Overview

Electricity production in 2022 reached 178.8 terawatt hours (TWh). Electricity demand was at the level of 177.1 TWh. For the first time in seven years, Poland was a net exporter of electricity. Exports amounted to 1.68 TWh in 2022. The share gross electricity generation from coal in 2022 was 70.7%, 1.7 percentage points less than in 2021. In 2022, the share of renewal energy sources (RES) capacity increased to 38.3% (from 32%). At the end of 2022, RES capacity exceeded that of coal-fired power plants. This fact is purely symbolic, as the operating characteristics and functions performed by these sources in the system are quite different. Photovoltaics are responsible for more than half of RES capacity (53%). Wind power accounts for 40%, with 60.0 GW achievable capacity at the end of 2022.

The pace of expansion and modernization of energy generation units is still insufficient to ensure energy security in the face of planned shutdowns in the conventional power generation. Despite high CO2 prices, coal-fired generation was less expensive than natural gas-fired generation, resulting in a record increase in the use of coal-fired capacity and a decrease in the use of natural gas-fired capacity. For the first time in years, wholesale electricity prices in Poland were among the lowest in Central Europe. This resulted in high exports and production. The average spot price of CO2 in 2022 amounted to $44.2/t CO2. Poland’s revenue from the sale of CO2 allowances was more than $4.94 billion in 2022. There is an ongoing energy crisis, triggered by Russia’s aggression against Ukraine and a decline in electricity generation in Europe from hydro and nuclear sources. Combined with fluctuations in supply, demand, and commodity prices caused by the COVID-19 pandemic, EU wholesale markets witnessed a steep rise in energy prices of up to 400 EUR/MWh in 2022. The Polish Government’s commitment to coal while the rest of the EU steps up climate action also led to high energy prices. Energy prices can be monitored at Electricity prices Europe (euenergy.live) as well as at U.S. Energy Information Administration - EIA - Independent Statistics and Analysis.

Leading Sub-Sectors

Power Generation

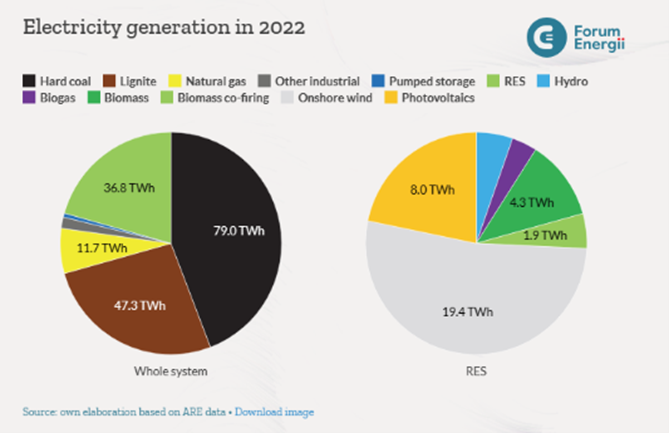

- The share gross electricity generation from coal in 2022 was 70.7%, (1.7 p.p. less than in 2021).

- For the first time, production from RES exceeded 20% of the mix and amounted to 20.6%, thanks to record production of 36.8 TWh and reduced demand for electricity (by 1.9%).

- Production from natural gas reached its lowest level since 2017, due to record high gas prices on global exchanges.

- Production from photovoltaics doubled relative to 2021, to 8.0 TWh.

- Gas and coal-fired capacity recorded the lowest-ever capacity factors.

- Production from natural gas fell by 4 TWh (-25% y/y), and from hard coal by 4.7 TWh (-6% y/y). This is a result of high prices for these fuels and increased production from RES, with reduced electricity consumption.

- Production from lignite increased by 1.3 TWh (+3% y/y).

- Among renewable sources, photovoltaic power generation grew most rapidly (+102% y/y, +4 TWh), while biomass sources recorded the largest decline (-11% y/y, -0.5 TWh), due in part to the cutoff of fuel supplies from Belarus.

- Production from wind farms increased by 19% y/y (+3.1 TWh), or 7 p.p. more than the capacity increase alone, thanks to more favorable wind conditions in 2022.

- Pumped storage power plants were used at record levels, 38% more than in 2021.

Gross domestic electricity production amounted to 178.8 TWh, 0.5% less than the prior year. Over a 10-year period, electricity generation increased by 8.7%, from 164.4 TWh in 2013. Production from conventional sources fell by 4%, from 146.9 TWh in 2013 to 140.9 TWh. Production declines were recorded from anthracite (-0.9 TWh, or -1%) and lignite (-9 TWh, or -16%), while production from gas sources increased (by 7.3 TWh, or 169%). Generation from renewable energy sources increased by 117%, from 17 TWh in 2013 to 36.8 TWh.

In 2022, 36.8 TWh of electricity was produced from RES – 20% more than in 2021. Wind power was responsible for more than half of the production from RES (53%) in 2022, solar PV accounted for 22%, and biomass for 12%. The largest increase, aside from solar PV, was in wind generation – up 222%, from 6 TWh in 2013 to 19.4 TWh in 2022. Declines were recorded in biomass co-firing, down 57%, and hydro generation, down 19%.

In 2022, bituminous coal imports totaled 16.9 million tons – 7.9 million tons more than in 2021. 34% (17% each) of the imported coal came from Kazakhstan and South Africa; 15% came from Colombia, with only 13% coming from Russia. As much as 37% came from other countries, mainly Australia and Indonesia. In 2022, 2.1 million tons of steam coal were exported. The main customers were Czechia (55%), Ukraine (18%), Germany (12%), and Slovakia (8%). Starting in May 2022, Poland stopped importing coal from Russia.

According to Forum Energii estimates, anthracite consumption in 2022 amounted to about 66 million tons, down about 4 million tons (-5.9% y/y) from the previous year. Net imports increased by 8.5 million tons (up 143.2%; to 14.5 million tons), mining fell by 2.5 million tons (down 4.4%; to 52.8 million tons), so according to estimates, about 1 million tons were put on the heap (increased stocks). Over the 10-year period, anthracite consumption fell by 13 million tons (-16.4%), mining fell by 24.2 million tons (-31.4%), and net imports increased by 14.8 million tons.

