Overview

South Korea’s geography is over 70 percent mountains, and the population of over 50 million are concentrated in six key population centers: 1) Seoul metro area; 10 million; 2) Busan metro area: 3.5 million; 3) Incheon metro area: 2.8 million; 4) Daegu metro area: 2.2 million; 5); Daejeon metro area: 1.6 million, and 6) Gwangju metro area: 1.5 million. Most freight forwarders use an extensive network of first-class railways, 3,000 miles of highways, and air routes that crisscross the country.

Incheon, Gimpo, and Busan’s first-class airports and ports are the points of entry for most products. Products are then transferred by highways and railways to major modern distribution centers in Seoul, Busan, Incheon, Daegu and Gwangyang. South Korea has 15 airports. Eight are international airports, including the world-class Incheon International Airport near Seoul. Eighty-eight international passenger airlines operate regularly between the Incheon International Airport and many nations around the world.

The Port of Busan Is the primary port in Korea and the world’s seventh largest cargo port and the Incheon Airport is the world’s second biggest cargo airport. the Incheon Airport opened a Cool Cargo Center in September 2021 to better manage increasing perishable cargo such as vaccines, fresh produce, and livestock. In November 2022, FedEx completed its new Incheon Gateway located at Incheon International Airport, South Korea. This allows FedEx to double the freight frequency from 24 times per week to 48 times per week.

Distribution methods and the function of intermediaries vary widely by product in this mature market. Traditional retail distribution networks of small family-run stores, stalls in markets, and street vendors have been replaced by large discount stores and e-commerce platforms.

In mid-2012, as part of Korea’s efforts to protect small “mom-and-pop” stores, under the auspices of “economic democratization,” the government imposed a rule closing big-box discount chains on two Sundays per month. Many major retailers initially ignored the restriction. The government then imposed financial penalties, which eventually led to compliance, with major retailers closing stores on the second and fourth Sunday of each month, as of late 2012.

Korea’s major cities have expensive large department stores and shopping malls. Thousands of second-tier and third-tier retail stores also abound. Full-line discount stores (FDS) have gained in popularity. U.S.-based Costco, which entered the Korean FDS market more than 10 years ago, is successfully competing against its rivals E-Mart, Lotte Mart, and Homeplus.

It should also be noted that parallel imports can legally enter Korea. Many U.S. companies continue to give exclusive contracts, since territorial limits in neighboring countries enhance the value of an exclusive area in any one country. Any parallel importer in Korea not receiving the support of the original equipment manufacturer (OEM), and not moving a meaningful volume of product, cannot be guaranteed a steady source of income. Legitimate exclusive distributors still have considerable advantages in Korea.

Using an Agent to Sell U.S. Products and Services

Before entering a contractual relationship with a Korean representative, U.S. firms should conduct a thorough due diligence check on their prospective business partner. A contract with an agent or distributor should be handled with care and with the assistance of an attorney. CS Korea can also assist U.S. firms through its International Company Profile (ICP). For detailed financial and related business information on the company with which you seek to work, please consult https://www.trade.gov/international-company-profile-0.

The most common means of product or service representation in Korea are:

• Appointing a registered/commissioned agent or “offer agent” on an exclusive or non-exclusive basis;

• Naming a registered trading company as manufacturer’s representative or agent; or

• Establishing a branch sales office, managed by home office personnel, and Korean staff.

Additionally:

• Appointing a registered/commissioned agent or “offer agent” on an exclusive or non-exclusive basis;

• Naming a registered trading company as manufacturer’s representative or agent; or

• Establishing a branch sales office, managed by home office personnel, and Korean staff.

The performances of your agent and distributor should be regularly monitored. Underperformance by either party should be addressed promptly, and guidance should be provided to improve performance. If performance continues to lag, then termination of the contract should be considered. All legal and contractual obligations must be thoroughly reviewed when considering contract termination. Once termination is legally binding, the U.S. firm can then search for a new distributor or manufacturer.

Finding a Good Partner in Korea

CS Korea offers its Gold Key Service (GKS) to assist U.S. firms in establishing relationships with potential business partners. Please consult https://www.trade.gov/gold-key-service. U.S. exporters are also encouraged to contact one of over 100 U.S. Export Assistance Centers (USEACs) as part of this process. Please contact the office closest to your business. Please consult https://www.trade.gov/about-us to begin the process.

