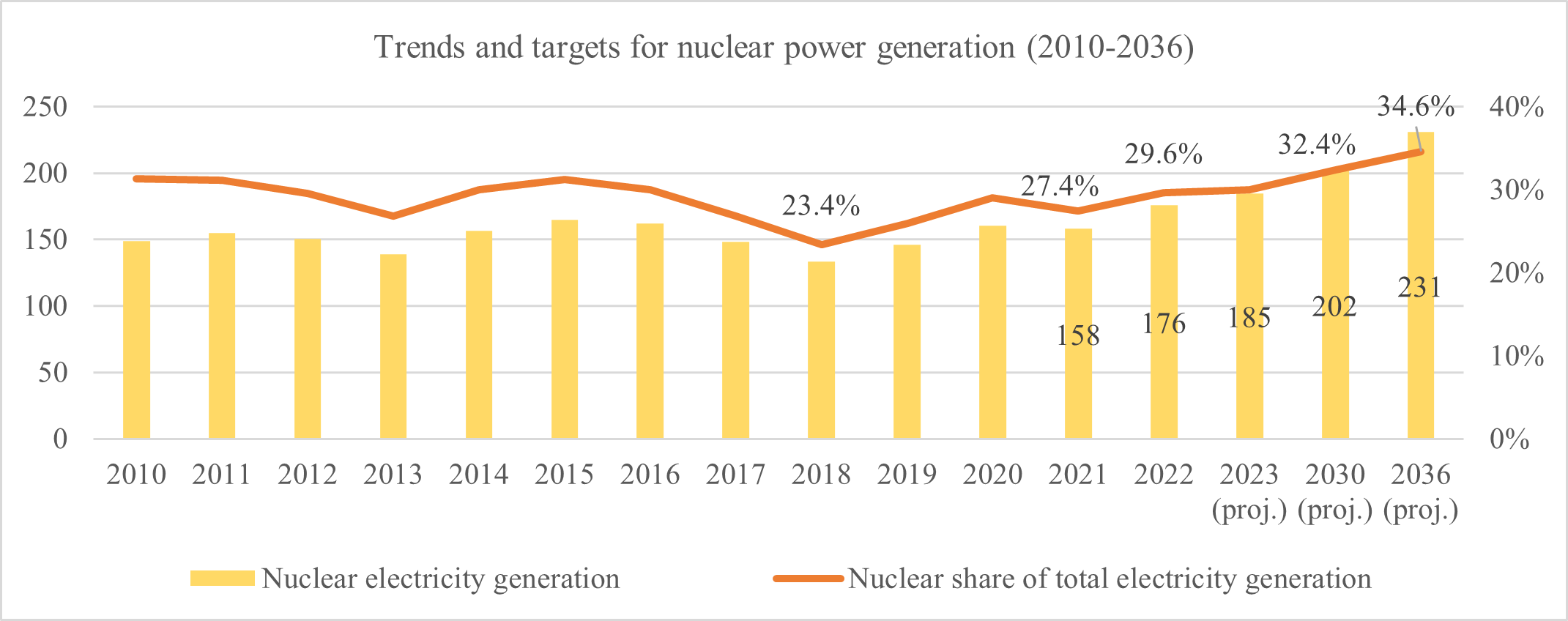

Korea ranked the world’s seventh-largest energy-consuming nation in 2022 reaching annual electricity consumption of 547.9TWh, an increase of 2.7% from the previous year due to the prevalence of emission-intensive industrial sectors according to the U.S. Energy Information Administration (EIA). Korea has actively pursued concrete efforts to achieve carbon neutrality, including converting aging coal power plants to LNG power plants, and changing key industries with high greenhouse gas emissions to low-carbon structures. The Korean government (the Ministry of Trade, Industry and Energy: MOTIE) established the 3rd Energy Master Plan in June 2019, the country’s top-level energy policy which contains mid- to long-term energy policy goals and plans for each energy source for the next 20 years under the Korea’s legislative framework for tackling emissions reduction target known as the Framework Act on Low Carbon, Green Growth. The master plan’s objective is to reduce Korea’s total energy consumption by 14.4% by 2030, 17.2% by 2035, and 18.6% by 2040 below the projected business-as-usual (BAU) level. In October 2021, Korea announced its revised Nationally Defined Contribution (NDC) at the UN Climate Change Conference in Glasgow (COP26) which includes plans to reduce its carbon emissions by 40% by 2030 from 2018 levels. As one of the sub-plans to support the master plan and achieve NDC goals, the government announced the 10th Basic Plan on Electricity Supply and Demand in January 2023 a 15-year mid- to long-term plan that includes the basic direction of electricity supply and demand, long-term prospects of electric supply and demand, planning of power facilities, and management of power demand. Under the scheme, the percentage shares of power generation mix by energy source should be nuclear power 32.4%, coal 19.7%, LNG 22.5%, renewable energy 21.6%, hydrogen and ammonia 2.1% by 2030. However, the Korean government aims to further expand the utilization of both nuclear power and renewable power generation by 2036. Accordingly, the proportion of coal and LNG power generation is expected to decrease significantly compared to 2030.

| Nuclear | Coal | LNG | Renewable (PV & wind) | Hydrogen/ ammonia | Others | Total |

2018 (act.) | 133.5 | 239.0 | 152.9 | 35.6 | 0.0 | 9.7 | 570.7 |

23.4% | 41.9% | 26.8% | 6.2% | 0.0% | 1.7% | 100.0% | |

2021 (act.) | 158.0 | 198.0 | 168.4 | 43.1 | 0.7 | 9.4 | 577.5 |

27.4% | 34.3% | 29.2% | 7.5% | 0.1% | 1.6% | 100.0% | |

2022 (act.) | 176.1 | 193.2 | 163.6 | 53.2 | 0.9 | 8.4 | 595.3 |

29.6% | 32.5% | 27.5% | 8.9% | 0.1% | 1.4% | 100.0% | |

