Overview

Bulgaria’s power sector is diverse and well developed, with universal access to the grid and numerous cross-border connections in neighboring countries. A key driver of the Bulgarian economy, the energy sector is strongly affected by geopolitical, economic, and regulatory pressures. The Bulgarian electricity market is in transition, but nuclear power is expected to retain its large share of generation capacities. The government intends to decrease its coal power capacity to gradually replace it with renewable power capacity. During this energy shift, the government plans to rely on nuclear power generation to meet a significant portion of electricity demand.

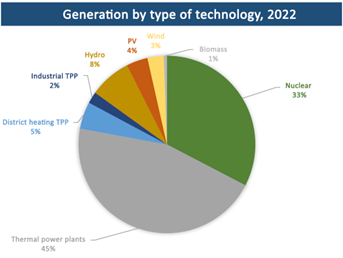

In 2022, the amount of electricity produced increased by 5.7% compared to the previous year. This growth comes from the increase in electricity generated by thermal power plants and renewable energy sources (RES). Among RES, the biggest increase was in photo voltaic (PV), generating 33% more electricity than in 2021. The reasons are an increase in the installed capacities of PV and more sunshine hours in 2022. In the past year, the export of electricity reached record levels of 12.2 TWh, which is an increase of 39% compared to the previous year, ranking Bulgaria third among the largest exporters of electricity in the European Union.

Electricity production capacities meet consumer demand in Bulgaria and enable exports to neighboring markets. In 2022, the Bulgarian energy industry exported more than 12 TWh of electricity totaling to EUR 3 billion, (USD 3.24 billion). Currently, the installed power generation capacity in Bulgaria is 13.247 MW, and the available capacity is 10,771 MW.

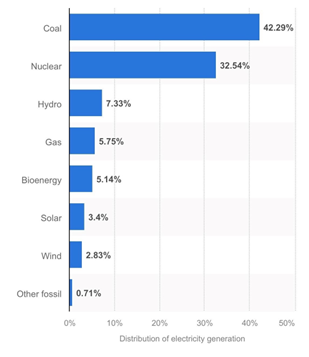

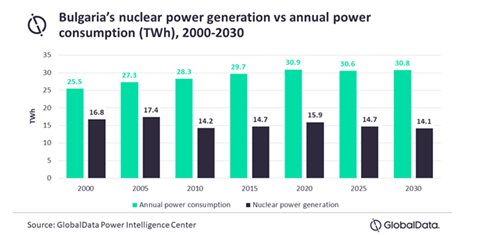

To support its energy needs, Bulgaria imports natural gas, oil and oil products, and solid fuels (anthracite and black coal, coal coke). The main local energy source in Bulgaria is lignite coal. Another local energy source is nuclear energy, which significantly contributes to energy independence. In 2022, the share of nuclear energy production is 32.6% of total electricity production in Bulgaria. The share is expected to remain above 40% until 2030. The reduction of fossil fuel imports into Bulgaria entails an increased need for energy production from renewable sources.

By the end of 2024, Bulgaria’s Electricity System Operator (ESO) will finalize its investment program aiming to ensure the grid connection of new power plants with a total installed capacity of 4,500 MW, primarily renewables.

ESO, the country’s transmission system operator, has invested more than EUR 25 million in digitalization of the grid. Modernization and digitalization of the medium-voltage grid is expected to be completed by 2024.

Power interconnectivity in the region has just made another important step forward with the completion of the second cross-border transmission line between Greece and Bulgaria.

Greece’s Independent Power Transmission Operator (IPTO) announced in July 2023 that the new international ultra-high voltage, 400 kV electrical interconnection is operational. The total length of the international interconnection, which starts from Nea Santa EHVC in Rhodopi and ends at Maritsa East Substation in Bulgaria, is 151 km, of which some 30 km is within Greek territory. Its capacity reaches 2 GW.

Bulgaria’s recovery and resilience plan calls for deployment of a minimum of 1.4 GW of renewable energy with storage in Bulgaria, including an investment in renewable and storage facilities that will be financed by EUR 342 million from the Recovery and Resilience Facility (RRF) (33 per cent) and EUR 684 million from private funding (67 per cent).