In 2022, the commercial power industry consumed 36.5 million tons of coal, of which 29.7 million tons were used for electricity generation. Industrial power generation consumed 3.4 million tons (mostly for heat – 2.8 million tons), and heating plants consumed 4.9 million tons. Coal consumption fell in every category of consumption, but the most for heat production in commercial units (-9.1%; -0.7 million tons). About a third of the anthracite (32.4%, or 14.5 million tons) was used for heat production. The remaining 67.6% (30.3 million tons) was used to produce electricity.

In 2022, natural gas imports (both via pipelines and LNG) amounted to 15.4 bcm, 3.1 bcm (-17% y/y) less than in 2021. 29% of imported natural gas came from Germany. Other significant import destinations were the United States (23%), Russia (19%), and Qatar (15%). Imports from the United States rose by 118% from the previous year, while those from Russia fell by 72%. In 2022, 0.6 bcm of natural gas was exported. More than two-thirds (67%) flowed to Ukraine. The remaining 23% flowed mainly to Germany (15%) and Czechia (12%). LNG imports accounted for a record 40% (6.2 bcm after regasification) of gas fuel imports. The main suppliers were the United States (55%) and Qatar (37%). Estimated consumption of natural gas fell by about 12% (about 88 PJ) to about 630 PJ in 2022.

Most Polish coal-fired power plants were built between 1960 and 1980 and now must be retired and replaced. Poland’s newest and the last coal-fired power plants are Kozienice (1,000 MW) and Opole (2x900 MW, Jaworzno (910 MW) and Turow (450 MW) commissioned in the early 2020’s. Subsequent power plant investments in Dolna Odra (2 x 700 MW) and Ostroleka (750 MW) will utilize natural gas sources. Ostroleka is evidence of the transition from coal to gas; the plan was originally contracted as a coal facility, but losing a legal challenge brought by shareholders, the plants owners were forced to convert the half-finished project into a gas fired plant.

European Union Green Deal and FIT for 55 Package

The European Green Deal aims for a 55% reduction of greenhouse gas emissions by 2030 (compared to 1990 levels) and full climate neutrality by 2050. For the energy sector and the Polish economy, it provides a chance to modernize, innovate and progress, including increased opportunities for investment.

The EU budget for 2021-2027 provides $164.3 billion in subsidies and $40.3 billion in repayable aid for Poland (in current prices), thereby making Poland the biggest net EU fund beneficiary among all the member states. Although the EU budget has been allocated to the member states, Poland has not signed their agreements with the EU Commission. The Commission is challenging the current judiciary system and has demanded concrete changes. Once the changes are introduced the Ministry of Economic Development Technology will be able to finalize the Partnership Agreement, i.e., the document specifying where Poland will invest its allocation of EU development funds. Poland will receive about €3.8 billion from the fund to mitigate the effects of energy transformation and moving away from coal, which will go mainly to the Silesia and Lesser Poland voivodships.

The Polish government estimates that the energy transformation requires about $250 billion. Adopted in February 2021, “The Energy Policy until 2040” (PEP2040) assumes that Poland will gradually reduce its use of coal, on which it is 70 percent reliant upon. By 2030, Poland’s energy mix is to decrease to at least 56 percent reliance on coal. The share of renewable energy sources is to increase to no less than 23 percent by that time. According to an agreement which the government reached with coal miners, the last mine in Poland is to be closed in 2049. As stated in a report published in October 2022 by the Polish Electricity Committee, the estimated value of capital expenditures in the area of generation, transmission, and distribution of electricity and system heat by 2030 will amount to $55 billion in Poland’s Energy Policy to 2040.

Poland may receive nearly €13 billion from the new Fit for 55 fund. As part of the new climate package, the European Commission proposes to establish a new Social and Climate Fund. Its budget for 2025-2032 is expected to amount to €72.2 billion. Poland is to be the biggest beneficiary of the new instrument easing the costs of transformation. The new Social Fund for Climate Action aims to provide member states with specific funding to help citizens finance investments in energy efficiency, new heating and cooling systems and cleaner mobility. The Social Fund for Climate Action would be financed from the EU budget with an amount equal to 25% of expected emissions trading revenues for fuels used in buildings and road transport. It will provide funding to member states of €72.2 billion for the period 2025-2032, based on a targeted revision of the Multiannual Financial Framework. Thanks to the proposal to use equivalent funding from the member states, the fund would mobilize €144.4 billion for a socially just transition, the Commission reports. In the years 2025-2032, Poland is expected to receive €12.7 billion from this fund, which constitutes 17.6% of the entire budget.

In June 2022, the European Parliament adopted a position on the three key legal acts in the Fit for 55 package: the revision of the EU ETS directive, the regulations on the CBAM carbon footprint duty, and the Social Climate Fund. The MEPs supported a milder version of the construction of the new ETS2 system for transport and buildings (excluding households until 2029) and a significant increase in the pace of reducing ETS1 emission allowances, which will push up CO2 prices. The adoption of the position opens the way to trialogue with the Council of the EU on the final shape of the regulations.

Civil Nuclear Energy

Poland has never had an operating nuclear power reactor but current has a number of emerging government-run, and semi-private programs to deploy nuclear power technology. The government program began in 2009, initially the state-owned power company PGE-EJ1 envisioned construction of two nuclear power plants with a 3,000 MW output to be completed by 2035. The program has been delayed significantly due to government reforms. The Polish government now plans to build of six nuclear reactors with 6-9 GW of total capacity. The first reactor is scheduled to launch in 2033, with the remaining five units coming online every two years until the project is completed in 2043. In November 2022, Poland announced the selection of the Westinghouse AP1000 for the country’s first three reactors. Since then, they have confirmed the selection of Bechtel as the Engineering Procurement and Construction (EPC) contractor. They plan to decide on the technology and EPC selection for the second three reactors in 2024.

