General Overview

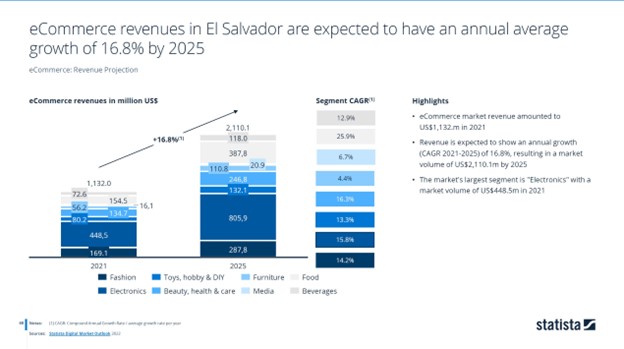

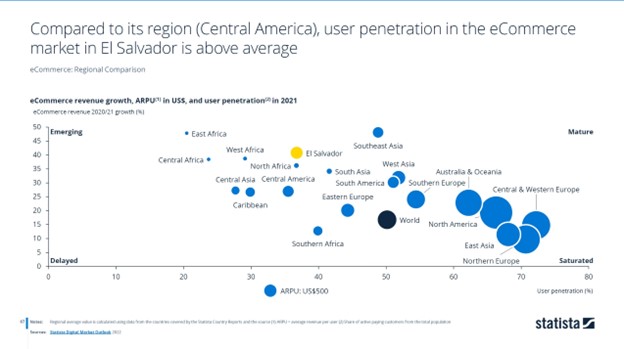

The use of eCommerce has significantly increased, and medium and small companies are adapting to the demands of digital development. According to a report by Statista, 92% of digital revenues is concentrated in the eCommerce sector, with 6.7% in digital media, .7% in eServices, and .5% in eHealth. Local companies that have strong eCommerce strategies include: Cupon Club, PagaPoco, Avianca, Cinepolis, Todo Ticket, Pizza Hut, Siman, La Curacao, Editoriales La Ceiba, Super Selectos and Premium Center.

Legal & Regulatory

The Electronic Signature law was passed in 2015, facilitating business and commerce through internet-based transactions. Per the legislation, the certified electronic signature is equivalent to an ink signature. In August 2021, law reforms allowed a locked and secure e-signature format. The Ministry of Economy controls and monitors electronic certification providers and the storage of electronic documents and backups.

On February 10, 2020, the Legislative Assembly approved the Electronic Commerce Law (Ley de Comercio Electronico). The law seeks to provide legal certainty to commercial and contractual relationships, carried out through digital means, between suppliers of goods and services.

In November 2021, the Law to Facilitate Non-Commercial Online Purchases was approved to promote and facilitate the importation of merchandise by Salvadoran individuals. The law provides an exception to import tariffs for purchases up to $300, but the 13% VAT still applies. Medicines under medical prescription as well as products specified in the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances do not benefit from this Law.

In September 2021, El Salvador implemented the Bitcoin Law which introduced Bitcoin as a legal tender, in addition to the U.S. dollar. Consequently, all prices may be denominated in Bitcoin and even taxes can be paid in Bitcoin. According to Article 7 of the Bitcoin Law, every economic agent shall accept Bitcoin as a form of payment when it is offered by the person acquiring a good or service.

Consumer Behavior

Salvadoran consumers use various platforms for their online purchases: Amazon, E-bay, AliExpress, Alibaba, and Mercado Libre, among others. Consumers typically pay using debit or credit card payments (Visa, MasterCard, and American Express), local bank accounts, deposits, and transfers. ApplePay is now available through credit cards issued by BAC Credomatic and Promerica Bank. Paypal is not commonly used.

Banks, businesses, and merchants of all sizes have been required to accept Bitcoin since September 2021, alongside the country’s other official currency, the U.S. dollar. However, a report published in April 2022 by the U.S. National Bureau of Economic Research showed that only 20% of those who downloaded the Chivo wallet continued to use it after spending the $30 bonus the government gave to encourage adoption and use. A survey published in March 2022 by the Chamber of Commerce and Industry of El Salvador found that 86% of businesses have never made a sale in bitcoin, and only 20% of businesses take bitcoin, despite the Law’s mandate that all merchants accept the cryptocurrency.