Capital: Beijing

Population: 1.4 billion (July 2021 est.)

GDP (Purchasing Power Parity): $23 trillion (2020 est., in 2017 dollars)

Currency: Renminbi Yuan (RMB)

Language: Standard Chinese or Mandarin

UNESCO Student Mobility Number

China has 1,061,511 students studying abroad according to UNESCO.

CIA World Factbook

28.77% of China’s population is under 25 years of age.

OVERVIEW

China has the largest education system in the world, with 270 million students and 16 million teachers in over 500,000 schools in 2020 (OECD) [1]. The Ministry of Education of the People’s Republic of China is the agency of the State Council that oversees education throughout the country. In 2019, the State Council issued a blueprint for the country’s education development in the coming decade, called China’s Education Modernization 2035. This plan sets the objective of establishing a modern education system of lifelong learning with universal quality pre-school education, balanced compulsory education, enhanced vocational education, and more competitive higher education.[2] Under these guidelines government policies, investment and financing, and consumer demand became the three driving forces for a dynamic education market in China, and the following subsectors emerged that are worth U.S. education sector attention: K-12 education, higher education, vocational education, and education technology (EdTech).

SUB-SECTORS

K-12 Education: China has the world’s largest K-12 education market. In 2019, there were 106 million elementary (grades 1-6) students, 48 million junior middle school (grades 7-9) students, and 40 million high school students (grades 10-12), which together created a market of approximately $120 billion. Additionally, China reported 47 million kindergarten students (3-5 years old) in 2019, a group excluded from China’s K-12 market definition, but which has demonstrated strong demand for international products and services. [3]

China’s regulations commonly categorize K-12 education service providers as either non-profit or for-profit. Non-profit entities are mainly schools that provide full-time curricular education. For-profit entities include private schools, academic extracurricular tutoring, and non-academic extracurricular tutoring.

The K-12 education market has grown rapidly in recently years, and in so doing, raised social anxiety among parents and students seeking to gain an edge. Early in 2021, China’s central government enacted tough rules meant to ease pressure on school children and financial pressure on families by regulating and restricting the private tutoring market. One example is the clampdown on the for-profit curricular tutoring industry[4] from July 24, 2021, which was touted as a measure to reduce the time and financial burden of out-of-school training on students through grade 9 and their families (http://politics.people.com.cn/n1/2021/0725/c1001-32168735.html). This policy affects both online and offline tutoring service providers.

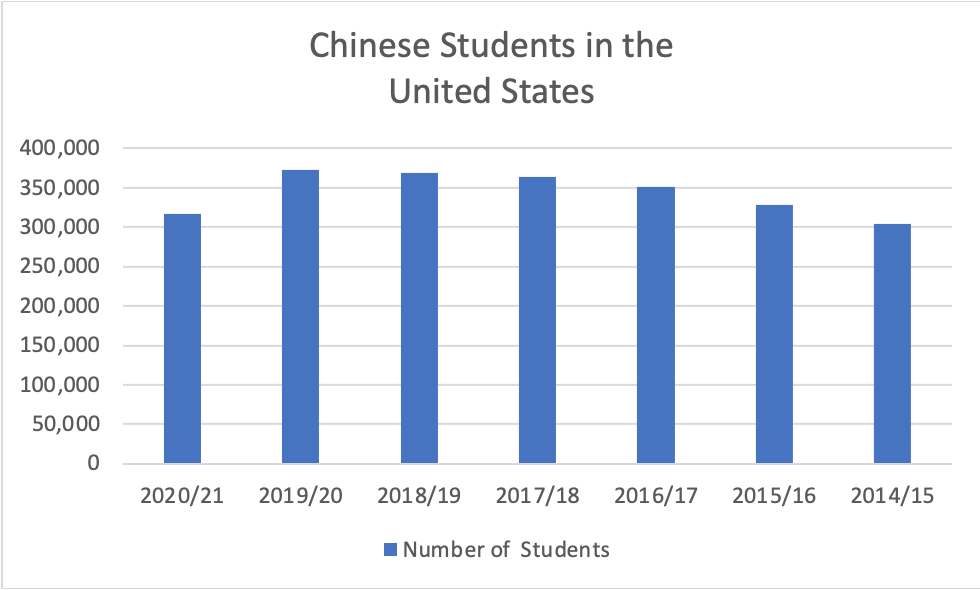

Higher Education: Despite the fact that China remains the largest source of international students in the United States for the 2020-2021 school year, with over 300,000 students in undergraduate, graduate, non-degree, and optional practical training (OPT) programs, this figure decreased 15% when compared to the previous school year.

