China continues to be the world’s largest vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles, an increase of 7.1% from 2020. Commercial vehicle sales reached 4.79 million units, down 6.6% from 2020.

U.S.-made vehicles exported to China face the same 15% tariff China applied to most major trading partners. Vehicles (HS codes 8703 and 8704) were included in the U.S.-China Phase One Trade Agreement, offering tariff exceptions and opening potential opportunities for U.S. exporters.

In the wake of the COVID-19 pandemic, the Chinese government has taken steps to buttress automobile consumption. These steps include allowing vehicles that meet China 5 Emission Standard to sell without restrictions, supporting electric vehicle consumption, reduction of car sales tax, and improving parallel import policies for autos. These changes are estimated to increase consumption by approximately $30 billion per year.

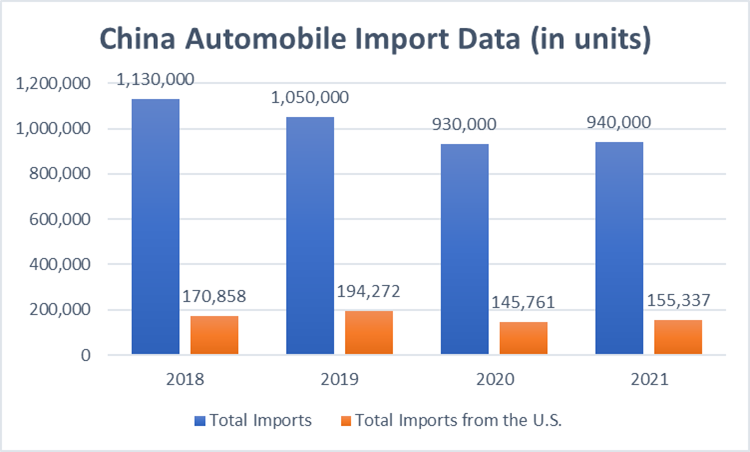

From 2018 to 2021, China’s imports of motor vehicles decreased from 1,130,000 to 940,000 units, while those from the United States decreased from 170,858 to 155,337 units.

Source: Ministry of Industry and Information Technology

Recreational Vehicles (RVs)

China’s RV market has undergone significant changes over the past several years, including a national focus on developing tourism, campgrounds, and the RV industry. With a growing demand for RVs and a shift in consumers’ travel preferences, tourism experts in China anticipate a surge in RV-related business in the coming years. U.S.-made RV exports have declined in recent years due to the trade tensions and the related uncertainty of tariff rates.

Trade Events

- 2023 Shanghai Auto Show

- All in Caravanning-Beijing

- China Commercial Vehicle Show-Wuhan