Overview

In Bulgaria, health policy priorities and national programs are determined by the Council of Ministers and executed through implementation of the National Health Strategy. The National Assembly and its Parliamentary Healthcare Committee represent the legislative power; the Council of Ministers and the Ministry of Health (MoH) represent the executive power; and the National Health Insurance Fund and the professional organizations represent the public and non-government sector. At a district level, all health policies are implemented by the Regional Health Inspectorates.

The Bulgarian Drug Agency (BDA) is a specialized state regulatory authority reporting to the Minister of Health exercising supervision over the quality, safety, and efficacy of drugs (including biological) and medical devices. The BDA is responsible for authorizing and registering drugs and medical devices launching in the market. The U.S. Food and Drug Agency (FDA) confirms the capability of BDA to carry out good manufacturing practice inspections at a level equivalent to the United States.

MoH is responsible for overall supervision of the healthcare system, drafting health legislation, developing national health policy, and implementing programs for improving the health of the population. National health policy is executed through activities of 28 Regional Health Boards. MoH operates the emergency care network, 28 hygiene-epidemiological inspectorates, and numerous national research centers. These include centers for hygiene, medical ecology and nutrition, health information, pharmaceuticals, public health and healthcare financing, tertiary care centers, and hospitals specializing in acute care, psychiatry, pulmonary diseases, and rehabilitation. There are also medical universities and faculties in Sofia, Varna, Plovdiv, Pleven, and Stara Zagora, which are largely autonomous.

The government’s draft budget for 2023 calls for more than USD 5 billion for healthcare spending. The adopted budget of the National Health Insurance Fund (NHIF) for 2023 is USD 4.07 billion. More than USD 248 million is planned for primary outpatient medical care; USD 250 million for specialized outpatient care; USD 148 million for dental care; USD 1,843 billion for hospital care; USD 97 million for medical and diagnostic activities; and USD 946 million for medicines, medical devices, and dietary foods. Additionally, more than USD 500 million is provided for improving access and ensuring the health needs of the population.

Among the main policies that will be developed are emergency assistance, staff motivation, financial sustainability, and e-health. Although health spending per capita in Bulgaria is low, it consumes a significant share of GDP and out-of-pocket payments are the highest in the EU. In general, pharmaceuticals and inpatient care absorb most of the health spending with very few resources dedicated to long-term care and prevention.

Bulgaria’s healthcare sector is funded principally through the compulsory health insurance system operated by the Bulgarian Health Insurance Fund (BHIF). The Fund collects contributions from the working population and the government makes payments on behalf of those exempt, such as the elderly, the unemployed, and dependents.

Healthcare Best Prospects

Pharmaceuticals

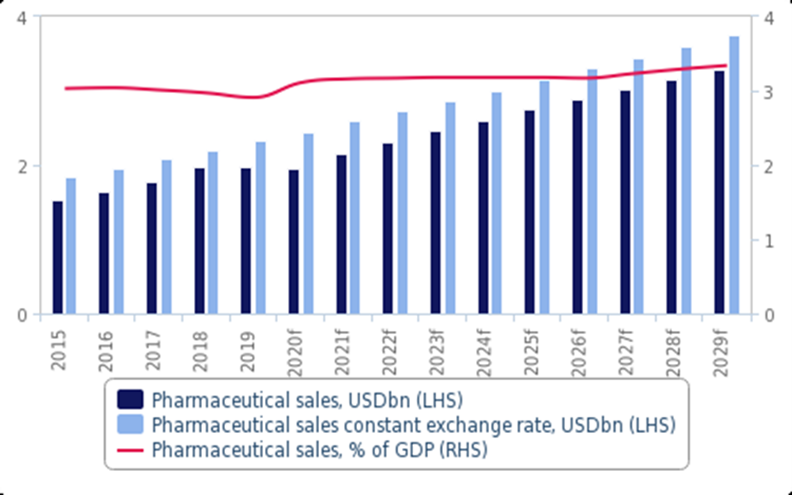

According to IQVIA, 10 billion tablets and 164 million liquid medicines are produced in Bulgaria, valued at USD 376 million. The pharmaceutical sector makes up 2.2% of Bulgaria’s GDP, and its direct contribution to the state budget from taxes, social and health insurance equals USD 74 million, representing 2.5% of the state budget.

