MDCP Cooperator Tools

Links to Frequently Used Resources

Budget Formulation

When preparing an MDCP application you will put together a list of expenditures that support your project, a budget. See “Budget” on our MDCP Application Process page. Guidance below will help you prepare your budget for your application and manage your budget if you receive an MDCP award.

Contractor Bid Threshold

As established by the Office of Management and Budget, for contractual expenses you include in your budget, no bids are required for anything less than the $15,000 micro-purchase threshold. For contracts valued at $15,000 to $350,000, you are required to have at least three bids. You do not necessarily have to choose the lowest bid. Ensure that the bidder you choose fulfills your statement of work. You are not required to include your bids in your MDCP project budget or supporting information. Just keep good records in case of an audit. (Note: For awards made prior to October 1, 2025, the thresholds are $10,000 and $250,000.)

Subrecipients

A subrecipient performs substantive work on an MDCP project. By contrast, a contractor is a vendor providing goods or services that benefit the cooperator (award recipient). If a cooperator project goal is to pay for part of the cost for a company to attend a trade show, the company receiving the assistance is a subrecipient, not a contractor.

In-Kind Match: Fair Market Value

See “What is in-kind contribution?”

Per Diem Rate

When formulating an MDCP project budget you need to estimate travel costs. For the airfare portion, just query a reputable travel site, ensuring that you are using U.S. flag carriers. For the per diem rates, you can use your organization’s pre-existing travel policy or you can use the federal GSA rate for domestic travel. For international travel, use the State Department rates.

Do you need to amend your project budget?

Most changes to an MDCP project budget are agreed and approved informally by the cooperator discussing such changes with the ITA-led federal support team. However, the following changes require formal approval and a revised budget:

- Change of scope

- Extension of project period

- Category-to-category 10% change threshold

With regard to the 10% threshold, when cumulative transfers between the 8 standard OMB budget categories exceed 10% of the total project budget, you will need to submit a revised budget for approval.

Steps for amending a budget that exceeds the 10% threshold

Start with your most recently approved budget. Most applicants use the MDCP budget worksheet Excel file for their budget worksheets. One of the tabs in this file is an Excel version of Standard Form (SF) 424A. You will only need to resubmit the numbers on rows 1, 6, 21, and 22 of the SF424A. Refer to the example and instructions below.

Use your budget worksheet to generate new numbers for an SF424A.

Transfer the numbers to a new SF424A.

Draft a short description of the changes between your previously-approved budget and your revised budget for which you are requesting an amendment. It may be easier to summarize them in a table based on the 8 standard OMB budget categories using the same order as in the SF424A.

Attach the description of the changes and your new SF424A in eRA. Per the example below, your revised SF424A should only have the following information filled in.

| Grant Program Function or Activity (a) | Catalog of Federal Domestic Assistance Number (b) | Unobli- gated Federal (c) | Unobli- gated Non-Federal (d) | Revised Federal (e) | Revised Non-Federal (f) | Total (g) |

|---|---|---|---|---|---|---|

| 1. MDCP | 11.112 | - | - | 300,000 | 600,000 | 900,000 |

| 6. Category | Fed | Non-Fed | Previous Fed | Previous Non-Fed |

|---|---|---|---|---|

| a. Personnel | 0 | 468,182 | 468,182 | |

| b. Fringe | 0 | |||

| c. Travel | 255,000 | 300,000 | ||

| d. Equipment | 0 | 0 | ||

| e. Supplies | 0 | 0 | 0 | |

| f. Contractual | 45,000 | 50,000 | 0 | 0 |

| g. Construction | 0 | 0 | ||

| h. Other | 0 | 0 | 50,000 | |

| i. Total Direct | 300,000 | |||

| j. Indirect costs | 81,818 | 81,818 | ||

| k. TOTALS | 300,000 | 600,000 | 300,000 | 600,000 |

| 21. Direct Charges: | 818,082 | 22. Indirect Charges: | 81,818 |

Example 1: In a $900,000 total project budget, re-allocating $45,000 from travel to contractual expenses does not trigger need for an amendment request because it is less than 10% of the total.

Example 2, shown above: Continuing on Example 1, later in the same year the same cooperator wants to move $50,000 from other to contractual. This would trigger the need for an amendment request because the cumulative of cross-category re-allocations exceed 10%: $45,000 + $50,000 = $95,000, which exceeds $90,000, 10% of the total budget.

Example 3: In a $900,000 total project budget (fed & non-fed shares together), spending $91,000 on travel to an expo in Hamburg instead of $90,000 for an expo in Munich exceeds 10% of the total budget but does not trigger a need for an amendment because the change remains within one budget category, travel, in this example.

