Overview

In 2022, Canada remained a top export market for U.S. agricultural exports, totaling US$28.3 billion, and accounting for nearly 15% of total U.S. agricultural exports. Consumer-oriented agricultural exports accounted for the largest share, at US$19.7 billion and almost 70% of total U.S. agricultural exports to Canada. Some of the top consumer-oriented export categories include baked goods, cereals, and pasta; fresh and processed vegetables; fresh and processed fruit; meat and meat products; non-alcoholic beverages; food preparations; chocolate and cocoa products; condiments and sauces; coffee; wine; beer; and pet food. In 2022, the United States imported just over US$37 billion worth of agricultural products from Canada.

Canada is the largest destination for U.S. exports of high-value agricultural products, with a 24% market share in 2022 and a value of US$19.7 billion. Consumer-oriented agricultural products are foods typically sold directly in supermarkets and used in restaurants. These high-value exports support over 135,000 jobs in the United States, and many of the suppliers are small and medium-sized businesses.

Most U.S. agricultural products have entered Canada duty-free since 1989 under the USMCA (and the preceding NAFTA and U.S.-Canada Free Trade Agreement). Major exceptions are the supply managed sectors, including dairy, chicken, turkey, and eggs.

Leading Sub-Sectors

Food Retail Sector

In 2022, Canada’s food and alcoholic beverage retail sales reached US$112 billion, including alcohol sales of US$21 billion – a modest two percent increase from the previous year compared to the record 11% in 2020 vs. 2019.

Canada is the largest overseas market for U.S. high-value, consumer-oriented products, with exports reaching nearly US$19.7 billion in 2022. This segment of agricultural and food products includes snack food, breakfast cereals, sauces, confectionery, pet food, wine, spirits, beer, and soft drinks. The top three consumer-oriented agricultural product categories were bakery goods, cereals, & pasta, fresh vegetables, and fresh fruits. U.S. products dominate in imported goods in the Canadian market, but recently implemented Canadian trade agreements with 3rd country trading blocs – CETA (Canada-European Union Comprehensive Economic and Trade Agreement) and the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) – have contributed to increased agricultural export competition in the Canadian market.

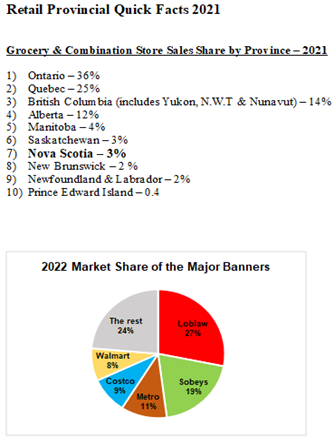

Canada’s retail market is mature and consolidated, with five leading retailers –Loblaws, Sobeys, Metro, Costco, Walmart – commanding nearly 76% of the market. The remainder of the market is represented by smaller regional retail chains, including 6,800 independents and 27,000 small and independent convenience stores across the country. Ontario, Québec, and British Columbia represent 61% of Canada’s retail market and are the provinces where most convenience, drug, grocery, and mass merchandise stores are located. By surface area, Canada is the second-largest country, but over 80% of Canadians live in the country’s 15 largest cities, making urban centers the nuclei of retail activity. As larger grocery banners focus their efforts on population-dense areas, smaller communities are serviced by smaller format retailers as well as independent and specialty retailers. While sophisticated, transportation logistics can be relatively expensive moving East-West. As a result, product distribution channels routinely flow North-South, reinforcing the importance of imports from U.S. suppliers.

The Canadian food market displays a dichotomy of demand, one for low-priced quality foods and the other for premium and specialty food items. Some premium consumer-packaged food products are sold in Canada at three times the comparable U.S. retail price. Customarily, U.S. companies selling natural, organic, or specialty foods will create demand and sales among the independents before tackling larger accounts. Proven sales in Canada are important to help persuade category buyers to list new products.

List of Top 10 Growth Packaged Food Products in Canada:

1) Ready Meals/Dinner Mixes

2) Meat and seafood substitute

3) Prepared Salads

4) Fruit and nut bar

5) Dry Nuts, Seeds, Trail mixes

6) Vegetables, pulses, and bread chips

7) Energy drinks

8) Salty & Savory Snacks

9) Ready-to-drink Tea & Coffee

10) Nut and seed-based spreads

Foodservice Sector

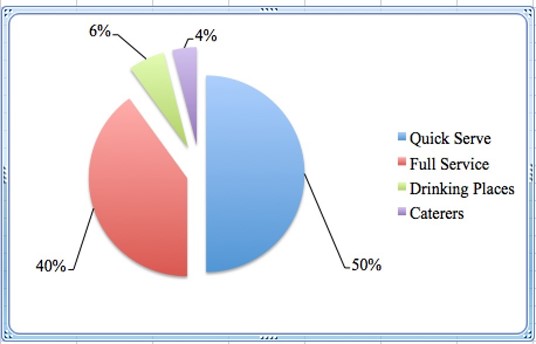

In 2022, total foodservice sales reached US$73 billion, a 17% increase over 2021. The foodservice sector is comprised of two major segments: commercial and non-commercial subsectors. The commercial foodservice subsector includes quick-service restaurants, full-service restaurants, caterers, and drinking establishments, representing 83% of the total foodservice sales or an estimated US$52.2 billion. The non-commercial subsector represents 17% of the total foodservice sales in Canada. This subsector includes tourism-related sales at hotels, accommodation food service, institutional, vending machines, and other entities.