The plan includes significant investments to accelerate decarbonization of the energy sector, tripling power generation from renewables by 2026, building large electricity storage capacity, cutting power sector greenhouse emissions 40 per cent by 2025, and setting out a framework for a coal phase-out. However, in January 2023, the Bulgarian Parliament voted to scrap interim coal-reduction commitments from the Recovery Plan and keep its entire coal fleet online until 2038, despite the risk of losing almost EUR 1 billion for energy sector modernization. The RRF is to be renegotiated with the European Commission to keep the coal industry on life support as long as possible.

Due to delays in ongoing repair projects and regulatory inconsistencies, Bulgaria uses only one-third of its large, pumped-storage hydro power plants (HPPs) and even less of smaller run-of-the-river plants. In times of rising prices and shortages of electricity supply, HPPs could ease pressure on the system and offer cheaper electricity during periods of peak consumption.

However, if a more modern solution is sought to support storage technologies, it would be more efficient to invest in development of battery systems that can be used freely by all participants in the electricity market. Such a solution was proposed in the latest version of the national Recovery Plan, but on a scale that would be difficult to implement in a short timeframe.

It makes more sense to support storage systems for small and medium-sized businesses, which can reduce their dependence on the grid and hence improve performance at peak consumption. Support measures aimed at industrial consumers are included in the Recovery plan. However, the proposed financing scheme for RES installations up to 1 MW would also lead to the non-utilization of a large part of existing market potential.

Distribution of electricity generation in Bulgaria in 2022, by source

Coal energy was the main source of electricity production in Bulgaria in 2022. It accounted for over 45 percent of total electricity generation. Nuclear energy ranked second, making up 35 percent of total production.

As Russia’s invasion of Ukraine sent shock waves across Europe, Southeast Europe (SEE) is bracing to bear the brunt of the economic, financial, and security consequences. The region is heavily reliant on Russian gas and oil, and for regular supply Russia is a major trading partner and investor. The sanctions on Russia and the indirect consequences of higher energy and raw material prices and supply chain disruptions are expected to impact businesses across the board, curbing production, further fuelling inflation and slowing recovery.

Bulgaria’s energy market is dominated by state-owned players, which include:

- Bulgarian Energy Holding (BEH) – which manages the most important companies in the energy sector;

- Kozloduy nuclear power plant (NPP) with two operating units;

- Three thermal power plants, one of which is state-owned;

- the National Electric Company (NEK);

- fifteen hydro power plants, owned by the NEK;

- Electric System Operator (ESO);

- Bulgargaz; and

- Bulgartransgaz

Bulgaria’s energy generation includes nuclear energy, solid fuels, such as lignite, as well as small quantities of gas. The role of renewable energy sources (wind, solar, biomass, and hydro) has increased dramatically in recent years.

The regulated Bulgarian electricity market is dominated by a few major players that have built a supply monopoly. undertaking, there is no real competition in the distribution market that could enable consumers to choose their supplier, as there is only one licensed supplier in each geographical region. Bulgaria’s energy intensity is among the highest in the EU. The country is reducing its dependence on imported fuels from Russia, and, at the same time, is attempting to develop itself as an energy hub.

Bulgaria’s first nuclear power plant was launched in Kozloduy (KNPP) in 1974. Over the years, six units were completed, making KNPP one of the largest nuclear power plants in the region, with the installed capacity of units 5 & 6 of 2,000 MW. In the 1980s, a new nuclear plant at Belene was approved for construction. Meanwhile, two of KNPP’s units were closed in the early 2000s as a pre-requisite for EU accession; two other KNPP units were closed as part of the 2007 agreement of Bulgaria’s accession into the EU. Over the years, there have been many discussions by the government and energy companies about a new KNPP unit (Unit 7), as well as debates about completing the controversial, and incomplete Belene project with two Russian reactor vessels, two pressure compensators and 24 hydraulic accumulators, which remain in storage.