2023 (Proj.) | 188.3 | 196.4 | 150.0 | 59.6 | n/a | 5.3 | 599.6 |

31.4% | 32.8% | 25.0% | 9.9% | n/a | 0.9% | 100.0% | |

2030 (Energy mix target per the 10th Basic Plan on Electricity Supply and Demand) | 201.7 | 122.5 | 142.4 | 134.1 | 13 | 8.1 | 621.8 |

32.40% | 19.70% | 22.90% | 21.60% | 2.10% | 1.30% | 100% | |

2036 (Energy mix target per the 10th Basic Plan on Electricity Supply and Demand) | 230.7 | 95.9 | 62.3 | 204.4 | 47.4 | 26.6 | 667.3 |

34.60% | 14.40% | 9.30% | 30.60% | 7.10% | 4.00% | 100% |

Source: The 10th Basic Plan on Electricity Supply and Demand, Ministry of Trade, Industry and Energy (MOTIE) and 2023 Korea Energy Demand Outlook, Korea Energy Economics Institute (KEEI)

(Note: The volume of electricity generated by private individual generators, which is estimated at 30 TWh annually, is not included.)

The government is also considering a major overhaul of the electricity trading market system. Most of the electricity generated from nuclear power, coal, LNG, and renewable energy has been traded in a single electricity bidding pool operated by the Korea Power Exchange (KPX) with Korea Electric Power Corporation (KEPCO) as a single purchasing entity, and the trading price of electricity was determined based on the logic of supply and demand. However, under this market reform, a certain volume of electricity generated by baseload energy sources such as nuclear power, coal, and low-carbon energy sources such as gray and blue hydrogen and ESS are planned to be traded through a separate bidding transaction market.

MOTIE also proposed a policy reform of the current electricity trade pricing system. In the Cost Based Pool (CBP), which Korea has implemented since 2001, the KPX conducts a cost evaluation based on fuel costs and fixed costs for each power plant and then purchases electricity at a price equal to a most expensive variable cost of a power plant that is the System Marginal Price (SMP). The CBP method is a unique competition method based on the production and fixed costs of each power generation company. However, under current market conditions in which the participation of private power generation companies is expanding and the supply of renewable energy is increasing, the ROK government is expected to gradually convert the current cost-based transaction system to a price-bid system (a.k.a. Price Bidding Pool: PBP) in which power generation companies autonomously set bidding prices based on their cost factors. However, some industry experts predict that this price-oriented bidding policy will have a negative impact such as deteriorating profitability of private power generation companies as it induces fierce bidding competition.