On July 1, 2021, Westinghouse Electric Company announced the launch of front-end engineering and design (FEED) work under a grant from the United States Trade and Development Agency (USTDA) “to progress” the nuclear energy program in Poland. FEED is one of the key elements in the implementation of the Intergovernmental Agreement (IGA) between Poland and the United States to cooperate on the development of Poland’s civil nuclear power program signed in October 2020. This 30-year agreement, the first of its kind, represents an enduring energy bond between the United States and Poland. This will be the basis for U.S. long-term involvement and for the Polish government to take final decisions on accelerating the construction of nuclear power plants in the country. In May 2023, Westinghouse and Bechtel signed an agreement with Polish company Polskie Elektrownie Jądrowe (PEJ) to design and build a commercial nuclear power plant in Poland. Westinghouse will lead the design phase, while Bechtel will lead the construction phase. The construction contract is due to be signed in 2025.

In June 2023, the Council of Ministers adopted a resolution to establish a program to support infrastructure investments in the Pomorskie Voivodship for the needs of, among others, a nuclear power plant. More than PLN 4.7 billion has been allocated for the implementation of the program in 2023-2029. The program provides for the construction of a national road, the construction or reconstruction of railway infrastructure, and the construction of hydrotechnical infrastructure providing access to, among others, a nuclear power plant near the municipality of Choczewo. In July 2023, PEJ received from the Polish Ministry of Climate and Environment the decision-in-principle for the first nuclear power plant in Pomerania, which formally confirms that the company’s investment is in line with the public interest and the national energy policy.

The financial model for Poland’s first nuclear power plant is still unknown. In May 2023, the Polish government adopted a resolution on financing a nuclear power plant. The Council of Ministers has obliged itself to develop a draft on the basis of which “it will be possible to provide sureties or guarantees on behalf of and for the account of the State Treasury to ensure obtaining the debt financing necessary to cover the investment costs.” The company PEJ, which is to build the power plant, is to “take measures to implement the investment” in consultation with the finance minister. In addition, the climate minister, together with the finance minister and PEJ, is to create an analysis on “the necessity of creating a support mechanism” for investment in the nuclear power plant. Such a system is to be approved by the European Commission, the resolution states explicitly.

Poland is also considering several semi-private projects that are partially or wholly implemented by state-controlled companies. This includes small modular reactors (SMRs). The country has become a focus of interest for companies seeking to develop SMRs. Polish firm Synthos Green Energy has exclusivity to deploy GEH’s design in Poland. They are in a joint venture with PKN Orlen to deploy a fleet of SMRs across Poland and possibly neighboring countries. Primary applications are power generation, industrial heat, and replacements for urban combined heat and power facilities. Orlen-Synthos Green Energy ambitiously hopes to start operating its first reactor by 2029. In addition, Polish mining giant KGHM is partnering with NuScale for a 1GW deployment. The reactor is primarily intended to support KHGM’s alloy processing operations but would also send electricity to the grid. KGHM is working closely with Romanian officials who plan to deploy the world’s first NuScale reactor in 2027 or 2028. Poland hopes to follow closely and start operations as soon as 2029.

Yet another U.S. SMR provider, Ultra Safe Nuclear Corporation (USNC), together with the Polish fertilizer producer Grupa Azoty Police, and the West Pomeranian University of Technology in Szczecin signed a new agreement to develop and construct a nuclear energy research facility based on USNC’s Micro-Modular™ Reactor (MMR®) technology. The parties are preparing a comprehensive research program and will jointly develop a plan for the construction, operation, and maintenance of the MMR. The first stage of the collaborative project will include construction of a 30MWt MMR to serve as a training, research, and test facility. It will be connected to the existing energy infrastructure of Grupa Azoty manufacturing facility in Police. In July 2023, Hyundai Engineering Co. Ltd joins the project of Grupa Azoty Police and USNC to construct research Micro-Modular™ Reactor (MMR®).

The Polish government is also considering conducting research into High Temperature Gas Reactor (HTGR) technology in Poland. They are currently planning a HTGR pilot project in cooperation with the Japan Atomic Energy Agency. In June 2023, the National Center for Nuclear Research (NCBJ) completed the design of a 30 MWt HTGR, although it currently lacks funding to construct the project. NCBJ is also considering building a test reactor using an existing micro reactor design. Poland could eventually consider developing commercial HTGR reactors that would provide heat for the chemical industry and energy for the electric grid in Poland.

Renewable energy

In 2008 all EU member states agreed to reach at least a 15% share of renewable energy (RE) by 2020. Building on the 20% target for 2020, the recast Renewable Energy Directive 2018/2001/EU established a new binding renewable energy target for the EU for 2030 of at least 32%, with a clause for a possible upwards revision by 2023. In 2022, for the first time, production from renewables exceeded 20% of the mix - reaching 20.6% thanks to record production of 36.8 TWh and a 1.9% reduction in electricity demand. Among renewable sources, electricity generation from photovoltaics grew most rapidly (+102% y/y, +4 TWh), while the largest decline was recorded in biomass sources (-11% y/y, -0.5 TWh). This is due, among other things, to the cutoff of fuel supplies from Belarus. Production from wind farms increased by 19% y/y (+3.1 TWh). This is 7% more than would result from the increase in capacity alone, thanks to more favorable weather conditions in 2022. Pumped storage power plants were used at record levels, 38% more than in 2021. Renewable energy laws strongly support prosumer activities, and individual producers of maximum 10kW power from the newly installed RES system used to guaranteed tariffs for 15 years. In July 2022, the system changed to net-billing. For larger producers, the law introduced an auction system. Each year, the Ministry of Economy announces the amount of renewable energy it will need and announces the reference prices for each group. According to the National Plan for Energy and Climate forecasts for 2021-2030, the capacity of energy from renewable sources in the national mix will increase from 28GW in 2025 to 50GW in 2030. In 2016, Poland passed legislation knows as the 10H law, which functions as a de facto moratorium on new onshore wind investments by restricting zoning in all parts of the country. On July 5, 2022, the Council of Ministers adopted a draft law on amending the Law on Investment in Wind Power Plants. The abandonment of the so-called 10H rule, meaning a ban on building windmills within a radius determined by ten times the height of the proposed power plant to buildings, and replacing it with a minimum distance of 700-meters from buildings will make about 12% of the country’s land available for windmill construction. The legislation was significantly less ambitious than the originally planned 500-meter restriction resulting in notably less available sites and a re-permitting process which caused multiyear delays in current projects.

