Overview

Currently, Burma’s energy sector is struggling to retain foreign investments and maintain its operating environment. Among the ASEAN countries, Burma has the lowest electrification rate, with only half of its population connected to the national grid and 80 percent of the rural people having no access to grid electricity.

According to the regime’s Ministry of Electric Power (MOEP), the annual need for power consumption in Burma is increasing annually from 15 percent to 17 percent. To fill the gap in energy needs, the government plans to implement an energy mix including hydropower, natural gas, coal, and renewable energy to provide electrical access to approximately ten million households as part of the National Electrification Plan(NEP) which envisions 100 percent nationwide electricity access by the year 2030.

The country’s electricity originates from 83 power plants, including 62 hydropower stations, 20 gas-fired plants, and one coal power plant. The 2019 new tariff pricing was counted by electricity consumption units and categorized by domestic and industrial channels, in which the latter has been priced much higher (an increase of over 50 percent) than the former. Guaranteed access to a stable and adequate electricity supply in Burma is challenging. The suspension of CNTIC VPower’s LNG plants in Yangon, the impairment of transmission lines connected to Baluchaung hydropower plants, the seasonal depletion of water reserves, and crippled human resources due to the civil disobedience movement across government ministries all contributed to the growing power outages across the country. Meanwhile, the rise of global oil and fuel prices, devalued local currency (MMK), the shortage of U.S. dollars in the local market, and the slowdown of foreign investment negatively impacted the energy sector. Energy projects approved before the military takeover have been suspended due to the political and economic turmoil in the country.

In the second year of the coup, the regime changed the structure and leadership positions at the Ministry of Energy and Electricity (MOEE). The military regime government reconstituted the MOEE into two ministries, the Ministry of Energy (MOE) and the Ministry of Electric Power (MOEP), in May 2022.

Without an official announcement by the regime, the MOE will likely oversee the gas and fuel-related departments, such as Myanma Oil and Gas Enterprise (MOGE), Myanma Petrochemical Enterprise (MPE), the Department of Oil and Gas Planning (OPGD), and the Petroleum Products Regulatory Department (PPRD). The Department of Electric Power and Planning (DEPP), the Electric Power Generation Enterprise (EPGE), the Electricity Supply Enterprise (ESE), the Department of Power Transmission and System Control (DPTSC), and the Department of Hydropower Implementation (DHPI) will be under the MOEP’s control.

In addition to the above seven authorized departments, U.S. energy firms should understand the roles of the Ministry of Planning and Finance, the Myanmar Investment Commission (MIC), the Ministry of Natural Resources and Environmental Conservation (MoNREC), and the National Commission for Environmental Affairs (NCEA). To accomplish the National Electrification Plan (NEP), a total investment of $5.4 billion will be required to initiate the electrification rollout, and $40 billion will be required for investment in transmission and distribution.

| Source of Supply | Hydro | Natural Gas | Coal | Diesel | Solar | Total |

|---|---|---|---|---|---|---|

| Total Installed Capacity (In MW) | 3,262 (54%) | 2,496 (41%) | 120 (2%) | 116 (2%) | 40 (1%) | 6,034 (100%) |

Source: Ministry Of Energy and Ministry of Electric Power

Electricity Generation in Burma (2020)

| Source of Generation | Hydro | Natural Gas | Coal | Solar | Total |

|---|---|---|---|---|---|

| Total Generation Mix (MW) | 1,990 (52%) | 1,722 (45%) | 76 (2%) | 40 (1%) | 3,828 (100%) |