In conclusion, the key point of the new energy scheme is 1) that the proportion of coal and LNG power generation will change compared to the existing plan as the proportion of nuclear and renewable power generation significantly increases and 2) that the reforms in the electricity trading market will be headed in a direction unfavorable to private power generation companies due to intensifying competitions.

Nuclear

Korea has 25 nuclear reactors with generating capacity of 24.7GWh with its reliance on atomic energy accounting for approximately 29.6% of its electricity generation. This is 6th in the world after the U.S. (92 reactors, 94.7GWh), France (56, 61.4GWh), China (55, 52.2GWh), Russia (37, 27.7GWh), Japan (33, 31.7GWh).

The volume of electricity from nuclear power generation increased by 12.3% in 2022 compared to the previous year, without a change in facility capacity. The operator of Korea’s nuclear power plants, Korea Hydro & Nuclear Power (KHNP) had tightened their safety inspection guidelines so that the utilization rate of nuclear power plant facilities has remained in the 70% range over the past five years. However, the rate recovered and rose to the mid-80% in the first half of 2022.

The energy scheme of the previous Moon government administration outlined nuclear energy phase-out policy reducing the power generation of nuclear power plants from the current low 30% to about 25% while sequentially shutting down nuclear power plants that reached the end of their original lifespan and halting construction of new reactors. However, under the current Yoon administration, the lifespan of the old nuclear power plant will be further extended and they will continue to operate, and the construction of four new 1,400 MWe nuclear power reactors, which are the Saeul 3, 4, and Shin-Hanul 3, 4 will be resumed again, as shown in the table below. According to Korea’s latest long-term energy plan, dependence on nuclear power generation will increase from 201.7TWh, 32.4% in 2030 to 230.7TWh, 34.6% in 2036, respectively.

In addition to these favorable government policies, the stable power supply capability of nuclear power plants and low nuclear fuel (uranium-235) cost are being emphasized. Nuclear is also now included under the EU taxonomy rules and labeled as an environmentally sustainable energy source earning a high status in the energy source mix.

Source: Statistics of Electric Power in Korea published in May, 2023 (KEPCO) and 2023 Korea Energy Demand Outlook, Korea Energy Economics Institute (KEEI)

List of nuclear power plants in Korea

NAME | LOCATION | TYPE | Capa. (MWe) | Ground-breaking | Operation date | Status |

Kori-2 | Jangan-eup, Kijang-Geun, Busan | PWR | 650 | 12/04/77 | 07/25/83 | Shutdown on 03/08/23, est. to be reinstated in Jun. 2025 |

Kori-3 | PWR | 950 | 10/01/79 | 09/30/85 | in operation | |

Kori-4 | PWR | 950 | 04/01/80 | 04/29/86 | in operation | |

Shin-Kori-1 | PWR | 1,000 | 01/17/05 | 02/28/11 | in operation | |

Shin-Kori-2 | PWR | 1,000 | 01/17/05 | 07/20/12 | in operation | |

Saeul-1 | Ulju-gun, Ulsan | PWR | 1,400 | 12/2015 | 12/20/16 | in operation |

Saeul-2 | PWR | 1,400 | 12/2015 | 08/29/19 | in operation | |

Saeul-3 | Ulju-gun, Ulsan | PWR | 1,400 | n/a | n/a | Former Shin-Kori-5 Expected to be in operation in Oct. 2024. |

Saeul-4 | PWR | 1,400 | n/a | n/a | Former Shin-Kori-6 Expected to be in operation in Oct. 2025. | |

Wolsong-2 | Gyeongju-si, Gyeongsangbuk-do | PHWR | 700 | 06/22/92 | 07/01/97 | in operation |

Wolsong-3 | PHWR | 700 | 03/17/94 | 07/01/98 | in operation | |

Wolsong-4 | PHWR | 700 | 07/22/94 | 10/01/99 | in operation | |

Shin-Wolsong-1 | PWR | 1,000 | 10/01/05 | 07/31/12 | in operation | |

Shin-Wolsong-2 | PWR | 1,000 | 10/01/05 | 07/24/15 | in operation | |

Hanbit-1 | Yeonggwang-gun, Jeollanam-do | PWR | 950 | 06/04/81 | 08/25/86 | in operation |