As reported by Bloomberg Poland, Europe’s “coal heartland” is now the hottest market for green power. Poland plans to increase its renewable power capacity through the development of offshore wind farms. By 2027, Poland expects 6GW power capacity to be generated by offshore wind. Poland has looked to the world’s largest players in renewable energy to help them develop the market.

In 2015, the Polish government passed the Renewable Energy Act, which introduced an auction system for renewable energy producers and developers replacing the system of green certificates. Each November, the President of the Energy Regulatory Office announces the volume and planned value of green energy procurement. After concluding the auctions he announces the results: RES auctions 2022: President of URE summarizes the results of auctions for sale of electricity from renewable energy sources - News - Energy Regulatory Office. In November 2023, seven auctions for renewable energy sources are to be held by the Energy Regulatory Office President. Nearly 88 TWh of electricity, with a maximum value of about $10 billion, is to be sold at the auctions.

Photovoltaics

The year 2022 was very good for the photovoltaic sector in Poland, better even than the record year of 2021. In 2022, photovoltaics was yet again the leader and the main driving power for the increase in RES market in Poland. According to data of the Energy Regulatory Office, the accumulated power installed in PV at the end of 2022 amounted to more than 12.4 GW, which in comparison to 2021 (7.7 GW) meant a record increase of more than 4.7 GW in new power and constitutes a record 61% increase in market growth.

At the end of the first quarter of 2023, the total power of PV installations exceeded 13 GW, with the share of prosumers being 74%, the share of small installations (50–1000 kW) 21%, and large PV farms 5%. The importance of energy from PV installations in energy production in Poland increased significantly. The share of PV energy in electric power from RES increased from 3% in 2019 to more than 23.3% in 2022 and 4.5% in the total generation structure (four years ago, it was only 0.4%). In addition to the sharp drop in the cost of photovoltaics and growing environmental consciousness, the market is being driven by a whole raft of incentive programs (e.g., My Current - €230 million, Clean Air, Thermomodernization, etc.). An incentive program called Agroenergia with a budget of €50 million is specifically geared toward farmers and offers low-interest loans or direct subsidies for the construction of solar power systems between 50 kW and 1 MW.

The number of prosumer photovoltaic installations at the end of 2022 amounted to over 1.2 million, which means an increase by more than 41% year over year. The total installed power was more than 9.3 GW. Prosumers in Poland have still the highest share in the photovoltaic market, and in 2022 they represented 68% of the annual growth of power installed in photovoltaics. The net-billing system results in a higher self-consumption index, since PV installations are more optimally sized due to the settlement method of surplus electrical power produced.

The program “Mój Prąd” (“My Power”), added to the net-billing system, has proven successful. It is directed at increasing self-consumption of energy and offers the possibility to support energy storage, heat storage and management systems, and lately also complementary technologies, such as solar collectors and heat pumps.

At the end of the first quarter of 2023, 3.4 thousand PV farms with a total power of 3.35 GW were in operation, constituting 26% of power installed in photovoltaics. Almost 60% of the total power represent small installations of 50–1000 kW. RES auctions in the years 2016-2022 proved a key growth stimulator, providing support for 6.8 GW of power, out of which almost 1.5 GW was completed and is selling energy to the power grid. Prices of energy contracted in the auction system for PV farms in the years 2016–2022 dropped by 18%.

According to IEO, by the end of 2023, the power of all installed photovoltaic sources will exceed 18 GW, and the increase in power year-over-year could exceed 6 GW, which will be another record. The total energy production from PV in 2023 will amount to 14.6 TWh. It is projected that in 2023, trade turnover of photovoltaics will increase significantly in comparison to 2022 and will amount to almost $7.25, with the value of the PV investment market on the level of $5 billion.

Being a leader in the EU and in the Polish energy sphere obliges the PV sector and the administration to increase their efforts. New challenges related to disruptions of supply chains and increasing component prices, the energy crisis, and introduction of photovoltaics on the distributed energy market in the situation of serious grid restrictions will require new competences and development of new business models by the sector. It is time for a new sectoral strategy, combining the successes in development of the PV market with the growing innovativeness of the industry. Poland needs a photovoltaic strategy as the flagship element of the currently updated Polish energy policy and Polish industrial policy, a strategy understood as a real program to face the challenges.

The Polish government introduced strong regulatory support, and there are subsidies for PV systems for on-site consumption as well as for utility-scale facilities. The expansion of “balancing” programs, which is what the Polish call net metering, is an example of how small and medium enterprises support prosumers.

Solar power systems with less than 50 kW also benefit from a reduction (23% to 8%) in value added tax (VAT). The purchase and installation costs for PV systems can also offset income and reduce personal income tax. Additionally, state-supported auctions are used to fund large-scale installations.

The largest photovoltaic farm in Poland is in northern-western Poland in Zwartowo. Its capacity is 204 MW. It is also the largest solar facility in Central and Eastern Europe. The farm covers an area of 300 hectares, which is equivalent to 422 full-size football fields. It was built by Respect Energy SA in cooperation with the German company Goldbeck Solar. The first phase of the investment was completed in September 2022. The second phase of the investment, scheduled for early 2023, will increase the total capacity to 290 MW.

However, the electricity infrastructure cannot keep up with RES development. In 2022 alone, more than 30,000 photovoltaic installations were refused grid connection. When the grid is overloaded, the operation of photovoltaic farms already in operation is also increasingly limited. In 2022, the total capacity of photovoltaic projects that were denied grid connection was almost six times greater than those that were issued connection conditions.

