Hong Kong is a dynamic export market for U.S. agricultural products. In 2022, total U.S. agricultural exports slowed for the fifth consecutive year to US$1.3 billion. However, Hong Kong is the 25th market for U.S. food and agricultural exports. For U.S. consumer-oriented exports, Hong Kong ranked 10th in 202s, with exports accounting for US$1.1 billion. In addition to lower re-export trade out of Hong Kong, other factors have contributed to lower U.S. agricultural exports to this market, including logistic shipping issues. Nevertheless, Hong Kong’s significance as a major food import market can be attributed to several factors:

- Most food and beverage products enter duty-free. A rules-based import regime and sophisticated infrastructure for trade servicing, including financing and logistics, facilitates Hong Kong’s role as a trade destination and regional hub to China and other regional markets.

- An affluent consumer base, with GDP per capita for US$49,464 in 2022, among the highest in Asia, that spends a significant portion of income on food. Hong Kong consumers appreciate the quality and safety of U.S. foods and are willing and able to pay for higher-quality goods.

- Hong Kong remains an important gateway to mainland China and the region.

Outlook for 2023

- The 2022 decline in U.S. agricultural exports to the city was due in large part to the adverse effects of the city’s Covid restrictions. Hence, food exports to Hong Kong could recover modestly by the end of 2023 but this will greatly depend on the level of domestic spending and inbound tourism. This said, local restauranteurs and food retailers observe that the reopening of the borders with mainland China has changed the city’s consumer landscape. Grocery products, meats, tree nuts, seafood, fresh fruit, spirits and wines, pet food and eggs continue to be major export items, with continuing growing demand for natural, plant-based, and organic food and beverages.

- U.S. agricultural products continue to benefit from its strong reputation as safe, high-quality options.

