Overview

Israeli defense spending averages approximately $21B-$22B per year (national funds). In addition, the United States provides Israel $3.3B annually in Foreign Military Financing (FMF), and $500M annually for missile defense appropriations. As of July 2023, Israel has 593 active Foreign Military Sales (FMS) cases valued at nearly $30B.

The current U.S. military aid to Israel, covering FY2019 to FY2028 is $38 billion: $33 billion in FMF plus $5 billion in missile defense appropriations. An additional one billion dollars was provided in 2022 to replenish Israel’s Iron Dome Missile Defense System.

Priority Initiatives:

KC-46 Tankers: Israel signed a $1.1B LOA and amendment in 2021 for four KC-46 aircraft and indicated a total requirement for eight units. The first two KC-46 aircraft are scheduled for delivery in late 2025; upon which it will undergo 1- to 2-year conversion process to achieve Israel-unique configuration.Heavy Lift Helicopters: Israel signed a $1.9B LOA for 12 CH-53K aircraft in December 2021, with a potential total requirement of 18 helicopters. Deliveries of these helicopters are scheduled for 2025-2027. F-35: Israel purchased 50 F-35 aircraft, 39 of which have been delivered to date. The next three aircraft will be delivered in February 2024. Israel recently submitted a new LOR for 25 additional aircraft in August 2023..F-15IA: In January 2023, the Israeli Ministry of Defense (IMOD) submitted a $4.5B Letter of Request (LOR) for 25 F-15IAs with an option to purchase an additional 25 units. The LOR also requests kits to upgrade their 25 F-15Is. The LOA is anticipated to be offered in early 2024.Naval Frigates: Israel plans to acquire up to five new naval frigates to be built cooperatively between U.S. and Israeli shipyards. This procurement is currently awaiting final Israeli government contractor selection.

The IMOD spends approximately one third of its annual FMF allocation on Direct Commercial Contracts (DCC) procurements negotiated between the IMOD’s Mission to the United States, based in New York City, and United Statesowned commercial business entities. Section 23 of the Arms Export Control Act (AECA) provides the authority for Israel and nine other FMF recipients to acquire material and services via DCC channels. DSCA has oversight responsibility for these procurements and approves the disbursement of FMF funds for DCC procurements. DSCA published the Guidelines for Foreign Military Financing of DCCs (updated in March 2017) to provide concerned parties with necessary procedural guidance.

Israel’s military and commercial activities with the U.S. defense industry are strong and include commercial contracts with major U.S. companies. The local industry sources quality components and sub-systems, presenting export opportunities to U.S. suppliers of high-quality components that can be integrated into Israeli systems. In November 2022, for the first time ever, a major U.S.-based defense company, Leonardo DRS, acquiried a significant Israeli defense technology company, RADA.

The country’s defense industry is dominated by three companies: Israel Aerospace Industries (IAI), Rafael Advanced Defense Systems (both parastatals), and Elbit Systems. The companies offer a diverse portfolio of products and services, including space and airborne reconnaissance systems, radar systems, UAVs, avionics and electro-optical systems, munitions, tanks and armored personnel carriers. They produce structural components and parts and operate maintenance, repair and upgrade facilities. In addition, there are several hundred small and medium sized enterprises active in the sector.

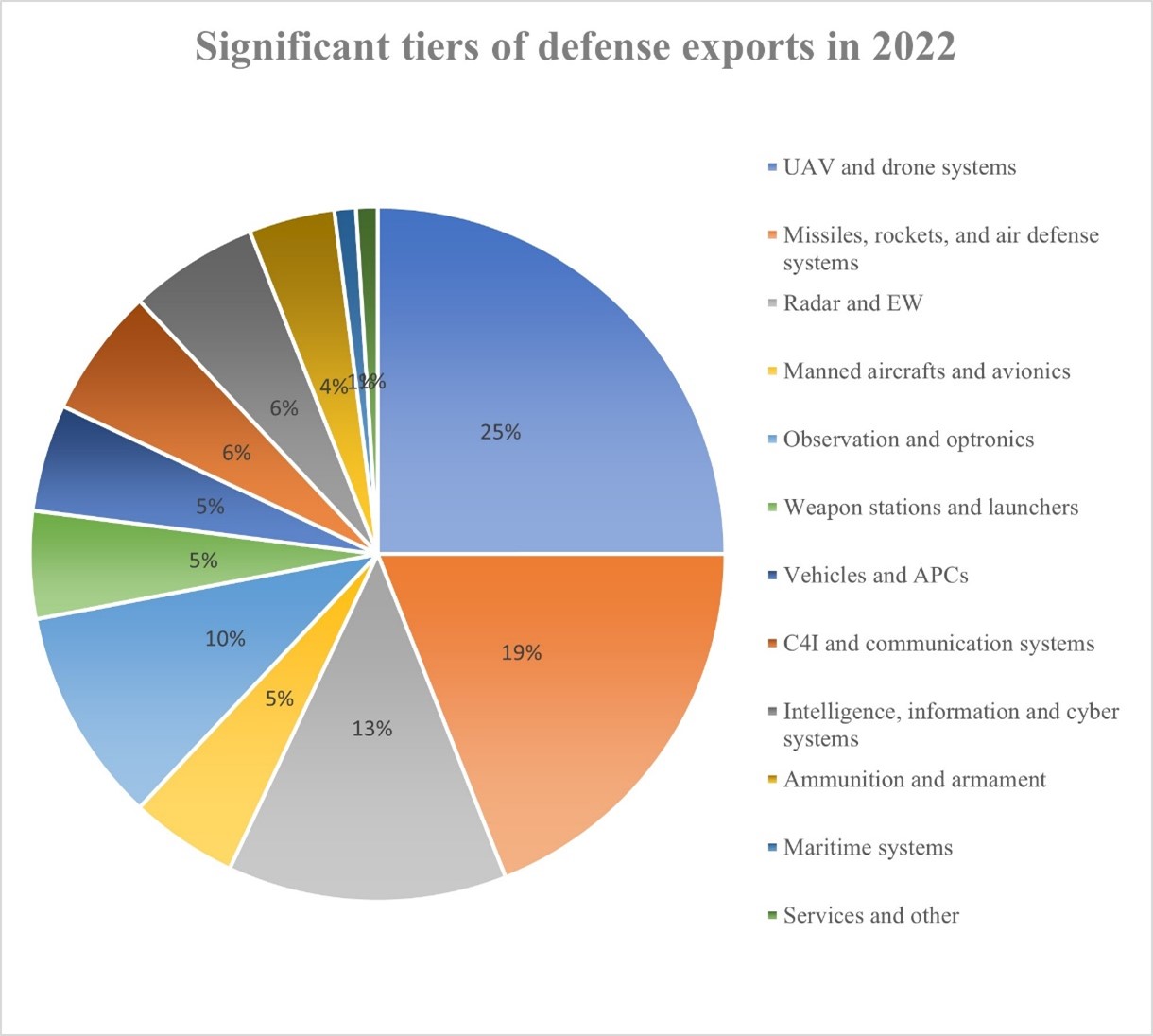

Israeli defense exports hit a new record in 2022, totaling $12.546 billion, showing a 11% increase since 2021 ($11.3 billion), Israel’s defense exports have reached a new peak for the second consecutive time, a remarkable 65% increase within five years.

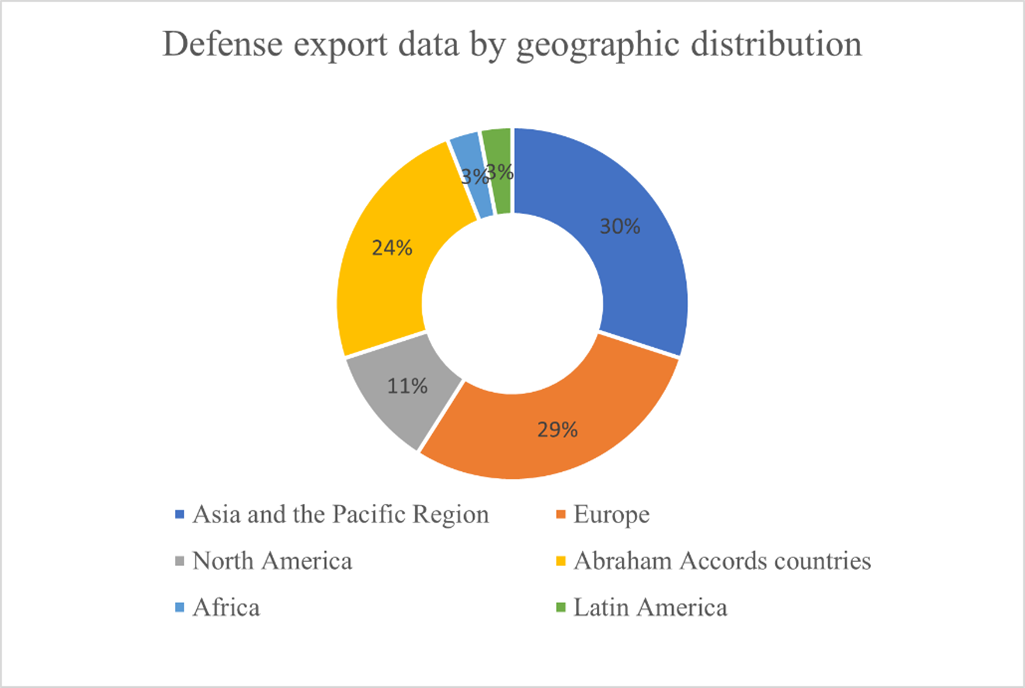

A new record was also set in the export of UAVs and drones with Israel’s total exports increasing ten-fold, with half of the agreements valued at over $100 million. Exports to Abraham Accords countries (United Arab Emirates, Bahrian, and Morocco) reached approximately $3 billion.

The rate of export agreements between countries signed by the Ministry of Defense has reached an all-time high, over $4 billion compared to $412 million in 2018. This constitutes a 10-fold increase in 5 years. While some European countries have declined to purchase Israeli weapons systems in the past, citing political reasons, the war in Ukraine has boosted Israel’s arms exports, such as the sale of hundreds of old Merkava tanks to Cyprus and Morocco, as well as Israel’s largest-ever single defense deal – $3.5 billion sale of Arrow 3 Air Defense Systems to Germany and a deal to export David’s Sling Air Defense Systems to Finland.

Israel has a space research program with scientific and commercial goals and has developed indigenous launch capabilities. A space cooperation agreement with NASA in 2015 expanded cooperation in civil space activities. Israel’s space program is small but significant. The country’s first mission to the moon was in April 2019, that resulted in an unsuccessful lunar landing, however this event established Israel as the fourth nation to attempt to soft land on the moon. In February 2023, Israel Space Agency (ISA) anounced its plan to launch Israel’s First Space Telescope Mission, the Ultraviolet Transient Astronomy Satellite (ULTRASAT) in 2026, and its second attempt to land on to the moon with Beresheet 2 lunar mission in 2025.

Israel’s national air carrier, El Al, has a fleet of 45 aircrafts, all manufactured by Boeing. The company saw major loses in 2020 and 2021 due to the pandemic. However, 2022 ended with a positive bottom line and Q4 of 2022 was the first time since 2015 that the company had positive net profit. Overall, 2022 results and significant milestones led the company to release ambitious expansion plans. The airline plans to carry some 7.5 million passengers per year through its Ben Gurion Airport hub, thus taking a 24% market share. The airline also intends to expand its fleet by purchasing or leasing 6 Boeing 787 planes and between 24 to 31 single-aisle planes.

Local manufacturers procuring components that will be integrated in systems for export to third countries consider U.S. export controls a challenge. Local industry also benefits from Israel’s offset program, which is administered by the Industrial Cooperation Authority at the Ministry of Economy. Israeli industry has also benefitted historically from an option to convert 25% of U.S. Government FMF from dollars to shekels, which has enabled the Israeli Ministry of Defense (IMOD) to spend FMF locally. The U.S. military aid program to Israel approved for 2019-2028 gradually eliminates that provision, which means that the IMOD will have to spend the entire amount in buying weapons, systems, and defense equipment solely from U.S. companies. Local industry is concerned about the negative impact the change will have on SMEs but this will not affect the three largest defense contractors, who already have a presence in the United States.

Leading Sub-Sectors

Aircraft and UAV parts, air-control technology, electronic components for land, air and sea platforms, airborne and ground-based engines, electro-mechanical devices, microwave components, and sensors.

Opportunities

U.S. exporters are strongly advised to appoint a local representative to introduce their products and services to the Israeli military and aerospace & defense industries. The local representative can also provide business development services and after sales support. For additional information about FMF tenders, please contact the IMOD procurement office in New York City, at: https://mission-ny.mod.gov.il/

Vendor Contact Form: http://www.mission-ny.mod.gov.il/VENDORS/Pages/contactUsVedorRegistration.aspx

In addition to FMF purchases, the IMOD publishes local tenders that present limited sales opportunities for U.S. companies. The U.S. Commercial Service has access to the list of local tenders and can make information available to interested U.S. suppliers. Bidding on local tenders requires opening a local bank account and appointing a local representative.

For information about local IMOD tenders, please contact Commercial Specialist Yariv Moravnik Shavitt at Yariv.Moravnik-Shavitt@trade.gov.

The IMOD’s International Defense Cooperation Directorate, SIBAT, publishes a directory of the Israeli defense industry that is a useful tool for U.S. exporters.