As of January 1, 2015, 100% of U.S. consumer and industrial goods enter the CAFTA-DR countries duty-free (for goods that meet the country-of-origin requirements). Approximately 80% of these products entered duty-free when CAFTA-DR first entered force in 2006. The remaining 20% of consumer and industrial goods were on a 5- or 10-year phased tariff reduction schedule.

CAFTA-DR provides preferential treatment for products that meet the CAFTA-DR origin rule. The local importer’s responsibility is to claim a preference under CAFTA-DR. The free trade agreement allows the included countries to conduct an Origin Verification Process when there is doubt regarding product origin. U.S. exporters and local importers are required to keep documentation proving origin for five years.

Under CAFTA-DR, most U.S. agricultural exports enter El Salvador duty-free. In 2006, El Salvador began a process to eliminate its remaining tariffs on nearly all agricultural products by 2021. Tariffs for rice and chicken leg quarters will be eliminated in 2024, and tariffs for dairy products will be eliminated in 2026. Tariff rate quotas (TRQs) permit immediate duty-free access for specified quantities during the phase-out tariff period – which are applicable for some poultry products until 2024 and dairy products until 2026.

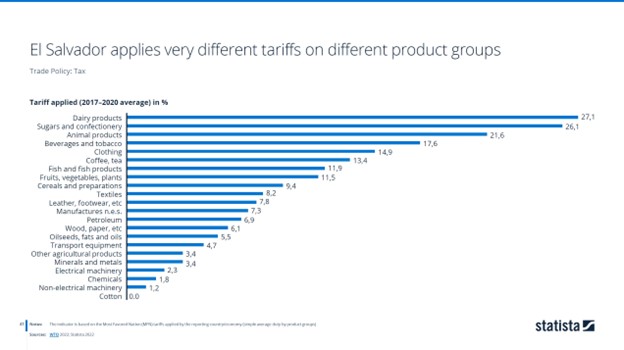

For countries with which El Salvador does not have a bilateral trade agreement, most of El Salvador’s tariffs do not exceed the maximum standard external tariff of 15% established by the Central American Common Market (CACM) treaty, of which it is a signatory. However, there are several exceptions and agricultural products face the highest tariffs. Some dairy, rice, pork, and poultry products are assessed a 40% duty. Alcoholic beverages are subject to a 20% to 40% duty, domestic taxes that include a specific tax based on alcohol content, and an 8% ad valorem tax. Motor vehicles usually have assessed a duty of 25-30%. In addition, all goods and services in El Salvador, regardless of origin, are charged a value-added tax (VAT) of 13%. charged a value-added tax (VAT) of 13%.

For tariff rates (applied and preferential) and taxes for goods, use the Customs Info Database Tariff Lookup Tool.

Also check FTA Tariff Tool.