Claim indirect costs as part of your required match

As an applicant, for every dollar of MDCP financial assistance, you must put up one dollar. But you can claim indirect costs as part of this required match. And you do not need an approved indirect cost rate to do it. Every applicant claims the same 10% of their direct costs. See the table for an example.

How to include indirect costs in an MDCP project budget

First, calculate direct costs. Then apply the indirect cost rate to the total direct costs. Take the amount that results and include it as part of the cash match. See the example below. When you are ready to create an MDCP application for funding, contact the MDCP Team for an electronic spreadsheet to use to create a more detailed indirect cost allocation suitable for including in your application budget.

| Category | Fed | Non-Fed | Total Budget | Notes/Calculations |

|---|---|---|---|---|

| Personnel | 0 | 95,000 | 95,000 | |

| Fringe | 0 | 20,000 | 20,000 | |

| Travel | 50.000 | 8,000 | 58,000 | |

| Contractual | 100.000 | 0 | 100,000 | |

| Supplies | 0 | 0 | 0 | |

| Equipment | 0 | 0 | 0 | |

| –––––- | –––- | –––— | –––— | ––––––––––– |

| Direct-subtotal | 150,000 | 123,000 | 273.000 | 273,000 * 10% = 27,300 |

| Indirect costs | 27,300 | Indirect costs are included in non-federal share (match). | ||

| Total | 150,000 | 150,300 | 300,300 | For the non-federal share, cash match must equal at least half the federal share. The rest of the non-federal share (match) can be either cash or in-kind contribution. In this example, total match must be at least $150,000. All match in this example is cash.* |

*Review a more detailed example of match requirements and indirect cost calculations, go to our Application Worksheets page, scroll down, and select Part B: Budget.

ITA policy on MDCP project indirect costs

The indirect cost rate is the ratio, expressed as a percentage, of an organization’s total indirect costs (numerator) to its direct cost base (denominator). ITA has an agency approved 10 percent indirect cost rate for MDCP awards. This rate is the same percent as the de minimis rate discussed in 2 C.F.R. §200.414. The 10 percent rate is used by all MDCP award recipients even if they have a negotiated indirect cost rate with the Department of Commerce or any other cognizant agency. Indirect costs constitute part of the cash match. Indirect costs are included in the budget by multiplying the 10 percent indirect cost rate by the total direct costs of the project.

Match (non-federal share): Cash v in-kind

Each MDCP award dollar (federal share) must be matched on a 1-to-1 basis. (Note: For MDCP awards made from 1993 through 2022, the match requirement was 2-to-1. This means that cooperators that received their award in 2022 or before will continue to use the 2-to-1 match. The example below is for a 1:1 match.)

The applicant must put up a match equal to or greater than the federal award amount. Of this match, an amount equal to at least half of the federal award amount must be cash. The balance of the match may include additional cash or in-kind contribution by the applicant. It may also include contributions by other organizations. All contributions for entities other than the award recipient are considered to be in-kind.

See the table below for an example.

| Category | Fed | Non-Fed Cash Match | Non-Fed In-Kind Match | Total Budget | Notes/Calculations |

|---|---|---|---|---|---|

| Personnel | 0 | 35,000 | 29,000[a] | 64,000 | [a] In this example, in-kind match is the fair market value of time spent on project activity by an entity other than the award recipient (cooperator). |

| Fringe | 0 | 6,000 | 7,000[b] | 13,000 | [b] In-kind fringe benefits portion of personnel cost described above. |

| Travel | 49,000 | 2,000[c] | 2,818[d] | 49,818 | [c] In this example, U.S. firms participating in project activity pay the cooperator $2,000 fees that include travel expenses. This is program income and is counted as cash match because it adds value to the project. [d] In this example, an airline contributes $2,818 in complimentary tickets to cover some of the project-related travel. It is in-kind. |

| Contractual | 55,000 | 0 | 0 | 55,000 | |

| Supplies | 0 | 0 | 0 | 0 | |

| Equipment | 0 | 0 | 0 | 0 | |

| ––––––– | ––––– | –––—– | –––— | –––— | ––––––––– |

| Direct-subtotal | 100,000 | 43,000 | 38,818 | 181,818 | |

| Indirect costs | 18,181 | 18,182 | - | ||

| Total | 100,000 | 61,182[e] | 38,818 | 200,000 | [e] The cash portion of the match must be at least as great as half of the MDCP award, the federal share. This is the case in this example. The award is $100,000 and the cash match is $61,181. |

| Reimbursement Ratio | 50.00%[f] | [f] Federal share (award amount) divided by the total project cost (100,000 / 200,000). This means that, on average, for every $10,000 of budgeted project expenditures of both cash and in-kind, the cooperator is reimbursed $5,000. |

*Review a more detailed example of match requirements and indirect cost calculations, go to our Mock Application (example) scroll down, and select Project Budget.

Need a source of cash match? Claim program income if there is value added.

Program income expended on project activity may be counted as cash match if it represents value added by the cooperator for project activity. For example, a cooperator could claim as program income fees paid to it by the prospective exporter for technical seminar participation if these fees are paid in recognition of the value added by the cooperator’s project. In this example, the value could be evident in the technical-seminar participation package that the cooperator creates. This might include organizing pre-seminar training, finding optimal hotel accommodations, securing group airfare, meeting with seminar organizers beforehand, and organizing a reception. Such a cooperator package helps determine project success.

Buy-in by participating U.S. firms

When companies seeking to export pay fees for such a package to the cooperator, they are doing more than getting themselves to a technical seminar; they are agreeing that the project itself has value. Because the cooperator’s package adds value and furthers project goals, the cooperator could charge fees, use the fees to pay for the project package, and claim the fees paid as cash match. Payment by a prospective exporter to a cooperator may only be claimed as program income and cash match if the payment is for a project participation package created by or facilitated by the cooperator.

Cannot count expenses incurred by participating firms

If it is a prospective exporter participating in your project that makes the arrangements, then the cooperator has not added value that the exporter is paying for and the cooperator cannot claim any program income.

Example

This can be illustrated in the example of a prospective exporter that attends a technical seminar as part of a cooperator’s project. If the prospective exporter negotiates amounts for its own arrangements with vendors, pays the total amount to the cooperator, then has the cooperator pay the amount to the vendors, the cooperator has not added value that the exporter is paying for. Except for the final payment to vendors, it is the prospective exporter, not the cooperator that has made all of the arrangements. The prospective exporter’s payment to the cooperator is not in recognition of any value that the cooperator had added with its project. Accordingly, it could not be claimed as program income. When structuring participation packages designed to elicit program income an applicant may include expenses that a prospective exporter might otherwise arrange and pay by itself. Common examples include hotel accommodations and exhibition hall booth rental. By grouping such expenses together, negotiating more favorable group rates, and adding additional activities that a prospective exporter is unlikely to arrange on its own, the cooperator adds value. The prospective exporter’s payment to the cooperator for the full amount of the participation package recognizes this value. Accordingly, it is program income to be counted as cash match.

Example in the table above

The example explained in the paragraph above is detailed and instructive. But the table above includes a more simple example of “cash match if value added” identified as note [e].

Financial Assistance (“Grants”) Management Resources for Cooperators

A. Contact

General Questions

- For questions about particular events in your project work, contact your ITA-MDCP team leader.

- For larger questions about policy and process, contact the MDCP program management team.

- Other contacts specific to financial assistance management are set forth below.

For questions about eRA Commons

- eRA Commons is your portal for submitting reports.

- Telephone the eRA service desk at: 866-504-9552 or 301-402-7469.

- Email the eRA service desk at helpdesk@od.nih.gov.

B. Drawing Down Award Funds

ASAP: Difficulty drawing down advances or reimbursements from your MDCP award

Soon after you received your award, NOAA Grants Management Division helped you set up an account with ASAP, a Treasury Department system that allows ACH transfers from your MDCP award directly to your organization’s bank account. (Note: Effective October 1, 2025, grants management support for MDCP awards transferred from NOAA to NIST.) After account setup, if you have trouble with ASAP, note the following:

- First, try the ASAP help desk.

- Your ASAP access will lapse if you go 90 days without logging on.

- If ASAP help desk tells you the problem is with the granting agency, Commerce/ITA, request help from mdcp@trade.gov.

ASAP: Justification of reimbursements and advances

ASAP requires a justification statement for each reimbursement or advance when you draw down award funds. Below is a format you can follow that should fulfill the requirement. See also two justification examples. These indicate the number of characters including spaces. ASAP limits justification statements to 300 characters. With such limits, you will not be able to include every expense. The justification statement is not an audit.

Format:

Request covers federal share of [indicate one or more events, project activities, and/or support elements including locations and dates].

Example 1 (182 characters):

Request covers federal share of travel/lodging for our staff attending Expo Manufactura in Monterrey, Mexico, Feb 11-13, 2025, and a portion of personnel costs incurred Jan-Feb 2025.

Example 2 (281 characters):

For Jan 15-Mar 30, 2025, request covers federal share of: cost of IT services contractor for development/maintenance of StandardsNow.org, 5 days travel/lodging of U.S. technical experts at ISO tech. committee meetings in Geneva, Switz., and salary/benefits of standards specialist.

C. Federal Financial Report SF-425, aka “FFR”

- Submit an SF-425 for the six months ended September 30 and March 31. The report is due 30 days after the end of the reporting period.

- Complete and submit your SF-425 on eRA per the instructions in the Performance Progress Reports accordion page.

D. General Federal Regulations

The guidance on MDCP Cooperator Tools contains most of what you need to know about managing your MDCP award. This guidance is based on the policy and regulations below that are part of your cooperative agreement with ITA.

“Excessive Cash on Hand” Message from eRA

Reason 1. for Receiving Message: Award Advance Remainder After 30 Days

As an award recipient, if you receive your MDCP award funds as an advance, you must spend such funds and claim the federal and non-federal share in eRA within 30 days. If you ever have over $5,000 of federal award funds after 30 days, eRA will send you this message to remind you that this is not permitted. This rule prevents recipients of federal financial assistance from earning substantial interest on federal award dollars.

If this accurately describes your situation, contact the MDCP Team to learn what action to take. It will probably include providing a written explanation on line 12 of your quarterly financial report.

Reason 2. for Receiving Message: Slow Draw-Down of Award Funds

Even if you draw down your award funds by reimbursement rather than by advance, you still may receive an “excessive cash on hand” message. eRA automatically checks to see how long it has been since the end of the last quarter that you have requested reimbursement for project activity expenses. If it has been more than several weeks, eRA will generate an “excessive cash on hand” message about your MDCP project should always be directed first to your ITA-MDCP team leader.

In such case, you can address the situation by emailing an explanation to the grants specialist and copying the MDCP director, who acts as the federal program officer. One or a combination of explanations below are likely to suffice for most MDCP projects. “Our draw-down of award funds has been delayed because…”

- The [name of event] listed in our work plan was postponed

- A staffing change temporarily interrupted personnel expense that we planned to charge as we had anticipated in our project budget

- A change in contractor temporarily interrupted contractual expense that we planned to charge as we had anticipated in our project budget

- The ITA-approved MDCP project work plan includes periods of time like the one at issue during which project expenses are too low to warrant a request for reimbursement or advance

- ITA has agreed that it would be better to participate in the [name of recurring event] during the next cycle [year, quarter, etc.] rather than the current cycle

A less timely alternative than the email suggested above will be to include an explanation such as one or more of those listed above on line 12 of your quarterly financial report.

Grants Management: Extend Your Project Period

Most cooperators find that they need more time to complete their MDCP project work plan. You can extend your project period up to five years following September 30 of the year you received your MDCP award. Most extensions are requested in chunks of one or two years.

How to extend:

- Explain in a brief paragraph why you need an extension. It can be something as simple as “Project activities were delayed and we need more time to accomplish project goals.”

- Specify that you request a “no-cost” extension and include the new project-end date you wish. Most cooperators opt for September 30.

- To create a revised Standard Form (SF) 424A, you will only need to resubmit the numbers on rows 1 and 6 of the SF424A. Refer to the example and instructions below. “Fed” and “Non-Fed” refer to the portion of your budget that remains. As indicated below, you will need to type “Fed” and “Non-Fed” as column headings on your blank SF424A. Find the totals for these amounts on your most recent financial report, SF425.

- Transfer the new numbers to a new SF424A.

- Log on to eRA Commons and submit your request, attaching your new SF424A. Be sure to specify your new, extended date for the end of your award period.

- Once the “signing official” you have designated for your organization approves the extension request, it goes to the program officer (MDCP Director), who recommends final action by the grants officer.

The example below is a cooperator whose original award (“Fed”) was $300,000 and match (“Non-Fed”) was $ 600,000. Now that they are part-way through their project, they have most recently reported on their SF425 financial report that $150,000 Fed remains and $300,000 Non-Fed. Extrapolate from this example using the numbers you reported most recently on your SF425 financial report.

| Grant Program Function or Activity (a) | Catalog of Federal Domestic Assistance Number (b) | Unobli- gated Federal (c) | Unobli- gated Non-Federal (d) | Revised Federal (e) | Revised Non-Federal (f) | Total (g) |

|---|---|---|---|---|---|---|

| 1. MDCP | 11.112 | - | - | 150,000 | 300,000 | 450,000 |

| 6. Category | Fed | Non-Fed |

|---|---|---|

| a. Personnel | 0 | 234,091 |

| b. Fringe | 0 | |

| c. Travel | 127,500 | |

| d. Equipment | 0 | 0 |

| e. Supplies | 0 | 0 |

| f. Contractual | 22,500 | 25,000 |

| g. Construction | 0 | 0 |

| h. Other | 0 | 0 |

| i. Total Direct | ||

| j. Indirect costs | 40,909 | |

| k. TOTALS | 150,000 | 300,000 |

Specific Award Conditions

Each MDCP award is subject to Standard Terms and Conditions. These are “standard” because they apply generally to all grants and cooperative agreements made by the Department of Commerce. They are part of the award package summarized on form CD-450, available to a cooperator on Grants Online. By contrast, Specific Award Conditions (SACs) are stipulations that are not standard for recipients of Department of Commerce financial assistance awards. SACs may be specific to all MDCP awards but may also be specific to just one particular MDCP award.