Source: Ministry of Energy and Ministry Of Electric Power

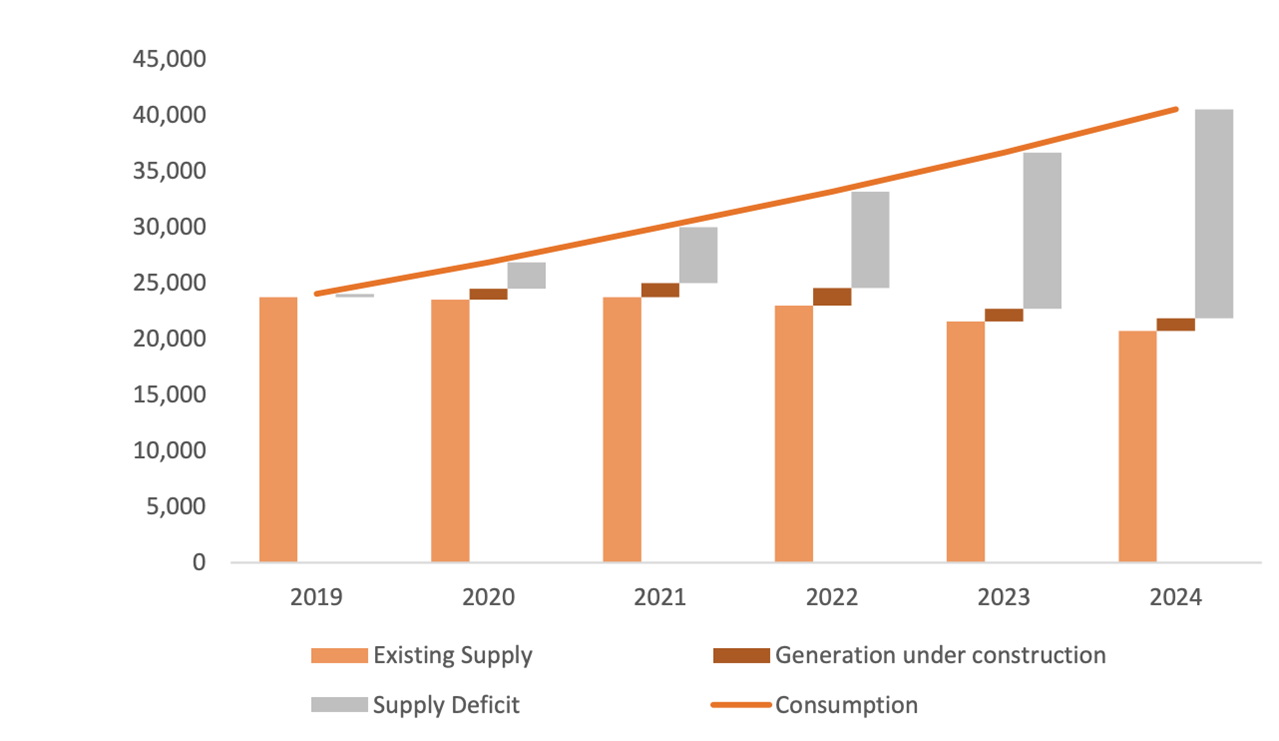

Burma Energy Demand and Supply Gap (2019-2024)

Source: World Bank

Total Market Size for Energy Sector in Burma

| Hydropower | Coal-fired | Gas-fired | |

|---|---|---|---|

| Number of Installed plants | 62 | 1 | 20 |

| Installed capacity in MW | 3,033 | 120 | 1,823 |

| Number of proposed plants | 51 | 10 | 1 |

| Proposed capacity in MW | 46,000 | 7,994 | 270 |

| Number of ongoing plants | 7 (out of planned 51) | 1 | 2 |

| Capacity of ongoing plants in MW | 1,656 | 405 | 625 |

Source: ADB, Myanmar Energy Assessment, Strategy and Road Map

Leading Sub-Sectors

Under the civilian-led government, the Ministry of Electricity and Energy (MOEE) drafted a renewable energy law with the goal of generating 8 percent of the country’s electricity through renewable sources by 2021, with 12 percent of all electricity generated in Burma to be renewable by 2025. Before the coup, Burma had a total installed capacity of approximately 3,300 MW from renewable energy sources. The country has an abundance of renewable energy resources that, if managed efficiently, could meet its future energy requirements for sustainable development.

Since early 2022, electricity blackouts have expanded across the country, including in the business hub cities of Yangon and Mandalay. Power generation declined from 3,711 MW in October 2021 to 2,665 MW in March 2022, and daily output dropped from 73,137 MWh to 51,776 MWh. The regime-managed energy ministry has been working on damage control measures and attracting new foreign investment to stabilize Burma’s energy sector, while attempting to resuscitate Burma’s energy sector despite outgoing foreign investments, local currency depreciation, the Central Bank’s restrictions on foreign currencies, and rising global fuel prices.

Hydropower: Burma’s four main rivers, the Ayeyarwady, Chindwin, Thanlwin, and Sittaung, represent an untapped natural energy resource. The Asian Development Bank (ADB) stated that Burma has significant hydropower potential, with more than 100,000 MW of installed capacity. Burma possesses 7.7 percent of the hydropower resources in Asia, and hydropower plants generate almost 62 percent of Burma’s power. Burma has 27 operating hydropower stations with a total installed capacity of 3,262 MW, with eight stations under construction. Five of the existing power stations were constructed on a build-operate-transfer (BOT) contract, and three hydropower stations with a combined capacity of 939 MW have been developed under joint ventures with foreign firms.

The deposed civilian-led government had mapped out potential locations for 41 new power projects, which will be under construction from 2016 to 2031. The new power plants are being built to increase electricity generation capacity to 29,000 MW by 2031. New projects have to also take into consideration that during the dry season, heavy reliance on hydropower could lead to shortages in power supply.

The country is facing certain challenges implementing hydropower projects due to environmental impact issues, extensive project construction timelines, unpredictable weather conditions, insufficient financial support, defects in aging equipment, and limited coal production.