Wind: onshore and offshore

Poland’s onshore wind generation capacity development was restricted in 2016, when President Duda signed a bill making it illegal to build turbines within 2 km of other buildings or forests, ruling out 99% of Poland’s land area. Due to these restrictions, the installed capacity in wind generation grew only by 0.8%. Since then, the government has made plans to revise parts of the bill that hindered wind energy development and created several investment disputes between Poland and international investors. Work on the liberalization of the so-called “Anti-Wind Law” took almost as long as the law itself, introduced in 2016. The abandonment of the so-called 10H rule, meaning a ban on building windmills within a radius determined by ten times the height of the proposed power plant to buildings, and replacing it with a minimum distance of 700 meters from buildings will make about 12% of the country’s land available for windmill construction. According to the Minister of Development, the liberalization of the distance law will allow 12-13 GW of capacity to be reached by 2030, while the total potential for onshore wind power in Poland exceeds 44 GW.

There are more than 1,200 installations in Poland using wind as a renewable energy source. Their installed capacity is over 7,185 MW, which is about 65% of installed capacity in all types of renewable energy installations working in Poland. Nearly 160 further wind installations are under construction, with total installed capacity of approximately 2,500 MW. The amount of energy produced from wind sources and introduced into the Polish power system is systematically increasing. In recent years, the produced amount of energy from onshore wind installations is around 14 GWh. Wind energy accounted for about 10% energy consumed in the country in 2022. According to the Polish Energy Regulatory Office, producers of wind and solar energy have been the primary beneficiaries of the auction support system for renewable energy production operating in Poland for more than five years. The results of the eight auctions decided in 2020 by the Energy Regulatory Office translated into nearly 54.5 TWh of capacity contracted for over $3.4 billion. As a result of two auctions conducted in 2021 51 TWh of energy from RESs was contracted for over $3 billion. In December 2022, the auction resulted in 245MW total capacity onshore wind farms will be built in the next years.

To meet the goal of 21% of RES by 2030, the Polish government is planning extensive offshore wind farm development. The PEP 2040 provides for visible participation of offshore wind in Poland’s 2027 energy mix, meaning the first mature projects should appear even around 2024. In the 2040 prospectus, the strategic document sets a potential of 10.3 GW. Companies controlled by the Polish State Treasury will have a dominant share in the development of offshore wind farms. Investments in offshore wind farms are carried out by companies such as the Polish Energy Group, PGE. By 2030, PGE and their Danish partner, Ørsted, intend to erect wind farms with 2.5 GW on the Baltic Sea. Another state group, PKN Orlen, also has concessions for the construction of a 1.2 GW offshore wind farm partners with Northland Power. PEP 2040 predicts that 55.2 TWh of energy will be produced from wind only. The Baltic Sea will be one huge construction site in the coming years, with investments estimated at roughly $ 25 billion. In the Baltic Sea advanced preparations for the construction of several large wind farms are underway and others are planned. This means that in the coming years the demand for personnel for the offshore sector will increase dramatically. It is estimated that over 70 thousand specialists may find employment in the sector.

The Polish Wind Energy Association (PSEW) estimates that the Polish energy system will require 1,000MW of newly installed wind energy capacity each year to comply with EU targets.

Transmission and Distribution Network

The Polish electrical transmission system is fully integrated with the EU system. Since 2005 Poland has been a member of ENTSO-E, the European association for the cooperation of transmission system operators (TSOs) for electricity. In June 2022, Minister of Climate Anna Moskwa said that Poland wants to overhaul the power line that connects Rzeszow with Ukraine’s Khmelnytskyi Nuclear Power Plant. The line, which was shut down in 1993, would operate at 400 kV and be used to import electricity from Ukraine. To implement the plan, Polish Energy Network (PSE) was to have already started design work and tenders to select the investment contractor and for the delivery of equipment. After tests conducted by both sites the line was opened for a commercial use on May 15, 2023. This is a radical change in the position of Warsaw, which for years opposed the effort to overhaul the power line, fearing the inflow of cheaper electricity from Ukraine; as of March 2022, PSE declared that the investment was possible around 2026. On June 1, 2022, U.S. Westinghouse signed a contract with Energoatom (the operator of Ukrainian nuclear power plants) for the construction of four more AP1000 reactors in Ukraine. In total, as many as 11 will be delivered, five of which under a similar agreement concluded in November 2021 (estimated at around USD 30 billion) - the first two are to be constructed at the Khmelnytskyi Power Plant. The power line to Rzeszow is to enable Ukraine to export low emission surplus cheap electricity with a high margin from Ukrainian reactors through Poland to Germany and Lithuania. Ukrainian Ukrenergo became the ENTSO-E observer.

A total of 875,861 km of power lines are in use in the country: 15,964 km of 750, 400 and 220 kV lines, 34,376 km of 110 kV lines, 321,089 km of MV lines and 504,492 km of low-voltage lines. In addition, a total of 273,278 substations are in use: 110 400 and 220 kV substations, 1,597 110 kV substations, and 271,571 MV substations, respectively: 0.04 percent, 0.58 percent, and 99.38 percent of their total number. The assumed lifetime of network infrastructure includes 30 years, while the lifespan of network infrastructure components varies, ranging from 15-80 years.

