ITA CODE: PR DFN

Overview

As of 2023, South Korea has the world’s 9th largest defense budget and is the world’s 8th largest defense exporter. South Korea, which has traditionally been heavily reliant upon the United States in supplying defense equipment to support its military forces, has become a major defense manufacturer over the past decades. Being able to develop and grow its domestic defense industry, South Korea has further transformed itself into a global exporter of defense articles. Nevertheless, South Korea continues to be the United States’ 3rd largest country for arms exports after Saudi Arabia and Australia based on the total export volume from 2011 to 2022, and thus remains a substantial market for U.S. defense contractors.

Military Expenditure by Country for 2022

Rank | Country | Defense Budget ($ Billion) | Percentage of GDP (%) | World share (%) |

| World Total | 2,240 | 2.2 | 100 |

1 | United States | 877.0 | 3.5 | 39 |

2 | China | 292.0 | 1.6 | 13 |

3 | Russia | 86.4 | 4.1 | 3.9 |

4 | India | 81.4 | 2.4 | 3.6 |

5 | Saudi Arabia | 75.0 | 7.4 | 3.3 |

6 | United Kingdom | 68.5 | 2.2 | 3.1 |

7 | Germany | 55.8 | 1.4 | 2.5 |

8 | France | 53.6 | 1.9 | 2.4 |

9 | South Korea | 46.4 | 2.7 | 2.1 |

10 | Japan | 46.0 | 1.1 | 2.1 |

Source: Stockholm International Peace Research Institute (SIPRI Fact Sheet, April 2023)

To complement its national defense strategy, South Korea has been pursuing force modernization programs for some years. The most updated program, known as Defense Innovation 4.0, was announced in March 2023.

One of the goals of such programs is to build an effective and capable force to meet emerging security threats while limiting reliance on foreign defense technology. It also encourages the development of homegrown technology, as well as the local production of weapons systems both in the form of parts or components, and complete systems. South Korea thus prioritizes the acquisition of locally developed and manufactured defense articles.

Defense Innovation 4.0, seeks to harness advanced science and technology to modernize and strengthen the ROK’s defense and military response capabilities. This includes a combat system based on artificial intelligence, manned and unmanned systems to overcome future security environments challenges. It is also important to note that this policy reflects South Korea’s low birth rate and a shrinking population which would likely impact and reduce the number of armed forces troops in the near future.

South Korea’s Defense Budget Trends 2019-2023

2019 | 2020 | 2021 | 2022 | 2023 | Change (%) | ||

2022-2023 | |||||||

Defense Budget

| Total | 39,574 | 42,502 | 44,780 | 46,281 | 48,317 | 4.4 |

Force Operations | 26,546 | 28,366 | 30,376 | 32,135 | 33,981 | 5.7 | |

Share (%) | 67.1 | 66.7 | 67.8 | 69.4 | 70.3 |

| |

Defense Capability Improvement | 13,028 | 14,136 | 14,404 | 14,146 | 14,336 | 1.3 | |

Share (%) | 32.9 | 33.3 | 32.2 | 30.6 | 29.7 | - |

Unit: USD Million, $1 USD = 1180 KRW

Source: Ministry of National Defense Data.

South Korea’s Defense Budget

For 2023, South Korea allocated $48.3 billion or 8.9 percent of its total government expenditure to its defense budget. This was a 4.4 percent increase compared to the previous year. The 2023 defense budget contained $33.9 billion for force operations which includes expenditure for military logistics, facilities, and education and training of military forces. Another $14.3 billion was dedicated to defense capability improvement, an expenditure used for securing advanced weapon systems to enhance and maintain defense capabilities in preparation of all kinds of possible security threats. Compared to the previous year, the budget for force operations and defense capability improvement represents a 5.7 percent increase and a 1.3 percent increase, respectively.

In particular, the 2023 budget for defense capability improvement reflects the key policy agenda of the Yoon Suk-yeol administration which includes the reinforcement of defense capabilities to respond to North Korea’s nuclear and missile threats, training an advanced artificial intelligence (AI) force by pursuing the Defense Innovation 4.0, and establishing high-tech war capabilities while expanding defense exports.

During the past five years from 2018 to 2022, South Korea’s defense budget has been growing at an average rate of 6.3 percent per year. This is 2.4% lower than the average annual growth rate of South Korea’s total government expenditure.

South Korea’s Acquisition of Weapons Systems

South Korea’s acquisition of weapons systems from overseas is administered through foreign procurement programs either in the form of Foreign Military Sales (FMS) or Direct Commercial Sales (DCS). South Korea’s purchase of foreign defense equipment has continued to grow since 2018 with the government pursuing large-scale programs such as the F-35A next-generation fighter jets, and high-altitude aerial systems (HUAS).

According to the latest data from the Defense Acquisition Program Administration (DAPA) published in 2022, the total volume of weapons South Korea acquired through foreign purchases from 2017 to 2021 was about $13 billion and more than half of it was acquired through FMS programs valued at $6.7 billion. Meanwhile, the total volume of weapons South Korea acquired through foreign DCS programs during the same period was about $6.4 billion in value and 55 percent ($3.6 billion) of it was purchased from the United Sates.

South Korea’s Arms Purchases from Overseas

| 2017 | 2018 | 2019 | 2020 | 2021 | Total |

Foreign Military Sales (FMS) | 398 | 2,124 | 1305 | 2,065 | 782 | 6,675 |

Direct Commercial Sales (DCS) | 909 | 1,227 | 846 | 1,984 | 1,446 | 6,412 |

Total | 1,307 | 3,351 | 2,151 | 4,049 | 2,228 | 13,087 |

Source: DAPA, Unit: USD Million. $1 USD = 1180 KRW

Figures are based on contract amount. FMS figures are based on the ROK government’s acceptance of new offers each year.

It is common for most advanced weapons systems with a U.S. origin to be acquired through FMS programs due to U.S. government regulations. Nevertheless, the number of procurement cases for weapon systems administered through DCS programs has been steadily increasing in recent years. In particular, the South Korean government has shown a tendency to procure some weapons systems through DCS programs in lieu of FMS programs which would entail complex and lengthy process for purchasing and approval.

Market Access and End Users

With a mission to improve the Republic of Korea’s (ROK) defense capabilities and foster its defense industry, the Defense Acquisition Program Administration (DAPA) was established in 2006 as the central administrative body for defense acquisition. Consolidating the defense acquisition function previously administered by each of the military branches, DAPA plans, executes, and oversees the procurement of arms, military equipment and supplies on behalf of the Ministry of National Defense (MND) across all domains. Furthermore, DAPA negotiates the requirements of defense products and services, authorizes offset credits, dictates terms and conditions, and makes changes to delivery schedules or required deliverables. DAPA controls all formal negotiations on the price, technology transfers, local work share, and offset packages.

The principal points of contact for major defense programs are the respective military service branches which includes the ROK Air Force, ROK Army, ROK Navy. These military branches, however, procure most military equipment and systems through DAPA. To participate in government programs that require local co-production or co-development, foreign defense contractors oftentimes form consortia with leading Korean defense firms such as the Korea Aerospace Industries (KAI), Korean Air, Hanwha, LIG NEX1, Hyundai Rotem and others.

Most foreign defense contractors seeking to participate in local defense bids and government programs work with in-country partners which may include distributors, sales agents, or commission-based sales representatives. Working with local partners is considered essential for foreign defense contractors in order to overcome language barriers, secure networking opportunities with key decision-makers, gain local market intelligence, and navigate the administrative and logistical challenges related to the procurement processes.

Market Challenges

Offset Trade Policy

Offset programs were first introduced in South Korea in 1982 with the objective to develop the ROK’s domestic aerospace industry. However, it gradually became an important means to acquire core technologies to develop the local defense industry. DAPA, as the central defense procurement agency, administers the offset policy, while technology quality assurance assessments are led by the Defense Agency for Technology and Quality (DTaQ), an organization under DAPA.

An offset obligation may arise for a foreign contractor should the value of the defense contract exceed $10 million. According to the latest guidelines, a minimum of 50 percent or more of the estimated value of the main contract would be allocated for an offset for contracts with competing suppliers. For sole source contracts, a minimum of 30 percent or more of the estimated value of the main contract would be applied to an offset.

According to the latest DAPA data published in 2022, foreign defense contractors from a total of seven countries had partaken in a total of 43 offset programs from 2017 to 2021. The total value secured through those offset programs during the same period was $736 million. Furthermore, out of the 43 offset programs, U.S. defense contractors participated in a total of 12 programs which were valued at $156 million. Israeli companies provided the largest value by participating in 11 offset programs valued at $241 million.

While more than half of the offset programs valued at $397 million were administered in the form of exporting Korean made parts and components of weapons systems, other types of offset transactions included acquisition of logistical support equipment, and technology transfers for weapon systems development.

Offset Program Suppliers by Country from 2017 to 2021

Country | No. of programs | Value |

U.S. | 12 (27.9%) | 156.1 (21.2%) |

Israel | 11 (25.6%) | 240.5 (32.7%) |

United Kingdom | 9 (20.9%) | 148.7 (20.2%) |

Germany | 5 (11.6%) | 28.7 (3.9%) |

France | 4 (9.3%) | 89 (12.1%) |

Spain | 1 (2.3%) | 52.7 (7.2%) |

Australia | 1 (2.3%) | 19.6 (2.7%) |

Total | 43 (100%) | 735.5 (100%) |

Unit: cases, USD million

DAPA revised its general offset policy guidelines and renamed it industrial cooperation in 2018. With aims to expand the exporting power of the defense sector, South Korea has been encouraging foreign defense contractors to pursue co-development and co-production with local defense manufacturers. However, foreign companies are oftentimes finding it challenging to commit to offset program requirements due to the number of extensive liability terms and conditions stipulated by the Korean government under its policy guidelines.

Government-driven Development of Homegrown Technology and Defense Exports

South Korea was the world’s 9th largest arms exporter during years from 2018 to 2022 accounting for 2.4 percent of the world’s defense exports. During those years, South Korea’s total defense exports totaled $3.2 billion. South Korea’s major defense exports are primarily platform systems including aircraft, artillery, and ships.

Traditionally reliant upon the United States in supplying defense equipment and systems to its military forces, South Korea’s strong government-led initiative to develop the local defense industry has enabled South Korea to grow into a manufacturer and an exporter of defense articles. The government continues to pursue policies that prioritize local technology and products over foreign defense technology. Some key South Korean defense exports include items listed below:

· 6 patrol corvettes to Malaysia ($1.2 billion)

· 12 FA-50 light combat aircraft to the Philippines ($420 million)

· 16 T-50 advanced trainers to Indonesia ($4 billion), 12 T-50 advanced trainers to Thailand ($110 million)

· Military vehicles to the Philippines ($345 million)

· K-9 Thunder self-propelled howitzers to India (100 units), Turkey (280 units), Finland (48 units), Norway (24 units), and Poland (648 units), Egypt (200 units, $1.7 billion), Australia (30 units, $730 million)

· Cheongung II (Mid-range surface-to-air-missiles) to UAE ($3.5 billion)

· 980 K2 battle tanks to Poland

· 288 K239 Cheonmoo Rocket Artillery Systems to Poland

· 48 FA-50 Light Combat Aircraft to Poland , 18 FA-50 Light Combat Aircraft to Malaysia