Hanbit-2 | PWR | 950 | 12/01/81 | 06/10/87 | in operation | |

Hanbit-3 | PWR | 1,000 | 12/23/89 | 03/31/95 | in operation | |

Hanbit-4 | PWR | 1,000 | 05/26/90 | 01/01/96 | in operation | |

Hanbit-5 | PWR | 1,000 | 06/29/97 | 05/21/02 | in operation | |

Hanbit-6 | PWR | 1,000 | 11/20/97 | 12/24/02 | in operation | |

Hanul-1 | Uljin-gun, Gyeongsangbuk-do | PWR | 950 | 01/26/83 | 09/10/88 | in operation |

Hanul-2 | PWR | 950 | 07/05/83 | 09/30/89 | in operation | |

Hanul-3 | PWR | 1,000 | 07/21/93 | 08/11/98 | in operation | |

Hanul-4 | PWR | 1,000 | 11/01/93 | 12/31/99 | in operation | |

Hanul-5 | PWR | 1,000 | 10/01/99 | 07/29/04 | in operation | |

Hanul-6 | PWR | 1,000 | 09/29/11 | 04/22/05 | in operation | |

Shin-Hanul-1 | PWR | 1,400 | 04/30/10 | 12/07/22 | in operation | |

Shin-Hanul-2 | NA | PWR | 1,400 | 04/30/10 | n/a | Expected to be in operation in Sep. 2023. |

Shin-Hanul-3 | NA | PWR | 1,400 | n/a | n/a | Expected to be in operation by Oct. 2033 |

Shin-Hanul-4 | NA | PWR | 1,400 | n/a | n/a | Expected to be in operation by Oct. 2033 |

Kori-1 | Gijang-gun, Busan | PWR | 587 | 04/27/72 | 04/29/78 | Permanently shut down on 6/18/17 |

Wolsong-1 | Gyeongju-si, Gyeongsangbuk-do | PWR | 679 | 10/30/77 | 04/22/83 | Permanently shut down on 12/24/19 |

Source: Korea Hydro & Nuclear Power Co., Ltd. (KHNP)

Korea is also accelerating the development of small module nuclear reactors (SMR) as a future economic and export driver, and from 2030, they will enter the global nuclear power plant market. Korea plans to complete the SMR standard design with a lifespan of 80 years by 2025 and develop core SMR technologies such as soluble-boron-free (SBF) SMR technology, the advanced nuclear fuel that utilizes thorium and high-assay low-enriched uranium, and passive infinite cooling safety system. In addition, they plan to secure SMR-related sites by 2028, start construction in 2030, and operate from 2033. Many Korean industry experts and government believe that SMR is a power generation source that will replace their coal-fired power plants in the near future. As a part of the effort, KHNP, Korean companies (Hyundai Engineering, SK Inc., SK Innovation, Doosan Enerbility) and the Export-Import Bank of Korea (KEXIM), and Trade Insurance Corporation (K-SURE) signed multiple MOUs with U.S. SMR design and engineering companies to cooperate in the development of advanced SMRs during Korean President Yoon Suk Yeol’s state visit to the United States in April 2023.

Renewable Energy

As Korea seeks to re-establish an energy mix focused around growth in nuclear power generation, anticipated growth in renewable power generation has been adjusted downward in the 10th Basic Plan on Electricity Supply and Demand. In the new plan, as in the 9th plan, the Korean government will emphasize expansion of new and renewable energy facilities. However, the government has delayed the timeframe to achieve a 30% new and renewable power generation target from 2030 to 2036. Further, the government will seek to regulate the indiscriminate increase of supply of renewable energy. One of the reasons is that KEPCO has not been able to cope with the rapid increase in electricity produced by solar power generation due to the government’s focus on releasing power generation permits without increasing power grid facilities such as transmission lines and distribution facilities and electricity storage systems (ESS). Also, the intermittency of renewable energy sources without ESS makes it difficult to provide constant energy. The main goal of the current plan is to limit the indiscriminate supply of renewable energy until the power system, including transmission, distribution, and storage facilities, is sufficiently expanded to leverage the volume of renewable power generation.

