Overview

Jordan is a net food-importing country with a growing market of more than 11 million consumers that has nearly doubled in the past decade. Jordan imports up to 98 percent of consumable items from abroad, including rice, frozen chicken cuts, nuts, fresh apples, cheese, beef, and food preparations. Due to the scarcity of water, agriculture has been declining as a component of the overall economy for years. Although it consumes around 50 percent of Jordan’s water resources, agriculture accounts for 5.9 percent of the country’s GDP. The agricultural sector employs 2-3 percent of the labor force, though many agricultural workers hail from Egypt, Pakistan and Syria. The horticultural product sector, poultry industry, and small-scale herding are major components of the agriculture sector.

Consumers demand a wider variety of foreign food and agricultural products that are packaged and clearly labeled. In 2021, Jordan imported $2.8 billion in consumer-oriented products, with the retail food sector valued at about $4.5 billion. For the list of export certifications required by Jordan for imports and the products they cover, please refer to a related article on Jordan’s “Restrictions and Prohibited Imports.” More details can also be found in USDA FAS attaché reports at: https://www.fas.usda.gov/.

Leading Sub-Sectors

- High Demand for U.S. Food Products in the Hotel, Restaurant, and Café Sector HORECA: The Jordanian retail food sector is estimated to be $4.5 billion. Higher income consumers drive much of the demand for imported products, while middle- and lower-income consumers substitute imports with domestic alternatives. Traditional outlets dominate the Jordanian market, representing 85 percent of total outlets and around 90 percent of total sales. Despite this, modern outlets are growing in number and volume of sales. Online retail platforms are also becoming increasingly popular as Internet penetration increases.

- Processed Food Ingredients: The food processing industry is growing and drives demand for ingredient inputs, which is expected to double in the next five years.

Market Structure

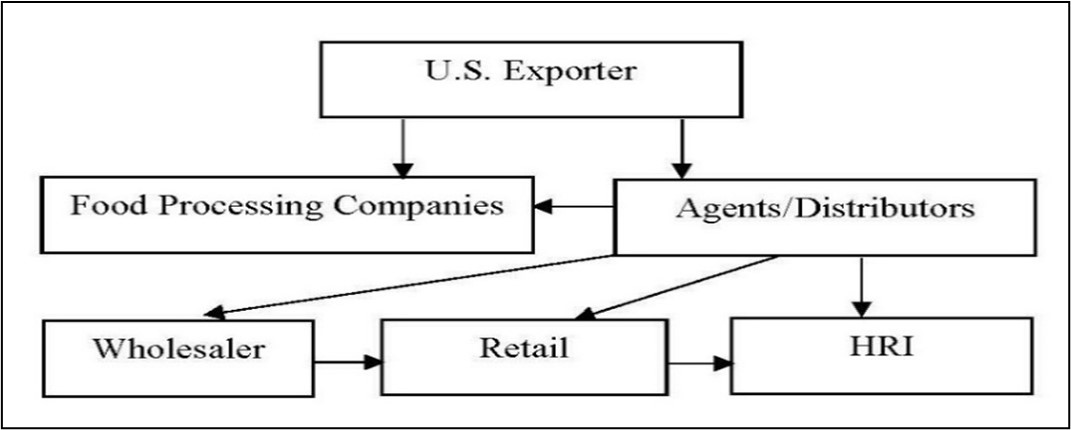

Jordan’s market structure is straightforward. Importers are food processors, manufacturers, and or agents/distributors, as well as generalists who import a wide range of food products. Larger companies source food ingredients and products directly to lower prices, guarantee product flow, and ensure quality. Agents/distributors service the food processing and manufacturing sectors. It is important for U.S. exporters to work with someone locally who knows the market well for a specific product.

CHART 1: JORDAN, Food Ingredients Import Distribution Channel

Opportunities

Jordan’s consumer behavior is gradually becoming more westernized. There is increasing demand in Jordan for the following goods: corn, rice, food ingredients, fresh and frozen sea products, U.S. origin cheese, fancy beef products, low priced chicken leg quarters, nuts and cereals. Although the candies market is growing, exporters should be aware that Genetically Engineered (GE) products require prior registration and must meet labeling requirements.

Jordan is traditionally price sensitive. Young Jordanians’ lifestyle and aspirational purchases are increasing due to greater exposure to global trends and brands. These consumers (within the 15-32 cohort) account for Jordan’s largest gross income concentration, despite relatively smaller incomes. Supermarket chains are the main channel for marketing imported food products targeting middle- and upper-income consumers. Indications are that the demand for upscale goods and services will remain strongest through 2030 amongst the country’s top income band, those making over $150,000 per annum. Middle-income households on average spent $14,000 (with an estimated 40 percent of discretionary spending going to food purchases).

For more insights on doing business in food and agricultural products, kindly visit USDA FAS attaché reports on Jordan https://www.fas.usda.gov/data