Retail Sales and Outlets

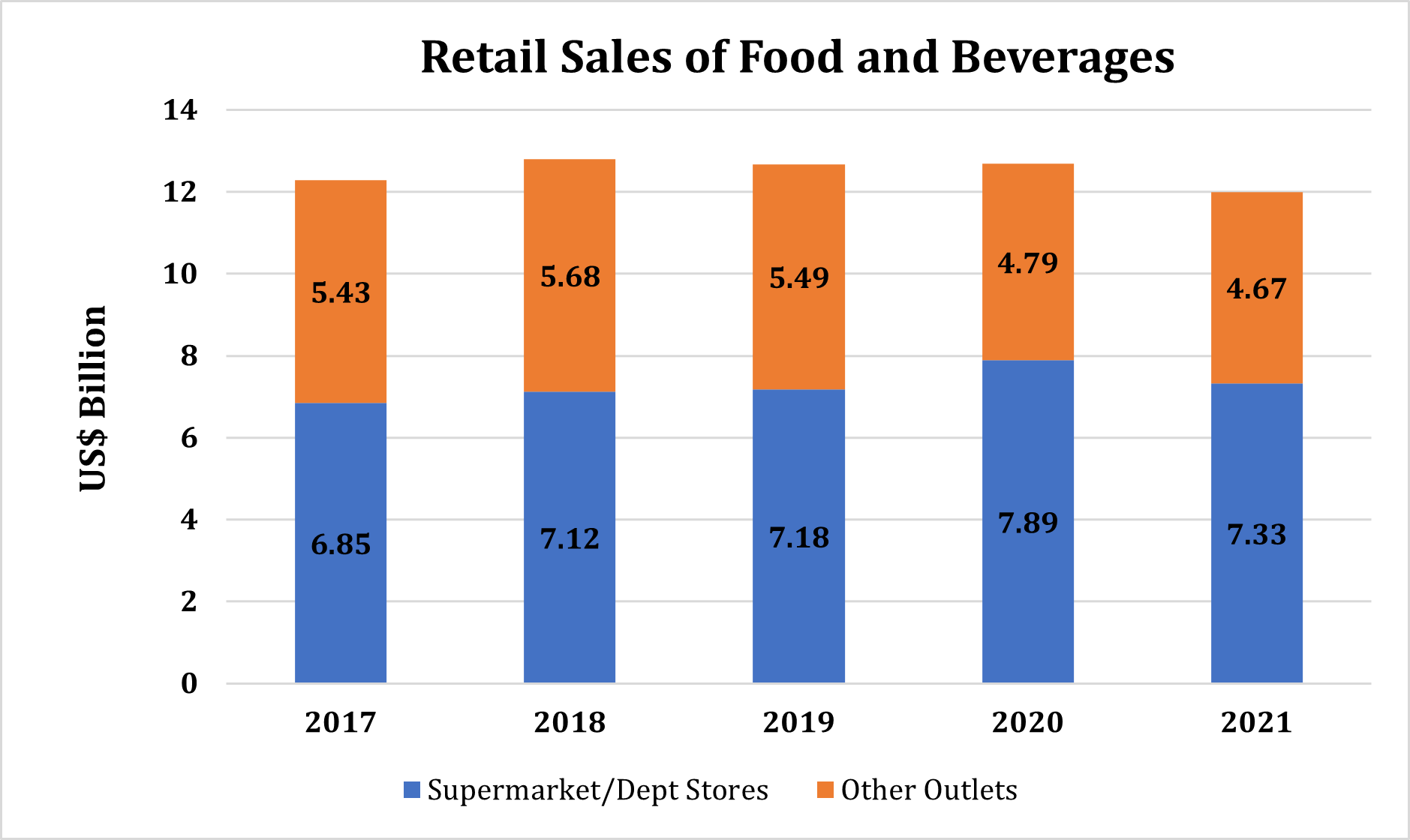

The Hong Kong food retail market is made up of supermarkets, convenience stores, and traditional markets. In 2022, Hong Kong’s retail food sector sales dropped 8 percent to US$11 billion.

| Channel | 2018 | 2019 | 2020 | 2021 | 2022 | Share (2022) | Growth (22 vs 21) |

| Supermarket/Dept. Stores | 7.12 | 7.18 | 7.89 | 7.33 | 6.96 | 61 percent | -5 percent |

| Other outlets | 5.68 | 5.49 | 4.79 | 4.67 | 4.50 | 39 percent | -3.6 percent |

| Total | 12.8 | 12.67 | 12.68 | 12 | 11.47 | 100 percent | -4.4 percent |

(Source: Hong Kong Census and Statistics Department, US$1=HK$7.8)

Chart 1 – Food &Beverage Retail Sales in Hong Kong (US$ billion)

There are more than 700 supermarkets, 1,300 convenience stores, and over 100 traditional markets in Hong Kong, making food shopping very convenient.

Traditionally, Hong Kong consumers shop daily because of a preference for fresh food. Much of the shopping is still done in traditional markets including street markets and locally owned shops. Overall, street market sales trend toward fresh foods while supermarkets dominate in processed, chilled and frozen, high value-added and canned food products. The competition between street markets and supermarkets has intensified in recent years.

Although the number of supermarket outlets is expected to remain stable, the market share for supermarket sales is expected to continue to increase in the future at the expense of traditional street markets which have lost in-person sales, especially from the more hygiene-conscious customers under the COVID-19pandemic and the shifting in consumer trends. The supermarkets’ share in terms of total retail sales rose from 44 percent of total sales in 1995 to 61 percent in 2021.

Online shopping continues to grow, driven by the change in consumer behavior during the pandemic. In 2021, food and drink e-commerce reached US$447 million, an increase of 14 percent over 2020, and it is estimated to reach US$733 million by 2026.

