Due to the sensitive nature of the defense industry sector, there are no official statistics available on local production, imports, and exports. The only data available through public sources is the annual amount of defense expenditures, which is illustrated in the table below.

Overview

Year |

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

2022

| 2023 |

Approximate Defense Spending $ billion | 8.79 | 9.05 | 10.36 | 10.67 | 10.30 | 9.8* | 9.5 | 10.1 | 12.5 | 12.5 | 13.3 | 14.0 | 24.0 |

Source: Ministry of Defense (MON) – Annual Budget

2016 exchange rate: 1 USD = 4.0 PLN

2017 exchange rate: 1 USD = 3.6 PLN

2018 exchange rate: 1 USD = 3.7 PLN

2019 exchange rate: 1 USD = 3.8 PLN

2020 exchange rate: 1 USD = 3.95 PLN

2021 exchange rate: 1 USD = 3.87 PLN

2022 exchange rate: 1 USD = 4.59 PLN

2023 exchange rate as of September 22, 2023: 1 USD = 4.31 PLN

Poland leads the former Eastern-bloc countries in parting from Soviet-era equipment and has long term plans to replace any remaining Soviet era equipment with modern NATO-compatible platforms. However, the Government’s plans to strengthen and reorganize the armed forces and domestic defense industry compete with other reforms that are financed through the state budget.

The 2023 defense budget raised defense spending to about $24.0 billion (PLN 97.4 billion), which amounts to 3 percent of 2022 GDP. This represents a 68.6 percent increase from the previous year’s budget and can in part be accredited to Russia’s 2022 full-scale invasion of Ukraine. The defense budget increase is also expected to involve an increase in military personnel to up to 300,000 (including 50,000 in the Territorial Defense Forces). Additionally, the Government plans to allocate up to 10 billion dollars via the Armed Forces Support Fund*, for modernization of the Polish Armed Forces. Altogether, Poland’s defense spending in 2023 will likely exceed 4 percent of GDP.

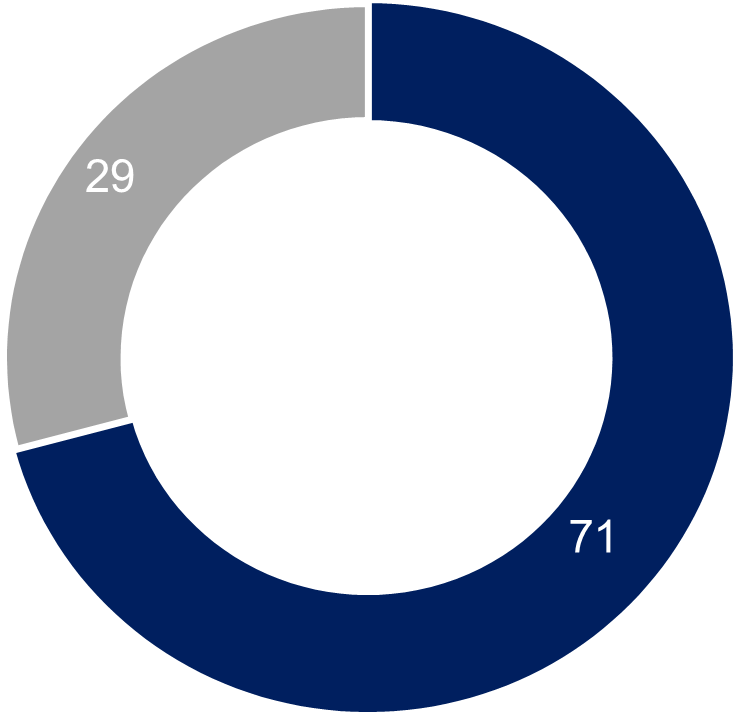

2023 Defense Sector Budget of USD 31 billion

Defense spending from National Budget (71)

Fundusz Wsparcia Sił Zbrojnych (Armed Forces (29)

Support Fund

*In May 2022, the Minister of National Defense signed an agreement with the President of Poland’s national development bank Bank Gospodarstwa Krajowego (BGK) regarding BGK’s management of the Armed Forces Support Fund. The “Homeland Defense Act” of 2022, consolidated defense regulations, increased the number of active personnel, increased defense spending to 3 percent of GDP by 2023, and established the Armed Forces Support Fund as an extrabudgetary means to significantly increase financing of defense expenditures and modernization.