Poland’s electrical transmission network is in good technical shape and the average age of Polish transmission lines is less than 40 years. Expanding and upgrading of Poland’s electricity transmission network is a key element to meet its EU goals of increasing renewable energy sources, improving energy efficiency, and better integration into European transmission networks. In 2022, the largest energy groups spent $1.8 billion on investments in the energy transmission and distribution sector; a year earlier, investments in the sector reached $2.1 billion. In 2021, Tauron spent the most on investments in the power network. The group’s investments in this area amounted to $0.52 billion. For comparison, the value of all Tauron’s investments in 2021 was $0.76 billion. In 2021, Tauron spent $260 million on the construction of new connections, $226 million on the modernization and restoration of network assets, and almost $10 million on the dispatch communication system. The second place in terms of the value of network investments in 2021 was taken by Energa Group. The total capital expenditures of Energa Group in 2021 amounted to $543 million, of which $392 million was spent on distribution. PGE Group was ranked third. The value of capital expenditures in this segment amounted to $348 million, of which $179 million was spent on the modernization of distribution assets and $172 million on new projects in the distribution segment. The value of all PGE Group’s investments in 2021 reached $1.2 billion. Distribution was the second largest investment area in PGE, with more money spent only on conventional power generation (the construction of gas units). The Enea Group spent $266 million on investments in the distribution segment in 2021, and these investments are expected to increase to $260 million in 2022. Distribution was the place where Enea spent the most on investments. Polish Energy Network (PSE) spent $250 million on investments in 2021. The company’s most important investments are two 400 kV lines under construction: Plewiska-Pila Krzewina-Zydowo Kierzkowo and Krajnik-Morzyczyn and Morzyczyn-Dunowo. PSE completed the construction of the 220 kV Glinki-RecLaw line and the Reclaw substation in 2021.

The capital expenditures of the Polish national energy transmission lines operator, PSE, resulting from the PSE development plan for 2021 agreed with the President of the Energy Regulatory Office, amounted to PLN 1531.8 million. However, the company realized them at a lower amount of PLN 969.7 million, which is 63 percent of the plan. Capital expenditures in the corresponding plan for 2022 amounted to PLN 2003.6 million. The company accomplished them in the amount of PLN 1269.5 million, which is 63%. In the 2020-2024 period, the length of new and upgraded lines is expected to be 2784 and 1337 kilometers, respectively. As for substations, 45 substations are to be modernized in the 2020 -2024 period, and 3 new ones are to be built. Outlays are expected to increase from 10.5 billion in 2020-2024 to nearly PLN 55 billion in 2025-2036. PSE’s current portfolio of ongoing investments includes 186 projects.

Over the next decade, Poland’s power system is expected to see more than 20 GW of solar sources (not including prosumer installations established after December 31, 2021) with a production potential of 21 TWh, more than 14 GW of onshore wind with a production potential of 37 TWh, and 10.9 GW of offshore wind with a production potential of 40 TWh.

Smart Grid

About four million electricity consumers in Poland already have remote reading meters. However, there are still several million devices waiting to be replaced. Targets for the installation of smart meters were set in an amendment to the Energy Law (the so-called Meter Law), which came into force in mid-2021. It stipulates that individual distribution system operators (DSOs) will achieve remote metering in at least 15 percent of energy consumption points of household end users by the end of 2023. By the end of 2025, this is to reach 35 percent of customers, in 2027, 65 percent, in 2028, 80 percent, and by July 2031, 100 percent of end-users nationwide should be equipped with Remote Reading Meters. The initial phase of installing smart meters in Poland took place between 2011-2015, but the process has since slowed. The reason behind this slowdown was a lack of applicable legislation that would obligate DSOs to implement Advanced Metering Infrastructure, and lack of regulator actions enhancing such activities. Introduction of capacity market in 2018 forced DSOs to install intelligent meters that enable remote data read-out. Among the five DSOs, Energa is the most advanced in Advanced Metering Infrastructure (AMI) implementation with installation of meters for 30% of their clients. Energa has already invested $500 million in smart grid development. During next three years, Energa plans to introduce smart grid in their entire territory, which covers 25% of Poland’s area. The project worth $60 million is to modernize the low voltage grid using EU funds. Tauron has installed 350,000 intelligent meters in Wroclaw (Smart City Wroclaw), and Innogy 100,000 units in Warsaw. PGE, the largest DSO, has been performing project of 50,000 meters in Bialystok and Lodz. Enea signed a contract for introducing intelligent grid in Szczecin and Swinoujscie in December 2019. PGE, Tauron, and Enea have together conducted several tenders for purchasing of smart meters.

According to Poland’s calculations, the installation of smart meters for 80% of end-users by 2026 will cost $1.2 billion. EU Infrastructure and Environment funds will cover $300 million of the cost spent by DSOs for grid infrastructure development, smart grid development, intelligent meters, grid automatization and energy storage systems construction. The high and medium voltage distribution lines are primarily automated while low voltage systems, which are most common in Poland, still require automation updates.

The needs of the Polish power sector in the smart grid arena are enormous, and to meet them even partially, significant financial resources are needed. Nevertheless, many solutions are gradually being implemented, including the so-called hard (physical) technologies, which have already reached sufficient technological maturity and the benefits of their implementation far outweigh the potential risks (e.g., cyber-attack). Activities in this area include:

- expansion and modernization of the power grid, especially in terms of increasing the reliability of energy supply and the possibility of connecting a larger number of micro-installations or shortening the line strings by adding substations to reduce voltage drops occurring at their ends or providing backup power in case of grid failure.

- replacement of transformers with low-loss transformers with automatic voltage regulation.

- network automation.

- network traffic management.

- replacement of energy meters with models equipped with remote reading modules; some of the power grid operators in Poland, especially for certain locations, choose two-way meters, measuring energy from micro-installations introduced into the grid.

Currently, Polish distribution system operators must unite to accelerate the development of the smart grid in Poland. Smart grid is an important element of moving away from fossil fuels.

Energy Efficiency

According to PEP 2040, energy efficiency is one of three major energy priorities in Poland. A system of white certificates that award energy efficiency, investments, and expansion are an instrument for incentivizing energy efficiency in Poland. This system is required for the consumer utilities selling electricity to the end-user market. The system is available for all projects that meet specific criteria. To receive a white certificate, a company must send an energy efficiency audit to the Office of Energy Regulation. Energy efficiency audits are required for companies with more than 250 employees. EU funds dedicated to improving energy efficiency have allowed the energy market in Poland to grow over the last decade, advancing the thermo-modernization of buildings, street lighting, and industrial processes. The EU has allocated €6.8 billion to support the low carbon economy in Poland. This includes €3.8 billion available from the European Regional Development Fund and €3 billion from the Cohesion Fund, which includes the Environment and Infrastructure Program. The EU may also fund the production of electric energy, including co-generation, electricity transmission and distribution, including the smart grid; energy modernization of public buildings and housing; and increased energy efficiency in factories. Other financing dedicated to such projects include: the National Fund for Environmental Protection, made up of subsidies and preferential credits; EBRD; and EU PolSEEF, which includes preferential credits.