Source: Open Doors[5]

Undergraduate and Graduate Programs: 125,616 Chinese students were enrolled in U.S. undergraduate programs and 118,859 in U.S. master’s and doctoral programs in the 2020-2021 school year. The number of undergraduates decreased 15% from the previous year, and the number of graduate students decreased by 13%.

These changes are reflected in Sunrise International’s research that shows the United States starting to lose ground to the United Kingdom and Canada as a study destination in the minds of Chinese families. Some of the major factors cited include the COVID-19 response, gun violence, and safety concerns for Asian students. But the same research also shows that the demand for study overseas is resilient. U.S. colleges and universities should continue to prioritize the safety of in-person study and provide institutional support for international students during COVID-19 restrictions to increase their appeal to Chinese students. [6]

Since early 2020, many college fairs and recruitment outreach events have been cancelled or switched to an online format. Although some of the in-person events resumed by the spring of 2021, it remains important for institutions to maintain a virtual presence through social media, webinars, and other marketing channels. Study agencies serving as a bridge for students and schools underwent a tough year in 2020. A study by BOSSA reports that 20% of agencies in China have closed, particularly small and medium-sized companies.[7]

Community College Programs: U.S. community colleges and vocational schools are gaining popularity in China. Such programs typically have fewer prerequisites for admission, have more affordable tuition and fees, and offer credits recognized by four-year universities in the United States. U.S. community colleges and vocational schools hoping to recruit students from China should focus on the unique experiences they offer to students. These can include proximity to major cities, ease of transportation, proximity to natural resources, and unique student community groups.

To further establish an exceptional value – and to provide differentiation in a very crowded market – community colleges and vocational schools should highlight feeder programs and partnerships with higher-level and highly-ranked universities. Community colleges and vocational schools should also highlight the unique features of their training programs. Corporate partnerships, apprenticeships, and internship programs are important features to highlight to help schools stand out.

Education Technology: Across the world, 2020 brought extraordinary changes to many sectors, and education is no exception. Both international students and domestic students have had to adjust their ways of studying by adapting to online learning on various technology platforms.

In the past five years, China has enjoyed rapid growth in the use of education technology (EdTech) and online learning, both in the private and public sectors. The driving forces include favorable government policies, abundant venture capital, increased consumption, fast-growing mobile Internet penetration, and the fact that the Chinese people attach great importance to education. Since 2015, China has been leading the global investment in EdTech. In 2020, China invested a record-high $10 billion in EdTech (https://www.holoniq.com/notes/16.1b-of-global-edtech-venture-capital-in-2020/). From 2010 through the end of Q1 2021, China invested nearly twice the amount of the U.S., six times that of India, and ten times that of Europe, according to Holon IQ.

The long-term impact of COVID-19 on education is expected to lead to an increase in spending on digital infrastructure and new digital models utilizing the new tools available in digital education.

Some industry trends and challenges in the EdTech sector include:

- Online Merge Offline (OMO) Model: The OMO model of the education industry refers to a business model that reshapes the entire education chain through technological innovation and organizational change, and then achieves online and offline integration. Through innovation, it broadens the service radius and enhances the effect of education via technology integration. For example, New Oriental has launched the dual teacher model and TAL has launched Xueersi online schools. For institutions, OMO is one of the key means to achieve product differentiation, reduce customer acquisition costs, and deepen the moat; OMO does not specify a precise boundary and scope, each institution explores its own solutions under the OMO model based on its own understanding of technology and education according to iResearch Inc (http://www.iresearchchina.com/).[9]

- STEAM learning continues to be a major priority for the Chinese market. The demand for STEAM education and training has seen the booming creation of training programs and startups offering out-of-school courses in coding, robotics, and 3-D printing and attracted the attention of publishers, toymakers, and app developers. STEAM-related courses are not only in demand for older children and students; rising middle-class incomes and fears of intense future competition for college admissions and jobs are leading parents to pay substantial sums for STEAM-related education for even young children and students.

- The emphasis on project-based learning is growing.