Poland has a very ambitious “Technical Modernization Plan” for its Armed Forces. The Plan currently estimates spending $131 billion on new equipment between 2021-2035. The plan is based on three principles: 1) assessment of Polish military needs; 2) timeframe for delivery of equipment; and 3) Polish industrial participation. The program places an emphasis on using Polish defense industry capabilities, especially Polish Armament Group (PGZ) companies.

To increase the competitiveness of Polish defense industry, in 2013, the creation of the Polish Armaments Group (PGZ) consolidates approximately 50 Polish state-owned companies of which 30 are defense companies and 20 others including shipbuilding, and new technologies. In 2022, Defense News ranked PGZ 70th out of the 100 biggest defense companies in the world. Cooperation with PGZ has been a key to success for many foreign defense firms entering the Polish market.

U.S. companies are encouraged to team with Polish defense companies seeking cooperative agreements or joint venture opportunities that, combined with the relatively lower cost of production in Poland, will be attractive to potential customers.

Major recent Foreign Military Sales agreements with the United States include the Abrams M1A2 SEPV3 main battle tank, the Integrated Battle Command System (IBCS), PATRIOT air and missile defense system, F-35 Lightening II fighter aircraft, High Mobility Artillery Rocket System (HIMARS), Javelin anti-tank missile, and Joint Air-to-Surface Standoff Missiles-Extended Range (JASSM-ER).

In late 2022, Poland was a recipient of $288 million in Foreign Military Financing (FMF). FMF grants helped backfill capabilities Poland provided from its own stocks to add to Ukraine’s defense. In September 2023, Poland received a milestone $2 billion FMF direct loan agreement to accelerate Poland’s defense modernization by supporting urgent procurements of defense articles and services from the United States. The U.S. government also provided up to $60 million in FMF grants for the cost of the loan. Loan proceeds will further advance Poland’s military modernization effort across a wide range of capabilities, substantially contributing to strengthening the defense and deterrence of NATO’s Eastern Flank.

Leading Sub-Sectors

Opportunities for American defense firms exist mainly in investment, technology transfer, and co-production work. Polish defense companies routinely seek cooperative agreements or joint venture opportunities with foreign defense companies.

Receptivity to American products is high due to an excellent reputation for high quality products, reliability, and technical assistance. However, technological advantage is not the only factor determining success in the Polish market. American companies should focus on educating end-users in the defense sector. A successful U.S. exporter is expected to support its agent/representative at trade shows, seminars, and conferences.

Polish officials maintain that the most important factor in awarding a contract is price (which is particularly critical for big-ticket purchases), after which other variables, such as quality, availability of services and training, technical assistance, and start-up operation of the equipment, become important. Therefore, superior performance offered from U.S. companies will not always win the deal.

The Polish government is required by law to hold public tenders for major procurements, though there is a national security exception. Financial value, project complexity, international cooperation, and political sensitivity determine the project category.

American companies that are well informed about upcoming projects are free to submit tenders to the contracting authority directly. However, direct purchases from foreign suppliers are very rare and we encourage U.S. firms to identify local agents/representatives who can provide necessary assistance. Selecting an appropriate representative is very important. The agent should have close contacts in the military/defense market. A reputable agent with good contacts can provide important and timely information, which is often not readily available through public sources. American companies exporting to Poland should be familiar with the country’s Public Procurement Law, Polonization, and Offset Act. Polonization is part of Poland’s long-term plan to become more self-sufficient, and to increase and promote local industrial production. The bottom line is that it is nearly impossible to effectively sell defense products without a competent agent.

