Romania has one of the most important digital economies in the CEE region, reflected in its developing e-commerce market. The coronavirus (COVID-19) pandemic accelerated growth across the e-commerce industry. As consumers ordered more products and services online, web sales of Romanian enterprises increased, peaking in the first year of the pandemic.

The share of enterprises making sales via the internet also increased, with businesses such as restaurants focusing on online channels and delivery. But while the e-commerce share in revenue remains relatively high for companies continuing to sell online, the cost of living, inflation rate, and rising prices pose a threat to the market as Romanians try to reduce their spending.

Romania is the 47th largest market for eCommerce with a predicted revenue of US$5,599.9 million by 2023, placing it ahead of New Zealand.

Revenue is expected to show a compound annual growth rate (CAGR 2023-2027) of 12.7%, resulting in a projected market volume of US$9,044.5 million by 2027. With an expected increase of 16.8% in 2023, the Romanian eCommerce market contributed to the worldwide growth rate of 9.6% in 2023. Like in Romania, global eCommerce sales are expected to increase over the next years.

Five markets are considered by ecommerceDB within the Romanian eCommerce market. Fashion is the largest market and accounts for 41.5% of the Romanian eCommerce revenue. It is followed by Food & Personal Care with 19.8%, Electronics & Media with 16.7%, Toys, Hobby & DIY with 11.1%, and Furniture & Appliances with the remaining 10.8%.

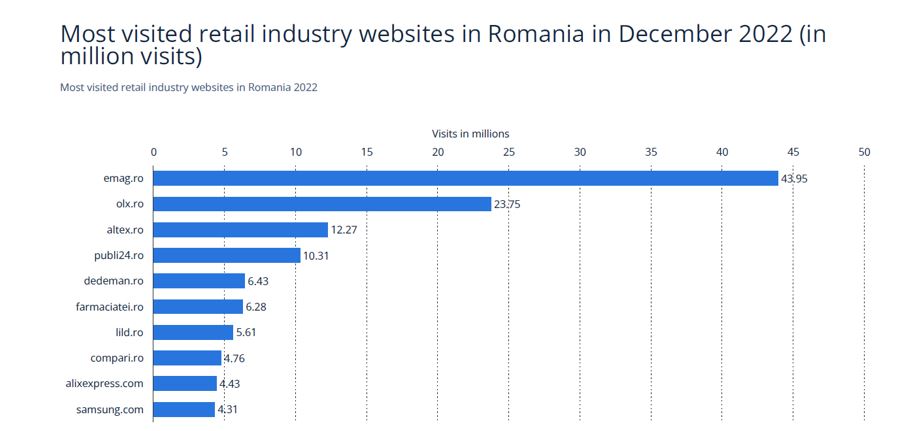

The biggest player in the Romanian eCommerce market is emag.ro. The store had a revenue of US$845.3 million in 2022. Amazon.com, Inc., Fashion Days Shopping SRL., Altex Romania SRL, Zara USA, Inc and emag.ro (Dante International S.A.) are the major companies operating in the Romania E-commerce Market.

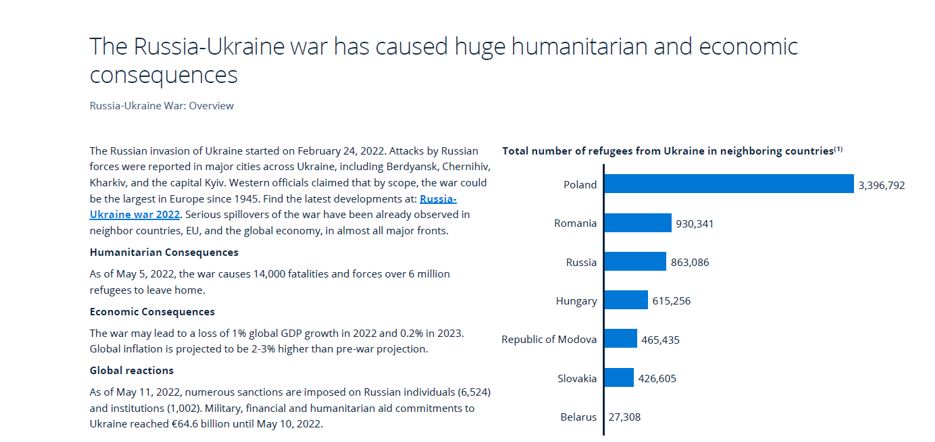

Chart 1: Russia Ukraine War Overview

Consumer Behavior: Romanian consumers have become more comfortable with online shopping, and they increasingly prefer the convenience and variety offered by e-commerce platforms. Common purchases include clothing, electronics, cosmetics, and household goods.

Payment Methods: Online payment methods are becoming more popular, including credit/debit card payments, digital wallets (e.g., PayPal), and cash-on-delivery. Trust in online payment systems and security measures have contributed to this shift.

Logistics and Delivery: The logistics and delivery infrastructure in Romania has improved to meet the demands of e-commerce. Companies have developed efficient delivery networks, including same-day or next-day delivery services in major urban areas.

Regulations: Romania has implemented various regulations to facilitate e-commerce, including consumer protection laws, data protection regulations, and electronic signature laws.

Mobile Commerce: Like in many other countries, mobile commerce is on the rise in Romania. Consumers often use smartphones and mobile apps to make purchases and compare prices while on the go.

Challenges: Despite the growth, there are still challenges in the Romanian e-commerce market, including competition, the need for continuous improvement in logistics and infrastructure, and the potential for counterfeit products.

Future Trends: The future of e-commerce in Romania is likely to be shaped by trends like personalization, AI-driven customer service, and sustainability, as consumers become more conscious of the environmental impact of their purchases.

According to available statistics on online payments, there is a rise in the adoption of card payments: the introduction of the extra security measures, or “instant money back” return option has increased the confidence in this type of safe payments method.

Social networks are accessed by a growing number of users, so they are gaining an increasingly important role in the sales strategy. Also, according to Veranda Shop Online, live shopping will also develop in Romania, acting as a lever that mixes online and offline interaction. This shopping method will be more valuable especially for niche products.

As of July 2021, new VAT regulations, which apply to online shopping outside the EU, came into force. The new regulations will make online shopping outside the EU, come into force. The new regulations will make online shopping in China more expensive and therefore less profitable, since VAT will also apply to cross-border online shopping with a declared value of up to 10 euros.