Overview

El Salvador’s telecommunication sector has operated under a privatized legal and institutional framework since 1997, encouraging competition in most areas and allowing foreign investment. América Móvil (Mexico), Grupo IBW (local), General International Telecom Limited GITL (UK), and Tigo El Salvador (Millicom International Cellular of Luxembourg) offer high-speed data and internet service through cable systems.

The regulatory authority responsible for spectrum development is the General Superintendence of Electricity and Telecommunications (SIGET). The Superintendency of Competition also controls the concentration of telecommunication operators as its antitrust agency.

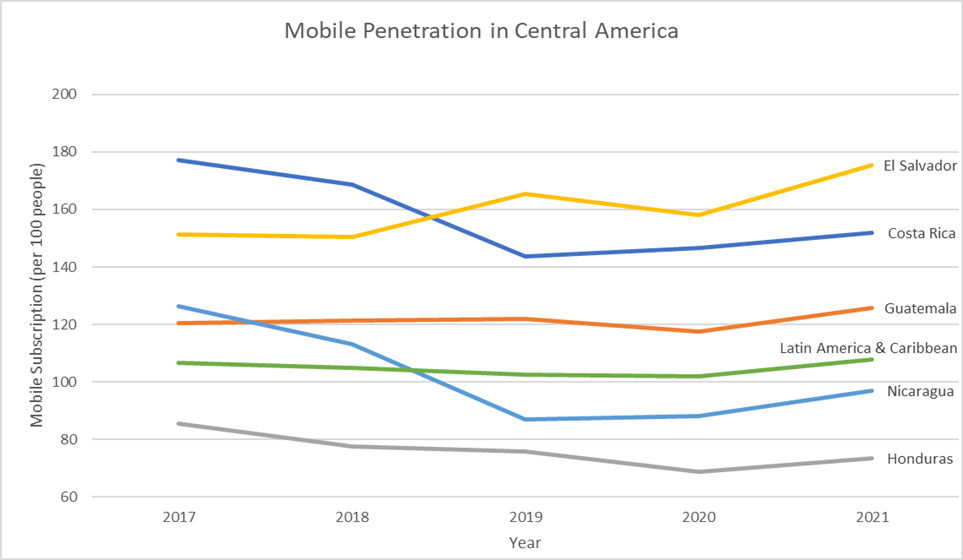

In 2022, mobile phone lines (post-paid + prepaid) were up to 11.5 million, exceeding the total population of 6.5 million; the mobile network covers 93% of the territory according to SIGET, and 92% of the population is covered by at least 3G mobile communication network. Mobile penetration is remarkably high considering El Salvador’s economic indicators, higher than the average for Latin America and the Caribbean. The growth in fixed-line services lowered in the face of mobile-cellular competition; fixed lines were 862,717 in 2022. Internet subscriptions reported by SIGET were 992,293 in 2022, 60% higher than in 2020.

Broadcast media combines multiple privately owned national terrestrial TV networks, supplemented by cable TV networks that carry international channels; the total number of multi-channel TV subscriptions is 513,041, including terrestrial multi-channel TV subscriptions and direct-to-home satellite antenna subscriptions and hundreds of commercial radio broadcast stations. The country was among the last in the region to provide 4G LTE services, mainly due to the inadequacy of a suitable spectrum. In 2019, the telecommunications regulator (SIGET) awarded more spectrum through a public tender, after which private operators deployed LTE 4.5G.

ICT Goods Market Size, million USD

Table: ICT Goods Market Size, million USD 2020 2021 2022 2023 Estimated Total Local Production 0 0 0 0 Total Exports 14.88 22.43 23.11 20.14 Total Imports 543.15 696.18 632 623.86 Imports from the US 27.04 31.62 29.42 29.36 Total Market Size 528.27 673.75 609.15 603.72 Exchange Rates NA NA NA NA (Total market size= (total local production + imports) – exports)

Source: World Bank Indicators

Units: USD millions

The United States is among the top three sources of ICT goods imports in El Salvador, with 4.7% of the imports market share in 2022; China leads with 66.6%, followed by Mexico with 15% of the market share. There is no significant local production of information and communication technology, except for capacitors used in electronic equipment produced at a free trade zone. Import duties for information and communication technology and equipment are zero percent, subject to a 13% value-added tax. Companies should either register an office or work with a local agent to do business in El Salvador.

Leading Sub-Sectors

- Consulting

- Professional and Technical Services

- Software Development

- Cloud Services

- Data Center Operations

- Computer and Network hardware and software

Telecommunications systems and products.

Opportunities

The Innovation Secretariat’s 2020-2030 Digital Agenda aims to implement a digital transformation through four pillars: 1. Digital Identity; 2. Innovation, Education, and Competitiveness; 3. Modernization of the Government; and 4. Digital Governance. Projects under execution include digital identity, digitalization of medical records, reduction of the digital gap, a centralized data center, electronic commerce, electronic signature and electronic invoice implementation, biometric passport, and a national connectivity plan, which includes a subsea cable, fiber optic connections and point, and 5G network.

The country has made several changes aimed at promoting innovation within the last year. One is the elimination of base price and yearly fees for up to ten years for the concession of radioelectric frequencies for satellite internet. Another key decision is the elimination of taxes for fifteen years for new technology investments, including income tax, withholding income tax, capital gains, municipal taxes, taxes on net company assets, customs and import duties, and transportation taxes. Most recently, the telecommunication and electricity regulator (SIGET) published a decision to allocate the entire 6GHz band for unlicensed technologies. The higher speeds and improved connectivity afforded by the band will unlock the full social and economic potential of Wi-Fi technology and facilitate the implementation of Wi-Fi 6E and Wi-Fi 7 products throughout the country.

El Salvador has ambitious plans to modernize customs, ports, airports, water, and sewage systems; and improve and expand mass mobility, lighting, surveillance of roads, and implement electronic voting. El Salvador’s private and public sector prefers U.S. information technology products, which creates opportunities for water metering, smart traffic solutions, smart lighting systems, custom technology solutions, and city monitoring systems. The primary buyer is the public sector, channeling purchases through an online portal for competitive bidding processes (refer to the Selling to the Government chapter for more information). Projects may also be listed on the websites for the various multilateral development banks, a good local partner should be able to keep on top of where the various government opportunities will be listed.

Resources

- Telecommunication Regulator SIGET

- Trading economics World Bank Indicators

Secretaria de Innovacion

Interested parties may contact Senior Commercial Specialist Maria Rivera at maria.rivera@trade.gov