The Office for Offset Agreements at the Ministry of National Defense (MoND) coordinates Poland’s defense offsets. The offset requirements are an important part of defense procurement contracts. On June 26, 2014, the Polish Parliament adopted a new Offset Act - the “Act on Certain Agreements Concluded in Connection with Contracts Essential for National Security.” The new Offset Act was signed into law by the President of Poland on July 7, 2014. The new law covering the use of offsets in defense acquisition brings the country in line with European Union (EU) military procurement rules.

The U.S. Commercial Service identifies the defense industry as one of its sectors with sizeable American sales potential in Poland. It offers several commercial export promotion programs and advice on regulation compliance, the market potential for a product or service, agent/representative vetting, as well as advocacy support. Please visit the Commercial Service in Warsaw for more information on how we help U.S. companies do business in Poland.

Foreign investors and joint venture partners with local firms can take advantage of government incentives. Joint ventures are an excellent way to facilitate export sales to the Polish market. U.S. companies competing for Polish defense contracts are encouraged to look for joint ventures, co-production, and other cooperative opportunities with Polish companies to make their bid offers more attractive. The relatively low cost of production in Poland has led many foreign defense companies to seek cooperative agreements or joint venture opportunities with Polish defense firms. Examples of such projects include co-production of tanks, armored vehicles, artillery, ships, aircraft, and helicopters.

The potential of the Polish private defense sector is growing, with private companies offering more innovative solutions. Major U.S. defense companies (e.g., Raytheon Technologies, Lockheed Martin, Northrop Grumman Defense Systems, Boeing Defense, Bell Textron, L3Harris Technologies, General Dynamics, Oshkosh Defense, and BAE Systems North America) are active in the Polish market.

Military Force Structure

Poland’s military is traditionally land force heavy, with an overall total of 198,251 military personnel. There are 125,651 regular military personnel, 6,020 regular soldiers in military education, 25,000 voluntary enlisted recruits, 3,580 voluntary enlisted recruits in military education and 38,000 Territorial Defense Forces personnel. There are 73,453 troops in the Land Forces; 17,589 in the Air Force; 6,426 in the Navy; 3, and 3,390 in Special Forces (SOF).

Poland’s military structure is also unique in NATO with three principal commands fulfilling functional roles under the General Staff. The General Command (GENCOM) is Poland’s force provider responsible to manning and equipping subordinate air, land, naval and SOF inspectorates. The Operational Command (OPSCOM) is the force employer which receives forces and equipment from GENCOM to employ during crisis and war and manages Poland’s deployment operations out of the country. Finally, Poland’s Support Inspectorate is the logistics arm ensuring both GENCOM and OPSCOM have cross-country mobility and sustainment for forces. The Territorial Defense Forces (TDF) report directly to the Ministry of Defense. The Polish Parliament is considering draft legislation on changing its current command structure to respond to possible crises or hybrid attacks more quickly.

Web Resources

Trade events

Participation in trade fairs, conferences, and seminars is an effective avenue for promotion in the defense/military sector in Poland.

Poland’s annual MSPO International Defense Industry Exhibition in Kielce is Central Europe’s largest defense exhibition, and the third largest in Europe following Paris and Farnborough Air. This 31st edition took place from September 5-8, 2023. The next edition is scheduled for September 3-6, 2024.

Other important exhibitions in the defense sector are:

BALT-EXPO - International Maritime Exhibition https://baltexpo.ztw.pl/, held biannually in Gdańsk.

BALT-MILITARY-EXPO focused on maritime safety and security, sea- and land-based defense, and rescue systems. is held bi-annually in Gdańsk. The next show is scheduled for 2025.

Defence24 DAY – Defense and security conference held annually in Warsaw, typically in May. Polish military officials often present modernization plans, and exhibitors are welcome. The next edition is scheduled for May 2024

Additional Resources & Contacts:

Ministry of National Defense (MOD)

Armaments Agency (MOD Procurement Office)

Polish Chamber of Defense Industry

For more information about the Defense Industry Sector, please contact:

U.S. Commercial Service Poland

Commercial Specialist Zofia Sobiepanek-Kukuryka

E-mail : zofia.sobiepanek@trade.gov