Overview

Romania’s energy sector is key to its evolving economy and security policy. It has a diverse energy mix, including coal, natural gas, nuclear, hydroelectric, and renewable sources. The largest share of electricity production historically came from coal and natural gas, followed by hydroelectric and nuclear power. In recent years, there has been a shift towards increasing the share of renewable energy sources, such as wind and solar. Romania has set ambitious targets for renewable energy, aiming to increase its share in the total energy mix. Wind energy has seen substantial growth, with numerous wind farms in operation, while solar energy is becoming increasingly important, particularly in the southern regions of the country. Romania has two operational nuclear reactors at the Cernavodă Nuclear Power Plant, which contribute a significant portion of the country’s electricity, but also significant natural gas reserves and production facilities, making it a key player in the regional natural gas market. Romania exports and imports electricity to and from neighboring countries, including Hungary, Bulgaria, Serbia, Ukraine, and Moldova, and is also part of the European Union’s internal energy market, which aims to create a single, competitive market for electricity and gas across EU member states. In Romania, the energy market is shared among five big electricity distributors: Electrica Furnizare, Enel Energie and Enel Energie Muntenia, E.On Energie Romania, Hidroelectrica, and CEZ Vanzare.

The country finds itself having a diverse energy mix based on natural resources such as gas, nuclear power, hydro and renewable energy. The National Recovery and Resilience Plan calls for phasing out coal and lignite by the end of 2032 and replacing them with renewable and low-carbon energy sources, including, but not limited to, clean hydrogen.

Overall electricity consumption has decreased by 7.5% in the first 5 months of 2023, compared to 2022. Electricity use in the economy dropped by 5%, public illumination by 20.4% and residential consumption by 13.6%, according to data from the National Institute of Statistics.

Prosumers have been the fastest growing segment adding electricity capacity in Romania this year. Their aggregate installed capacity (77,638 prosumers) reached 973 MW on July 1, 2023. At the start of 2023, there were only 417 MW. That means a doubling in only half a year. Most prosumers are in Ilfov county (6.500 prosumers with 79 MW).

Only 16 MW of installed storage capacity in the energy system, so there’s huge potential for growth in this area.

Domestic production of primary energy increased by 3.7% in the first six months of the current year compared to the same period in 2022, while imports fell by 6.2%, shows data published by the National Institute of Statistics (INS). Domestic production amounted to 106,380 GWh, an increase of 3835 GWh (+3.7%) compared to the amount between 1 January and 30 June 2022, while imports amounted to 82,247 GWh, a decrease of 5,452 GWh (-6.2%).

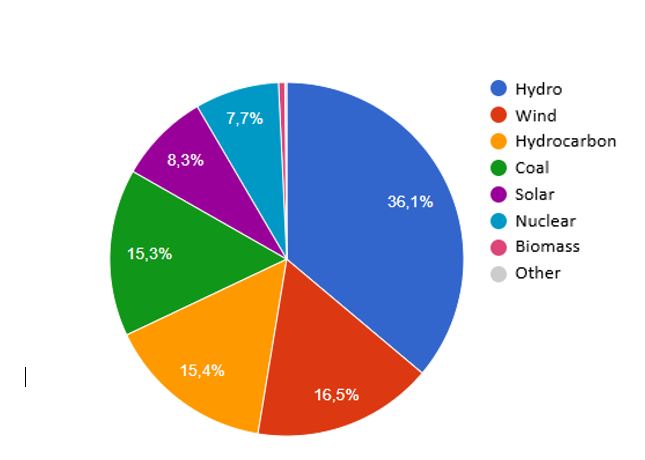

Chart: Romania Energy Mix

NRRP- National Recovery and Resilience Plan

In the context of the COVID-19 crisis, the European Commission (EC) established a Recovery and Resilience Mechanism to give effective and meaningful financial help to Member States to improve the current state of the national economy following the COVID-19 crisis, to promote economic growth and job creation necessary for labor inclusion, and to support green and digital transition in order to promote sustainable growth.