Forecast of new and renewable energy generation by year (2022-2036) (Unit: GWh, %)

| Renewable energy | New energy | TTL. | |||||

| Solar | Wind | Hydro | Tidal/wave/ocean thermal energy conversion | Biomass | Fuel cell | Integrated Gasification Combined Cycle (IGCC) | Share from total power generation |

| ||||||||

2022 | 27,391 | 3,381 | 3,961 | 457 | 12,481 | 5,491 | 2,377 | 55,539 |

9.2% | ||||||||

2023 | 31,812 | 3,881 | 3,983 | 457 | 13,329 | 6,827 | 2,377 | 62,667 |

10.4% | ||||||||

2024 | 35,891 | 5,098 | 4,015 | 459 | 13,365 | 8,154 | 2,384 | 69,365 |

11.4% | ||||||||

2025 | 39,676 | 6,335 | 4,031 | 457 | 13,329 | 9,435 | 2,377 | 75,641 |

12.3% | ||||||||

2026 | 43,815 | 7,890 | 4,063 | 457 | 13,329 | 10,740 | 2,377 | 82,671 |

13.3% | ||||||||

2027 | 47,747 | 10,562 | 4,095 | 457 | 13,329 | 12,044 | 2,377 | 90,612 |

14.6% | ||||||||

2028 | 51,861 | 16,622 | 4,144 | 459 | 13,365 | 13,384 | 2,384 | 102,219 |

16.5% | ||||||||

2029 | 55,242 | 26,662 | 4,176 | 457 | 13,329 | 14,652 | 2,377 | 116,895 |

18.9% | ||||||||

2030 | 58,921 | 38,887 | 4,219 | 457 | 13,329 | 15,956 | 2,377 | 134,146 |

21.6% | ||||||||

2031 | 62,997 | 50,082 | 4,275 | 457 | 13,329 | 17,097 | 2,377 | 150,613 |

23.9% | ||||||||

2032 | 67,491 | 58,179 | 4,354 | 459 | 13,365 | 18,124 | 2,384 | 164,356 |

25.8% | ||||||||

2033 | 71,415 | 64,200 | 4,408 | 457 | 13,329 | 19,053 | 2,377 | 175,239 |

27.1% | ||||||||

2034 | 74,616 | 68,170 | 4,461 | 457 | 13,329 | 20,031 | 2,377 | 183,442 |

28.1% | ||||||||

2035 | 78,122 | 72,916 | 4,504 | 457 | 13,329 | 21,498 | 2,377 | 193,203 |

29.3% | ||||||||

2036 | 82,185 | 77,282 | 4,559 | 459 | 13,365 | 24,172 | 2,384 | 204,406 |

30.6% | ||||||||

Source: the 10th Basic Plan on Electricity Supply and Demand, Ministry of Trade, Industry and Energy (MOTIE)

