Overview

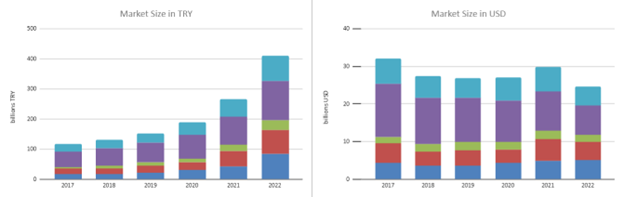

Market size estimates for the ICT sector*:

Source: www.tubisad.org.tr

* Due to devaluation of the lira, while the size of the domestic market increased in lira terms, in USD terms, a slight decrease is indicated.

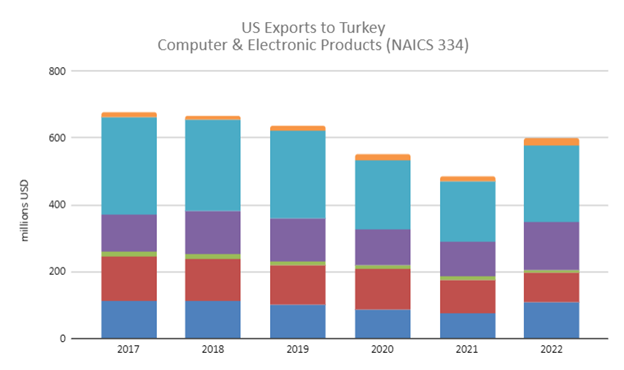

source: https://usatrade.census.gov

Foreign vendors find it increasingly difficult to operate in Türkiye due the existing digital services tax (DST), local content requirements, and restrictions on social media platforms. Türkiye has agreed to transition away from its existing DST to a new international tax framework (under the Two-Pillar solution of the OECD/G20 Inclusive Framework), which is scheduled to be implemented by the end of 2023 (although it will likely miss this date). Nevertheless, forthcoming large-scale projects, the GoT’s 2019-2023 strategic plan, and country-wide 5G initiatives provide opportunities for U.S. firms in this sector.

The size of the communication technologies market grew from $9.1 billion in 2021 to $13 billion in 2022, while the information technologies market reached a market size of $11.7 billion in 2022, up from $6.9 billion in the previous year. Information technologies companies in Türkiye increased employment 17% to 171.000, while in the communication technologies sector employment increased 7% to 42.000. The number of organizations in this sector expecting growth in employment in 2023 declined compared to 2022.

5G trials are underway. Sectors including banking, healthcare, and media, are set to benefit immensely from the development of this technology. Integration and alignment with EU standards and regulations, as well as exposure to industry best practices are driving Türkiye to employ top-of-the-line IT solutions. Local telecom operators are speeding up Internet of Things (IoT) solutions and smart city projects. Cybersecurity continues to provide opportunities as Türkiye is at high-risk for cyber threats.

Data Infrastructure

Roughly 92% of households have access to broadband internet. Approximately 61.9% of households access the internet through fixed broadband and 88.5% via mobile broadband. There are 88.5 million mobile subscriptions for broadband use.

Social Media Use

Türkiye has 68.9 million active social media users (80.8% of the population). The most used social media platform is WhatsApp, followed by Instagram, and Facebook. On August 6, 2020, Parliament passed legislation that could significantly restrict access to platforms (those with more than 1 million daily users in Türkiye) that are non-compliant with official requests to remove content deemed offensive. The law also requires social media companies to have at least one representative in the country.

IT Hardware and Software

IT hardware spending fell last year due to the cannibalization of tablet sales by smartphones. Software and services spending proved more resilient, with some areas seeing strong growth in cloud computing. The main software categories were enterprise resource planning and customer relationship management. The largest contributors to traditional IT services sales were systems integration, consulting, and computer programming.

Key sectors and areas for ICT spending:

- Financial services (online, mobile banking payments,e-commerce platforms)

- Insurance sector (Insuretech)

- 5G technology-IoT services, network and support systems

- Healthcare, mobile-health

- Mobility

- Automatıon and Manufacturing (advanced automation technologies)

- Data centers and disaster recovery areas

Telecommunications

The Turkish telecom market is highly developed, yet still has room to grow. In the mobile market there is a strong demand for high-speed data services. Nearly all of Türkiye’s 97.6 million mobile phone users use smartphones. 4G service will continue to grow until 5G begins to take over. The major GSM cellular operators in Türkiye are Turkcell (41.3% market share), Vodafone (30.8%) and Turk Telekom/TT Mobil (27.9%). 4.5G (LTE) technology came into use in 2016 and the number of subscribers reached 81 million (92% of the data market) in 2020. As a result of 4.5G deployment, e-commerce, mobile broadband, mobile banking services, and mobile television services sales have increased, creating favorable business opportunities for investors. New technology investments and the transition to 5G technology is likely to accelerate sector expansion. Localization is a major GoT priority in 5G development and localization requirements are frequently written into tenders for 5G projects.

