Romania overthrew its communist regime in December 1989, yet the Romanian government still plays an oversized role in the economy in terms of employment, ownership of assets, and influence on the business environment. State-owned enterprises shape many industries, acting as dominant customers, suppliers, or, in some cases, competitors. Despite pleas from the international finance and business community, state-owned enterprises in the country do not regularly utilize private management.

While some progress has been made since joining the EU in 2007, companies in Romania still report challenges regarding the independence and efficiency of the judicial system, corruption, bureaucracy, and political instability. Romania’s poor infrastructure continues to negatively impact business costs, productivity, public safety, and the country’s ability to attract foreign investment. The country’s connections to the rest of the EU’s transportation infrastructure are still underdeveloped, which holds back the country’s ability to realize its full potential for new investment, trade, and tourism.

Romania is not a member of the Euro Zone, so payments are made in local currency – the New Romanian Leu (RON). However, many companies and consumers have debt denominated in euros, and most big-ticket consumer items (i.e., real estate, cars, and major appliances) are priced in euros. This has the tendancy to at times create trade inefficiencies due to higher transaction costs and exchange rate fluctuations.

Many U.S. firms operating in Romania face ongoing challenges with recruiting and retaining employees. A fast growing economy, increasing investments and the ability for Romanians to work for higher wages elsewhere in the EU have led to a labor shortage. This shortage is more pronounced in northern and western parts of the country, where employers often bus in workers from villages. While unemployment rates are higher in Romania’s north, companies report that skilled workers are harder to find in the lesser-developed eastern portions of the country.

All companies operating in Romania complain about frequent legislative changes without prior private sector consultations. Regulatory Impact Assements (RIAs) , which track the way that new legislation impacts the ability to do business, are very rare and laws can change with little notice.

The conflict in Ukraine has increased market uncertainty for Romanian companies, especially those involved in international trade, during this period. Summer 2023 has seen the highest volatility in the currency market in years, similar to levels since the beginning of the pandemic.

According to the World Bank Group, it takes 20 days to start a business in Romania, compared to the average in the Southeast Europe region of only 9 days.

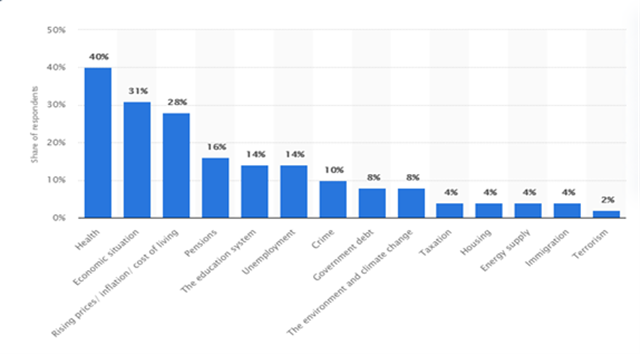

Respondents to a 2022 survey done by Statista in Romania considered that the country’s biggest problem is the health system, followed by the country’s economic situation. Only two percent of Romanians thought that terrorism was the biggest threat.

Source: Statista 2022

Construction of highways and other critical infrastructure, the overhaul of the public health system, the enhancement of the state education system and a greener economy are all major objectives for further development of Romania. Over the long term, however, 41% of investors believe the attractiveness of Romania’s business environment will improve during the next three years.