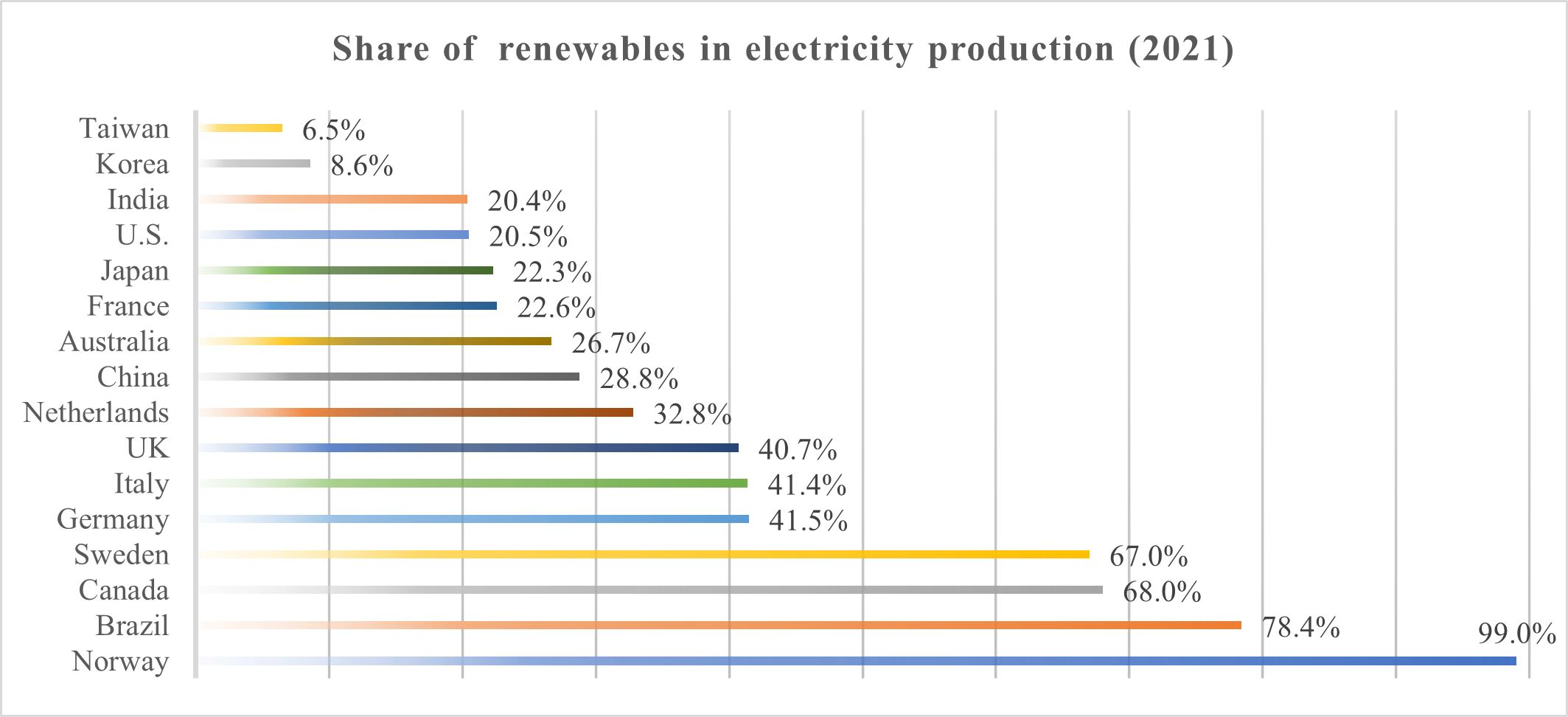

Unlike Korea’s policy on new and renewable energy, the U.S. and European countries have presented large-scale new and renewable energy support policies, increasing energy self-sufficiency, reducing fossil fuel imports, and improving sustainability through new and renewable energy. As shown in the graph below, Korea’s gap with major countries whose share of new and renewable power generation has already far exceeded 20% is expected to widen further in the future.

Source: The World Energy & Climate Statistics-yearbook 2022, Enerdata

Wind

According to the Korea Wind Energy Industry Association (KWEIA), the total amount of electricity through both onshore and offshore wind power generation in 2022 was 3,381GWh, up 6.3% from the previous year, accounting for 0.57% of Korea’s total power generation of 595.3TWh. Currently, 112 wind farms (109 onshore plus 3 offshore) are in operation, with a capacity of 1.8 GWh. The spread of wind farms also includes three offshore power generation testbeds (Seonamhae in North Jeolla Province, Youngkwang in South Jeolla Province, and Tamla, Jeju) that are in commercial operation with a cumulative generation capacity of 125MWh, accounting for only 7.4% of Korea’s total wind power generation.