- Continuing with the growing demand for personalized learning, formative methods are supplanting traditional, summative approaches (especially with regard to test taking). As a result, we are starting to see more EdTech firms with solutions that focus on formative assessments.

- Robotics kits are becoming better packaged (even for young students) and incorporate apps to teach coding.

- Elements of AI (albeit noncomplex) are becoming an integral part of responsive apps that adjust to various learning levels.

- EdTech firms have seen the emergence of opportunities to create apps for preschool and kindergarten students.

- The mobile education texting-for-homework-help/crowdsourcing market has expanded to include a handful of firms that have developed crowdsourcing apps/web platforms to allow students to answer each other’s questions or to engage quickly with a teacher/expert for help.

- School management systems.

Challenges

- The biggest challenge for U.S. EdTech firms is localization. Many firms have created education technology to specific curriculum and U.S. state standards. To adapt their technology to a specific market, whether it be language, standards, curriculum, etc., will increase costs. This may deter some U.S. education technology firms from entering smaller markets with unique languages or very specific curriculum standards and requirements.

- Finding the right local partner is an important multiplier to market exposure. Other ways to gain awareness in the marketplace is through e-commerce or targeting private schools and parents.

- Startups in the EdTech sector face a unique challenge in marketing their products worldwide on a limited budget.

OPPORTUNITIES

K-12 Education: There remains enormous demand for better education and supplemental learning as both parents and schools seek a competitive edge for their students. Large players might shift their business focus to new frontiers like extracurricular tutoring and vocational education, both of which were not impacted by the above-mentioned regulatory changes. These and other opportunities are outlined below:

1. Non-academic extracurricular programs that offer all-around education: Such programs are exempted from the government’s recent policy changes and include subjects such as art, computer coding, sports, music, and others. Chinese parents’ strong belief in personal education investment remains unchanged, especially among those families interested in an overseas college education.

2. Academic and non-academic pre-college enrichment programs for high school students: China’s tough measures on education have had, and will continue to have, large effects on the nine-year compulsory education (grades 1-9) market, yet barely impact high schools. High school students who intend to study abroad are eager to get more prepared through these types of courses. Chinese domestic leaders in this segment, like GEC Academy, reported soaring sales of international enrichment courses in 2020. Market demand is expected to continue to grow even after COVID travel restrictions are eased.

3. Boarding schools: U.S. boarding schools remain appealing to Chinese parents and the U.S. Commercial Service in China (CS China) expects interest to rise as routine international travel resumes. Up until COVID restrictions made travel difficult or impossible, we noted increased interest in boarding schools for the lower grades in addition to high schools, which previously were the most popular options pursued by Chinese families.

4. Educational toys and games: Providers of educational toys and games may see the opportunity to emerge as replacements to academic tutoring. Opportunities exist for both physical products and online learning in the form of websites, software, or apps.

5. Language training: Academic language training providers might find it difficult to operate in China, while those who provide programs designed to enhance reading ability, without being specifically designed to tutor speaking, may find opportunities.

Higher Education: When it comes to emerging recruitment channels in China, we note that in 2020, there were nearly 400,000 children enrolled in English-medium international schools. The number of international schools in China continues to grow, with 53 international schools operating, 75% of them in lower-tier cities.[10] Unlike students within the public education system, most of those enrolled in international schools choose to study abroad after graduation. International schools have been and will continue to be important recruiting channels for U.S. higher education institutions.

Statistics (http://en.moe.gov.cn/documents/statistics) show that in 2021, 3.8 million people, both recent college graduates and working professionals, took the postgraduate entrance exam in China, an increase of 11% over the previous year. With an admission rate of only 35%, nearly 2.5 million cannot enter graduate school and represent a pool of potential candidates who are seeking to further improve their academic qualifications. Many of them are financially well prepared. [11] Based on research by Sea Master Education (https://www.seamastereducation.com/), the market for online master’s degree programs is booming. The flexibility of online learning is appealing to the population between 25- and 45-years old who are unable to study abroad due to the cost of lost job opportunities and for family reasons. We have also noticed a growing number of U.S. universities launching online master’s degree programs in China. [12]

Vocational Education and Community College: In “China Education Modernization 2035”, one of the six key points is to significantly improve vocational education in China. In pursuit of this, China is building the world’s largest vocational education system. According to China’s Ministry of Education, there were 11,500 vocational schools and nearly 29 million students at the end of 2020.

