Overview

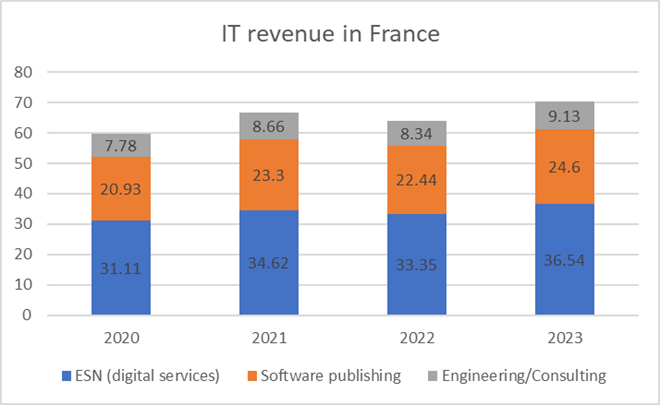

Units: $ Billions

Exchange rate: 1Euro= 2021-USD 1.1827;2022 USD 1.0530; 2023 USD 1.0813; 2024 USD 1.0800

Despite economic and geopolitical uncertainty throughout 2022, the French digital sector has remained resilient and exceeded growth expectations. The total market size of France’s digital market in 2022 is estimated to be 60.9 billion euros (USD 64.233). The market is divided among the three following activities: ESN/digital services (52.4%), software publishing (35.5%), and engineering and technology consulting (12.1%). The global ICT sector in France represents close to 30,000 companies, including numerous highly specialized SMEs, and the sector employs over 660,000 people.

In 2022, the French digital sector experienced an industry-wide growth of 7.5%. Such growth is largely driven by investments and development in areas like the Cloud (24.5%), Big Data (22.1%), IoT (19.1%), and Cybersecurity (11.3%). Despite massive strides, future growth in the digital sector may be hampered by a talent shortage even though the French digital sector created 47,000 jobs in 2022. While this issue is not new to the sector, it has intensified greatly as companies struggle to find talent trained in the skills necessary to support the digital transformation of the French economy in 2023 and beyond.

Still, the digital sector continues to be an area of focus for all firms across France, regardless of industry, as 48% of companies increased their IT budgets in 2022, a 10% increase from 2021. Similarly, it was forecasted by Numeum (French ICT trade association) that 55% of French companies will increase their IT budgets in 2023.

Leading Sub-Sectors

- Cloud Computing (+ 24.5% growth in 2022)

- Big Data (+ 22.1% growth in 2022)

- IoT (+ 19.1% growth in 2022)

- Cybersecurity Solutions (+ 11.3% growth in 2022)

- Digital Transformation (+ 10.2% growth in 2022)

Opportunities

Analysts expect the French digital market to continue to grow consistently in the following areas: cloud consulting and systems integration; digital transformation; the collection and use of data; 5G and edge computing; cybersecurity; and especially artificial intelligence.

France has an ambition to be the ‘A.I. hub of Europe,’ with government officials, including President Macron, promising aggressive investments into A.I. training and research. Since 2018, France has allocated over €500 million per year as part of its “National Strategy on AI” aimed at enhancing research, development, and education in France through 2026. France has yet to produce any large global players in A.I., so there is likely a significant opening for investment and development opportunities as France looks to grow domestically in this sector.

While market growth of consumer software and services hovers around 7.5%, the cloud market continues to expand at a rapid rate of 24%. The cloud (and especially the public cloud) market continues to be an attractive commercial opportunity.

Cybersecurity in France is a €3.7 billion market and has continued to grow by roughly 10% each year for the past several years. This growing demand arises as the French economy continues to digitize and severely damaging cyber-attacks become more and more common. For example, in December of 2022, a hospital in Versailles was victim to a major cyber-attack which caused significant disruption to hospital operations and severe breaches in patients’ privacy. Similarly, in March of 2023, a group of hackers took down the French National Assembly’s website, demonstrating that not even the government is immune to such attacks. The 2018 “Network and Information Systems Security Act” imposed strict security requirements on digital service providers as they become an increasingly essential service to the public. However, in the meantime, French companies still have a long way to go considering they have devoted only 10.7% of their respective IT budgets towards cybersecurity. With the increase of cyber-attacks targeting all kinds of organizations of any size, danger awareness has improved widely. Therefore, opportunities are significant in this area, as companies increase their investment in solutions to protect themselves.

American tech companies are still viewed as leaders in the computer services and software sector with key players such as Microsoft, Google, Apple, Dell, Adobe, IBM, or Oracle having large market shares. However, the French and EU governments have implemented a variety of digital policies that have significantly affected how American companies operate in these markets. Most notably, digital policies and regulations such as the Digital Markets Act and Digital Services Act have created a challenging environment in the French market, especially for large American platform providers. Nevertheless, high growth in many ICT subsectors represents an opportunity for business investment, entry, and expansion.

Trade Events

The U.S. Commercial Service in France can assist in identifying the trade show best suited to each ICT subsector and industry vertical (AI, Cybersecurity, blockchain, industrial IT solutions, e-commerce, and social marketing, etc.).

General Tech event for start-ups and scale-ups:

Vivatech – Paris, May 22-24, 2024.

Resources

- Numeum (French ICT sector trade association) 2022 review and 2023 Outlook

- OECD.AI Policy Observatory

Contact: U.S. Embassy France - U.S. Commercial Service Trade Specialist

Rose-Marie.Faria@trade.gov +33 (0) 1 43 12 71 49