Overview

Bulgaria has made significant improvements in its environmental performance since its European Union accession in 2007. While Bulgarian legislation reflects the EU’s environmental requirements, implementation remains a challenge.

Concerns about air quality, especially in Sofia, construction in protected areas, lack of integration of nature and biodiversity policy, and lack of adequate management and conservation objectives continue to challenge Bulgaria’s government.

Bulgaria’s drinking water, due to extensive, high-quality aquifers throughout the country, is of excellent quality but of insufficient quantity. The country’s sewage network is incomplete and sewage treatment rates for urban wastewater are low. Bulgaria needs to build drinking water and wastewater treatment plants for communities of fewer than 10,000 inhabitants.

Environmental Opportunities for U.S. Companies

- Industrial, agricultural, and municipal wastewater treatment technologies

- Membrane technologies

- Solid waste landfill construction and maintenance

- Waste collection and waste sorting equipment

- Waste-to-energy technologies

- Recycling and waste sorting technologies and facilities

- Composting of bio and agricultural waste

- Hazardous waste treatment technologies

- Closure and rehabilitation of non-compliant landfills and enforcing of the ‘polluter pays’ principle

- Integrating nature and biodiversity policy into other sectorial policies, and defining conservation objectives and measures for adequate protection and management of protected nature sites

- Air pollution control technologies for various industries

- Drinking water treatment technologies, including removal of heavy metals

- Water loss detection equipment

Bulgaria’s new Operational Program on the Environment 2021-2027 (valid through 2029) offers opportunities to U.S. firms to participate in local tenders. It provides USD 1.77 billion in EU funds for water management, waste management, biodiversity, climate change and air pollution control. Expected outcomes from the new Operational Program are an additional 1.5 million people served by improved wastewater treatment; an additional 200,000 people served by improved water supply; 285,000 tons less waste going to landfills; 1.3 million people benefitting from cleaner air; 4.4 million hectares of species and habitats with improved conservation status; 2.8 million people benefiting from flood protection and reduced risk of landslides.

Bulgaria New Operational Program on the Environment 2021-2027

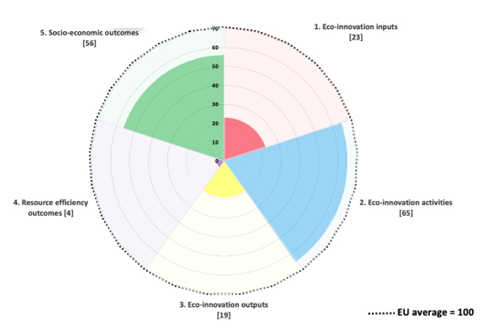

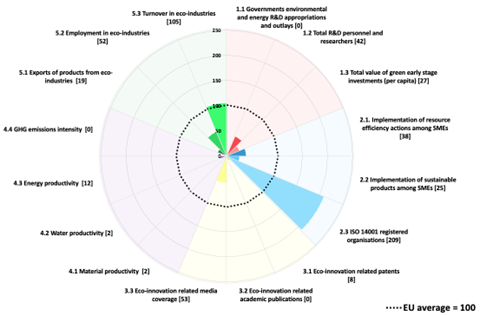

Source : https://ec.europa.eu/environment/ecoap/bulgaria_en

Sub-Sector Prospects

Air Pollution Control

The air pollution control sector offers opportunities to U.S. exporters for construction of pollution control installations at various industrial facilities. Measures to combat air pollution have been highlighted as priorities by the government of Bulgaria and EU funding has been allocated. Some municipalities are more active and are looking for new technology for air pollution control.

The Operational Program on the Environment provides funding to municipalities for air pollution control projects such as reduction of coarse particle dust, PM10, carbon dioxide; replacement of coal and wood-heating appliances with environmentally sound alternatives in several municipalities, including Burgas, Montana, Sofia, and Smolian.

Among the main sources of pollution in Bulgaria is domestic heating of solid fuels such as coal and wood, combustion of coal for electricity and heat from thermal power stations, road transport, industry, construction, and repair activities. A big push for solar energy projects and battery storage was launched in 2022 to reduce air pollution.

The EU Green Deal paves the way of a massive transformation of industries. It will impact all businesses in the EU and all member states seeking to achieve carbon neutrality by 2050.

Source: https://www.iqair.com/us/bulgaria

Drinking Water and Wastewater Management

With 688 rivers, 43 lakes, 13 coastal waterways, and 177 groundwater bodies/aquifers, it is estimated that most of Bulgaria’s natural surface water bodies reach a good or high ecological status.

To meet EU requirements, most Bulgarian industries will need to construct or upgrade their wastewater treatment facilities. Urban wastewater treatment plants are planned for hundreds of cities and towns with less than 10,000 residents. Wastewater treatment plants of towns with more than 10,000 inhabitants have already been constructed. Financing water infrastructure depends on master plans that identify the needs of given districts/groups of towns. The EU will provide funding for both standard and innovative solutions for wastewater treatment, to include funds for construction and rehabilitation of water supply/sewage networks in many municipalities.

Bulgarian water utility companies will tender these projects as design and build projects. Opportunities exist for U.S. exporters to provide consultancy services and participate in supply chains. EU funding for construction or rehabilitation of sludge-treatment facilities, wastewater treatment plants, and biomass utilization projects also exist.

To further speed up the process of upgrading Bulgaria’s water infrastructure, the government empowered municipalities to work with the recently established water associations at the municipal level to transfer ownership and improve their performance, water quality and water management. Bulgarian water utility companies are beneficiaries of the EU funding for water/wastewater treatment facilities. Price is a key factor in winning these tenders, but U.S. firms may participate with a Bulgarian partner or representative. The U.S. Commercial Service Sofia can assist with identifying a Bulgarian partner.

Waste Management

Municipal/solid waste generation in Bulgaria increased slightly in 2022 but remains below the EU average. Contrary to the desired goal, there has been an increase in the usage of landfills and a decrease in recycling. Recycling of municipal waste (including composting) increased to 35 percent but is still low compared to the EU average of 46 percent. Bulgaria still has one of the highest landfill rates at 62 percent in comparison to the EU average of 24 percent. The country needs to either close or rehabilitate numerous non-compliant landfills.

Full implementation of waste legislation could create more than 14,000 jobs in Bulgaria and increase the annual turnover of the waste sector by USD 1.6 billion. Waste legislation and policies could create an additional 16,500 jobs and increase the annual turnover of the waste sector by USD 2.1 billion.

Trade events:

BULACVA – Investments in the water sector, Sept. 28 – 29, 2023

Web Resources

Ministry of Environment and Water

Ministry of Regional Development and Public Works

Environmental Operational Program 2021-2027

U.S. Commercial Service Sofia Contact Information

Name: Stanislava Dimitrova

Position: Senior Commercial Specialist

Email: stanislava.dimitrova@trade.gov

Phone: +359-2-939-5740