The Chinese eCommerce Market

Challenges of the Chinese eCommerce Market

China’s online consumer market has always been an attractive goal to strive towards, but are US businesses pursing a market that is built to always favor China’s national business interests?

Apart from the appeal and potential of market volume, China’s local ecommerce digital policy regulation, nation-wide online firewalls, and selective use of “strategically critical industries” designation all collude to make China a very difficult market for U.S. businesses to sell into.

China’s “Great Firewall” Domestic Digital Policy Bundle Challenges

The “Great Firewall of China” as it is often referred to, is the combination of several digital policy rulings handed down by the ruling Chinese Communist Party (CCP). Most recently the CCP started enforcing their own consumer data legislation called the Personal Information Protection Law and Data Security Law, which further complicates access to the market making it more difficult for US firms to sell into. You can view China’s and other country’s regulation of ecommerce on this digital policy tracker resource.

Another element of the Chinese market that further complicates business access is the stratification of consumers into audiences that are monopolized by domestic Chinese service providers— a condition of the limited access and competition that Great Firewall legislation creates.

Chinese Online Marketplaces Challenges

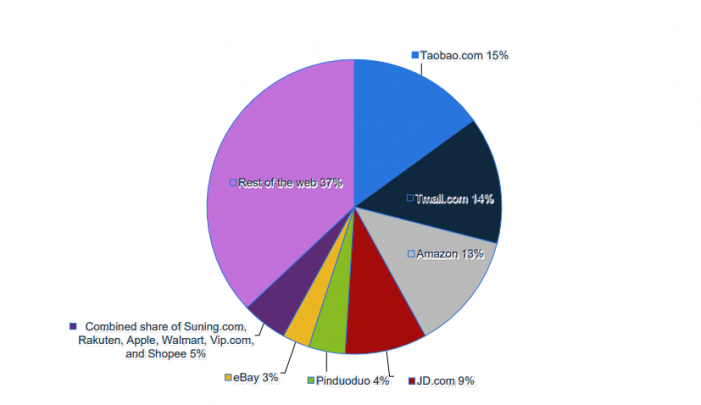

Chinese online marketplace service providers dominate the Chinese domestic market and have grown their international footprint significantly. The White House’s official findings for its 2022 report, “The Notorious Markets List,” highlights China’s online and physical markets that reportedly engage in or facilitate substantial trademark counterfeiting, copyright piracy, and intellectual property rights (IPR) violations.

The 2021 Notorious Markets List also identifies 42 online markets and 35 physical markets that are reported to engage in or facilitate substantial trademark counterfeiting or copyright piracy in China. The 2021 list identifies, for the first time, AliExpress and the WeChat e-commerce ecosystem, two significant China-based online markets that reportedly facilitate substantial trademark counterfeiting. Also, China-based online markets Baidu Wangpan, DHGate, Pinduoduo, and Taobao continue to be listed, as well as nine physical markets located within China that are known for the manufacture, distribution, and sale of counterfeit goods.

Selling into China requires that you pair up with at least one Chinese online marketplace service provider to access their domestic consumers, which has historically reported business opacity issues. US marketplace competition can’t show up in Chinese consumer search as shopping alternatives in China as a result, so this limits the ways a US business can access the Chinese consumer market.

The US Commercial Service China has offices in Beijing, Guangzhou, Shanghai, Shenyang, and Wuhan with a network of trade professionals to help US small and medium-sized businesses succeed exporting to China. Our CS offices in China can help you with promoting your brand, business matchmaking services, business due diligence reports, and more.

Strong Chinese Online Consumerism Challenges

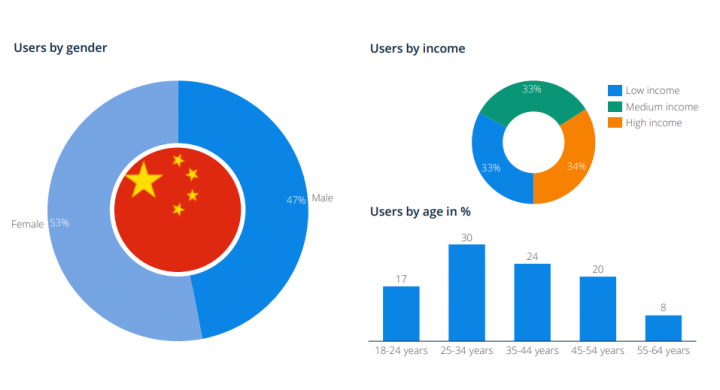

The leading industries for online sales in China by far are women’s fashion and clothing, and this is due simply to consumer demographic volumes.

34% of Chinese online shoppers belong to the higher income group and prefer high-end luxury items from overseas brands and manufacturers.

China’s large population and continued growth have made China a leading consumer market for the region for all things fashion, cosmetics, and health products. Following this, toys/hobby, food, personal care, and furniture are all top selling online categories with Chinese consumers.

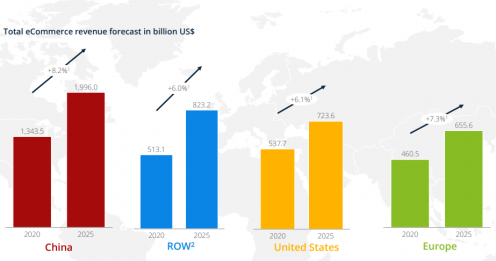

Forecasts show stable sales growth in all categories through 2025 for China ecommerce market opportunities.

Return to eCommerce Frontline Library Content

Looking for more ecommerce resources?