SACs often require that the award recipient (cooperator) certify that the SAC has been satisfied. Do this in eRA.

If you need help, see Financial Assistance Management Resources.

Performance Progress Reports (PPRs)

See the description of the three parts of the quarterly reports in the table below. Can’t find the report templates we gave you at orientation? Ask any member of your federal MDCP support team or request them directly from the MDCP Team.

Once completed, email the Excel version of your reports to the MDCP Team, also save as PDF, and submit the PDF in eRA. Due 60 days after March 31, June 30, September 30, and December 31.

| Part | How to Submit | Description | Status |

|---|---|---|---|

| A 1 | Online Survey | Estimate future exports. | PUBLIC |

| A 2 | Online Survey | Exports generated. | PRIVILEGED-NOT PUBLIC |

| B (customized template for each cooperator) | Upload Excel file to eRA. Request Excel template from MDCP@trade.gov if needed. | Project-specific milestones. | PUBLIC |

Submitting PPRs (and Financial Reports) in eRA

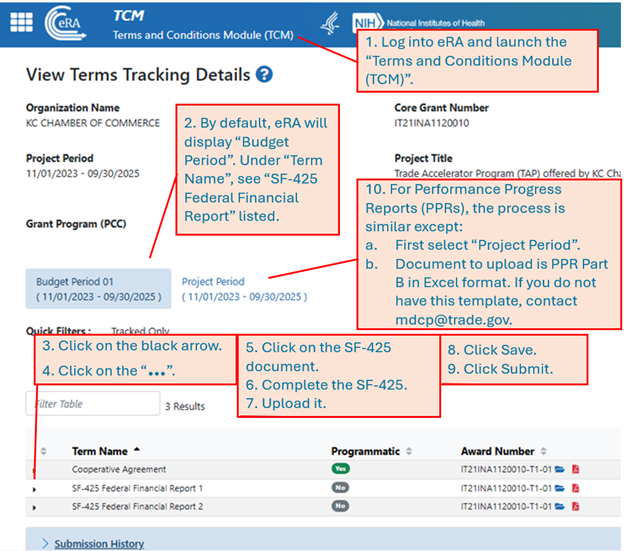

Both financial reports (FFRs) and performance reports (FFRs) are submitted via the same eRA module, TCM, short of for Terms and Conditions Module. You must start in this module to submit these reports. Follow the detailed directions below:

- Log into eRA and launch the “Terms and Conditions Module (TCM)”.

- By default, eRA will display “Budget Period”. Under “Term Name”, see “SF-425 Federal Financial Report” listed.

- Click on the black arrow.

- Click on the 3 dots.

- Click on the SF-425 document.

- Complete the SF-425.

- Upload it.

- Click Save.

- Click Submit.

- For Performance Progress Reports (PPRs), the process is similar except:

- First select “Project Period”.

- Document to upload is PPR Part B in Excel format. If you do not have this template, contact mdcp@trade.gov.

Final Performance Report

The final report is due 90 days after the award period ends. There is no prescribed form but please limit it to two pages. There is no need to include the detailed information submitted over the course of the project period. Focus on trends, accomplishments, highlights, how ITA can do better, and what you might do differently.

Need Help with eRA?

ERA Commons is your portal for submitting Part B and your final report. Get assistance from the eRA helpdesk at 866-504-9552.

Success Agreements

Most MDCP projects include events in which U.S. companies that seek to export participate. When recruiting firms for such events, a cooperator should use a successful agreement. Use the table below as a guide for drafting a successful agreement. Each U.S. company participating in MDCP export development activity should sign a success agreement as a condition of participating in project activity. An example success agreement is included in a mock application. Find it at on the Application Worksheets page, Part B: Budget, Section 3, MDCP App Other Attachments. Contact us at mdcp@trade.gov if you have questions.