The Chinese government hopes to increase the ability of the workforce and economy to adapt to rapid technological change, provide more skilled workers to support industry, and upgrade the numbers and quality of the workforce able to contribute to the adaptation to new technologies.

China’s central government promotes international cooperation and exchanges for vocational education. China has sent delegations to learn from the countries where vocational education is well-developed. China has also received foreign vocational education delegations, invited foreign experts on the topic to give lectures in China, and created partnerships with foreign vocational education institutions. China also works with international organizations, such as UNESCO, UNDP, the World Labor Organization, UNPF, and APEC, to promote vocational education.

DIGITAL MARKETING STRATEGIES

With regards to social media and digital platforms, local Chinese sites and search engines are most popular in-country. For example, students regularly use TikTok, Bilibili, Weibo, QQ, and WeChat. The most popular social media sites are Bilibili, TikTok, and Weibo. Baidu is most used to research information, and Zhipin, LinkedIn, Douban, and 51job are used by students to search for job opportunities. To stream videos, students use Tencent, Aiqiyi, and Youku.

In-country schools and schools from competitor countries use TikTok, Bilibili, Weibo, QQ, WeChat, Tencent, Aiqiyi, and Youku to reach students and parents about education opportunities.

The U.S. Commercial Service in China recommends that U.S. study state consortia and/or education institutions communicate their unique offerings and experiences to differentiate themselves from competitors, identify champions to provide testimonials and drive digital marketing, and seek best practices from peer institutions, especially those that have successful marketing experience in China. The champions to provide testimonials can be current students or alumni from China.

EVENTS

- China Education Expo 2022, October 2022 – Beijing, Guangzhou, & Shanghai: https://www.chinaeducationexpo.com/english/index.shtml

- Global Education Technology Summit & Expo 2022- November 2022 – Beijing and Online: https://www.getchinaforum.com

RESOURCES

- U.S. Commercial Service – China: https://www.trade.gov/china

- U.S. & Foreign Commercial Service Global Education Team: https://www.trade.gov/education-industry

- Industry and Analysis, Office of Supply Chain, Professional & Business Services: https://www.trade.gov/professional-and-business-services

- Ministry of Education of the People’s Republic of China: http://www.cacie.cn/f/home?langtype=en

- China Education Association for International Exchange: http://en.ceaie.edu.cn/

U.S. COMMERCIAL SERVICE CONTACTS

Shenyang

Ms. Andrea Shen, Commercial Specialist

Phone: +86 24 2322 1198, ext. 8145

Email: Andrea.Shen@trade.gov

Beijing

Ms. Maggie (Jing) Qiu, Commercial Specialist

Phone: +86 10 8531 4157

Email: Jing.Qiu@trade.gov

Shanghai

Ms. Lauren (Yuan) Liu, Senior Commercial Specialist

Phone: +86 21 62798958

Email: Yuan.Liu@trade.gov

Wuhan

Ms. Catherine Le, Commercial Specialist

Phone: +86 27 8555 7791, ext. 2811

Email: Catherine.Le@trade.gov

Guangzhou

Ms. Veronica Liang, Commercial Specialist

Phone: +86 20 3814 5630

Email: Veronica.Liang@trade.gov

Guangzhou

Mr. Karic Chen, Commercial Specialist

Phone: +86 20 3814 5598

Email: Karic.Chen@trade.gov

[1] Benchmarking the Performance of China’s Education System (OECD) - https://read.oecd-ilibrary.org/education/benchmarking-the-performance-of-china-s-education-system_4ab33702-en#page5

[2] China Daily released on Feb 2019

[3] Ministry of Education of the People’s Republic of China http://www.moe.gov.cn/s78/A03/moe_560/jytjsj_2019/qg/

[4] http://politics.people.com.cn/n1/2021/0725/c1001-32168735.html

[5] IIE Open Doors / China (opendoorsdata.org)

[6] https://sieconnection.com/research

[7] “China Student Recruitment in 2021: Market Update and Strategy.” Bonard, 25 Feb. 2021, https://bonard.com/project/china-student-recruitment-in-2021/

[8] https://www.holoniq.com/edtech/10-charts-that-explain-the-global-education-technology-market/

[9] http://www.iresearchchina.com/

[10] CHINA - Phase 1: International Schools Market Intelligence Report. ISC Research, 2020. https://www.iscresearch.com/services/market-intelligence-report/china-mir