In June 2022, the European Commission announced that it has made 2.4 billion euro available to seven countries under a modernization fund to modernize their energy systems and reduce greenhouse gas emissions from energy, industry, and transport. Poland is to receive 244.2 million euros from this pool to improve energy efficiency in industry.

Energy Storage

In May 2021, Polish policymakers removed legal and regulatory barriers that prevented the development of the energy storage industry. The Polish Parliament adopted an amendment to national Energy Law concerning the treatment and definition of energy storage. The comprehensive regulations open the possibility of using energy storage facilities in various areas of the power system, the new rules cover electricity storage system licensing and eliminate tariff obligations, which were “double charging” energy storage systems connection to the grid.

The new rules incentivize energy storage by reducing the fee payable by owners and operators of energy storage assets for connecting to the grid. The new rules create an opportunity for Poland to create a broad energy storage industry, PSME’s president said, from the development of technologies and products to the creation of jobs.

In the main power market auction in 2022, battery energy storage was contracted for the first time - 165 MW to be exact. According to experts these results could be strongly improved in 2023. The 2022 auction was held on December 15 and covered the 2027 delivery year. Storage contracted a total of about 165 MW under five, 17-year capacity contracts.

Columbus Energy won the largest contract (124 MW), followed by OX2 (21 MW), Battery ESS-1 (9.2 MW), PKE Pomerania in partnership with Hynfra Energy Storage and Heyka Capital Markets Group fund (6.5 MW) and Energa Wytwarzanie (3.8 MW).

State-owned power company PGE has the largest plans to invest in energy storage facilities and wants to have approximately 800 MW in this technology by 2030. The company has selected several locations, of which the largest CHEST project with a capacity of 205 MW and 820 MWh is to be constructed in Zarnowiec. Almost all storage facilities currently designed by PGE will use the lithium-ion technology, but a liquefied air storage facility is planned in Kielce. Other state-owned power companies Enea and Tauron received funding from the same program for storage projects. Enea in five locations: Bydgoszcz, Zielona Gora, Gubin, Pogorzelica, and Opalenica, is testing five different technologies - lithium-ion and double-layer capacitors and lithium-ion (LFP, LTO) and lead-acid batteries. These are small storage units with capacities ranging from 1.8 to 100 kWh. The test results will be used to develop an efficient way to store energy at the low-voltage level to help balance prosumer micro-installations.

Besides the big commercial investors Poland has almost one million prosumers who invested in small RE installations, in majority photovoltaics roof, in the recent three years. This prosumers’ development boom was driven by the subsidies that the Polish government offered to individuals. So far, the grants partially financed the purchase and fixing of photovoltaic installation. The new prosumer billing rules, which entered into effect April 1, 2022, are expected to make home PV owners start investing in energy storage. Also, issued in November 2021, the Meter Act created a legal framework for the development of modern technologies that enable the integration of distributed energy and lifted previous barriers to the operation of energy storage, such as double counting of network charges. Currently, storage facilities are not subject to mandatory registration and are treated as generation units. The Metering Act has introduced mandatory electronic registration of energy storage facilities above 50 kW. This will allow monitoring the development of storage technologies in Poland.

In the draft update of PEP 2040, about 5 GW of prosumer and large-scale energy storage capacity was assumed. Their cost was estimated at nearly $9.4 billion.

Introducing auctions for hybrid renewable installations, such as facilities combining at least two renewable energy systems and an energy storage facility with a utilization factor of at least 60%, is still in the government’s plans. In 2022, resources for small scale projects (1MW or less) totaling 5MW and larger installations totaling 15MW are expected to be tendered in a pilot auction.

Hydrogen

In 2021, the Council of Ministers adopted the Polish Hydrogen Strategy until 2030 with an outlook until 2040. Amendments to the Act on Electromobility and Alternative Fuels and the Act on the System of Monitoring and Control of Fuel Quality also entered into force. The Polish Hydrogen Strategy specifies three key areas, that is industry, power generating sector and transport, six specific goals to be achieved and forty tasks which, when completed, will enable Poland to become a beneficiary from the hydrogen technologies.

Currently, the Ministry of Climate and Environment is working to regulate the market and implement support mechanisms for the production and use of low-emission hydrogen. Green Hydrogen is a priority in Poland in alignment with European Union energy policy. The European Union (EU) aims to increase the use and importance of electrolysis generated hydrogen in the energy and transport sectors. This forward-looking approach will reduce the dependency of hydrogen produced from fossil fuels, which accounted for 95% of its production in 2020. Though Poland already has a hydrogen strategy in place, and the construction of a hydrogen electrolysis plant near Konin is nearing reality, the Polish market is still waiting for hydrogen regulations.

According to energy experts, the hydrogen market should develop very dynamically due to increasing amounts of renewable sources, which are the basis for green hydrogen production. The President of Poland’s National Fund for Environmental Protection and Water Management announced that in 2022 the Fund will enter hydrogen initiatives, giving low interest loans to investors.

In the budget of its Recovery and Resilience Plan submitted to the EU Commission, Poland allocated 800 million euros to implement the hydrogen economy by adapting the law governing the use of hydrogen, creating infrastructure for production, transmission, refueling and storage of hydrogen. The Commission will first authorize disbursements of these funds based on the satisfactory fulfilment of the milestones and targets outlined in the Recovery and Resilience Plan, reflecting progress on the implementation of the investments and reforms. Some milestones are necessary to ensure the effective protection of the EU’s financial interests and must be fulfilled before Poland presents its first payment request.

