The U.S. Department of State Investment Climate Statements provide information on the business climates of more than 170 economies and are prepared by economic officers stationed in embassies and posts around the world. They analyze a variety of economies that are or could be markets for U.S. businesses.

Topics include Openness to Investment, Legal and Regulatory systems, Dispute Resolution, Intellectual Property Rights, Transparency, Performance Requirements, State-Owned Enterprises, Responsible Business Conduct, and Corruption.

These statements highlight persistent barriers to further U.S. investment. Addressing these barriers would expand high-quality, private sector-led investment in infrastructure, further women’s economic empowerment, and facilitate a healthy business environment for the digital economy. To access the ICS, visit the U.S. Department of State 2021 Albania Investment Climate Statement website.

Executive Summary

Albania is an upper middle-income country with a gross domestic product (GDP) per capita of USD 5,286 (2020 IMF estimate) and a population of approximately 2.9 million people. The IMF estimates that Albania’s economy contracted by 3.5% in 2020, due to the combined effect of the COVID-19 pandemic and the November 2019 earthquake. The contraction is smaller than initial forecasts due in large part to the positive net growth in construction, real estate, and agriculture sectors fueled by large government spending and private investments in real estate. Albania’s economy maintained its macroeconomic and fiscal stability during 2020, thanks to prudent macro and fiscal policies. Budgetary and COVID-19 related support provided by the international financial institutions and the EU helped the country meet urgent payment needs, and respond efficiently to two consecutive shocks, the earthquake and pandemic. During 2020, the IMF disbursed USD190 million under the Rapid Financing Instrument, the World Bank approved USD 80 million under its Fiscal Sustainability and Growth Development Policy Financing (DPF) program, and the EU approved around USD 205 million for Albania under its 3-Billion-Euro Macro-Financial Assistance (MFA) package for ten enlargement and neighborhood partners.

The IMF projects the economy will grow by 5 percent in 2021. The rebound is expected to be fueled mostly by increased consumption, better performance of tourism sector, and continued post-earthquake reconstruction program financed by the government and close to USD 330 million in grants raised from the post-earthquake International Donors Conference in February 2020.

However, uncertainties related to the pandemic, elevated fiscal deficits and public debt, and a relatively high level of non-performing loans (NPLs) present challenges for the projected recovery. In 2020, the fiscal deficit expanded from 1.9% to 6.7% year-on-year and public debt increased from 66.6% to almost 80% of GDP.

Albania received EU candidate status in June 2014, and in March 2020, the European Council endorsed the recommendation of the European Commission to open accession talks with Albania. Albania awaits its first Intergovernmental Conference, which would mark the start of accession negotiations.

The Albanian legal system ostensibly does not discriminate against foreign investors. The U.S.-Albanian Bilateral Investment Treaty, which entered into force in 1998, ensures that U.S. investors receive national treatment and most-favored-nation treatment. The Law on Foreign Investment outlines specific protections for foreign investors and allows 100 percent foreign ownership of companies in all but a few sectors. Albania has been able to attract increasing levels of foreign direct investment (FDI) in the last decade.

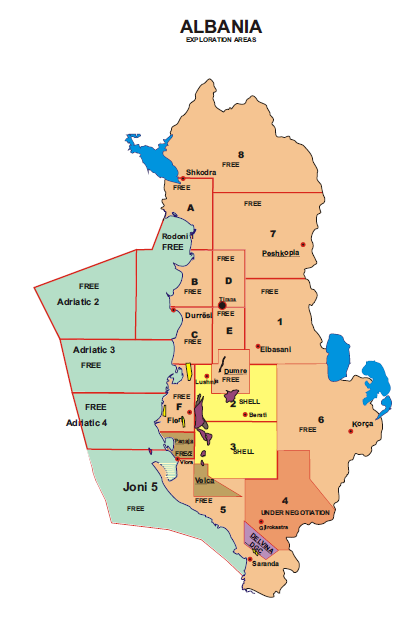

According to the UNCTAD data, during 2016-2019, the flow of FDI has averaged USD 1.2 billion and stock FDI reached USD 8.8 billion at the end of 2019. Despite the pandemic, according to preliminary data of the Bank of Albania the FDI flow in 2020 was relatively stable at USD 1 billion. Investments are concentrated in extractive industries, the energy sector, banking and insurance, information and communication technology, and real estate. Switzerland, The Netherlands, Canada, Italy, Turkey, Austria, Bulgaria, and Greece are the largest sources of FDI.

To attract FDI and promote domestic investment, Albania approved a Law on Strategic Investments in 2015. The law outlines investment incentives and offers fast-track administrative procedures to strategic foreign and domestic investors through December 31, 2021 depending on the size of the investment and number of jobs created. In 2015, to promote FDI, the government also passed legislation creating Technical Economic Development Areas (TEDAs) similar to free trade zones. The development of the first TEDA has yet to begin but the Government of Albania (GoA) announced a new tender on March 2021 for the development of the first TEDA after previous unsuccessful attempts.

As of March 2021, 95 percent of all public services to citizens and businesses were available online through the E-Albania Portal . The platform offered more than 1,200 types of services to citizens and businesses. Increased digitalization of services is expected to curb corruption by limiting direct contacts with public administration officials.

Despite a sound legal framework and progress on e-reform, foreign investors perceive Albania as a difficult place to do business. They cite corruption, particularly in the judiciary, a lack of transparency in public procurement, unfair competition, informal economy, frequent changes of the fiscal legislation, and poor enforcement of contracts as continuing problems in Albania. Reports of corruption in government procurement are commonplace. The increasing use of public private partnership (PPP) contracts has reduced opportunities for competition, including by foreign investors, in infrastructure and other sectors. Poor cost-benefit analyses and a lack of technical expertise in drafting and monitoring PPP contracts are ongoing concerns. U.S. investors are challenged by corruption and the perpetuation of informal business practices. Several U.S. investors have faced contentious commercial disputes with both public and private entities, including some that went to international arbitration. In 2019 and 2020, a U.S. company’s attempted investment was allegedly thwarted by several judicial decisions and questionable actions of stakeholders involved in a dispute over the investment. The case is now in international arbitration.

Property rights continue to be a challenge in Albania because clear title is difficult to obtain. There have been instances of individuals allegedly manipulating the court system to obtain illegal land titles. Overlapping property titles is a serious and common issue. The compensation process for land confiscated by the former communist regime continues to be cumbersome, inefficient, and inadequate. Nevertheless, parliament passed a law on registering property claims on April 16, 2020 which will provide some relief for title holders.

Transparency International’s 2020 Corruption Perceptions Index ranked Albania 104th out of 180 countries, an improvement by two places from 2019. Albania fell 19 spots in the World Bank’s 2020 Doing Business survey, ranking 82nd falling from 63rd in 2019. Although this change can be partially attributed to the implementation of a new methodology, the country continues to score poorly in the areas of granting construction permits, paying taxes, enforcing contracts, registering property, obtaining electricity, and protecting minority investors.

To address endemic corruption, the GoA passed sweeping constitutional amendments to reform the country’s judicial system and improve the rule of law in 2016. The implementation of judicial reform is underway, including the vetting of judges and prosecutors for unexplained wealth. More than half the judges and prosecutors who have undergone vetting have been dismissed for unexplained wealth or ties to organized crime. The EU expects Albania to show progress on prosecuting judges and prosecutors whose vetting revealed possible criminal conduct. The implementation of judicial reform is ongoing, and its completion is expected to improve the investment climate in the country.