Overview

Kenya’s power sector experienced steady growth over the last two decades under an aggressive electrification program. Moreover, Kenya has abundant renewable energy resources as evidenced by its energy mix, which consists of wind, solar, geothermal, and hydro accounting for approximately 90% of Kenya’s installed capacity. In addition, Kenya is one of the lowest cost geothermal power developers in the world. As a result of Kenya’s aggressive electrification program over the years, today national electricity access stands at 84%, having grown from 32% in 2013. The country aims to achieve universal access by the year 2030 by largely focusing on expanding in rural access.

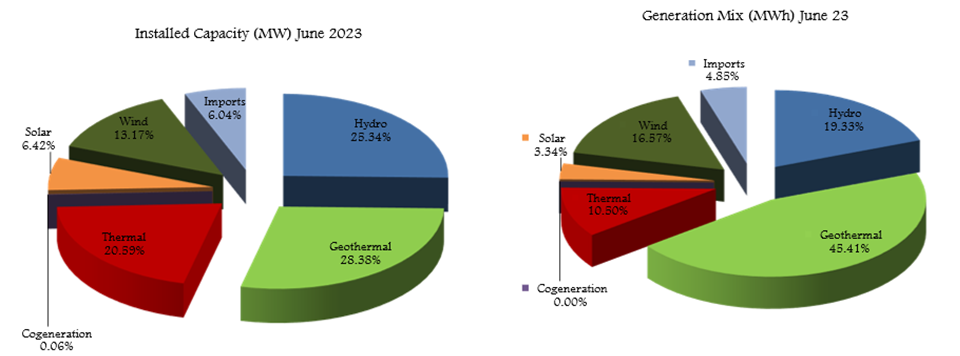

Generation:

Kenya’s installed electricity capacity as of 2023 stood at 3,321MW, a significant growth from 1,800MW in 2014, but still low for a country with a population of over 50 million. The GoK pursues efforts to increase power demand and supply and lower the cost of electricity by injecting cheaper renewable energy sources, such as geothermal, wind, and solar, into the energy mix, while weaning off the more expensive heavy fuel oil (HFO) plants. It is expected that power generation will reach 5,000MW by the year 2030 with the bulk of it coming from clean energy sources. Kenya has a long-term goal of developing nuclear power with the first project expected in 2036. The sector presents commercial opportunities, especially in renewable sources like geothermal, solar, and wind.

Around a third of Kenya’s installed capacity is owned and operated by independent power producers (IPP) across several plants, including small-scale hydro, geothermal, biomass, wind, solar, and heavy fuel oil plants. The remaining capacity is owned and operated by Kenya Electricity Generating Company (KenGen), which is 70% government owned.

Renewable Sources:

Approximately 90% of Kenya’s electricity is generated from renewable/clean energy sources. Of these, geothermal remains the most significant source with an estimated potential of 10,000MW, but it remains relatively unexploited with a current installed capacity of less than 985MW. Kenya is the seventh largest geothermal producer in the world. Geothermal power generation is primarily undertaken by government owned KenGen with only two IPPs producing energy in the sector, the U.S. firm Ormat’s 150MW Olkaria III plant and Sosian Energy’s 35MW Menengai plant. Government efforts in geothermal production seem to be paying off with various projects currently underway by both the public and private sector that should add over 1,100MW to the national capacity.

Wind energy is another key growth area. Kenya is estimated to have a wind power potential of 3,000MW. The Lake Turkana Wind Power Plant is the single largest wind power generation plant in Africa supplying 310MW to the grid. GE Energy is the technology supplier for the 100MW in Kipeto wind power plant, a Development Finance Corporation (DFC) -funded project that was commissioned in late 2021. KenGen has additional planned investments in wind power in Meru and Marsabit.

Kenya has high potential for solar power given irradiation levels available throughout the year. There is huge untapped demand for off-grid solar that will supply communities located far from existing transmission infrastructure. Plans are also underway to convert off-grid diesel stations to solar-hybrids to lower costs.