Thermal power plants were encouraged in Bulgaria in the early 2000s as Kozloduy NPP units were being closed. Today there is a thermal power plant complex (TPP), known as the Maritza Iztok Mining complex, which consists of three lignite-fired thermal power plants (TPPs) known as: Maritza East 1 (ME-1), a 686-MW U.S.-built plant, owned and operated by AES Corporation; Maritza East 2 (ME-2), a 1,610-MW state-owned plant; and Maritza East (ME-3), a 908-MW plant owned by the U.S. company Contour Global. Other TPPs exist throughout the country.

Bulgaria’s electricity production

In 2022, in Bulgaria’s electricity production reached 50.6 TWh. The generation structure in 2022 was dominated by coal-fired thermal power plants, followed by the Kozloduy nuclear power plant and hydroelectric plants, with the percentage distribution by plant type shown in the figure below.

Bulgaria’s energy sector priorities are:

- Decarbonization;

- Facilitating deployment of renewables and alternative energy sources (green hydrogen and biogas);

- Setting ambitious targets to expand storage capacity for solar and geothermal electricity;

- Liberalizing the wholesale and retail electricity markets; and

- Renovation of building stock.

Bulgaria needs to continue the process of developing infrastructure that allows the procurement of energy resources (especially gas) from other sources. Examples already underway include the construction of a gas interconnector between Bulgaria and Serbia, and a Bulgarian-Turkish agreement on access to regasification capacities in LNG terminals in Turkey.

Bulgaria, a leading electricity exporter in southeastern Europe, has used profits from its mainly state-owned energy producers to shield businesses and consumers from surging power costs.

Sub-Sector Best Prospects

Natural Gas

Bulgaria’s domestic market for natural gas is some than 3 billion cubic meters (bcm) per year. Bulgaria used to import 2.9 billion cubic meters of gas from Russia per year under a long-term contract valid through 2022.

In April 2022, Gazprom cut off deliveries of natural gas to Bulgaria after the Bulgarian government refused to comply with Gazprom’s demand that that it pay for natural gas deliveries in rubles. Bulgaria quickly secured alternative gas supplies from Azerbaijan and the United States.

Bulgaria, which currently transports Russian gas to Serbia and Hungary via an extension of the TurkStream pipeline, can also transmit over 20 billion cubic meters of gas annually through its gas network north to the rest of Europe.

Just nine months after the commissioning of the 182-km Interconnector Greece-Bulgaria, the company that operates the pipeline is looking to almost double its throughput capacity. The gas interconnector operator invited consumers and industry players in July 2023 to express their interest in booking additional throughput capacity for the pipeline, which may increase to more than 5 bcm per annum.

Greece plans to double storage capacity of its sole LNG terminal in Revithoussa soon and build a new LNG terminal near its northern port of Alexandroupolis by the end of 2023.

Bulgaria launched a project to almost double its gas storage with a BGN 298 million (USD 165 million) deal between grid operator Bulgartransgaz and a Bulgarian-led consortium. Capacity at the Chiren underground gas storage facility will be expanded to 1 billion cubic meters from 550 million cubic meters (mcm) by the end of 2024 for an estimated BGN 600 million. The project is of strategic importance for improving energy security, increasing competition and liquidity in the natural gas market in Bulgaria and the region.

Bulgargaz booked a capacity of 500 mcm of natural gas per year for a 10-year period at the Alexandroupolis Independent Natural Gas System (INGS), offshore Greece. Bulgaria’s participation in the gas terminal project is in line with the government’s strategy for diversification of its natural gas sources, aimed at guaranteeing the country’s energy security. Bulgarian gas transmission system operator Bulgartransgaz holds a 20% interest in Gastrade, which is developing the floating LNG terminal off Greece’s northern coastal city of Alexandroupolis. The construction of the Alexandroupolis LNG floating terminal is on schedule and the first gas deliveries are expected in January 2024.

Potential gas project opportunities (for suppliers, principal contractors, etc.) include:

- LNG technologies and liquefaction know-how provides opportunities for further diversification of natural gas supplies in Bulgaria.

- Significant booking capacity exists for expanding the Bulgarian gas transition system to Turkey and Serbia.

- Depleted fields are being considered for construction of underground gas storage in the Black Sea.

- Onshore gas exploration opportunities in Western and Northern Bulgaria.

- Setting up Bulgaria’s gas exchange market to facilitate establishment of a distribution center (hub) in Bulgaria, as well as a suitable market environment, by establishing a new subsidiary company.