Operators are partnering with providers such as Nokia, Ericsson, and Huawei to invest in advanced networks. The Turkish Government sought to be an early adopter of 5G, but plans have stalled and 5G operations will likely begin toward the end of 2023.

In Türkiye, smartphone use is widespread. Samsung has the lead in the mobile and wireless market; however, Apple’s iPhone has been extremely successful in recent years, followed by Xiaomi, Oppo, Vivo, and Huawei.

ZTE, Nokia, Northel Telecom, Alcatel, Siemens, Ericsson, and NEC supply most fixed-line switches, trans-multiplexers, and other traditional telephone equipment. Nokia, Ericsson, and Huawei are major network providers in Türkiye. Cisco, Motorola, Nokia, Ericsson, and Siemens are the main GSM switch and base station suppliers.

Leading Sub-Sectors

- Communication Technologies/5G-related tech and services/Fiber optic solutions

- M2M communication/IoT

- Edge Computing Systems

- Cloud/Data Centers

- Cybersecurity solutions

- Public Investments & e-Government

- Consumer electronics

- e-sports

- Gaming

- Robotics supported by Artificial Intelligence/Augmented Reality applications

- e-Commerce

- Blockchain solutions

- Wireless equipment and services

- Internet Protocol Television (IPTV)

Opportunities

5G

Funding allocated for the development of 5G in Türkiye is attracting investment in the telecommunications market. In 2019 alone, the government allocated $5 billion to the development of advanced 5G networks. Operators will initially look to implement 5G service in the major cities of Izmir, Istanbul, Ankara, and Antalya while 4G will remain prominent elsewhere. A spectrum auction for 5G frequencies is expected to occur within the next year, but has not yet been announced.

Türkiye’s Information and Communication Technologies Authority (BTK) is the authority and main entity leading 5G efforts in Türkiye. BTK recently established the ‘New Generation Mobile Communication Technologies Türkiye (5GTR) Forum,’ comprised of government, universities, manufacturers, operators, and NGOs, to provide a platform for meeting 5G requirements in the market with the goal of promoting localization and collaboration among vertical sectors. Private companies and associations such as Ericsson, Huawei, ZTE, Vestel, Vodafone, Turkcell, Turk Telekom, Ulak Communication, GTENT, the Telecommunications Businessmen Association, and the Technology Development Foundation of Türkiye, are members of the working group formed within the cluster.

Fiber Optics

Fiber optic solutions providers are gaining market access as Turk Telekom, TTNet, and other ISPs make infrastructure investments. Türkiye’s regulator is also keen to ensure greater broadband access as stated in its 2019-2023 strategic plan. The broadband market including xDSL, fiber and cable, has 18.2 million subscriptions, but this is expected to climb to 23 million within 10 years, according to BTK.

Cybersecurity

Network security against attack and viruses, email and web security, cyber governance, identity and certificate governance, mobile security, system security, data, and application security are top priorities. The government has increased expenditures on hardware and software to battle cyber threats. BTK, the Ministry of Transport and Infrastructure, Digital Transformation Office of the Presidency of Türkiye, Ministry of Justice and Interior, the Turkish National Police, and the Turkish military continuously update their cybersecurity technologies. The Ministry of Transport and infrastructure formed the Cyber Incident Response Teams (SOMEs), charged with preventing and mitigating cyber-attacks on state organizations and institutions.

Consumer Electronics, New Technologies

Türkiye’s young population continues to drive sales of PCs, tablets, cell phones, and consumer electronics, as well as cellular voice and data services. The audiovisual market is expected to rise further. The application of new emerging technologies such as Machine-to-Machine (M2M) connections, AI, blockchain and robotics will also continue to grow, underpinned by the development of IoT and Industry 4.0.

For further information on this section or more on potential opportunities, contact:

Gokce Tuncer

Commercial Specialist

U.S. Commercial Service Türkiye