In December 2022, the U.S. and Kenya signed a Nuclear Cooperation MoU, which opens the door for U.S. industry to engage and share information with Kenya on technology for nuclear power production. Kenya plans to become a nuclear power producer by 2036 and is working together with the International Atomic Energy Association as it builds capacity.

Transmission:

Kenya experiences approximately 16% system loss of generated power due to aging transmission and distribution networks. To address this, Kenya Electricity Transmission Company (KETRACO), in its 2023-2042 Transmission Master Plan, includes the construction of 6,510 kilometers of transmission lines and 18,866 megavolt-amperes of transformation capacity. This will also help prepare the grid to meet projected growth in electricity demand from 12,985 gigawatt hours (GWh) in 2022 to 36,291 GWh by 2042. KETRACO estimates this buildout will require investments of $4.778 billion, of which only $987 million had been secured by the end of May 2023 when the master plan was published.

The GoK is opening space for PPPs in the transmission sector with funding from the World Bank and help from the International Finance Corporation to launch two tenders in 2024. KETRACO is piloting PPPs in the transmission line business with the hope of introducing a more efficient transmission infrastructure and creating a new revenue stream.

Distribution:

Kenya Power & Lighting Company (KPLC) is currently the sole distribution company in the country, and operates Kenya’s interconnected grid, as well as several off-grid stations in the northern regions of the country. Impressively, KPLC more than doubled access from 26% of households in 2013 to 77% in 2018, meeting best-in-class benchmarks globally. KPLC has been assisted in this effort by the Rural Electrification and Renewable Energy Corporation (REREC). Founded in 2006, REREC’s mandate has been to accelerate the pace of rural electrification across Kenya. Since its inception, REREC helped move rural electrification from 4% to 32% of rural households, largely through its efforts to connect 60,000 public facilities (mostly primary schools) around the country and all household consumers within 600 meters of those facilities.

Oil and Gas:

Kenya announced multiple onshore discoveries by Tullow Oil since 2012 that led to exploration and production companies’ optimism about the country’s potential. Tullow estimates current recoverable crude oil reserves to be approximately 750 million barrels. Tullow faced various challenges including funding hitches and the withdrawal of two key partners in the project, TotalEnergies and Africa Oil in 2023, who cited low petroleum potential in the project. Tullow is expected to announce its final investment decision by late 2024.

Current Energy Mix:

Kenya’s energy mix predominantly consists of green energy with geothermal, hydro, wind, and solar accounting for 85% to 90% generation in 2023, according to different estimates. The remainder is filled by biomass, HFO plants, and imports. Renewable sources are expected to replace existing thermal plants as Kenya moves towards a fully green grid by 2030.

Source: EPRA

Electricity Sector Institutions:

The key public-sector institutions involved in managing and regulating the Kenyan electricity sector are the Ministry of Energy and Petroleum, the Energy and Petroleum Regulatory Authority (EPRA), KPLC, Kenya Electricity Generation Company (KenGen), the Geothermal Development Company, the Kenya Electricity Transmission Company (KETRACO), and REREC.

In a policy shift, Kenya introduced regulatory changes in 2024 seeking to end the current monopoly in transmission and distribution held by KETRACO and KPLC respectively. The Energy (Electricity Market, Bulk Supply and Open Access) regulations 2024 provides open access to the transmission and distribution systems for private distributors at a fee which is expected to increase competition, efficiency and reliability and improve the quality of service within the electricity market while attracting investment in generation, transmission, distribution, and retail supply.

Power Africa:

Power Africa is a market-driven, U.S. Government-led public-private partnership that aims to double access to power in Sub-Saharan Africa by adding 30,000 MW of capacity and 60 million new household and business connected to the grid by 2030. It offers private sector entities tools and resources to facilitate doing business in Africa’s power sector. In Kenya, Power Africa is supporting the development of the energy sector through financing, grants, technical assistance, and investment promotion. More information about how Power Africa is partnering to address key challenges in Kenya’s electricity sector and supporting private sector investment in power infrastructure is available at https://www.usaid.gov/powerafrica/kenya.

Leading Sub-Sectors

Although installed capacity is relatively small, Kenya is the leading generator of electricity in eastern Africa. REREC is focused on connecting major town centers, schools, and hospitals to the grid, as well as looking at off-grid solutions such as diesel-fired power plants. REREC has been issuing tenders to convert these plants to hybrid solar Photovoltaic (PV) plants. Opportunities also exist for mini grids to solve power needs in county development plans.

The Solar Home Systems (SHS) segment experienced significant growth over the last ten years both urban and rural Kenya. It contributes greatly to rural electrification and access to clean energy. Players in the sector have had to innovate to increase uptake such as the “Pay-As-You-Go” (PAYG) model, a credit financing system where one pays very low daily rates over a long period of time to own the system. According to a World Bank-funded study, Kenya became the world’s second largest standalone SHS market after India, with millions benefiting from the off-grid lighting solutions. Kenya also adopted national standards for solar equipment, thus ensuring the quality and safety of products offered in the market.

Solar power is increasingly in use in rural Kenya where there is poor or no access to the grid. This creates a great opportunity for solar power systems providers; however, low-cost Chinese imports have flooded the solar panel market. Some establishments, such as hotels, are turning to solar lighting and water heating to reduce their power bills. This presents an opportunity for U.S. products for the commercial and industrial customer whose priority is quality.

The best prospects for U.S. exporters include drilling materials and related equipment, generation, substation, transmission and related equipment, electric and electrical cables, transformers, electric meters, electric poles, switchgears, wind turbines, solar thermal and solar PV equipment, inverters, deep cycle batteries, smart grid systems, and consultancy services.

Opportunities

The GoK is focused on developing the geothermal power potential in Kenya with a plan for drilling additional wells in the Rift Valley. KenGen plans to add 560MW of geothermal power to the grid through joint ventures, in addition to 1000MW of wind, and various solar installations at existing hydro sites. GDC plans to develop 2000MW from the Bogoria-Silali geothermal block and received a $89 million in concessional loans from the German Development Bank for this development, part of which will be applied to drilling of exploration wells. Numerous other exploration activities are underway in 10 other blocks.

Both KETRACO and KPLC are undertaking extension of the transmission and distribution grid network. In addition, the live line maintenance of distribution networks will require live line equipment where American companies have an advantage. The same applies to the expansion of the underground cabling system, where U.S. firms can compete to provide the necessary knowhow, equipment, and materials.

KETRACO plans to construct over 10,000 kilometers of high voltage transmission infrastructure including lines, switch gears, and sub-stations over the next four years. These will be financed by the GoK, development partners, IFIs, or through PPPs. These projects will also require consultancy and advisory services.

REREC is implementing solar mini-grids to serve households and provide other socio-economic benefits such as education, health, water, and food preservation in the off-grid areas of Kenya. In addition, the World Bank funded Kenya Off-Grid Solar Access Project (KOSAP) aims, in partnership with the private sector, to electrify 14 low-density, remote, and traditionally underserved counties that represent 20% of the population. The project, a flagship program of the Ministry of Energy, plans to implement mini-grids, standalone solar systems, solar water pumps and clean cooking solutions in these areas.

One key challenge in the sector is the delay in approving Power Purchase Agreements and the GoK’s reluctance to issue letters of support for project developers, which is a key component in getting projects to financial close.

Resources:

- Kenya Ministry of Energy

- Kenya National Bureau of Statistics

- The World Bank

For more information on the Energy sector please contact:

Mary Masyuko

Senior Commercial Specialist

U.S. Commercial Service, U.S. Embassy Nairobi

U.S. Department of Commerce | International Trade Administration

Tel: +254 (20) 363-6063; Mary.Masyuko@trade.gov