Hotel, Restaurant, and Institutional (HRI) Food Service Sector

Restaurants

Hong Kong boasts over 14,000 restaurants which range from local “dives” to high-end fine dining outlets. The Michelin Guide 2023 records 94 “star” restaurants in Hong Kong and Macau, including seven “three-starred” establishments in Hong Kong, outnumbering the five three-start restaurants in both New York City and London. In 2022, Hong Kong restaurant food and beverage purchases, valued at US$3.7 billion, a decrease of 4.5 percent compared to 2021, generated estimated sales of US$11.1 billion, equivalent to a decrease of 6.5 percent over 2021. In 2022, ongoing disruptions to normal operations in the food service and hospitality sectors in response to the city’s most severe pandemic wave led to weaker sales performance. While restaurant receipts began to recover in the first half of 2023, a full recovery remains tempered by labor shortages in the food and retail service sectors.

| 2020 | 2021 | 2022 | Growth (22 vs 21) | |

| Restaurant Receipts | 10.2 | 11.9 | 11.1 | - 6.5 percent |

| Restaurant Purchases | 3.3 | 3.9 | 3.7 | - 4.5 percent |

(Source: Hong Kong Census & Statistics Department, US$1=HK$7.8)

For statistical purposes, restaurants in Hong Kong are grouped into five broad categories: Chinese, non-Chinese, fast food, bars, and other establishments.

Chinese Restaurants

According to the Hong Kong Census and Statistics Department, Chinese cuisine is the top grossing restaurant category and it will continue its dominant share in the market due to deep-rooted cultural events, such as banquets for weddings and dim sum lunches, often enjoyed by groups of working-class adults and families. Among all Chinese cuisines, Cantonese is the most widely available, with others including Shanghainese, Sichuan, and Chiu Chow also providing many options to diners.

Non-Chinese Restaurants

Due to its history as a global trade hub, sophisticated and affluent Hong Kong consumers have an enthusiasm for a range of international cuisines made from high-quality ingredients. Restaurants offering non-Chinese cuisine options include Western, Japanese, Korean, Thai, Vietnamese, Indian, and more, and are found everywhere in Hong Kong, leading to numerous opportunities for usage of U.S. foods and beverages as ingredients and for pairing.

Fast Food

Fast food outlets suit Hong Kong’s quick-paced lifestyle where dining out twice per day at convenient locations is common. Competition among fast food chains is intense as brands strive to retain customers and raise brand awareness, but some newer, leading U.S. fast food chains such as Five Guys and Shake Shack have a strong presence here. McDonald’s and KFC are the leading Western-style fast food chains, and Café de Coral and Fairwood are the leading local fast-food chains, by brand share of foodservice value. Western style outlets including Pret a Manger and Oliver’s Super Sandwich are often located in areas easily accessed by office workers who appreciate healthy and light options such as salads and sandwiches.

Bars

Hong Kong’s vibrant nightlife is renowned and is served by over 680 bars and pubs across Hong Kong. Lan Kwai Fong in the Central Business District is home to over 90 bars and restaurants. It is a place where locals, expats, and tourists gather for drinks in the evenings and during special occasions like New Year’s Eve.

Other Establishments

“Tea restaurants” offer a range of localized Western and Chinese cuisines and beverages. Milk tea is a particular local favorite consisting of adding milk (evaporated or condensed) to various tea combinations. Hong Kong also has a vibrant coffee culture. Independent specialist coffee shops have grown in number of outlets and sales the past several years. The leading chains, by brand share of foodservice value, are Starbucks, McCafé, and Pacific Coffee.

Hotels

There are over 300 hotels providing more than 88,000 rooms for visitors to Hong Kong.

Institutions

Hong Kong’s institutional foodservice sector consists of hospitals, residential care facilities, schools, prisons, and travel industry catering facilities. Many of these facilities, especially those operated by the government, purchase food supplies through tenders where price, quality, consistency, and stable supply matter. Experienced local importers are familiar with the process and requirements.

Hospitals

Hong Kong has 43 public hospitals and institutions, managed by the Hospital Authority, and 12 registered private hospitals. Some of the meal services are outsourced to caterers and distributors.

Schools

According to the latest (2022/2023 school year) Hong Kong government statistics, there were 1,030 kindergartens, 456 primary schools, 391 secondary schools, and 22 degree-awarding institutions in Hong Kong. The Government provides nutritional guidelines for students’ lunch and the appropriate procedures to select school lunch suppliers.

