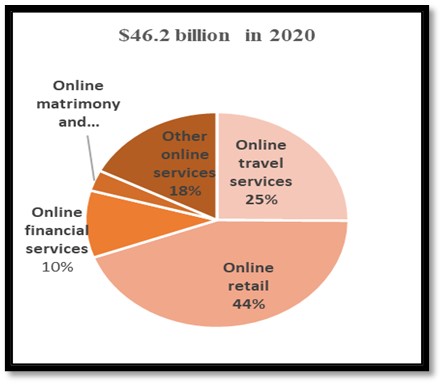

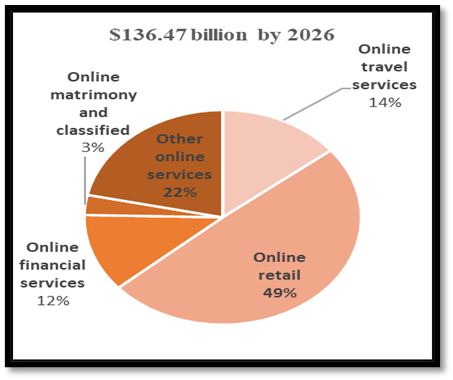

India’s e-commerce market is one of the fastest growing in the world. The value of Indian e-commerce was $46.2 billion in 2020 and is expected to grow at 18.29 percent to $136.47 billion by 2026. E-commerce activity is increasing, as is the use of digital payment systems. Momentum in this sales channel has been steadily growing but was amplified during the COVID-19 pandemic. It is often beneficial to have a distributor with an online presence and dedicated website, positioned to market your product via the e-commerce channel. E-commerce is subject to the Competition Act issued by the Indian government to enforce pricing and distribution laws. To avoid competition law violations, U.S. companies should be aware of such provisions and include relevant clauses in distribution partnership agreements.

Although e-commerce witnessed a steep decline during initial COVID-19 pandemic lockdowns, this channel soon realized accelerated growth across segments as the population adapted, including hyperlocal delivery, digital education, food delivery, digital health, digital media, and entertainment. This was accelerated by rapid adoption of online payment options. India has emerged as a preferred destination for suppliers focused on online sales due to its large consumer base, diverse demographics, low-cost digital infrastructure and services, and supply chain ecosystem.

Major Segments of India’s E-Commerce Market

Legal and Regulatory Environment

India lacks clear and specific laws that govern the use of consumer data and consumer privacy. The Information Technology Act of 2000 and the Indian Contracts Act of 1872 touch on these issues, and India’s Parliament is considering a legal framework on the digital ecosystem that may address personal data protection and privacy. The draft Personal Data Protection Bill, 2019, was deliberated heavily by the Joint Committee of Parliament. In August 2022, the bill was withdrawn and a new bill covering personal data protection is planned that will fit into the proposed comprehensive legal framework. Timelines for this have yet to be identified. Also, the Reserve Bank of India (RBI) promulgated new guidelines for payment gateways and payment aggregators prohibiting them from storing credit card data.

Foreign companies are required to establish an Indian entity with goods and services tax (GST) registration or to partner with an Indian distributor or importer while doing business in India. The Ministry of Commerce and Industry regulates online sales in the Indian market.

In 2019, the Indian government released a draft national e-commerce policy to regulate the sector. The policy focuses on cross border data flows, intellectual property, and competition. The Indian government allows 100 percent FDI in B2B e-commerce firms and 100 percent FDI in B2C e-commerce under the “automatic route,” which does not require prior approval from the RBI or the central government. The e-commerce policy also touches on topics addressed by draft Non-Personal Data Governance Framework and the National Cyber Security Strategy, 2020.

Rules and Regulations Affecting E-Commerce

- Income Tax Act, 1961

- Consumer Protection Act, 1986

- Information Technology Act, 2000

- Foreign Exchange Management Act, 2000

- Payments and Settlement Systems Act, 2007

- Companies Act, 2013

- Laws related to goods and services tax.

In July 2020, the Ministry of Consumer Affairs, Food, and Public Distribution published the Consumer Protection (E-Commerce) Rules, 2020. The Rules concern how to display the country of origin of products and services, the labeling of goods with expiration dates, and information about returns, refunds, exchanges, warranties, and guarantees.

In June 2021, the Ministry proposed additional amendments to the Rules, including alteration of the definition of an e-commerce entity; mandatory registration of e-commerce entities; establishment of a grievance redressal mechanism; a ban on what the Indian government alleges to be the manipulation of e-commerce search results; and a ban on flash sales.

Though the Indian government allows 100 percent FDI in the e-commerce marketplace model (ECM), it is not allowed in the inventory-based model. Under the ECM, vendors utilize online portals to sell their products in the e-commerce marketplace, but under the inventory-based model they both own and sell products in the e-commerce marketplace. Following vendor and trader complaints, the Department of Industrial Policy and Promotion imposed stricter regulations on foreign-owned ECMs. Based on a comprehensive review of the FDI rules, the following changes were made:

- If an ECM owns a business or a start-up, the company is not permitted to sell its products on the same ECM’s portal.