Goals of the NRRP include:

- Promoting Romania’s development by implementing critical programs and projects that boost resilience, crisis readiness, flexibility, and growth potential through major reforms and key investments with monies provided to Romania under the existing structure.

- Attracting funds made available by the European Union through the “NextGenerationEU”.

The Energy Component of the NRRP has a budget of approx. 1.7 bln. USD. Beneficiaries (both direct and indirect) are Small and Medium Enterprises, major companies, local public authorities, and administrative-territorial units.

The Modernization Fund

The Modernization Fund is derived from revenue from the auctioning of 2% of the total certificates allocated to Member States under the EU-ETS scheme for the period 2021-2030.

The estimated allocation is $15.7 bln., of which up to 70% is dedicated to relevant priority investment costs and up to 30% for investments that do not fall into the priority areas but are relevant to greenhouse gas emissions. The Modernization Fund concerns 10 member states, including Romania. The EC stated in June 2022 that it will achieve its 2030 energy and climate commitments.

The modernization fund supports at least 45 investment proposals in some of the following fields: production of renewable energy, modernization of energy networks, and energy efficiency in the energy sector for general industry. An example of an investment supported by the fund in Romania is the construction of eight photovoltaic (PV) parks and two combined cycle gas turbines, which will replace conventional power sources such as lignite with renewable energy and gas sources.

Generation of Energy

The main electricity generation plants are state-owned: Cernavoda Nuclear Power Plant, 208 hydropower and pumping plants, and six coal-fired power plants.

In June 2023, Romania produced 4.412 TWh of electricity.[1]

Transmission of Energy

The electricity transmission system in Romania and the interconnection system with its neighboring countries is managed and operated by Transelectrica SA company (the Romanian TSO). They also manage the market operation, the grid and market infrastructure development, and the security of the national energy transmission system.

Transelectrica oversees Romania’s national electrical system, electricity transmission network, and the cross-border transmission capacities. Generating, distribution, and supply activities were totally segregated from the transmission system and system operational services.

Supply and Distribution of Energy

In 2022, five major electricity suppliers were active in Romania:

- Electrica Furnizare – 17.96% market share

- Enel Energie and Enel Energie Muntenia – 20.97%

- E.On Energie Romania – 10.57%

- Hidroelectrica – 8.04%

- CEZ Vanzare (MIRA investment fund) – 5.55 %

As of March 2023, the licensed distribution system operators are: e-Distributie Muntenia, e-Distributie Banat, e-Distributie Dobrogea, Distribuție Energie Oltenia, Delgaz Grid and Distributie Energie Oltenia.

State-owned enterprises such as Nuclearelectrica, Hidroelectrica, Termoelectrica, Hunedoara Energy Complex (CEH), and Oltenia Energy Complex (CEO) are the primary producers of power.

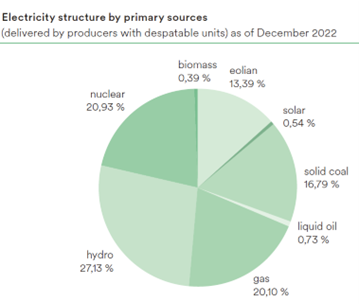

According to the National Energy Regulatory Agency (ANRE), the energy output in Romania in 2022 was 53 TWh (terawatt-hour), while imports were 5.9 TWh. Electricity consumption by household end-users was 13.5 TWh, while non-household end-users were 36.7 TWh. Furthermore, energy exports were 4.6 TWh. In August 2023, approximately 40% of generated power (delivered by producers) had renewable resources as follows: hydropower at above 27%, wind at above 10%, photo-voltaic above 2%, and biomass above 0.6%[2].

NRRP- National Recovery and Resilience Plan

In the context of the COVID-19 crisis, the European Commission (EC) established a Recovery and Resilience Mechanism to give effective and meaningful financial help to Member States to improve the current state of the national economy following the COVID-19 crisis, to promote economic growth and job creation necessary for labor inclusion, and to support green and digital transition in order to promote sustainable growth.