Annual new wind power generation installation capacity (2016-2022) (unit: MWh)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | TTL. |

Onshore | 977 | 109 | 123 | 191 | 100 | 64 | 75 | 1,638 |

Offshore | 30 | 0 | 35 | 0 | 60 | 0 | 0 | 125 |

Korea TTL. | 1,007 | 109 | 157 | 191 | 160 | 64 | 75 | 1,762 |

Global TTL. | 51,759 | 52,300 | 91,000 | 60,941 | 95,169 | 99,688 | 88,631 | 539,488 |

Source: Korea Wind Energy Industry Association (KWEIA) and World Wind Energy Association (WWEA) 2022 annual report

After reviewing various conditions, Korea has decided to foster the floating offshore wind power industry as a future flagship business. Korea is a country with a small land area and many mountainous terrains, but considering the advantage of being surrounded by the sea on three sides, it is expected that if offshore floating wind power is utilized well, Korea is expected to form a significant market like the EU, but the industry is still at an early stage due to burden in attracting large-scale investment and opposition from the commercial fishing communities and their demand for compensation for loss of income. In response, the government proposed legislation called ‘the Special Act on the Promotion of Propagation of Offshore Wind Power’ to strengthen communication with the commercial fishing communities, support the developers in the licensing processes, and create a system in which the government designates offshore wind power junction sites.

More than half of all turbines and parts used in the wind power sector in Korea consist of imported components. The market share of Korean wind turbines and foreign wind turbines is approximately 45% and 55%, respectively according to a Korean industry publication, Electric Power Journal. While Denmark (Vestas) holds the largest market share (32.88%) in the Korean wind turbine market, two Korean turbine makers UNISON (15.42%) and Doosan Enerbility (13.6%) are expanding their share narrowing the gap. Siemens Gamesa Renewable Energy S.A. increased its market share to 11.34% by steadily improving its supply performance. Enercon (Germany) and GE (US) hold a market share of 2.86% and 2.69%, respectively in Korea.

An additional 74 wind farm projects with a total scale of 23.7GW have received Electric Business License (EBL) and are being evaluated through feasibility studies and in the process of obtaining further permits including the environmental impact assessments. Korea has introduced the expansion of wind energy with a capacity of 19.3GWh by 2030 and 34.1GWh by 2036 in the 10th Basic Plan on Electricity Supply and Demand. This would be achievable only when the supply rate of electricity through wind power generation records a double-digit increase. So, the Korean government plans to revise and further expand the wind power bidding market and review the conversion of the Renewable Portfolio Standard (RPS) system to a bidding system.

Best Prospects

The U.S. is considered a global leader in energy and related engineering services and exporters of energy solutions. Companies with price-competitive technologies and services should have the potential to penetrate the market in the following areas:

Engineering services for Korean companies establishing powers plants in the United StatesEnriched uraniumDecommissioning of nuclear facilitiesLNG exportCoal exportLiquid hydrogen and ammoniaProject financingWind turbine system (rotors including blades and hubs, nacelle, gearboxes, generators, controllers)

Opportunities

As of 2022, KEPCO and its wholly owned power generation subsidiaries, collectively referred to as the GENCOs, sustained approximately 70% of the nation’s electric power generation, while local Independent Power Producers (IPPs) accounted for 30%. KEPCO is a state-owned power company and is responsible for the nation’s transmission and distribution. The GENCOs are one of the primary end-users of new and renewable energy (NRE) products and services. The trend of shifting the power source to NRE will continue under the Renewable Portfolio Standard (RPS) requirements.

The six GENCOs are:

· Korea Hydro and Nuclear Power (KHNP).

· Korea South-East Power (KOEN, formerly KOSEP).

· Korea Western Power (KOWEPO).

· Korea Midland Power (KOMIPO).

· Korea Southern Power (KOSPO).

· Korea East-West Power Company (EWP).

According to KPX, there are 27 Independent Power Producers (IPPs) including, three majors that are SK E&S, GS EPS and POSCO Energy.

Resources

2023 International Green Energy Expo, Daegu

Korea Energy Show, Busan

World Climate Industry EXPO (WCE)

NET ZERO EXPO 2023, Busan

EXPO SOLAR 2023, KINTEX

International Energy Storage System (ESS) Expo & Conference

SWEET (Solar, Wind, Earth Energy Trade Fair), Gwangju

Key Contacts

- Korea Energy Agency (KEA).

- Korea Electric Power Corporation (KEPCO).

- MOTIE

- Korea H2 Business Council

Local Contact

U.S. Commercial Service Korea

U.S. Embassy Seoul

188 Sejong-daero, Jongro-gu

Seoul 03141, Korea

Tel: 82-2-397-4535

office.seoul@trade.gov

https://www.trade.gov/south-korea