The major U.S. research and development drug manufacturers present in the market include AbbVie, Amgen, Eli Lilly, Janssen, Roche (Genentech)., Merck Sharp & Dohme Corp. (MSD), a subsidiary of Merck & Co., Inc., and Pfizer. Most are members of the Association of the American Pharmaceutical Manufacturers in Bulgaria (AmPharMA) and all are members of the Research-Based Pharmaceutical Manufacturers Association (ARPhaRm), representing 24 international pharmaceutical companies.

Pharmacies & Drug Stores

An ageing population provides pharmacy operators a steady growth of 10% in drug sales. The market is also one of the most consolidated among retail sub-sectors in Bulgaria. Currently, there are 4,197 registered pharmacies operating in Bulgaria. The leading retail chain, Apteka Mareshki, operates more than 300 pharmacies and drug stores in 120 cities and towns across the country. There are 14 other chains, including foreign companies DM Pharma and Betty. Consolidation is expected, as some pharmacy chains are big enough to acquire smaller, regional competitors in the medium to long term.

The 2023 pharmaceutical budget includes a USD 137.44 million (16.75%) increase for pharmaceuticals, compared to last year.

Bulgaria-based distributor of pharmaceuticals Sopharma Trading (part of Sofia-based Sopharma - Bulgaria’s second-largest drug maker and one of the country’s oldest companies) entered the retail market in 2017. In recent years, it acquired Ceiba, Sanita, and Pharmanova and expanded in 40 cities, to 200 pharmacies.

Medical Devices

Bulgaria represents one of the smallest medical device markets in the EU, which will register a mid-single-digit local currency compound annual growth rate (CAGR) over the 2018-2024 period. The market is largely reliant upon imports, which are primarily sourced from other EU member states and the United States. Market growth will be dependent upon increasing healthcare funding and the success of efforts to develop the private sector.

MedTech is the association of manufacturers and suppliers of medical devices in Bulgaria. It counts leading healthcare domestic and international companies as members.

| 2019e | 2020f | 2021f | 2022f | 2023f | 2024f | |

| Total market (USD million) | 323.9 | 353.9 | 390.7 | 421.6 | 452.8 | 480.4 |

| Per capita (USD) | 46.3 | 51 | 56.7 | 61.6 | 66.6 | 71.2 |

Source: Fitch Solution Estimate, National Statistics Institute

Key opportunities:

- National Children’s Hospital Project (Sofia)

- Valued at USD 45.2 million, the hospital expansion to 400 beds and new operating facilities offers opportunities for U.S. medical devices suppliers. The project is expected to be finalized by the end of 2025. It is supported by the European Investment Bank and Children’s Hospital Health Investment Company.

- Medical helicopters

- Bulgaria has hired two medical helicopters and is building nine landing sites. By 2025, Bulgaria plans to acquire six medical helicopters and train more medical specialists to operate them.

- Active implantable devices

- Anesthetic and respiratory devices

- In vitro diagnostic devices

- Ophthalmic and optical devices

- Diagnostic and therapeutic radiation devices

- Hospital equipment

- Laboratory equipment

- X-ray machines

- Software and hardware

E-health & Innovation

There is a strong U.S. presence in Bulgaria in the med-tech industry. Bulgaria has excellent mobile and internet networks with high penetration rates, which results in a market open to innovation and digital technologies. Intense competition exists, mainly from German and Chinese providers competing on price and delivery. The National Health Insurance Fund (NHIF) administers the resources collected from the mandatory health insurance contributions.

Bulgaria’s e-health sector reform strategy encourages modernization and upgrades in a wide range of areas, including the demand for telemedicine and introduction of a national health care Web portal. Bulgaria is expected to receive USD 350 million from the European Resilience and Recovery fund for various projects in the healthcare sphere that will improve access to healthcare and connectivity and bolster prevention of fatal casualties in critical time periods.