| Section | Text |

|---|---|

| Benefits to a U.S. company of participating in MDCP project activity | WILL BE SPECIFIC TO YOUR PROJECT ACTIVITY: Most cooperators create a benefits section of the success agreement that is unique to each distinct event or activity. What you include will depend on the specifics of your project. Commercial Service counseling: ITA’s Commercial Service has trade specialists in offices across the country. Their job is to help your company become more globally competitive. A Commercial Service specialist will contact you. Communicate with them and coordinate about what help you may need and follow-up regarding your success. |

| Pledge to report export success | MAY VARY BUT MUST INCLUDE LANGUAGE SIMILAR TO THIS: Reporting your success. Our partner, ITA, needs to be able to show that its financial assistance is a worthwhile investment of U.S. tax dollars. So, as a condition of benefiting from this project, you agree to report as set forth below.

|

| U.S. company and U.S. product affirmation | MUST INCLUDE: I certify that I am, that my company is, or that I or my company represents:

AND I am, my company is, or the entity I or my company represents is, exporting, or seeks to export goods or services produced in the United States, or goods or services that contain at least 51 percent U.S. content. I understand that this certification is a requirement to participate in the MDCP project activity described above and that an intentionally false certification may result in termination of participation in such activity. Information provided to the International Trade Administration (ITA) is intended solely for internal use. ITA will protect business confidential information to the full extent permitted by law and Administration policy. U.S. law prohibits U.S. government employees from disclosing trade secrets. |

Changes, Collaboration, Cooperative Agreement

ITA MDCP project team collaboration and changes to your plan

Collaboration with Your ITA MDCP Project Team

An MDCP award is not a grant but, rather, a cooperative agreement. This means ITA will have substantial involvement in helping you meet your project goals. Depending on your project goals, your ITA MDCP project team will work closely with you to coordinate project activity, engage in commercial diplomacy/advocacy, participate in project activities, promote your project, track success, and more.

Changes to Your Project Scope and Objective

A cooperator’s submitted MDCP application includes the scope and objective of a proposed project, for example, the adoption of fair and transparent vehicle standards in South Korea. At the time of the MDCP competition, a different scope or objective could have led ITA to select a competing application to receive an award instead of the cooperator. Therefore, post-award, to change the project scope or objective, a cooperator needs to request and receive a scope amendment.

For purposes of MDCP awards, scope can be generally understood as industry focus, target market, or both. By contrast, objective is the desired outcome and/or method for achieving it. To continue the example above, the scope of project is the automotive market in South Korea. The objective is to achieve certainty, clarity, and/or fairness in the standards regime that governs vehicles. A change from South Korea as target market would require a scope amendment. A change from vehicles to another target industry such as financial services would require a scope amendment. A switch from industry standards to matchmaking potential buyers would be a change in objective that would require a scope amendment. Changes in scope and objective are made via scope amendment.

When A Scope Amendment Is Not Necessary

Modifications less significant than a change in scope or objective can be addressed through joint cooperator-ITA team coordination and concurrence as noted above. To continue the example, after starting its MDCP project ITA tells the cooperator of upcoming United Nations meetings that could be good venues to address vehicle standards issues relevant to South Korea. Though not in the original work plan, such activity can be added to the plan after getting joint cooperator and ITA agreement that doing so will help achieve project objectives. While no scope amendment may be required, the cooperator will need to pay attention to other parameters. For example, changes it works out informally with its ITA MDCP team might, nevertheless, result in breaching the 10% change threshold for changes to its project budget. Or, it may require more time, and therefore, an extension of the project period.

Diffused Project Benefit Does Not Equal Expanded Scope

If, in the example above, standards promulgated in United Nations affect more markets than just South Korea, the cooperator would not need to request an expansion of the scope beyond South Korea. A cooperator can claim positive outcomes from its project activity that go beyond the market originally targeted.

How to Request a Scope Amendment

- Discuss it with the ITA MDCP project team.

- Explain and justify:

- What are the changes?

- What circumstances prompt the proposed change?

- How do the proposed changes compare to the submitted application?

ITA will need enough information to state either that (1) the application with the amended scope would have been selected during the MDCP competition or that (2) based on circumstances that have changed since the competition, ITA would still find the cooperator’s revised application good enough to merit an MDCP award.

- Create a revised SF-424A per the template and instructions.

- In eRA, enter your explanation/justification and attach your revised SF-424A.