To find information about the Korean Agriculture markets, go to https://www.trade.gov/gold-key-service. U.S. exporters of food and agricultural products can also find assistance from one of the State Regional Trade Groups (https://www.fas.usda.gov/state-regional-trade-groups) or the Agricultural Trade Office in Seoul, Korea (https://www.atoseoul.com/index.asp).

Additional market intelligence, network, and resources are also available at AMCHAM’s American Business Center (https://www.amchamkorea.org/page.php?menu=0710).

The GKS provides:

• A customized schedule of face-to-face meetings with carefully selected prospective candidates.

• Market briefing, interpretation service (fee-based), and transportation (fee-based); and

• Information regarding each meeting, focused market research, and insights gained by CS specialists in setting up the GKS.

CS Korea strongly recommends that:

• U.S. companies seek legal counsel prior to signing a contract or making major business decisions with Korean companies.

• Any distribution or agency contract should include a termination clause. If not, Korean commercial arbitrators may specify the terms for termination, including compensation claims against the principal. A mutually signed contract between a supplier and an agent/distributor, with termination provisions, would take precedence and avoid placing the U.S. company at risk.

U.S. companies should protect their intellectual property, trademarks, and patents with the Korean Intellectual Property Office (KIPO).

A local Korean or U.S. attorney in Korea can perform these tasks. Under Korean law, applications to KIPO must be completed and submitted in Korean. This should be done in the U.S. company’s name, not the Korean agent/representative’s name. Since the passage of the KORUS FTA, there are now numerous U.S. law firms with offices in Korea. Additionally, there are more than 20,000 Korean lawyers practicing in Korea.

Establishing an Office

Korea’s dynamic and mature market, coupled with its strategic location in East Asia, may lead U.S. companies to consider opening an office in Korea. The following options exist:

• Subsidiary Office: Established as a local company, a subsidiary has a closer relationship with the local business community and can provide the local subsidiary access to Korean government investment incentives, as it would be eligible to receive corporate income tax incentives (Special Tax Treatment Law STTCL) if it meets certain requirements. These tax incentives are not available to branch or liaison offices.

• Branch Office: Not subject to audits by external auditors in Korea, a branch office’s net income is automatically considered included in the headquarters balance sheet. A company expecting to grow large enough to require the establishment of a subsidiary in the future should consider doing so from the beginning rather than starting as a branch operation.

• Liaison Office: A liaison office can only conduct marketing and support and cannot conduct direct sales. A liaison office is subject only to the tax code of the headquarters country and is the simplest form of conducting business in Korea.

A basic checklist for setting up an office in Korea includes:

• Contact Invest KOREA: Consult the one-stop services offered by Invest KOREA, a government-sponsored, non-profit organization of the Korea Trade-Investment Promotion Agency (KOTRA)

o KOTRA maintains offices throughout the United States and is poised to guide U.S. companies through the administrative, legal, and tax implications of opening an office in Korea.

• Authorization: Once “authorization to proceed” with an investment is granted, companies must notify the Ministry of Trade, Industry and Energy (MOTIE), a delegated authority (major Korean bank), or Invest Korea.

• Your Office in Korea: Consult a reputable real estate agent or consulting firm when deciding the best location for your office. A partial list is available at: https://www.trade.gov/south-korea-business-service-provider

• Under Korea’s Foreign Land Acquisition Law, foreigners can purchase land regardless of size or purpose. Local zoning laws regulate categories of activity allowed and should be reviewed prior to making final investment decisions. It is highly recommended that anyone desiring to purchase land consult with a reputable Korean or U.S. law firm.

• Register with the Tax Office: Investors must register their office/investment with the local tax office. Given language issues, the complexity of Korean tax laws, and the potential for misunderstanding, companies should hire a local accounting firm to file taxes.

o Consult: https://www.trade.gov/south-korea-business-service-provider

o Seek Qualified Employees: Koreans are attracted to U.S. firms based upon criteria such as salary rates, work environment, prestige, opportunities for travel, the ability to use and learn English, and the possibility to transfer to the company’s home office or another foreign branch office.

Korea has a large pool of conscientious and highly educated workers. Female employees are solid candidates, given their educational achievements, language abilities, and the prevalence of traditional Korean cultural attitudes toward female employees (which have historically prevented women from progressing as quickly as they would in a U.S. company).

Due to differences in U.S. and Korean employment practices, CS Korea recommends consulting with Korean employment agencies before hiring.

Contact the Seoul Global Center website for information on the Seoul Metropolitan Government’s program, which occasionally offers free or reduced rent/office space for foreign residents.

Refer to the State Department’s Investment Climate Statements, which has information on investment and business environments in South Korea.

Franchising

According to the Korea Fair Trade Commission, the number of franchise companies increased from 7,342 in 2021 to 8,183 in 2022. In 2021, franchisees reported a decrease in sales of 9 percent on average, but in 2022, sales were similar to 2021, with a slight increase of 0.4 percent. Among the 8,183 franchise companies, 6,308 were in food service, with each company owning 1.5 brands on average. The average lifespan of a food service franchise brand is six years and five months. While over 1,000 new franchise brands disappear, new brands continue to enter the Korean market every year.

Franchisors interested in this market should consider the following:

Meet the rules under Korea’s Fair Transactions in Franchise Business Act,

https://elaw.klri.re.kr Register disclosure documents with the Korea Fair Trade Commission (KFTC). As it relates to disclosure requirements, franchisors are required to register the disclosure document with the KFTC first and then furnish the registered disclosure documents to the potential franchisee.

Korean franchisees are reluctant to pay the high franchising fees and royalties often required by U.S. companies. The minimum facility size and number of store openings required by some U.S. franchisors are also a challenge for the Korean franchisee. The high cost of commercial real estate in Korea is one of the reasons why brands that might be successful in other countries struggle in Korea. Korean franchisees prefer to do business with U.S. franchisors with established brand names that are already popular among Korean travelers to the U.S. Industry experts point out that U.S. food service brands with outlets on the west coast or New York City enjoy high brand recognition.

Main types of franchise investors:

· Major retailers who have access to capital and real estate;

· Private equity funds with the intention of reselling the businesses in the future;

· Individuals and SMEs with actual experience with franchising brands; and

· Individuals and SMEs who are newcomers.