- Construction of the gas interconnection Bulgaria-Serbia (IBS) started in February 2023. The length of the pipeline within Bulgaria is 62 km. IBS was co-funded by the EU under the Connecting Europe Facility Energy program with EUR 27.6 million. Besides the gas pipeline network, other facilities will be built, such as pigging facilities, valve assemblies, two automated gas-regulating stations (at Slivnitsa and Dragoman) as well as a gas-metering station at Kalotina. Following its construction, the gas interconnection will have an estimated throughput capacity of 1.8 bcm/y with a reverse-flow capability.

- In the summer of 2023, the Greek operator of the national grid announced its intention to build a hydrogen pipeline connecting Greece to Bulgaria. The proposed 540 km pipeline, linking hydrogen centers in Greece and Bulgaria, will cost EUR 1 billion (USD 1.12 billion). Greek grid operator DESFA stated that the plans for the project have already passed an initial technical assessment from the European Commission.

- The gas interconnector with Romania is completed and the current government committed to advance the one and Serbia. There is a plan for increased capacity for electricity interconnectivity, primarily with Greece.

- In August 2023, the Bulgarian government opened a tender for the exploration of oil and natural gas in the exclusive economic zone of Bulgaria in the Black Sea. The area is over 4,000 sq.km in size and permission will be granted for a five-year exploration, with the right to three extensions of two years each. Potential bidders are required to have generated at least EUR 150 million in net sales revenue over the past three financial years.

- Bulgaria’s Parliament tasked the Minister of Energy to conduct negotiations for the inclusion of the state in the gas exploration project in the “Khan Asparuh” block. The country may become a shareholder with up to 20% in the consortium of Total Energies and OMV Petrom, which is exploring for oil and gas in the Khan Asparuh block in the Black Sea. Negotiations will be conducted by the Minister of Energy, and Bulgarian Energy Holding (BEH) is a potential with EUR 20 million.

Oil

In early 2023, the Bulgarian President announced plans to revive a trans-Balkan oil pipeline project to secure non-Russian crude oil supplies for its only oil refinery on the Black Sea, controlled by Russia’s Lukoil. Sofia is holding talks with neighboring Greece to build a 300 km oil pipeline to transport crude oil from the Greek port of Alexandroupolis to Bulgaria’s Black Sea port of Burgas. In December 2022, Bulgaria received a two-year exemption from a European Union ban on ship-borne imports of Russian crude oil, imposed over the invasion of Ukraine.

The country needs to secure enough non-Russian crude to keep operations running at the 196,000 barrels per day Black Sea refinery after the exemption from the ban on Russian crude expires at the end of 2024, government officials say. The refinery provides over 75% of the fuels for the local market. Diversifying crude oil supplies away from Russia is only the starting point in a long uphill battle for Bulgaria and its government on the road to energy security and independence.

There are three refineries in Bulgaria:

- INSA’s facility located in the village of Belozem, Central Southern Bulgaria;

- The Bulgarian Petroleum Refinery in Dolni Dabnik in Central Northern Bulgaria; and

- Lukoil Neftochim Refinery in Burgas port, the largest refinery in the Balkans and owned by the second-largest oil company in the Russian Federation.

In July 2023, the government of Bulgaria adopted a decision to notify Lukoil Neftochim about the termination of the concession contract to operate Rossenets oil port, the country’s only specialised oil terminal.

At present Bulgaria is the third-largest buyer of Russian oil in the world. Critical energy decisions, including those related to seeking alternative oil supplies and the future of the refinery in Burgas, could be made soon by the government.

Smart Grids

In April 2023, the Council of Ministers approved four priority projects for financing with funds from the Modernization Fund: deployment of nearly 450,000 smart electricity meters, digital transformation of the network, online management of processes in the electricity systems, and construction of charging stations for electric vehicles. The main beneficiaries are the electricity distribution companies Electrohold, EVN and Energo-pro, which otherwise have no way to finance such investments except through the fees that the state regulator approves. In general, smart electricity meters and digitalization of the network will also allow easier and faster connection of more RES capacities.