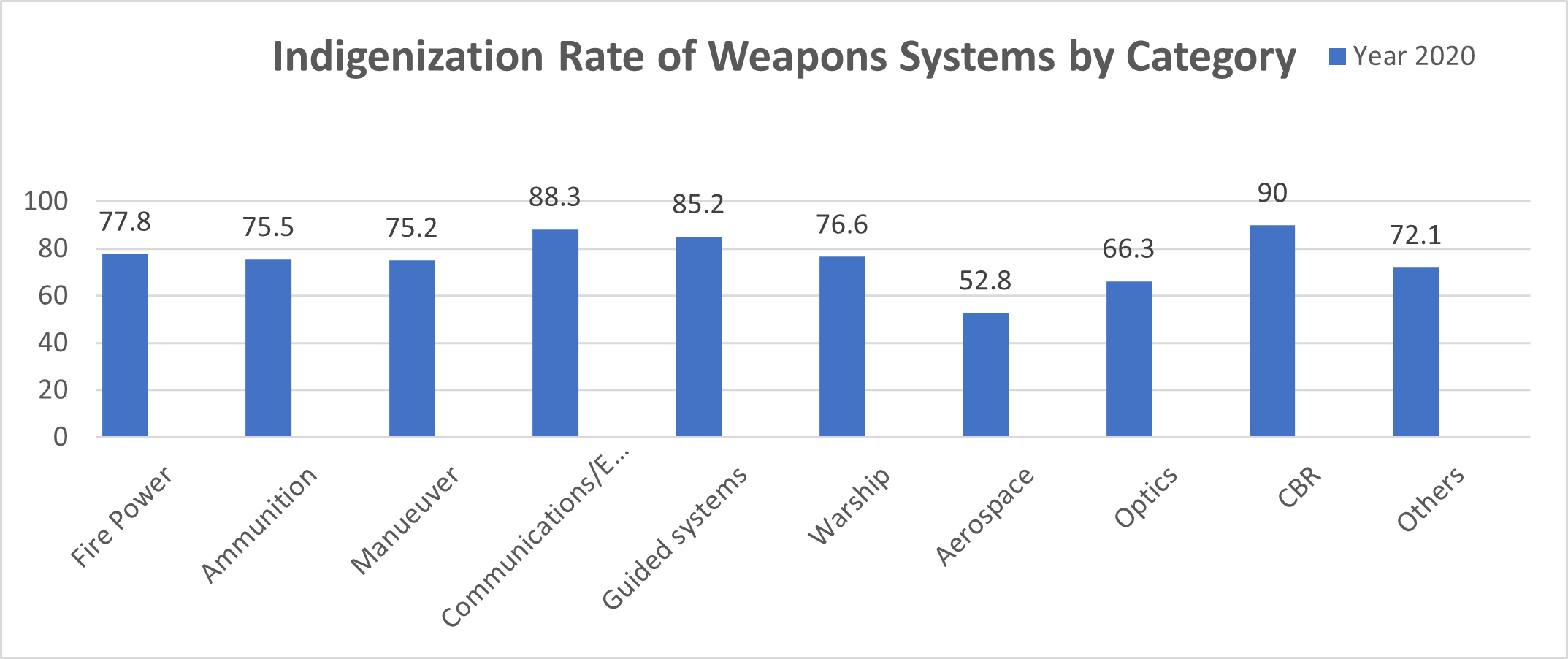

South Korea’s defense technology indigenization rate has been steadily increasing. According to 2021 Korea Defense Industry Association’s (KDIA) data, South Korea’s overall weapons’ systems indigenization rate has grown from 70.8 percent in 2016 to 76.0 percent in 2020. Compared to the previous year, those weapons systems with a strong domestic technology base that use fire power, communications electronics, guided systems, warships, as well as chemical, biological, and radiological (CBR) arms demonstrated a relatively higher indigenization rate compared to those in the aerospace domain which traditionally rely heavily on foreign suppliers for its core components.

South Korea’s Indigenization Rate of Weapons Systems

In August 2021, DAPA revealed a new industrial policy, known as Korea Defense Capability, which prioritizes the sourcing of Korean-made defense articles over foreign-produced defense products linked to defense procurement contracts. This new policy requires all defense procurement to adopt an 80 percent to 20 percent quota between local and foreign products, respectively.

The United States and the ROK Defense Industry

The United States maintains a total of 28,500 troops on Korean soil in support of its commitment under the U.S.-ROK alliance to help secure peace and stability on the Korean peninsula. The alliance serves as a powerful deterrent against the rising and evolving threat of North Korea, as well as the rapidly changing security dynamics in the Asia-Pacific region. Thanks to the 70 years old alliance which serves as a cornerstone for U.S.-ROK security relations, most Korean defense systems and equipment have a U.S. origin and are thus based on American standards. This remains to be a key factor that affects South Korea’s defense procurement decisions.

While the U.S. continues to be a primary supplier of defense articles and weapons systems to South Korea, stringent requirements under the U.S. export control regimes, and competitive price points offered by other European and Israeli competitors pose market challenges for American firms seeking entry into the Korean market.

Best Prospects and Opportunities

· Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR)

· Aircraft upgrades

· Avionics, high-tech sensors, radars, and missile system

· Support for combat equipment

· Anti-terrorism products

Resources

Trade Shows

· International Maritime Defense Industry Exhibition (MADEX) 2023, June 7-9, 2023

· Seoul International Aerospace and Defense Exhibition (ADEX) 2023, October 17 - 22, 2023

· Defense Expo Korea (DX-Korea), September 4-7, 2024

· International Maritime Defense Industry Exhibition (MADEX) 2025, May 28-31, 2025

Key Contacts

- Defense Acquisition Program Administration (DAPA)

- Ministry of National Defense (MND)

Local Contact

U.S. Commercial Service Korea

U.S. Embassy Seoul

188 Sejong-daero, Jongro-gu

Seoul 03141, Korea

Tel: 82-2-397-4535

office.seoul@trade.gov