Direct Marketing

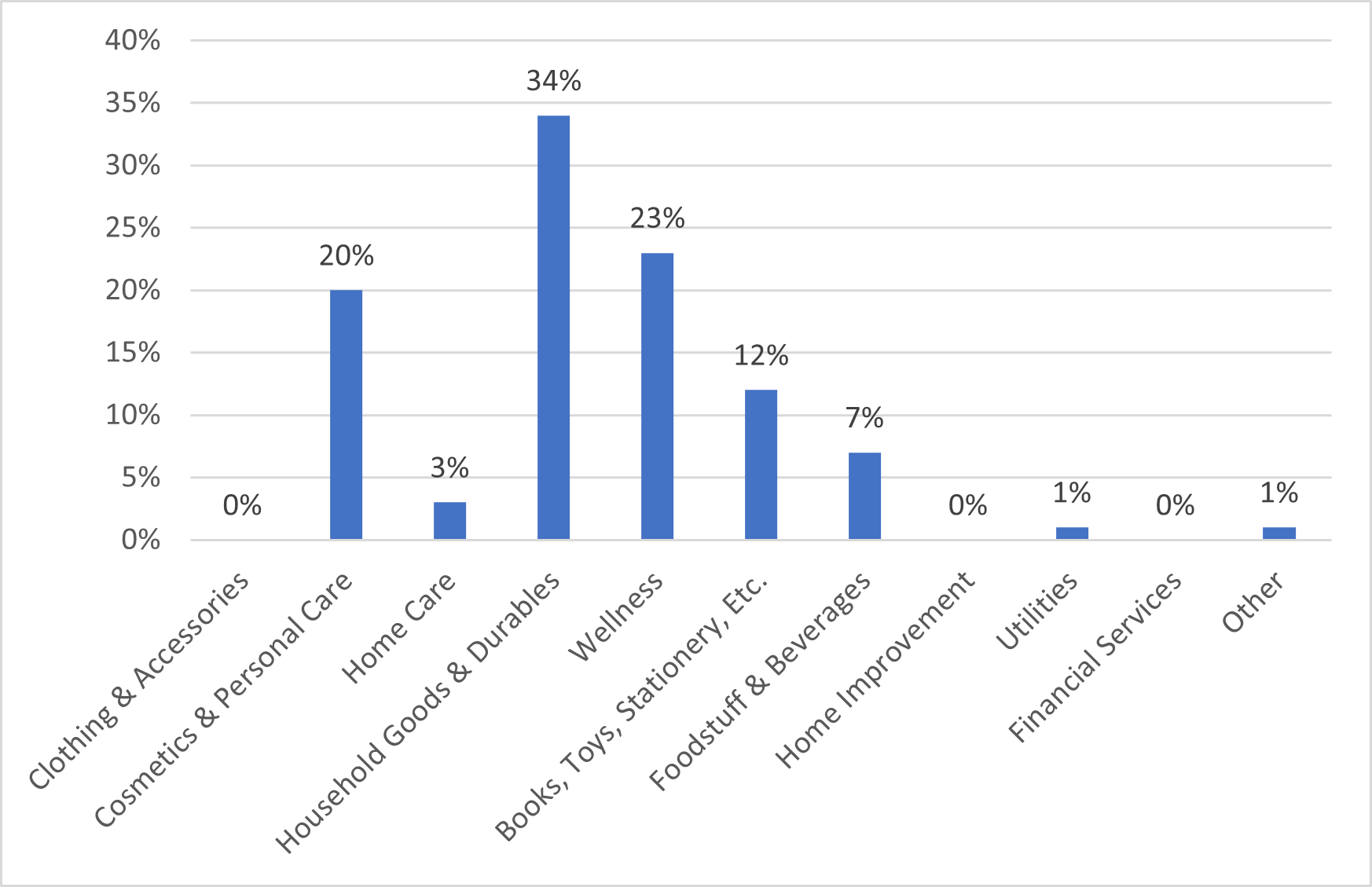

Due to the increase in the elderly population in Korea, door-to-door sales and multi-level marketing remain steady. Convergence among e-commerce, door-to-door sales, and multi-level marketing has become more common, making estimating each subsector’s market size challenging. According to the World Federation of Direct Selling Association (WFDSA: https://wfdsa.org), the Korean direct selling market reached KRW 22.2 trillion ($19.4 billion) in 2021, up from KRW 20.9 trillion ($17.7 billion) in 2020. The most common products sold through direct selling in Korea in 2020 were: Household goods & durables (34%), wellness products (23%), cosmetics & personal care products (20%), books, toys, stationery, etc. (12%) and foodstuff & beverages (7%).

Chart 1: Consumer Sales in Korea via ‘Direct Selling’ by Product Category – 2021

Source: World Federation of Direct Selling Association (WFDSA), 2022

Door-to-Door Sales

Although the total market size for door-to-door sales in Korea is unavailable, sponsored door-to-door sales were reported to be $2.6 billion in 2021, down from $2.8 billion in 2020, according to Fair Trade Commission. Although the sales of one of five major sponsored door-to-door companies increased, those of the other four companies decreased significantly as more consumers opted for e-commerce. The overall decreasing market value trend is expected to remain the same as e-commerce continues to grow.

Multi-Level Marketing (MLM)