Meanwhile, the European Commission announced in June 2023 that it is granting EUR 196 million to Bulgaria for implementation of four plans to modernize the electricity network. The projects are related to developing a smart energy infrastructure through distribution of so-called “smart meters” among end-customers, supporting the investments that energy associations would have to make in order to modernize the distribution networks so that data from smart meters can be used. One plan is rationalization and development of the energy network in Southeastern Bulgaria.

The deployed smart meters in Bulgaria (in percentage to the number of end-customers in the region) are as follows:

- Electrohold – 15%

- EVN – 66%

- Energo-pro – 10%

In line with the Recovery and Sustainability Plan, financing of projects for the modernization and digitization of the electricity generation industry is also provided, but they are intended only for the state company ESO.

Nuclear Energy

Bulgaria has a longstanding positive experience in nuclear energy, recognizing the benefits it brings to people and the environment. Bulgaria currently has two nuclear reactors, generating more than one-third of its electricity.

Bulgaria’s only nuclear power plant, the state-owned Kozloduy nuclear power plant (NPP) has six units. After the decommission of units 1 and 2 in 2002 and units 3 and 4 in 2006, all the country’s nuclear power is generated through units 5 and 6. Bulgaria had planned to build a second nuclear reactor at Belene, but subsequently opted not to do so. In December 2016, following international arbitration, Bulgaria paid EUR 600 million (USD 642 million) in compensation to Russia’s Atomstroyexport for the equipment already manufactured by the company for the new nuclear capacity project. The equipment is now stored at the site designated for the construction of the power plant.

At the end of 2022, Kozloduy signed a deal with Westinghouse Electric to supply it with nuclear fuel for its 1,000 MW Russian-built Unit 5, a first step to diversify away from Russian supplies. KNPP plans to load the new fuled in mid-2024. The nuclear plant produces about 35% of the country’s electricity and currently uses nuclear fuel supplied by Russian firm Rosatom. Bulgaria’s nuclear energy regulator signed contracts with France’s public institute for nuclear and radiological risks, IRSN, and a Czech-Ukrainian tie-up for an independent assessment of the safety analysis of the nuclear fuel to be produced and delivered to the KNPP by Westinghouse Electric. The consortium comprises Czechia-based energy equipment services provider ES Group, Ukraine’s State Scientific and Technical Center for Nuclear and Radiation Safety and Energy Safety Group Ukraine, the Nuclear Regulatory Agency said in a press release. The French institute will study 20 reports analyzing Westinghouse’s RWFA nuclear fuel type throughout its life cycle, including in the context of malfunctions, transportation, and storage. For its part, the consortium will independently assess the compatibility of the new fuel type with the internal reactor control system of Unit 5, one of Kozloduy’s two operating Soviet-designed VVER units, which Westinghouse Electric will supply with fuel. The Nuclear Regulatory Agency will take the independent appraisals into account in its assessment of Kozloduy NPP’s recently lodged application for license for the use of Westinghouse fuel.

Kozloduy is also aiming to sign a deal with France’s Framatome, a unit of EDF, for its other reactor, Unit 6. Bulgaria currently relies on Russian nuclear fuel for both units but is seeking to boost its energy security following Russia’s invasion of Ukraine by identifying non-Russian sources of nuclear fuel.

Moreover, there are signed memorandums of understanding (MoU) with U.S.-based NuScale Power, X-Energy, Fluor Corporation and Holtec International for deployment of U.S.-designed small modular reactor (SMR) technology. Such steps provide a clear indication that the government, despite plans to shift toward renewable power, is still keen on developing nuclear power.

Project opportunities exist in the following areas:

- Equipment of turbine hall for new nuclear capacity, including switchgears, transformers, and power evacuation,

- Maintenance and upgrade of steam turbines at Kozloduy NPP (see https://www.kznpp.org/),

- Activities related to the decommissioning of four NPP reactors,

- Small /Advance Modular Reactors,

- Diversification of Kozloduy NPP’s fuel supply,

- Removing and packaging historical nuclear waste,

- Nuclear safety and radiation protection,

- Technical support for the regulatory body, and

- Working with Bulgaria’s universities on training and educating nuclear engineers

Renewables

Moscow’s decision to halt gas exports to Bulgaria following its invasion of Ukraine created an opportunity for Bulgaria to expand renewable energies and invest in energy-efficiency solutions.

