ITA CODE: SV TRV

Overview

| South Korea | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Total Outbound Travel | 26,496,447 | 28,695,983 | 28,714,247 | 4,276,006 | 1,222,541 |

| Outbound Travel to the U.S | 2,334,839 | 2,210,597 | 2,298,279 | 439,286 | 202,711 |

| Global Inbound Travel | 13,335,758 | 15,346,879 | 17,502,756 | 2,519,118 | 967,003 |

Source: Korea Ministry of Culture, Sports and Tourism (MCST), Korea Tourism Organization (KTO), U.S. Department of Commerce National Travel & Tourism Office (USDOC, NTTO).

South Korea has been a growing market in terms of arrivals and export revenue for the United States. Koreans’ desire for international travel and the abundance of information sharing through mass media and social networking platforms, has been contributing to the growth of outbound tourism. Unfortunately, the year 2020-2021 has been a challenging period due to COVID-19. The advent of coronavirus pandemic brought forth an unprecedented crisis and the Korean travel industry has been severely impacted by international travel restrictions. In 2021, 1.22 million Koreans traveled internationally, a 95.7 percent decrease compared to 2019. In the same year, 202,711 Koreans traveled to the United States, a 91.2 percent decrease compared to pre-pandemic year 2019. However, Korea is internationally recognized for its successful handling of COVID-19, without the enforcement of total lockdowns, and the Korean market is set to become one of first rebounding markets and top inbound travel destinations for America following the pandemic. U.S. airlines resumed flights to U.S. destinations from July 2020 after a four-month flight suspension. As more countries re-open and lift restrictive measures, Koreans are preparing to travel overseas to those selected less-hit countries. Furthermore, domestic travel has resumed at a faster pace than international travel, due in part to displacement effects of travel restrictions and changes in Korean travel behavior seeking “safer” alternatives such as road trips and other outdoor activities. Airlines and travel agents are reporting a significant rebound in international travel bookings since spring 2022 following the Korean government’s removal of mandatory 7-day quarantine upon arrival which went into effect as of April 1. Recent industry surveys show that more than 85 percent of Korean are eager to plan a vacation in the next six months and overseas travel is the most anticipated activity.

Prior to COVID-19, Koreans’ international travel was rapidly growing and offered significant opportunities for U.S. tourism exports. The U.S. remained one of the top five destinations for Korean outbound travelers and was consistently the top non-Asian and long-haul destination. Koreans overwhelmingly choose the U.S. as their travel destination of choice, primarily because of the diversity in tourism opportunities and unique experiences, not generally available in Asia, as well as for American-style shopping; fine dining; theme parks; cultural attractions in major U.S. cities; relatively inexpensive golf experiences; and the U.S. National Parks. On average, in 2019, a Korean visitor to the U.S. spent approximately 4,900 USD per trip. This number translated to over 11 billion USD in tourism revenue from Korean outbound travelers to the United States. However, the outbreak of global pandemic posed severe travel export revenue challenges during 2020-2021. In 2019, Korea was the sixth largest source of inbound travel to the U.S., behind Canada, Mexico, the United Kingdom, Japan, and China.