Goals of the NRRP include:

- Promoting Romania’s development by implementing critical programs and projects that boost resilience, crisis readiness, flexibility, and growth potential through major reforms and key investments with monies provided to Romania under the existing structure.

- Attracting funds made available by the European Union through the “NextGenerationEU”.

The Energy Component of the NRRP has a budget of approx. 1.7 bln. USD. Beneficiaries (both direct and indirect) are Small and Medium Enterprises, major companies, local public authorities, and administrative-territorial units.

The Modernization Fund

The Modernization Fund is derived from revenue from the auctioning of 2% of the total certificates allocated to Member States under the EU-ETS scheme for the period 2021-2030.

The estimated allocation is $15.7 bln., of which up to 70% is dedicated to relevant priority investment costs and up to 30% for investments that do not fall into the priority areas but are relevant to greenhouse gas emissions. The Modernization Fund concerns 10 member states, including Romania. The EC stated in June 2022 that it will achieve its 2030 energy and climate commitments.

The modernization fund supports at least 45 investment proposals in some of the following fields: production of renewable energy, modernization of energy networks, and energy efficiency in the energy sector for general industry. An example of an investment supported by the fund in Romania is the construction of eight photovoltaic (PV) parks and two combined cycle gas turbines, which will replace conventional power sources such as lignite with renewable energy and gas sources.

Generation of Energy

The main electricity generation plants are state-owned: Cernavoda Nuclear Power Plant, 208 hydropower and pumping plants, and six coal-fired power plants.

In June 2023, Romania produced 4.412 TWh of electricity.[1]

Transmission of Energy

The electricity transmission system in Romania and the interconnection system with its neighboring countries is managed and operated by Transelectrica SA company (the Romanian TSO). They also manage the market operation, the grid and market infrastructure development, and the security of the national energy transmission system.

Transelectrica oversees Romania’s national electrical system, electricity transmission network, and the cross-border transmission capacities. Generating, distribution, and supply activities were totally segregated from the transmission system and system operational services.

Supply and Distribution of Energy

In 2022, five major electricity suppliers were active in Romania:

- Electrica Furnizare – 17.96% market share

- Enel Energie and Enel Energie Muntenia – 20.97%

- E.On Energie Romania – 10.57%

- Hidroelectrica – 8.04%

- CEZ Vanzare (MIRA investment fund) – 5.55 %

As of March 2023, the licensed distribution system operators are: e-Distributie Muntenia, e-Distributie Banat, e-Distributie Dobrogea, Distribuție Energie Oltenia, Delgaz Grid and Distributie Energie Oltenia.

State-owned enterprises such as Nuclearelectrica, Hidroelectrica, Termoelectrica, Hunedoara Energy Complex (CEH), and Oltenia Energy Complex (CEO) are the primary producers of power.

According to the National Energy Regulatory Agency (ANRE), the energy output in Romania in 2022 was 53 TWh (terawatt-hour), while imports were 5.9 TWh. Electricity consumption by household end-users was 13.5 TWh, while non-household end-users were 36.7 TWh. Furthermore, energy exports were 4.6 TWh. In August 2023, approximately 40% of generated power (delivered by producers) had renewable resources as follows: hydropower at above 27%, wind at above 10%, photo-voltaic above 2%, and biomass above 0.6%[2].

[1] https://www.transelectrica.ro/documents/10179/45094/7productie17b.xls/a7f8f6aa-2dd4-47ab-b613-c1e5af42c8aa

[2] https://www.transelectrica.ro/web/tel/sistemul-energetic-national

Oil and Gas

Romania was the first nation in Central Europe to employ natural gas for industrial purposes and has Central Europe’s largest natural gas market. As the second-largest gas producer in the European Union with sizeable reserves (including those recently found in the Black Sea), Romania is the nation in the region with the lowest reliance on imported natural gas and therefore has a reduced dependency on external gas sources.

Romania supports a long-term perspective of natural gas in the European Green Pact because it forecasts that this resource will remain an important tool in changing the energy sector and transitioning to a more sustainable and carbon-free economy.

It is expected that, by 2027, natural gas will be extracted from the Black Sea through the Neptun Deep project, with estimated production about 30 times the annual demand covering 4.3 million households, according to OMV Petrom representatives. OMV Petrom and Romgaz approved the development plan for the Domino and Pelican South commercial natural gas fields in the Neptun Deep perimeter.

Neptun Deep is the largest natural gas project in the Romanian Black Sea and the first deepwater offshore project in Romania. The estimated investments for the project’s development phase are up to EUR 4 bln.

In addition to Neptun Deep, Romania can diversify its energy supplies with the Midia Natural Gas Development Project of Black Sea Oil and Gas (BSOG). Romania’s natural gas distribution network has increased four times in the last three decades, from 10,772 km in 1990 to 43,563 km in 2020 and 45,449.9 km in 2021, according to data synthesized by the National Institute of Statistics (INS), with an average annual growth rate of 4.8%.

The main offshore titleholders in the Black Sea are BSOG. Other title holders are Lukoil, OMV Petrom, Petromar Resources, Petro Ventures, Gas Plus Dacia, and Romgaz SA. Also, Romania stands to become a regional gas provider should its total extracted gas exceed domestic needs.

Romania’s Ministry of Energy supports a strategic partnership to acquire liquefied natural gas (LNG) from Azerbaijan through a Southern Corridor pipeline known as BRUA (Bulgaria-Romania-Hungary-Austria).

LNG at the Black Sea

The Black Sea has no LNG terminal; the position held by Turkey on allowing LNG tankers to pass through Istanbul and the Bosphorus Strait plays a large part. Romania had planned to build a terminal onshore at the Port of Constanta. Indeed, since Romania’s priority was to have completed the BRUA pipeline in 2020 and to start gas production in the Black Sea (see above – BSOG production), the Constanta LNG project could come online in 2026, yet it is still awaiting private investment.

Romania has a large potential for LNG developments in its Black Sea territories. With infrastructure investments and the development of competitive market mechanisms, Romania can succeed in becoming a major European LNG supplier and transport hub.

In October 2022, Romanian gas producer Romgaz and Azerbaijan’s state-owned Socar announced a memorandum of understanding (MOU) to develop an LNG project in the Black Sea. The project would consist of a liquefaction plant, an LNG regasification plant, and all other installations and facilities needed to transport natural gas from the Caspian region into Romania.

Nuclear Sector

Romania has a long tradition and rich nuclear expertise gained through the construction, commissioning, and safe operation of Cernavoda Nuclear Power Plant (hereinafter “NPP”) Units 1 and 2 and other nuclear facilities such as the heavy water plant, the nuclear fuel plant, research institutes, engineering, and advanced physics centers. At Cernavoda, two more units are under construction, pressurized heavy water reactors of CANDU 6 design (CANadian Deuterium Uranium), each with a gross output of 706.5 MWe.

Small Modular Reactor (hereinafter “SMR”) technology will help Romania and other EU member nations achieve national decarbonization goals by promoting a fair transition to carbon neutrality.

Romania has expedited its decarbonization goals to 2030 from 2050. Renewable energy sources, nuclear power (via completion of Cernavoda NPP Units 3 and 4, refurbishment of Unit 1, and deployment of SMRs), and natural gas - the latter considered a transitional energy source - form the backbone of Romania’s energy transformation.

Coal Sector

Romania’s coal production is expected to decrease by 12.5% in 2023[1]. This was due to the pandemic-induced worldwide crisis, followed by the geo-political context in the area due to the Ukrainian war, but also because of the orientation shift from conventional energy sources to renewable energy.

The role of traditional fuels such as oil, natural gas, coal, and uranium in the energy mix is currently being reconsidered/renegotiated according to European Union-led new context and trends (EU Green Deal). Romania produces pit coal and lignite and maintains several coal-fired power plants, all needing immediate upgrades to comply with EC guidelines.

Renewable Energy

In order to reach its 2030 renewables target of 34 (previously set to 30.7%), Romania plans to add around 7 GW of new capacity, of which around 3.7 GW is intended to be PV solar projects. According to the statistics provided by windeurope.org, during the first months of 2023, Romania reached first place in wind energy utilization and 4th and 5th place in the EU production-wise in some daily reports.

The Romanian Ministry of Energy has launched a tender for the deployment of 950 MW of renewable energy capacity. The government has allocated a budget of €457.7 mil. ($506 mil.) for the procurement exercise, which will be open to wind and solar projects, with the possibility of links to storage. Around €372.7 mil. of the total will be devoted to projects exceeding 1MW in size and €75 mil. to wind and solar plants with a capacity between 200 KW and 1MW.

Romanian authorities will grant a rebate of €750,000 per MW installed to PV projects with a power of 200 KW to 1MW and of €425,000 per MW installed to solar arrays over 1 MW. For wind power, rebates are €1.3 mil. and €650,000 for the two project typologies. Selected projects must begin commercial operations in June 2024.

Romania is also supporting rooftop PV deployment via a program called “Casa Verde Fotovoltaice” (Green PV Home) for residential solar installations under the national net metering regime. According to the International Renewable Energy Agency, Romania had 1.8 GW of solar installed by the end of 2022.

In 2022, the overall energy production was 53.5 TWh. In 2022, the imported energy output was 5.9 TWh, while the exported energy output was 4.64 TWh.

Romanian Association for Wind Energy (RWEA) launched RESInvest, a program dedicated to the localization of a value chain for renewable energy by encouraging local production of renewable technology and the creation of investment opportunities based on an EU-funded capacity of 3,000 MW. RWEA states that Romania could become a know-how hub.

Opportunities

Power Production and Distribution

American companies can find opportunities for their equipment, expertise, technologies, design and construction, installation, upgrading, maintenance, and repair services in electrical power systems, products, and services related to energy efficiency, smart grid, power distribution, power and gas storage, and refurbishment/construction of power generation capacities.

In Romania, as of August 2023, the installed power in electricity production capacities was: 35.1% Water; 18.1% Coal; 15.9% Wind; 15.1% Hydrocarb; 7.5% Nuclear; 7.5% Solar; 0.8% Biomass, and related.

Oil and Gas

As reported in the Transgaz (the national transport system operator, hereinafter “SNT”) Investment and Development Plan 2020-2029, several possible strategic investment projects are on the horizon: the finalization of BRUA; new developments tied to the Black Sea extracted gas; interconnection of SNT to a future LNG terminal by the Black Sea; regasification installation by the Black Sea, to take over liquified gas imported with specialized ships and to prepare the gas for the entry into Transgaz SNT pipelines; modernization of stations Isaccea and Negru Voda.

Nuclear

The Intergovernmental Agreement law between Romania and the US regarding cooperation on Cernavoda nuclear-energy projects and civil nuclear energy was promulgated in July 2021. The agreement targets several fields of cooperation such as: Units 3 and 4 Cernavoda new projects; revamping of Unit 1; regulating, research and development; exchanges between research labs and universities; and personnel training. The entry into force of this agreement allows the development of the civil nuclear program by ensuring technical, regulating, nuclear security, and safety expertise.

Renewables

The Ministry of Economy, Entrepreneurship and Tourism recently launched a Modernization Fund program which will provide funding for improvements in energy efficiency, modernization of energy systems, and the transition to coal-dependent regions.

Romanian authorities have allocated a budget of €457.7 mil. (approx. $505 mil.) for new renewable sources procurement exercise. Selected wind and solar projects will be granted rebates ranging from €0.425 to €1.3 mil. per MW installed.