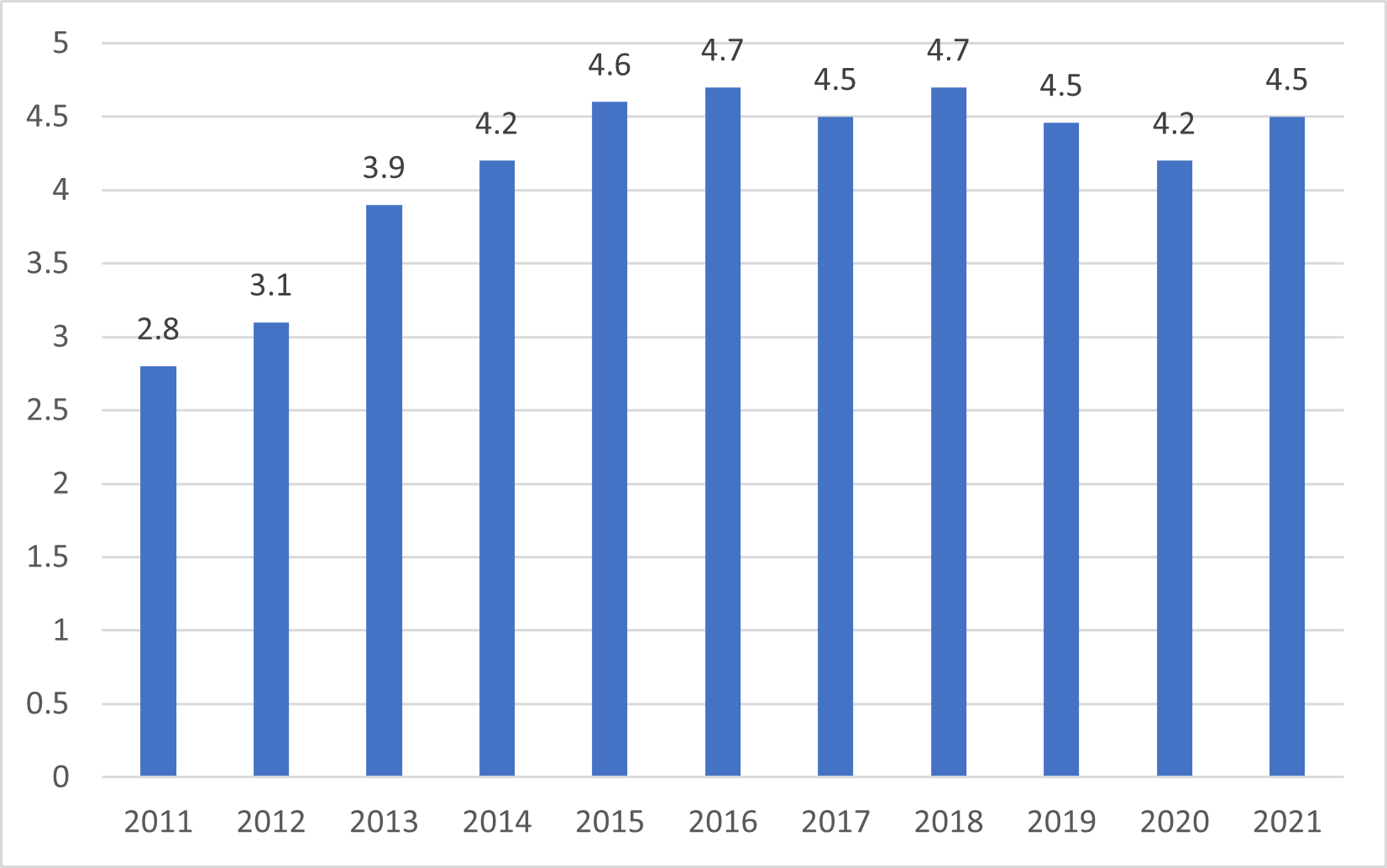

According to Korea Fair Trade Commission, Korea’s multi-level marketing sales for 2021 was $4.5 billion, up from $4.2 billion in 2020. Between 2020 and 2021, the number of registered multi-level marketing (MLM) companies in Korea decreased from 122 to 120. MLM reportedly employs over 7.3 million sellers/distributors as of December 2021, which is down from 8 million in 2020. Additionally, the actual number of sellers/distributors is assumed to be lower than the reported figure due to duplicate registrations and inactive sellers. The MLM sector is expected to remain stagnant as more Koreans depend on e-commerce.

Chart 2: Consumer Sales in Korea via Multi-Level Marketing (in billions of USD)

Source: Korean Fair Trade Commission (FTC), 2022

MLM activity for U.S. products is concentrated in the cosmetics, cleaning products, health and wellness, and kitchenware industries. MLM companies should promote their products and services appropriately and efficiently by carefully analyzing Korean market trends and sophisticated and mature Korean consumers. Accurate Korean retail and consumer market knowledge can prevent unnecessary conflicts with government agencies, consumer “watchdog” groups, or industry groups. Consumer groups, industry associations, and government agencies have been monitoring MLM since 2006 to better control the market and warn consumers about potential issues that may arise in transactions as some MLM companies have been identified as exploiting their members and are viewed as illegal pyramid schemes.

Joint Ventures/Licensing

Koreans prefer to maintain local control of JV operations with foreign entities. Thus, the financial goals, internal organization, and key management issues of a JV must be agreed upon by all involved parties as early as possible. Reaching such an agreement can take time.