Focusing on digital transformation of the healthcare sector, the National e-Health Strategy 2021-2030 is based on three technological pillars: cloud technologies, wireless communication networks (4G/5G), and the mass deployment of high-speed optical networks for data transmission. The technological backbone of the e-Health deployment will be the National Health Information System (NHIS), which will integrate all accepted software applications concerning human health. The project for the National Health Information System is underway, with several tenders already announced for various systems. Significant opportunities for U.S. companies can be found in the following:

- ERP/EHR/PHR/E-prescriptions management solutions

- Telemedicine and m-Health

- Pharmacy automation, software and services

- Picture archiving and communication system (PACS)

- Big data and cloud solutions.

Digitalization of the healthcare sector will help improve general healthcare and clinical treatment effectiveness and results. The need for digitalization opens many opportunities for U.S. companies offering digital health services and data-management solutions.

In terms of innovation, Bulgaria has set a priority to optimize the procedure for assessing and including new pharmaceutical therapies for reimbursement. As changes in EU pharmaceutical legislation approach, Bulgaria has an opportunity to implement more efficient and streamlined processes that grant patients faster and better access to innovative treatments.

R&D and Clinical Trials

In 2023, Bulgaria ranks 4th in the EU and 6th in the world for number of clinical testing centers (1,084). This means there are trained doctors and proper equipment for R&D drugs in almost every Bulgarian hospital and medical center. At the end of 2022, 550 clinical trials of drugs were conducted, and an average of 200 new ones are allowed each year. Approximately 12,000 patients participate in such studies annually.

The R&D and clinical trials market in Bulgaria is estimated at USD 100 million annually, with about 40% U.S. market share.

Bulgaria has great potential for the development of drug trials due to availability of well-trained doctors and specialists, lower costs for conducting the trials, and a high number of patients willing to enroll in them. To develop this sector, Bulgaria should focus on digitization - introducing electronic patients registers, an integrated database, and an electronic exchange of documents.

Bulgaria also offers potential for Contract Research Organizations (CRO) and all major providers are present in the market. The main U.S. competitors are German, Swiss, and French. The Bulgarian Association of Clinical Research (BACR) has 135 members. It advocates for high standard in conducting clinical trials and adherence to the requirements of Bulgarian and international standards.

Dietary Supplements & Sports Nutrition

Dietary food supplements sector has posted steady growth in the last several years: 17.5% growth in 2022, compared to 2021, reaching almost USD 422 million. Dietary supplements have enjoyed increased popularity over the last five years and represent more than half of the overall value of sales in vitamins and dietary supplements. The increased popularity of such products is mainly because they are seen as natural, harmless, and a healthy substitute for synthetic traditional remedies, which have potential side effects. The most popular dietary supplements category is probiotic supplements.

Medical Tourism

In recent years Bulgaria has developed a network of private cosmetic surgery and dental clinics which offer world-class medical service at affordable prices. Coupled with the tradition of balneology (treating diseases by bathing, a traditional medicine technique usually practiced at spas), spa tourism, modern facilities and rehabilitation centers, and the highly qualified healthcare staff make Bulgaria a top choice for foreign visitors. Bulgaria also offers treatment of infertility, plastic surgery, dental care, hip replacement surgery, and laser eye surgery. The cost of medical or cosmetic services and the quality provided is a strong incentive for further development of this type of tourism, including direct foreign investments.

Trade Events

Bulmedica/Buldental (May 2024) - the leading annual medical exhibition in Southeast Europe at Inter Expo Center in Sofia.

Galenia (October 19-22, 2023)- an international pharmaceutical and balneology trade fair held in Plovdiv, showcasing the latest technologies, products, and application techniques.

Web Resources

- https://www.mh.government.bg/en/ (Ministry of Healthcare)

- https://www.nhif.bg/ (National Health Insurance Fund)

- http://www.arpharm.org/ (Association of Research-based Pharmaceutical Manufacturers in Bulgaria)

- https://www.minfin.bg/en/ (Ministry of Finance)