A further look into the commercial sector shows that quick service establishments maintain the largest share of the market, followed by full-service restaurants. The pandemic changed the style in which customers order and eat, influencing buying behavior. Takeout, delivery orders, and fast foods increased by 27% in 2022. New mobile apps and third-party platforms, such as Doordash, Ubereats, and SkiptheDishes continue to gain popularity and are readily used by many Canadians across the country, particularly by Millennials and Gen Z’s.

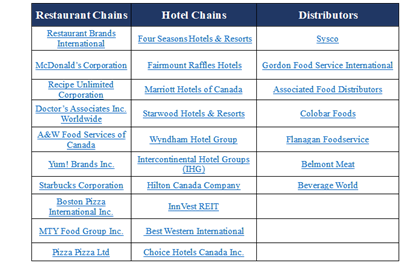

Sysco and Gordon Food Service remain the largest national foodservice distributors in Canada, representing approximately 40% of the market. Smaller regional and specialty commodity/product distributors also play an important role in meeting foodservice sector needs and presenting opportunities for special imported products, e.g. with Macgregors Meat and Seafood and the Cheese Boutique in Ontario, and Colabor in Québec and covering the Atlantic Provinces.

Below are the major restaurant, hotel and food service distributors:

The major trend in the foodservice sector is healthy choices, as more and more Canadians adopt a healthier lifestyle and demand health-conscious offerings, such as rice bowls and meatless menus. Another top trend is the continuing growth of ethnic foods, largely influenced by Canada’s growing diversity. Also, immune boosting products, such as smoothies with vegetables and dishes that use upcycled ingredients. Prospects for both commercial and non-commercial foods in 2023 look promising, as each has reached sales levels similar to pre-COVID-19 levels.

Food Processing Sector

Canada’s food processing industry has remained strong, and proves to be a viable export market, despite the lack of investment in the sector. In recent years, the sector faced additional strains associated with increased raw material cost, supply chain disruption, and labor shortages. Despite these challenges, Canada’s food processing industry ranks as the second-largest manufacturing sector in Canada in terms of value of production, with sales of goods manufactured worth US$156 billion in 2022 - a 10.6% increase over the previous year. This value is forecasted by Farm Credit Canada to reach US$160 billion in 2023.

Canada’s food and beverage manufacturing establishments are overwhelmingly small and medium-sized enterprises (SMEs), with less than 500 employees. Despite the large number of SMEs, large domestic and foreign-owned firms account for the majority of sales. Ontario and Québec account for the majority of the food processing sales, followed by British Columbia and Alberta. The sector gained approximately 20 new federal food processing facilities in the past decade compared to 4,000 in the United States in the same period.

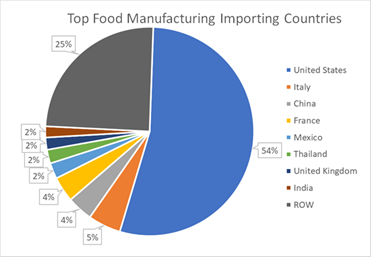

Imported ingredients are vital inputs to Canadian food and beverage manufacturers. Canada relies heavily on two-way trade with the United States and depends on it for its raw, semi-processed and processed ingredients. In 2022, food import volume grew more than five percent, with total dollars increasing 18%, year over year, of which U.S. exports make up the majority.

In 2022, the inflationary environment led to a change in consumer behavior. Consumer demand for convenient, healthy, and sustainably produced foods remains strong. However, affordability has become a more important selection criterion, especially for non-essential luxury food and beverage products. Canada’s changing demographic landscape, coupled with the increased price sensitivity of the average consumer is an opportunity for imported foreign food manufacturers to gain a larger segment of the market. The strength of the current U.S. dollar coupled with the current free trade agreement, advantages U.S. food and beverage manufacturers looking to enter the Canadian market.