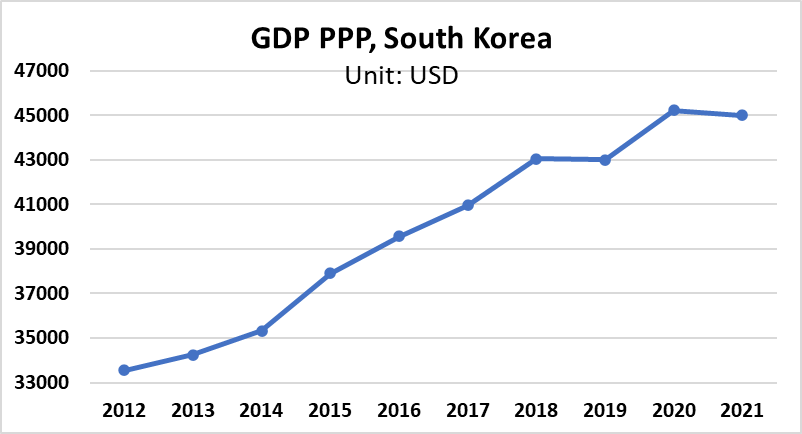

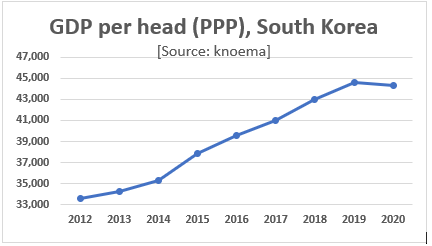

Korean consumer confidence was gradually increasing across generations, but general travel confidence was hard hit by the health crisis. In the context of post pandemic era, rising discretionary spending on activities, gradual increases in vacation time, heightened globalization, and greater awareness of international developments outside the Korean Peninsula will resume and motivate more Koreans to travel overseas. Korea’s GDP per capita (PPP) rose to USD 45,220 in 2020 (according to the World Bank), placing it securely in the ranks of middle-income countries. Positive economic indicators, Korea’s addition to the U.S. Visa Waiver Program (late 2008), and the U.S.-Korea Free Trade Agreement (KORUS FTA), which entered into force in March 2012, are helping spur even more leisure and business-related travel to the U.S. In 2019, nine percent of Korean travel to the U.S. is for business purposes.

The recent boom of social commerce (social networks and websites that give product/service sellers access to a large pool of Korean consumers) is contributing to a growing trend, as it offers all types of travel products and unique experiences. Following COVID-19, Korean travelers use social media platforms such as Kakao Talk, Instagram, Facebook, and YouTube, and other online platforms to search for travel information. Korea is well-known for having one of the fastest internet networks in the world, and internet penetration reaches 98 percent. Moreover, travel booking via mobile devices continues to expand for Korean consumers and is becoming a widely used method of travel planning. Nine out of 10 Korean travelers own a smartphone, and roughly half of those users booked flights/hotels via smartphones in the past twelve months. The number of internet and smartphone users has reached 95 percent of the Korean population. As a result, more Korean travel companies are focusing on app-based travel platforms and creating user friendly mobile applications, since the number of Korean travelers that are using online/mobile booking services is rapidly increasing.

Korean mass media is influenced by U.S. movies, advertising, and popular culture, and this influence continues to stimulate interest in U.S. travel destinations. South Koreans’ positive perception of overseas travel and the abundance of information-sharing through mass media and social media are expected to continue to boost the growth of outbound tourism is the coming years.

Sub-Sector Best Prospects

- Free and independent travelers.

- Group package tours.

- Family vacation packages.

- Cultural tours and scenic/nature tour packages, especially designed for Korean travelers.

- Luxury packages catering to Korea’s single, professional women, traveling for leisure.

- National parks.

- Outdoor activities.

- Culinary tours.

- Educational travel.

- MICE.

Opportunities

Tourism has been one of the most directly affected sectors by the coronavirus pandemic in Korea. However, the tourism industry has demonstrated significant resilience, and when it is safe to travel again, the pent-up travel demand will increase for outbound travel. Even during the pandemic, Korean travelers never stopped researching and planning overseas trips for the future. As the travel and tourism industry prepares plans for a comprehensive recovery, and with the help of the vaccines and other mitigation efforts, travel restrictions have been gradually lifted, Korean market is expected to bounce back to pre-pandemic level. New emerging trends such as health safety and hygienic travel conditions have become key factors for Koreans to select destinations and tourism activities.

The U.S. has been the leading non-Asian destination for Koreans as it offers a variety of activities, culinary tours, and cultural experiences. U.S.-bound Koreans account for 8.0 percent of Korea’s outbound market and there is room for further growth. Los Angeles, San Francisco, Las Vegas, and Seattle followed by the New York-Washington, DC corridor, have been the most popular destinations. For outbound travel, Koreans use group package tours or travel individually to visit friends and relatives. Group tours can focus on price-competitive products that entice travel agencies in Korea to sell these products. Korean travelers are generally interested in the following activities in the U.S: visiting museums, national parks, amusement/theme parks, fashion outlets, golf courses, buying OTC pharmaceuticals/vitamins and U.S. cosmetics, and visiting unique local restaurants and wineries.

To tap into the Korean market, American travel and tourism entities should provide marketing collaterals on their destinations and attractions in the Korean language and cultivate long-term relationships with the travel trade industry in Korea. There are approximately 11,000 tour agents handling outbound travel packages in Korea. Having effective educational programs and digital marketing strategies on the U.S. are key factors in accessing and revitalizing the travel demand from the Korean market.

For more details, please contact the U.S. Commercial Service in Korea.

Resources

Trade Events

- Korea World Travel Fair (KOTFA).

June 23-26, 2022. - Seoul International Tourism Industry Fair.

June 6-9, 2022. - Busan International Travel Exhibition.

October 13-16, 2022. - Key Contacts

- National Travel and Tourism Office (NTTO).

- Korea Tourism Organization.

- Ministry of Culture, Sports and Tourism.

- Visit USA Korea.

- Brand USA.

Local Contact

U.S. Commercial Service Korea

U.S. Embassy Seoul

188 Sejong-daero, Jongro-gu

Seoul 03141, Korea

Tel: 82-2-397-4535

office.seoul@trade.gov