Currently, Bulgaria has the goal of using 27% renewable energy sources (RES) by 2030. The planned investments in the renewable energy sector are insufficient for the transformation of the energy mix. According to rough estimates, more than USD 8 billion is needed to replace coal plants with energy production from photovoltaics, wind power, biomass, and geothermal energy in the next 10 years. This transition to green energy also requires excellent connectivity among the networks of all countries in Europe. This creates the need for network modernization, digital management, and protection from cyberattacks.

The transformation of the electricity mix of RES and Kozloduy nuclear power plant should put an end to rising electricity prices. Volatility may occur at limited times of the year, when a combination of imports, demand management systems, and energy efficiency would smooth out the peaks and ensure security of supply. Bulgaria will receive EUR 480 million under the RePowerEU plan related to the energy transition of EU members. This includes modernization of the Electricity System Operator (ESO) which requires significant funding to connect the photovoltaic and wind components that are currently under construction.

Interest in investments in renewable energy is surging in Bulgaria as the business sector rushes to take advantage of high energy prices and European funds. In addition, the ESO signed agreements with power distribution companies for an additional 3 GW, to be added in the next three to five years.

In the last three years, Bulgaria’s photovoltaic installed capacity practically doubled, to 2.2 GW, with another 700 MW expected to become operational in 2023. With this pace, Bulgaria will surpass its 2030 National Energy and Climate Plan target for photovoltaic installations nearly seven years early.

Bulgaria will add over 2,500 MW of installed renewable power capacity by the end of 2024 through the installation of 700 MW of wind farms, 1,600 MW of solar parks, and 219 MW of biomass-fired power plants.

In Bulgaria, the National Electric Company (NEK) owns 15 conventional hydro and pumped-storage plants. Hydropower’s importance is not limited to the production of energy because it plays a key role in greenhouse gas emissions reduction.

Energy Efficiency

Bulgaria remains the most energy-intensive economy in the EU by a wide margin. The structure of Bulgaria’s final energy consumption is like that of the EU. Bulgaria’s economy consumes 3.5 times more energy resources per unit of its GDP than the EU average. That may not sound alarming, but Bulgaria is highly dependent on coal and nuclear power. The energy sector is the biggest greenhouse gas emissions polluter in the country. It is responsible for 70 percent of the total greenhouse gases nationwide. Low wages and pension benefits also contribute to many people being unable to afford more sustainable means of heating during winter. The National Energy and Climate Plan stresses Bulgaria’s commitment to decarbonize its economy by 2050 in the context of the European Green Deal, but also states the intention to keep Bulgaria’s reliance on domestic lignite sources to 2050 and beyond.

In 2021-2027, in Bulgaria, the cohesion policy fund will invest EUR 5.3 billion in the green transition. Investment in the energy efficiency of buildings is expected to benefit 3,800 homes and 180,000 square meters of public buildings. At the same time, finalization of the Just Transition Fund (JTF) programming could help Bulgaria support sustainable energy solutions, training and education, and diversify the local economy in the affected coal regions. This will help alleviate the socioeconomic impacts of Bulgaria’s commitment to phase out the use of coal.

In 2020, Bulgaria requested a derogation from the EU for implementation of the National Energy Savings Plan, under the energy-efficiency obligation scheme. The reason was that this proposal was put in place about three years earlier than the relevant European directive. In Bulgaria, the energy efficiency obligation scheme is implemented through a combination of individual energy savings targets for energy traders and alternative measures. To date, Bulgaria is experiencing difficulties in implementing the energy efficiency obligation plan.

Resources

Associations with Traders of energy in Bulgaria

Energy Infrastructure Projects of Common Interest

Energy and Water Regulatory Commission

Energy Efficiency and Renewable Sources Fund

Bulgarian Wind Energy Association

Global Data

Statista

Agency for Sustainable Energy Development

National Statistical Institute

U.S. Commercial Service Sofia Contact Information

Name: Emily Taneva

Position: Commercial Specialist

Email: emily.taneva@trade.gov

Phone: +359-2-939-5770