The military regime has prioritized hydropower projects, developing existing facilities, and undertaking new projects since dams are a primary power source for Burma’s energy sector during every military government time.

Solar: Burma has tremendous solar resource potential, especially in the middle of the country and in its extensive dry zones. Mini-grids and solar energy home systems are renewable energy solutions that could solve power shortage problems in rural communities. More than 30,000 rural villages are not directly connected to the national grid, according to the MIMU. As a result, the SAC is also committing sizable resources to off-grid renewables. The overall potential for solar power is approximately 51,973 terawatt-hours per year.

Currently, Burma only has one utility-scale solar power project, the 170 MW Minbu solar project in Minbu Township, located in Magwe Region, that has reached full commercial operation and has been producing 350m KWh annually electrifying roughly 210,000 households. The ousted civilian government called for 29 solar projects with a total capacity of 1 GW under 20-year contracts in 2020, and Chinese companies won 28 of the 29 projects. In June 2021, the regime-managed ministry invited a second tender for 1 GW solar projects and the state-owned utility Electric Power Generation Enterprise (EPGE) to accept the proposals. A few months later, it postponed the bid submission deadline. According to PV Magazine, one of the biggest tender winners, Chinese PV inverter manufacturer Sungrow announced in April 2022 that they canceled a project won in the 2020 tender. Currently, most solar projects stagnate due to the unstable political and banking situation and security concerns. The regime claimed that two solar projects, most likely the 40MW LetPanHla and 30MW NyaungPinGyi solar projects awarded in the 2020 tender, are more than halfway complete.

Wind: As the very first project for wind power in Burma, MOE signed an agreement with China’s Three Gorges Corporation to develop a 30MW wind power project in Chaung Thar, Ayeyarwady Region. Burma is an agriculture-based economy with ample land area, providing significant potential for wind-powered projects. These could be developed in Chin State, Rakhine State, Ayeyarwady Region, Yangon Region, Shan State, Kayah State, Tanintharyi Region, Mon State, and Kayin State, essentially most parts of the country. ADB forecasts that Burma has the potential for the development of 4,032 MW from wind energy.

Mini-grid/Off-grid: Across Burma, there are already numerous hydro mini-grids and hybrid solar-diesel mini-grids in operation. The potential for further mini-grid development in dry zones is high, particularly in the Magway and Sagaing regions. Direct combustion and gasification are the relevant technologies for mini-grids in Burma. Mini-grids could solve power shortage problems in rural communities since they are not directly connected to the electric power grid.

Many villages in rural areas still use off-grid diesel generators. Under the NEP plan, the Department of Rural Development (DRD) was mandated to undertake off-grid electrification to increase electricity access in rural areas, with the help of using public funds for system enhancements. From 2016 to 2020, a total of 434,480 households were electrified with a solar home system and mini-grids in 8,568 villages providing electrical access to 2.172 million people. There are still over 19,000 villages remaining to be electrified. As a result, the government is committing sizable resources to off-grid renewables.

Coal-fired: All contracts, except the Tigyit project, for coal-fired power plants signed by the former government with international and regional companies have stalled due to public opposition and concerns about pollution and other environmental impacts. Tigyit coal-fired power plant, the only coal power plant in Myanmar, operated by a joint venture between the China National Heavy Machinery Corporation and a group of Myanmar businessmen affiliated with the military, is producing 120MW and is connected to the national grid. Although Burma has estimated domestic coal resources of 540 million tons, coal extraction has remained slow due to low investment and the remoteness of the country’s identified coal sites.

Opportunities and Challenges

To achieve Burma’s electrification goals, serious investment in infrastructure development and power generation is needed. According to the MOEP and MOE, the ministry will need $5.8 billion to construct medium and low voltage lines and transformer/substations under the NEP plan.

However, the energy sector poses some significant challenges for foreign investors, including unsettled political and economic policies, unclear rules and guidelines, and a shortage of skilled labor. In addition, corruption, lack of transparency in the tender and procurement process, and banking issues are additional barriers. Finally, Chinese companies and investors stand as significant competition for U.S. firms. Chinese brands were chosen for 28 of the 29 solar power plant project tenders that opened for bidding in May 2020, and pricing is a major obstacle for U.S. companies when competing with Chinese brands.

Rising electricity demand from 3075 MW in 2017 to between 9100 MW-14,542 MW by 2030 will make renewable energy resources, including solar, wind, biomass, and geothermal, critical in the future. As Burma’s national grid system is weak and not accessible to most villages in rural areas, renewable mini-grids can be an affordable option for rural communities. U.S. firms need to consider and monitor political changes and constant shifts in rules and regulations in the energy sector.

Resources

Ministry of Energy and Ministry of Electric Power (https://myanmar.gov.mm/ministry-of-energy)

MMR Research

Contact Information

U.S. Commercial Service

U.S. Embassy, Burma

Email: office.burma@trade.gov