Aside from the programs for the promotion of RES funded by the Environment Fund, the promotion of RES continues through green certificates. ANRE has established a mandatory annual quota for the purchase of green certificates. In addition, ANRE has developed a new regulatory framework to facilitate the marketing of energy produced in renewable power plants with an installed electric power of up to 400 KW per place of consumption belonging to consumers and delivered in the electricity network to electricity suppliers with whom they have concluded contracts for the supply of electricity.

ANRE informs that in Romania, the transition from a target of 24 percent in 2020 for the share of electricity produced from renewable sources in total gross final energy consumption to a target of 30.7 percent (proposed) in 2030 was already equivalent to an increase of more than 140% in the share of electricity production capacity from renewable sources, compared to the production capacity installed in the period 2010-2016 (of about 4785 MW) Furthermore, starting with March 2023 it has been announced that the new target for 2030 concerning renewable sources is now increased from 30.7% to 34% for Romania.

Wind Energy

Romania could get another 1.4 GW of wind farms in the next five years, with investments being estimated to be as much as EUR 2 bln. According to media outlets, it would be the second wave of investments in wind energy in this country. In the period 2009-2014, Romania attracted investments of over 4.8 bln. USD in the sector. Currently, the country has about 3 GW, which covers about 10% of electricity consumption.

PV Energy

According to the ANRE, Romania currently has about 1.52 [2]GW of installed solar power capacity in August 2023. The country is expected to become the European Union’s wind and PV hub, with such power plants installed throughout the country.

Romanian authorities intend to grant a rebate of 794,000 USD per MW installed to PV projects with a power of 200KW to 1 MW and of 450,000 USD per MW installed to solar arrays over 1 MW. For wind power, the rebates are 1.37 mil. USD and 688,000 USD for the two project typologies, respectively.

The largest PV project recently announced was in November 2022, when a 1.044 GW project was made public, which will be developed by Monsson in the Pilu / Graniceri area – Arad County, with a total estimated cost of 800 mln. EUR (864 mln. USD), making it the largest PV park in Europe, employing over 1,000 local individuals to build such park. There are also discussions about the subsequent building of a storage capacity.

Biomass Energy

Studies conducted in Romania reveal the potential in green energy production at 65% via biomass, 17% from wind energy, 12% through solar energy, 4% micro hydropower, and 2% geothermal.

In terms of the energy potential of biomass, Romania’s territory is split into eight regions: Danube Delta (Biosphere Reserve), Dobrogea, Moldavia, Carpathian Mountains (Eastern, Southern, Western-Apuseni), Transylvanian Plateau, Western Plain, Carpathians Hills and South Plain. So, biomass electricity production is a potential that needs to be capitalized on.

Trade events:

- Career days in the energy industry

- International Conference on Energy and Environment

Other relevant organizations and info: National Regulatory Agency for Energy; National Agency for Mineral Resources; Electrica; Romania Production of crude oil, 2018-2020; Romania Crude Oil Production | 1994-2020 Data; Romanian Petroleum Exploration and Production Companies Association; Romania Primary coal production, 1973-2019; Transgaz; Romgaz ; Nuclear and Radioactive Waste Agency; Romania Energy Center (ROEC); Romanian Association for Biomass and Biogas; Employers Federation of Companies Associations in Energy Utilities: ACUE; Romanian Photovoltaic Industry Association: RPIA | Romanian Photovoltaic Industry Association .; Romanian Association for Wind Energy; Romanian Association for Biomass and Biogas; EnergyNomics https://www.energynomics.ro/; A European Green Deal | European Commission.

Contact Information

Mihaela Dodoiu, Commercial Specialist

Mihaela.Dodoiu@trade.gov, +40 721 40 72 74

[1] https://economedia.ro/importurile-de-carbune-ale-romaniei-au-scazut-cu-aproape-60-in-primele-5-luni-din-2023.html

[2] https://arhiva.anre.ro/ro/energie-electrica/rapoarte/puterea-instalata-in-capacitatiile-de-productie-energie-electrica