Prisons

The Hong Kong Correctional Services managed some 29 correctional facilities including prisons and rehabilitation centers. Inmates receive meals that are prepared according to health guidelines.

Airlines

Hong Kong is located less than five flying hours from half of the world’s population, so its airport is very busy. Connected to over 200 destinations, the Hong Kong airport handled 5.7 million passengers in 2022. Data from the Airport Authority Hong Kong (AAHK) shows that the airport handled 3.8 million passengers in November 2023, 76 per cent of the level recorded in the same month in 2019.

Cruise Ships

Hong Kong’s Kai Tak Cruise Terminal can accommodate the largest ships in the cruise industry. The number of cruise ship passengers throughout reached 138,000 in 2022. Due to COVID-19the pandemic, Hong Kong cruise terminals suspended operations in February 2020 and resumed activities in July 2021. While the industry was then preparing for the resumption of cruise travel, the surge of COVID-19 cases in early 2022 posed a new challenge to the industry. In February 2022, Royal Caribbean announced that it would cancel the remaining 2022 Hong Kong cruise-to-nowhere season and relocated its vessel “Spectrum of the Seas” to Singapore. Cruise operator genting Hong Kong’s subsidiary, Dream Cruises, filed to close the company.

Entertainment Parks

The two major theme parks in Hong Kong are Disneyland and Ocean Park. Disneyland operates thirty-six restaurants, and Ocean Park houses nine. These include restaurants and cafes that offer various cuisines.

Outlook for the Hotel, Restaurant, and Institutional (HRI) Sector in 2023

Since Hong Kong reopened its borders to the world in late 2022 and to mainland China in early 2023, the city’s economy started to rebound. As a result, Hong Kong’s real GDP grew by 1.5 percent year-on-year in the first six months of 2023. The adverse economic effects of 2022 lingered on the city’s imports during the first half of 2023. From January to June in 2023, Hong Kong global imports of consumer-ready food products dropped 2.3 percent to $12 billion compared to the same period in 2022. During the same period, restaurant receipts grew 82 percent to $3.53 billion compared to the previous year. However, the recovery remains tempered by labor shortages. The government is actively working on different plans to import labor for different sectors in the economy including food service and retail. The tourism sector continued to recover in the second quarter of 2023. In the second quarter of 2023, visitor arrivals surged further from 4.4 million in the first quarter to 8.5 million but still a long way from pre-pandemic levels. The Government has launched a series of campaigns to expand inbound tourism but also encourage domestic consumption. Planned activities across Hong Kong include large-scale gourmet markets in various districts, a large-scale carnival at Victoria Harbor and other entertainment events on pop culture, sports and music. These campaigns are expected to stimulate local consumption and boost the economy toward the second half of 2023.

Best Prospects for U.S. Consumer-Oriented Food Product Exports in 2023

U.S. food and beverage products will continue to enjoy good prospects in Hong Kong:

- Hong Kong has a highly developed marketing system, with tourists and affluent consumers demanding high-value imports. Per capita GDP in Hong Kong is among the highest in Asia, enabling Hong Kong consumers to spend on high-quality food and beverages.

- Hong Kong will continue to be a key gateway for trade to other markets in Asia.

- Some product categories that are expected to be top prospects for U.S. consumer-oriented food product exports in 2023 include tea, fresh vegetables, fresh fruit, prepared food, eggs, condiments, and sauces, processed vegetables, pet food, distilled spirits, wine, bakery goods, and non-alcoholic beverages.

For more information about this industry sector, please see the U.S. Agricultural Trade Office in Hong Kong

Market Reports or contact:

U.S. Agricultural Trade Office

Address: 18/F, St. John’s Building

33 Garden Road, Central

Hong Kong

Tel: (852) 2841-2350

Fax: (852) 2845-0943

Email: atohongkong@usda.gov

Website: https://www.atohongkong.com.hk