- No single vendor or trader can account for more than 25 percent of total sales on an ECM platform.

- Limits are placed on exclusive partnerships with profitable brands and preferential services to a small number of vendors is prohibited; and

- ECMs cannot influence product prices.

Consumer Behavior

Customers in India prefer online purchase channels for categories such as accessories, apparel, footwear, personal care products, household supplies, and consumer electronics, with customer preference for online channels estimated from 25 percent to 30 percent. The COVID-19 pandemic caused consumers to begin or increase purchases through online channels. The most important factors for purchasing goods online are price, discount, delivery time, seller ratings and reviews, best before date, and country of origin.

According to a report by U.S.-based payment systems company ACI Worldwide, digital payments in India are set to account for 71.7 percent of total payment volume by 2025, leaving cash and checks at 28.3 percent. Google Pay, Visa, Mastercard, and Paytm are the digital payment platforms most preferred by consumers.

Artificial Intelligence (AI) is transforming the Indian e-commerce industry by providing high-tech experiences ranging from stores to websites, chatbots, and voice assistants. AI is being utilized to proactively market products and services through popular social media sites including Instagram, Facebook, and WhatsApp. Due to strong competition to expand their customer base, e-commerce players also incorporate AI into their enterprise resource planning systems.

Cross-border e-commerce is still in its infancy in India. Notable U.S. players include eBay and Amazon, the latter having a strong presence in India. Domestic players such as IndiaMart and TradeIndia are expected to venture into cross-border trade. However, cross-border trade is largely unregulated and therefore attracting the attention of authorities.

Intellectual Property Rights

Among the major world economies, India faces significant challenges in implementing and protecting IPR. Despite numerous initiatives, progress has not kept pace with the high level of demand to foster innovation and promote creativity, including in the e-commerce sector. The government has attempted to take positive steps over the last five years, such as modernizing its intellectual property offices, increasing manpower, and delivering patent grant certificates.

A major issue hampering intellectual property rights protection is India’s lengthy and uncertain legislative process. Additionally, there is no statutory protection for trade secrets, creating uncertainty for businesses that need to secure sensitive information exchanged between parties.

Digital Marketing and Social Media

According to Business Insider, digital marketing through videos saw the highest return on investment in India, at around 62 percent, followed by branded pages, emails and newsletters, live events and streaming, and influencer marketing. According to Statista, India had over 35 billion digital transactions valued at over $769 billion in 2021. By 2026, the digital transaction volume is expected to exceed 210 billion.

The share of company-owned e-commerce platforms has increased in comparison to online platforms used by marketers to drive sales in India. As such, companies are increasingly relying on their own e-commerce platform rather than third-party e-commerce platforms or social media marketplaces. According to a Statista survey, the most used communication platforms are WhatsApp, Instagram, and Facebook Messenger, all owned by Meta.

E-Commerce Business Service Provider Ecosystem

Third-party service providers in India’s e-commerce market can facilitate faster access to online ecosystems by providing services such as imaging, cataloguing, enhanced brand content, account management, advertising, international shipping and logistics, domestic transportation, and tax management. The Amazon Service Provider network, for example, allows sellers to gain access to Amazon’s service provider ecosystem to facilitate sales, fulfilment, and assist with after-sales support across India.

Popular Indian E-Commerce Sites

B2C: Amazon.in; Flipkart; Myntra; Tatacliq; Pepperfry; Paytmmall; Nykaa; 1mg; Firstcry; AJIO; Bigbasket; Grofers; Shopclues; Makemytrip; Bookmyshow; Koovs; Lenskart; Meesho; and Zomato.

B2B: Jumbotail; Elasticrun; Ninjacart; DeHaat; Farmley; Udaan; Bizongo; IndiaMart; GoMechanic; Retailio; Saveo; Horeca Stop; ChemX; Infra.Market; NowPurchase; OfBusiness; VendorInfra; Fibre2Fashion; Fashinza; Bijnis; Moglix.

Major Buying Holidays

- Ramadan (March–April)

- Rakhi (August)

- Diwali (October or November of the year)

- Dussehra (October)

- Christmas (December)

- New Year (January)

Trade Shows and Conferences

- HGH India – Delhi, December 2023

- Meet Magento, Ahmedabad, Gujarat, February 2024

- Great India Retail Summit – Mumbai, February 2024

- Phygital Retail Convention – Mumbai, May 2024

- DigiMarCon India 2023 – New Delhi, August 2024

- Cosmoprof Beauty- Mumbai, December 2024

For more information about export opportunities in this sector, please contact Commercial Specialist Smita Sherigar.