Table 1: Global Top 10 Food Manufacturing Import by Food Category

|

Food Category |

Change in Ranking |

Leading Importing Countries |

|

Wine |

- |

France, Italy, USA |

|

Bakery Products |

- |

USA, Mexico, Italy |

|

Other Processed Foods |

- |

USA, China, Taiwan |

|

Chocolate |

- |

USA, Belgium, Switzerland |

|

Pet Food |

↑ |

USA, Thailand, China |

|

Dry Beverage (Coffee, tea, herbal, etc.) |

↑ |

USA, Switzerland, Italy |

|

Distilled Spirits |

↑ |

United Kingdom, USA, France |

|

Soft Drinks |

↓ |

USA, Switzerland, France |

|

Cooked and Prepared Shellfish |

↓ |

USA, India, China |

|

Baking Inputs |

- |

USA, Thailand, China |

Bakery products were one of the only categories to see volume growth at the grocery store level despite elevated retail prices. Margins for soft drinks and non-alcoholic beverages increased. Ready to drink, low- and non-alcoholic versions of traditional alcoholic beverages have been growing in popularity. In addition, caffeine beverages and energy drink sales volumes increased.

Table 2: U.S. Top 10 Food Manufacturing Import by Food Category

|

Food Category |

Change in Ranking |

|

Bakery Products |

↑ |

|

Other Processed Foods |

↓ |

|

Pet Food |

- |

|

Chocolate |

- |

|

Soft Drinks |

- |

|

Baking Inputs |

- |

|

Dry Beverage (Coffee, tea, herbal, etc.) |

↑ |

|

Condiments |

↓ |

|

Breakfast Cereal & Other Breakfast products |

↑ |

Opportunities

To ensure export success, the Foreign Agricultural Service in Canada (FAS) recommends exporters study the foodservice landscape well. FAS/Canada offers several Global Information Agricultural Network (GAIN) Reports, that provide further details on various sectors in Canada. These reports are at no cost to exporters and can be accessed at the bottom of the FAS/Canada webpage under Resources.

After studying the foreign market, individual companies are encouraged to inquire about the various export programs supported by USDA and administrated by the State-Regional Trade Groups (SRTGs) and other cooperators that specialize in a selected commodity, such as the Northwest Wine Coalition. The SRTGs provide one-on-one counseling and seminars to U.S. businesses on how to enter the Canadian market. Small-and medium-sized (SMEs) firms may qualify for financial support to promote their brands in Canada and other foreign markets around the world under these programs: Branded Program / CostShare Program / FundMatch Program. If a potential exporter’s products meet the minimum of 50% U.S. origin, then they are likely to qualify for these programs, which cover up to 50% of export costs, such as label modification, merchandising, along with exhibiting at Canadian shows and a small selection of U.S. trade shows. To learn more about these resources contact your international trade specialist with your State Department of Agriculture.

Some of the shows and export program opportunities offered by the SRTGs are:

- Participation in Canadian and selected domestic shows whereby 50% of the cost of the booth, booth displays, and Canadian travel (only) can be covered by registering in the above mentioned SRTG programs. Restaurants Canada, Toronto, Ontario (April 8 - 10, 2024), SIAL Canada, Toronto, Ontario (tbd 2024), along with the Restaurants Show in Chicago (May 18 – 21, 2024). The Foreign Agriculture Service (FAS) Canada will be offering Virtual Market Showcase (comprised of B2B meetings) that will be free of charge, except for shipping samples to Toronto this coming December.

- In-bound trade missions into the United States comprised of Canadian and other foreign buyers. This is an opportunity to meet one-on-one with potential interested buyers.

- Out-bound U.S. company missions (focused only on U.S. beverage and food products) to Canada with Canadian retail tours for participants to learn about the competitive landscape. The following day will focus on one-on-one meetings with Canadian buyers, arranged by SRTG’s Canadian Trade Representatives with technical knowledge on the food and beverage market in Canada.

- Financial support in creating a Canadian web page.

- Financial support in executing demonstrations in Canada and developing point-of-sale (POS) materials.

Resources

Main Trade Shows in Canada

Agriculture and Agri-Food Canada, USDA’s Canadian counterpart, maintains a list of trade shows on its webpage. FAS/Canada is providing funding support for U.S. companies to participate in the following trade shows:

- Canadian Health Food Association Trade Show

- Canadian Produce Marketing Association and Convention Show

- SIAL Canada

- Canadian Restaurant and Beverage Show

- Vancouver International Wine Festival

- National Women’s Show

- Live the Smart Way Expo

Useful Canadian Websites

The following is a listing of important Canadian institutions and their websites:

- Canada Border Services Agency

- Canadian Food Inspection Agency

- Global Affairs Canada

- Bank of Canada. Daily Currency Convertor

USDA’s Foreign Agricultural Service

For further information and for assistance in marketing U.S. agricultural and food products in Canada, U.S. exporters should contact:

Office of Agricultural Affairs

U.S. Embassy, Canada

P.O. Box 5000, Ogdensburg, NY 13669-0430

Telephone: (613) 688-5267; E-mail: agottawa@usda.gov