Changes that Require Action in eRA But Not a Scope Amendment:

- Removal, addition, or substitution of cooperator program director or business officer

- Significant sub-awards beyond relevant bid thresholds

- Extension of time to your project period

- Fly America Act waiver requests

- Cumulative category-to-category changes that exceed 10% of the total project budget

Fees for Some Services Provided by the Commercial Service

The Commercial Service participates on each MDCP project team. Applicants should understand that the Commercial Service is required to charge fees to cover costs for many of the services it provides. The policy set forth below applies to Commercial Service resources that are provided as part of MDCP cooperative agreements. The Commercial Service will provide, as part of each cooperative agreement, a limited amount of reasonable assistance to MDCP cooperators at no charge. Such assistance does not extend to a cooperator’s constituent member companies or to any other for-profit enterprises. These will pay the Commercial Service normal user-fees as applicable. The policy set forth below applies to Commercial Service resources that are provided as part of the cooperative agreements. For assistance that goes beyond the “limited amount of reasonable assistance” as defined below, applicants should make provision in their budgets. To determine the cost for services provided by the Commercial Service, applicants should contact the domestic offices, U.S. Export Assistance Centers (USEACs), or overseas Commercial Service offices.

There may be situations that prevent the Commercial Service from providing no-charge services to cooperators. Perhaps the most common example is another event to which the Commercial Service office has already committed its resources. The definitions below will guide the domestic or overseas Commercial Service offices in implementing this policy.

Overseas Commercial Service Offices: Limited Amount of Reasonable Assistance

“Limited amount of reasonable assistance” means two days’ Commercial Service effort per cooperator, per country, per year. Depending on the availability of resources at the time that it is needed, the assistance could include briefings on market conditions, temporary use of Commercial Service office space, help in making appointments and hotel reservations, and organization of seminars and conferences. Out-of-pocket costs to the Commercial Service and specially-prepared market research are not included in the no-charge assistance.

No Charge

No-charge means that no fees are collected. The term applies to costs the Commercial Service has already undertaken to cover such as time expended by Commercial Service employees and its own office space. It does not apply to any out-of-pocket cost. Cooperators should always expect to pay costs such as hiring a private interpreter or transportation.

Office of the Commercial Service Domestic Network, aka U.S. Export Assistance Centers (USEACs)

USEACs can generally implement the policy as a no-charge extension of normal client support. Most USEAC service to cooperators is provided as part of long-term relationships developed in local exporting communities throughout the United States.

Fiscal Year Operating Plan

Each August during the award period, each cooperator formulates an operating plan for the coming October-September federal fiscal year (FY) based on the work plan submitted in the application and any changes that have happened since. The plan identifies:

- Work items: Events and/or significant undertakings

- Projected dates for work items, and

- Rough cost estimates for each work item.

Contact the MDCP Team to request an example operating plan to use as a template. Or ask your ITA-MDCP team lead.

- By Aug. 18: Each COOPERATOR provides a ROUGH estimate of the value of major work plan activities

- List the 3-10 most significant work items planned for October-September.

Include a very rough estimate of the total value of the MDCP project budget to be devoted to each item.

Approximate the portion of the total MDCP project budget (award, cash match, in-kind match, and indirect costs) that will be devoted to each item. These NEED NOT TRACE to the detailed project budget. ITA uses the list of work items and rough cost only to approximate the magnitude of cooperator effort.

Depending on the size of the project budget, rounding to the nearest $5,000 or $10,000 is probably accurate enough.

- By Aug. 29: The ITA MDCP TEAM assigned to support each cooperator estimates cost of its participation which may include:

- Travel cost of any federal team member to participate in cooperator project activity.

- Cost of other research, trade press subscriptions, etc. needed to support the project.

- The ITA MDCP Team follows guidelines on ITA’s MDCP internal site. The link is available to ITA staff by contacting MDCP@trade.gov.

Fly America Act Waiver Requests

For travel that is funded by the federal share (your MDCP award) or the non-federal share (match) of the project budget, you must comply with the provisions of the Fly America Act. When this is not possible or practicable, you can request a waiver through eRA. Before you do so, first contact the MDCP Team. Refer to the summary of allowable waiver reasons below.

| Allowable Waivers | Description | Justification/ Documentation |

|---|---|---|

| U.S. flag carrier service not available | 1. U.S. carrier involuntarily re-routes traveler on a foreign carrier. 2. No U.S. carrier serves a particular leg of the trip. | 1. Attach carrier/travel agent document. 2. Attach search results showing that no U.S. carriers serve destination(s) in the leg of the trip. |

| Increased travel time | 1. When the flight from origin to destination airport by a foreign carrier is 3 hours or less and: a. Use of U.S. carrier extends travel by 6 hours or more, or b. Use of U.S. carrier doubles travel time. 2. Air travel between U.S. gateway airport & foreign gateway airport and use of nonstop U.S. carrier extends travel by 24 hours or more. | Attach each results (Kayak, Expedia, etc.): -Limit search parameters to date/time when travels needs to be completed. -Do not limit search parameters to non-stop flights. -Priority sort by time, not by price. -Include all search result screens. -For any/all U.S. carriers that show search results, explain why such flights cannot be used. (Hand-written notes on search results really help! For example, “increases travel time by more than 6 hrs.”) |

