U.S. companies can contact the U.S. Commercial Service office in Hong Kong regarding our fee-based services in search of a successful market entry strategy into Hong Kong. For insights on selling cosmetics to China, please refer to the China Country Commercial Guide.

Overview

| 2019 | 2020 | 2021 | 2022 | 2023(estimated) | |

| Total Market Size | 2,471 | 3,770 | 5,140 | 3,998 | 2,454 |

| Total Local Production | 134 | 212 | 275 | 292 | 227 |

| Total Exports | 3,911 | 4,786 | 5,983 | 4,953 | 3,210 |

| Total Imports | 6,248 | 8,345 | 10,848 | 8,659 | 5,437 |

| Imports from the U.S. | 741 | 1,040 | 1,404 | 417 | 389 |

| Exchange Rate: 1 USD | 7.8 | 7.8 | 7.8 | 7.8 | 7.8 |

Total Market Size = (Total Local Production + Total Imports) – (Total Exports)

Units: USD million

Data Sources:

Total Local Production: Estimated from industry sources

Total Exports: HK Census & Statistics Department

Total Imports: HK Census & Statistics Department

Imports from U.S.: HK Census & Statistics Department

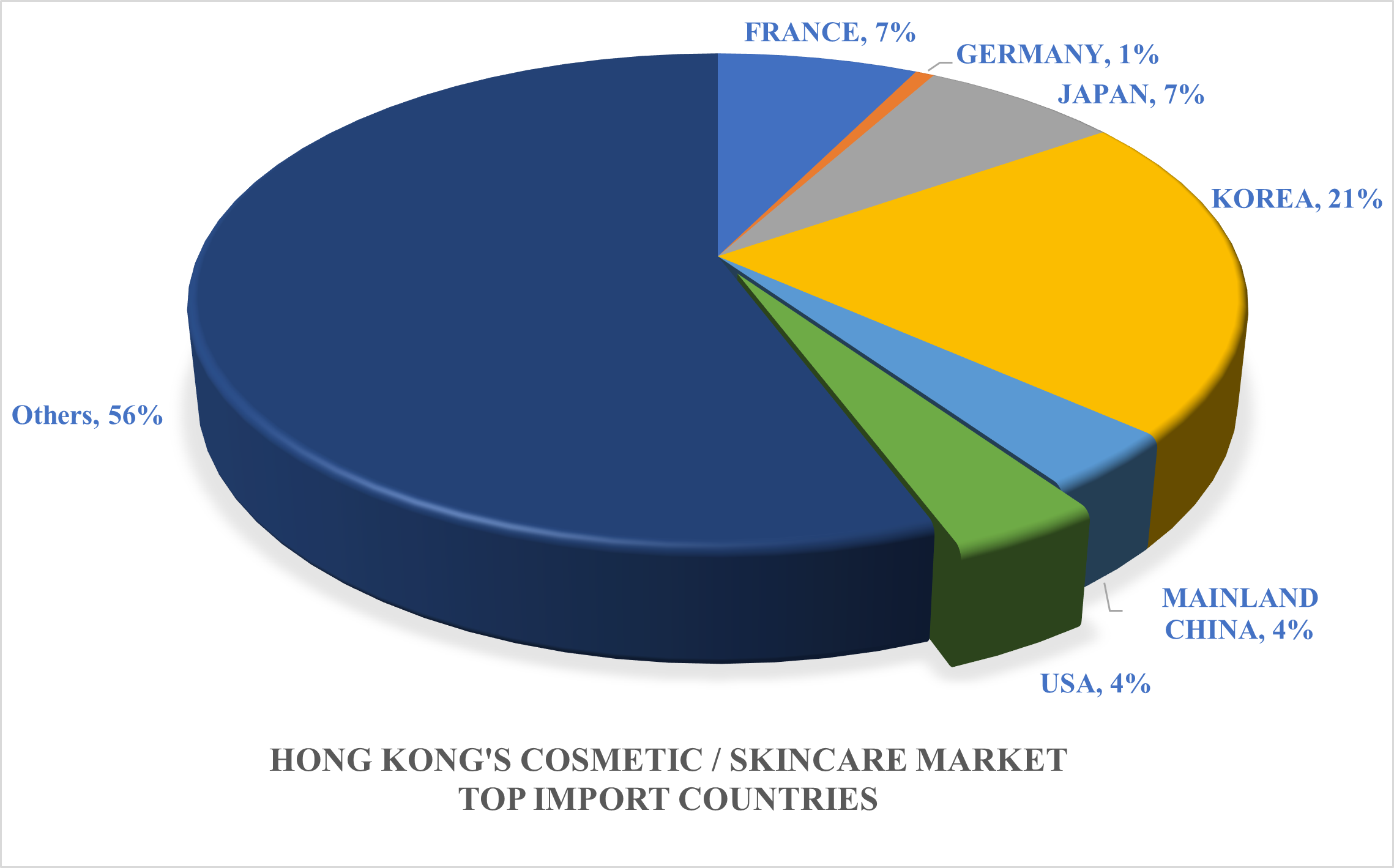

Chart 1: Hong Kong’s Cosmetic / Skincare market; top import countries

Hong Kong, a vibrant market for cosmetics, toiletries, and skincare, serves as an international hub with tax-free imports and no registration requirements.