The Korean government encourages and promotes foreign direct investment (FDI). Korea offers substantial incentives to potential foreign investors to attract more foreign direct investment into Korea. The Korean government has frequently made clear its desire to improve the business environment for foreign investors and attract more FDI.

When considering FDI in Korea, it is vital to consider the following:

· The decreasing influence of (some) chaebols (conglomerates), the Korean government’s promotion of SMEs, and the government’s interest in seeking anti-monopolistic and more diversified JVs;

· Koreans prefer to maintain local control, regardless of the percentage invested by foreign entities; and

· Management control should be evaluated on three levels: 1) shareholder equity, 2) representation on the board of directors, and 3) active management (representative director and subordinate management). Legally, Korean board meetings require the physical presence of all JV members, and a quorum of the directors. A representative director who resides in Korea must be appointed if a foreign investor intends to exercise day-to-day management of an operation. The director requires the support of and access to key functional areas of the company to manage in accordance with the foreign investor’s wishes.

Contractual Agreements in Korea

Well-written, well-understood, and well-executed contractual agreements provide the basis for a U.S. firm’s success in Korea. Cultural differences surrounding the expectations of a contractual agreement and how one successfully arrives at a mutually beneficial agreement are often the basis of consternation and challenges. For Koreans:

· A contract represents the “current understanding” of a deal. It is the beginning, rather than the end, of a negotiation.

· Any change in the circumstances surrounding the contract (omissions, invalid issues, new leadership, non-existent issues) may cause problems to arise.

· Koreans may regard a contract as a “gentlemen’s agreement,” subject to further negotiation should conditions change; Americans generally regard the same written agreement as legally binding.

· Contract negotiations in Korea should be viewed as an ongoing process of dialogue and should have the following objectives:

· Reaching a common understanding about the deal.

· Reaching an understanding of each party’s responsibilities.

· Recording the detailed understandings.

· Being prepared to modify the terms of the agreement should there be a change in circumstances (leadership, other issues).

Additionally, the following precautions should be addressed:

· Technology transfer, raw material supplies, marketing, and distribution should be agreed upon, in detail, in the JV agreement.

· A company’s IP may not be protected and could be vulnerable in the later stages of a JV business relationship, especially if the Korean company depends upon technology transfer (see the section on Protecting your IP, also in this chapter).

· Korea’s legal system can be lengthy, cumbersome, and expensive. When dealing with contracts, the best strategy is to prevent conflicts.

Foreign investors are encouraged to consult the Korean Commercial Arbitration Board. The KCAB advises foreign companies on contract guidelines.

Express Delivery

Korea has a well-established domestic parcel service. On average, deliveries take 1-2 business days, and costs start at 2,700 KRW. Some companies offer next-day and/or overnight delivery with an added fee. Some of the largest parcel service companies are the Korean Post Office (https://parcel.epost.go.kr), CJ Logistics (https://www.cjlogistics.com/ko/support/guide/parcel), Lotte Global Logistics (https://www.lotteglogis.com/), Hanjin Express (https://hanex.hanjin.co.kr/kor/Main.do ), and Logen Express (https://www.ilogen.com/web/personal). Same-day deliveries are also available through “Quick Service” providers, with costs starting at 10,000 KRW.

FedEx, DHL, and UPS provide international shipping services from the U.S. to Korea. Shipments to Seoul take 3-4 business days on average, and costs vary by weight, dimension, and destination of the package. The approximate cost is $60 for one pound and $10 for every additional pound. Customs procedures are usually handled by the shipping company; however, Korean customs require that individual recipient’s sign-up for a Personal Customs Clearance (PCC) code to clear the package through customs. Korean citizens and foreigners living in Korea with an Alien Registration Card can sign up for the PCC code through this website (https://www.customs.go.kr/english/main.do).

Due Diligence

Conducting a thorough due diligence check is critical when selecting a local partner for a joint venture, licensing, representation, and distribution. A due diligence check should include:

An evaluation of the company’s financial and operational history.Accounting practices.Hidden ownership interests.Corporate relationships with other Korean companies.Position in the market for the product(s) you are exporting.

CS Korea offers a fee-based service called the International Country Profile (ICP): https://www.trade.gov/perform-due-diligence. The ICP includes the above information, obtained by the Commercial Service in Korea, in addition to a visit to the office of the Korean company, as well as obtaining financial information from Dun&Bradstreet, both of which also provide due diligence reports.