The Rise of eCommerce in Africa

Mobile-Driven Africa

The logic of growth on this area is pretty much based on technology jumps that do occur within Africa because of historically missing economic infrastructure, such as banks, telecom landlines, etc. Africa is forecast to surpass half a billion ecommerce users by 2025, which will have shown a steady 17% compound annual growth rate (CAGR) of online consumers for the market.

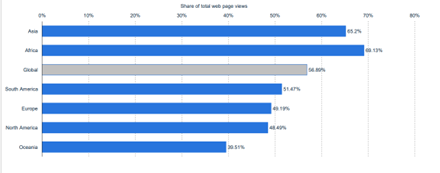

Africa leads mobile device web traffic generation, with 69% of its total web traffic consisting of mobile internet users as of 2021 and is forecast to be almost exclusively mobile-based market by 2040.

Compared to other regions, as of 2021 the African continent leads mobile internet usage a full 13% above the global average, and almost 5% more mobile usage than Asian region markets. This should indicate a “mobile-first” approach to any business looking to sell online to the various African markets.

Challenges of eCommerce Markets in Africa

African nations collectively are still behind global consumer banking habit averages, with almost half of the adults not in possession of any formal bank account preferring to pay in cash. Debit card payment methods makes for 10% penetration of the population, while credit card ownership rates are low with an average 2% for the entire continent. Therefore online payments remains a perennial challenge for businesses wishing to target ecommerce consumers in the African Markets.

Kenya leads the African continent with 88% of its population having bank accounts, followed by the nation of South Africa at 82%, Nigeria at 51%, Morocco at 42%, and Egypt at 38% of its population engaged with banking products.

The lack of multinational marketplace presence is another main challenge to adjust to, as local online marketplaces and online retailers that sell and ship regionally are favored by consumers across Africa’s ecommerce landscape.

African Online Consumer Preferences

Revenues for online sales of grocery and personal care products continues to grow and is forecast to continue steady growth through 2025.

Fashion and electronics products create the highest sales revenues among online shoppers in African markets, with fashion products predicted to reach $13.4 billion USD in sales and electronics predicted to reach #11.2 billion USD in annual sales by 2025.

Return to eCommerce Frontline Library Content

Looking for more ecommerce resources?