In 2022, cosmetic and skincare imports totaled US$5.437 billion, reflecting a 38% decrease attributed to the pandemic. Business closures, particularly affecting salons and retail were prevalent.

The Hong Kong cosmetics market is very competitive, with the top ten brands accounting for about 70 percent of the total market. Appointing a local distributor and working closely with them to market and promote the brand is still one of the best ways to launch a brand.

Since 2020, U.S. imports have fallen by 73 percent, while Korea dominates exports to Hong Kong, holding a 21 percent market share. This has largely been the trend as K-culture continues to be popular across Asia. They are also well-received due to the affordable price point, attractive packaging and marketing. Other than Korea, other top exporting countries include France, Japan, the United States, and Mainland China.

Despite the pandemic’s impact, Hong Kong remains an attractive market for U.S. exporters due to low entry barriers. Overall, cosmetics and toiletries from U.S. brands are well-regarded, and customers recognize certifications such as USDA’s Certified Organic, B Corp, and Leaping Bunny. They are seen to be innovative, safe, high-quality, and competitively priced. Numerous companies have found success in Hong Kong through continuous brand-building activities and advertisements, adaptation of products to local market demands and trends, and entering the market utilizing a competitive pricing strategy.

Discerning local consumers, including a growing demographic focused on natural and organic products, present opportunities for new brands. Hong Kong consumers are savvy, discerning, adventurous, and willing to pay for high-quality products. With a rapidly aging population, mature consumers are investing heavily on anti-aging and corrective cosmetics. Besides older consumers, male consumers, particularly born after the 1990s, contribute significantly to industry growth.

Cross border e-commerce has changed the industry as consumers can access online marketplaces to purchase products. This has significantly reduced profit margins for distributors, and hence they need to be selective with the brands they represent. As Hong Kong normalizes following the pandemic, questions arise about product potential and its status as a top shopping destination. Cross-border e-commerce has transformed consumer habits, with mainland consumers seeking experiential travel over traditional shopping.

Brands that are better known have the potential to succeed through opening an online shop via cross-border e-commerce sites like Tmall and HKTVMall. However, all brands must continue to invest frequently in marketing and promotion to create more brand awareness.

Leading Sub-Sectors

Products with the best sales prospects in Hong Kong include:

- Complete line of facial products with brightening and anti-aging properties

- Daily-use facial masks. Skincare, cosmetic and toiletry products made of organically grown and naturally derived ingredients; also, hypo-allergenic, with low concentrations of fragrance and preservatives.

- Skincare, cosmetic and toiletry products made of organically grown and naturally derived ingredients; also, hypo-allergenic, with low concentrations of fragrance and preservatives.

- Skincare products, hair styling products, and grooming products for men.

- Eye make-up such as fake eyelashes and eyelash extension products, and semi-permanent make-up, glossy and bold eye shadow colors.

- Nail colors, nail-care products, soft gel nails gels, and nail-art.

- Body treatments, body shaping treatments, massage and bath products for use in spas and professional skincare salons.

- Sun protection products.

- Hand creams that have powerful moisturizing ingredients.

- Dermo-skincare products for retail distribution and for distribution to doctors.

- Private labeling /OEM of skincare products and cosmetics for leading chain stores

Opportunities

Open Regulatory Environment: Numerous international cosmetics brands choose Hong Kong as their first overseas market or to launch new products in Asia due to Hong Kong’s open regulatory environment. Hong Kong accepts U.S. product labeling, and there is no mandatory labeling or registration requirements on cosmetics.

E-commerce: Retailers have reported a substantial increase in online sales, especially after the outbreak of Covid-19, with local consumers avoiding shopping trips to retail stores. Top e-commerce sites in Hong Kong include Taobao, Alibaba, HKTVmall, Wechat, JD.com and Amazon.

Changes in product mix: During the pandemic, retailers restructured their product mix to focus on hand sanitizers, hand washing products, and home-care personal care.

Resources

Hong Kong Trade Show:

Dates: November 13 – November 15 2024

Venues: Hong Kong Convention and Exhibition Centre

U.S. Trade Show:

Dates: July 23 – July 25 2024

Venues: Mandalay Bay Convention Center, Las Vegas

Association: