Southeast Asia Region Forecast

Article written by James Bledsoe, Director of the eCommerce Solutions Center

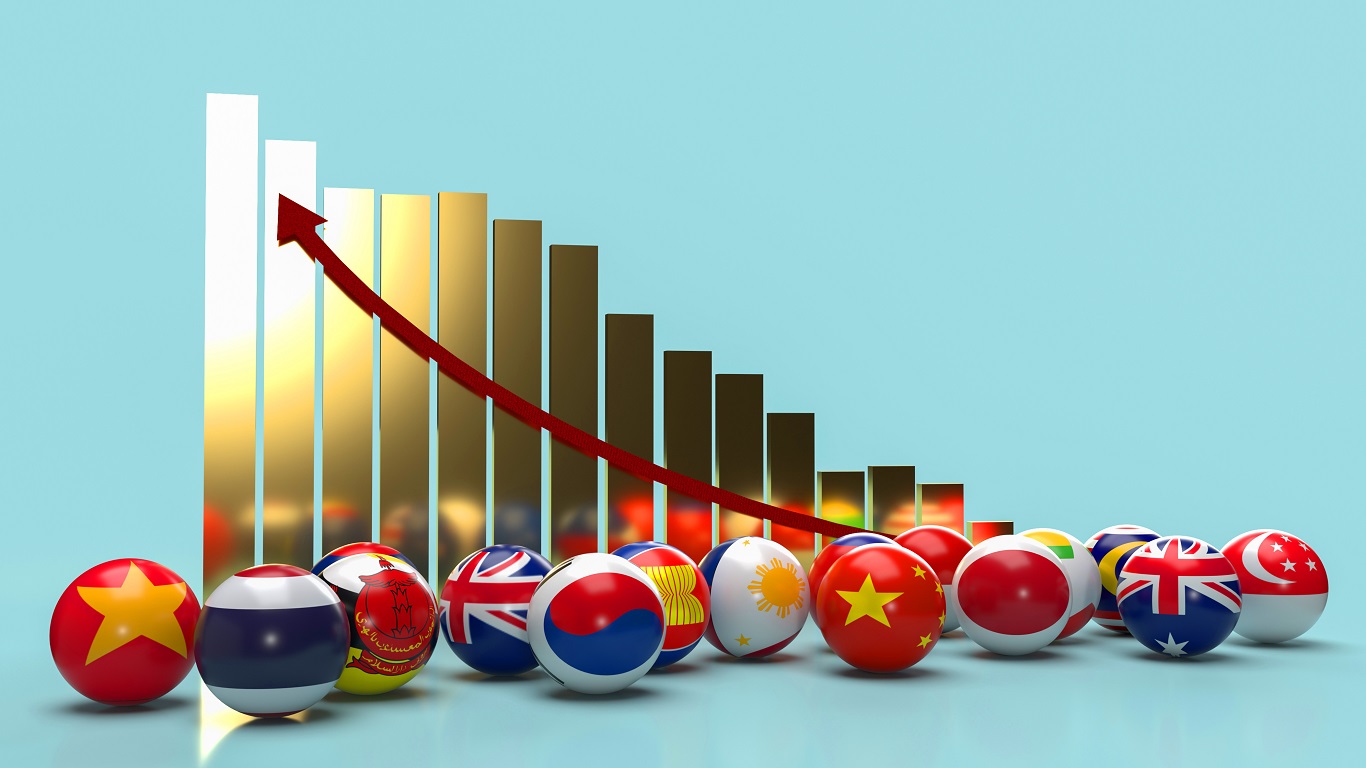

The Larger Asia Pacific Region Leads eCommerce Globally

Business-to-business ecommerce for the larger Asia Pacific region has been increasing at 15% on average annually, higher than the global average of 14.5% gross merchandise value growth annually.

Cross-border ecommerce development varies by individual markets within the Asia Pacific region, with China (71.4) scoring the highest in a ranked development index. South Korea (66.7) and Singapore (65.5) are the next ranked markets on the cross-border ecommerce development index, followed by the Japan (61.1), Thailand (58.8), Malaysia (57.7), and Indonesia (54.3) ecommerce markets.

Consumer electronics continues to lead the Asia Pacific region’s ecommerce revenue growth, along with the fashion and the toys & hobby segments comprising the majority of the total value of ecommerce sales through 2027.

Southeast Asia eCommerce Markets Are Set for Growth

The total internet economy for Southeast Asia is forecast to grow from USD$194 billion to over USD$330 billion by 2025, with Indonesia leading the rest of the region’s markets with an internet economy of over USD$82 billion in 2023.

Forecasts for Southeast Asian ecommerce market volumes show significant growth through 2030, with Vietnam, Thailand, and Philippines expected to more than double their ecommerce market values.

Reaching Southeast Asian eCommerce Consumers

Consumers in Southeast Asia predominantly use ecommerce marketplaces (57%) for new product discovery, followed by social media channels (50%), and Google search (40%). It is therefore important to focus on your digital strategy and website search engine optimization to make sure that your business shows up where and when it should for that international online sale.

Payment methods vary by individual market, with cash payments previously being the most frequently used payment method for ecommerce. Currently credit cards and local online wallets dominate as the preferred ecommerce payment method for Southeast Asia, with a forecast significant increase in both usage and merchandise value being process through these online payment methods through 2026.

| European Retail eCommerce Forecast | European B2B eCommerce Forecast | Africa eCommerce Spotlight | USMCA Country eCommerce Overview |

|---|

Return to eCommerce Frontline Library Content

Looking for more ecommerce resources?