Natural Gas

Poland consumes about 20 billion cubic meters (bcm) of gas annually. Before the 2022 Russian invasion of Ukraine, Poland relied mostly on Russia for its gas supply. In 2022, Polish Oil and Gas Company (PGNiG) imported about 6.04 billion cubic meters of liquefied natural gas to Poland - 50 percent more than a year earlier. Imports from the eastern direction amounted to 2.9 billion cubic meters. The share of Russian gas in PGNiG’s total natural gas imports remained at about 20 percent. The western and southern directions covered the rest of the imports. Total gas imports by PGNiG in 2022 amounted to approximately 13.9 billion cubic meters. In 2022, natural gas imports (both via pipelines and LNG) amounted to 15.4 bcm, 3.1 bcm (-17% y/y) less than in 2021. 29% of imported natural gas came from Germany. Other significant import destinations were the United States (23%), Russia (19%), and Qatar (15%). Imports from the United States rose by 118% from the previous year, while those from Russia fell by 72%. In 2022, 0.6 bcm of natural gas was exported. More than two-thirds (67%) flowed to Ukraine. The remaining 23% flowed mainly to Germany (15%) and Czechia (12%). LNG imports accounted for a record 40% (6.2 bcm after regasification) of gas fuel imports. The main suppliers were the United States (55%) and Qatar (37%). On May 23, 2022, Poland broke a 1993 gas agreement with Russia to build a transit pipeline system and supply gas to Poland. This was in response to Russian withholding of supplies and sanctions on gas transit. This gas contract was to expire at the end of 2022, and Poland decided to diversify its supplies much earlier. As such, Poland is in the process of building gas infrastructure to become more energy independent and meet growing consumption.

Poland began this process with its first LNG terminal in Swinoujscie in 2015. Since then, Poland has also increased its imports of LNG from Qatar and the United States. The year 2023 will be record-breaking in terms of LNG deliveries, announced the gas transmission system operator Gaz-System. Gaz-System added that since the beginning of the operation of the terminal in Swinoujscie, 243 LNG deliveries have been accepted and pumped to the National Transmission System - 24.2 billion cubic meters of gas.

Poland’s LNG terminal in Swinoujscie is the first onshore regasification facility in the Baltic Sea region. This facility receives shipments from the United States and Qatari suppliers under long-term contracts, as well as a series of auxiliary deliveries secured via the spot market. In November 2017, PGNiG signed a five-year contract with Centrica LNG Co. This contract allows the deliveries of U.S. LNG from Cheniere Energy’s Sabine Pass LNG Terminal in Louisiana. In 2018, PGNiG signed other long-term contracts for US LNG that include 20-years contracts with: Venture Global Calcasieu Pass LLC and Venture Global Plaquemines LNG LLC for together 2.7BCM and Cheniere Marketing International 1.95 BCM of degasified LNG yearly. In May 2022, PGNiG signed yet another contract for LNG supply; this time with Sempra Energy that agreed to deliver 3 million tons of liquified gas per annum starting 2027. First deliveries upon these contracts start in 2022-2023. In 2018, the Polish government made the decision to increase the LNG terminal’s capacity by 50%, giving the terminal 7.5 BCM. The tender was announced in the beginning of 2019 and was recently concluded. From 2023, PGNiG will have at least 7.45 million tons of liquefied gas, which is more than 8 billion cubic meters of natural gas. Such quantities of LNG will strengthen the company’s position on the market for this fuel and will contribute to the increase of gas supply security of Poland. In May 2022, Poland received a record number of LNG cargoes so far. PGNiG emphasized in the communiqué that never has the company taken delivery of so many cargoes of liquefied natural gas in a single month. The total volume of May deliveries amounted to 0.45 million tons of LNG, i.e., 620 million cubic meters of natural gas after regasification.

In September 2022, Poland inaugurated the Baltic Pipe, natural gas pipeline that will enable Poland to import up to 10bcm of gas annually from Norway. The project, supported by the Trans-European Networks for Energy, enhances the diversification of gas supply in Central-Eastern Europe and the Baltic States by opening a new import route from the North Sea to the EU. The Baltic Pipe has been a Project of Common Interest since 2013 and has received around €267 million of EU funding through the Connecting Europe Facility, helping to complete the preparatory studies and construction works necessary for this project.

In addition, the Polish government is planning to purchase of a Floating Storage Regasification Unit (FSRU) by 2026; it will be located in the bay of Gdansk with plans for possible expansion. This investment will allow Poland to accept delivery of 12 bcm of liquefied natural gas per year. In addition to transporting liquefied gas, the tanker would also enable reloading and bunkering (refueling) of LNG-powered vessels. The Russian invasion in Ukraine triggered negotiations between Poland and Czechs and Slovakia, Poland’s two neighbors without sea access, about possible gas supply using the existing gas interconnectors between the countries. Czechs and Slovakians are interested in access to 6 bcm of gas delivery capacity. During the Tri-City Self-Government Congress held in Lublin in June 2022, the Polish Minister of Climate Anna Moskwa announced that the planned floating LNG terminal in Gdansk Bay will be twice as big as originally planned and will reach the target capacity of 12 billion cubic meters. The revision of the plans is the effect of greater interest in the gas from Poland’s southern neighbors - the Czech Republic and Slovakia - but also from Ukraine.

Resources

- Energy Information Administration

- Ministry of Climate and Environment

- Energy Regulatory Agency

- Energy Market Agency

- Polish Committee of Electric Energy

- Association of Polish Power Plants

- Polish Association of Professional Combined Heat and Power Plants

- Polish Power Transmission and Distribution Association

- Chamber of Industrial Power Plants and Energy Suppliers

- Polish Chamber of Power Industry and Environmental Protection

- Association of Energy Trading

- Polish Wind Energy Association

- Polish Economic Chamber of Renewable and Distributed Energy

- Polish Offshore Wind Energy Society

- Polish PV Association

- Chamber of the Natural Gas

- Polish Energy Storage Association

- Institute for Renewable Energy

For more information about the Energy Sector, please contact:

U.S. Commercial Service Poland

Commercial Specialist: Anna Janczewska

E-mail: anna.janczewska@trade.gov