| Bad foreign connections | When a U.S. carrier does not offer a nonstop or direct flight between origin and destination, and using a U.S. carrier: - Increases plane changes outside the United States by 2 or more, or - Requires 4 hours or more layover at foreign interchange point. | Same as for “increased travel time” above. |

| Use of a foreign carrier is a “a matter of necessity” because: | 1. U.S. carrier cannot provide needed transportation: a. For medical reasons b. To avoid unreasonable risk to traveler’s safety c. Seat in authorized class of service is available on foreign carrier d. Other reasons U.S. carrier cannot provide transportation 2. Use of U.S. carrier will not accomplish the U.S. Department of Commerce’s mission. | 1.a. & b.: Explain/document: - Medical condition - U.S. Govt. travel advisory - Other 1.c. Attach carrier/travel agent document 1.d.& 2. Explain/document (Convenience of traveler and cost are not valid justifications.)

|

| Bi- or multi-lateral agreement with foreign carrier’s flag nation | Travel aboard carriers flagged in the countries below is treated the same as if it were travel on a U.S. flag carrier: Iceland, Norway, Switzerland, Australia, Japan, or the European Union. | Explain that the travel will be on a carrier from one of the approved countries with a bi- or multi-lateral agreement with the United States. |

| No U.S. air travel segments | Applies to travelers with a home duty station or place of work that is considered to be a foreign location. | Explain that the traveler is based abroad, not in the United States. |

Use of ITA Emblem and CS Logo

In communications about MDCP project activities, such as outreach to potential participants in project activity, notices of project activity, and acknowledgments of support, each cooperator must acknowledge its MDCP cooperative agreement with ITA by using the ITA emblem. ITA encourages each cooperator to also include the Commercial Service (CS) logo in its acknowledgment. Both the ITA emblem and the CS logo are trademarks of the U.S. Department of Commerce. Your permission to use them is governed by your MDCP cooperative agreement which incorporates the Department’s License to Use DOC Symbol Other Than the Seal. Follow the steps below.

1. Get image files

ITA has several different image files you can use. Request them from the MDCP Team or from MDCP@trade.gov.

2. Integrate ITA emblem & CS logo into your graphic

Create a draft (“proof”) of each graphic you intend to use in conjunction with MDCP project activity. Include the ITA emblem and CS logo within these parameters:

a. The ITA emblem and CS logo should be the same size.

b. Use a CS logo image file that includes the circled R symbol denoting registered trademark.

c. For proofs in a language other than English use the ITA emblem/CS logo only for communication directed to non-U.S. entities located outside the United States, e.g. potential buyers of U.S. exports.

3. Email your proof(s) to your ITA team lead and MDCP director

The MDCP director or their designee will respond to your requests for permission. Plan ahead. On average, securing ITA permission takes about four business days.

4. Each proposed use

ITA does not issue blanket approvals. Send a request, as described above, for each proposed use, e.g. each proposed email, webpage, poster, etc. for each project activity.

Frequently Asked Questions and Similar Resources

The collection of frequently asked questions below may be relevant to cooperators working on active MDCP projects.

- Budget basics

- Federal government shutdown

- Funding: Basic parameters for MDCP project spending

Similar resources that may be relevant for project work:

- MDCP project success stories

- Summary of completed MDCP projects

- Summary of current MDCP projects

Public Release of Winning Applications & the Freedom of Information Act (FOIA)

ITA may make available publicly “winning” applications. This generally happens in response to requests from entities that wish to see examples of winning applications. Such requests are almost always made informally but may come pursuant to a FOIA request. Whether in response to an informal request or a FOIA request, ITA’s policy with regard to public disclosure of applicant information is the same.

If your application contains information or data that you want to withhold from public disclosure:

a. Bracket [information] to be withheld from public disclosure. Above each affected page or paragraph include header: “LIMITED USE: BUSINESS IDENTIFIABLE INFORMATION (BII) surrounded by brackets [] includes trade secrets, commercial, or financial information.”; and

b. Explain why the information should not be disclosed and mark each affected page to assist ITA in making disclosure determinations.

Based on your bracketing, marking, and explanation, ITA will protect the confidentiality of the content of your application to the maximum extent permitted by law.

If you receive an MDCP award and have claimed BII treatment for any of your application content, you will redact such content to create a public version that we can release upon request.

Based on prior experience, some, but not all MDCP applicants consider the following to be BII:

- Salary and benefits information that identifies specific people.

- The identity of specific companies that indicate their interest in participating in MDCP project activities in the event the application is selected to receive an MDCP financial award.