1) Information Technology (IT)

Overview

The Brazilian Information Technology (IT) market was valued at US$45.2 b in 2022, growing 3 percent from 2021, according to the International Data Corporation (IDC)’s 2023 Brazil Predictions study and a report by the Brazilian Association of Software Companies (ABES). Brazil ranks 12th in the world IT market and represents 36.5% of the Latin American market. The Brazilian IT market can be further delineated into market segments as follows:

Brazilian IT Market 2022 (US$ Million) | ||

Hardware | 24,680 | 54.5% |

Software | 11,666 | 25.8% |

Services | 8,897 | 19.7% |

Total | 45,243 | 100.0% |

Source: ABES

Note: The values refer to domestic Market, not considering export amounts.

The software market is driven by security, data management, artificial intelligence (AI), and customer experience (CX) solutions, and is expected to grow 15.1% in 2023. Half of the sales in software will be Software as a Service (SaaS), projected to increase by 27.6% in 2023. General IT services are estimated to grow 6.7% in 2023, specifically in application management, consulting, and systems integration.

Major software and services user segments include the service sector, telecom, financial services, industry, commerce, government, oil and gas, and agriculture. According to an ABES report, in 2022, spending increased the most in two user segments, government by 6.7%, and commerce by 18.3%.

Companies with know-how and technology in these areas are encouraged to establish partnerships with local Brazilian companies, as well as to participate in tenders and reverse auctions organized by the Brazilian government. To succeed in Brazil, U.S. companies must either be established in-country, or have a well-informed local representative. It is important to have a distributor or systems integrator that can offer post-sales and maintenance services, offering replacement parts and repairs. Whether introducing a product to the market independently, or entering with an existing local partner, it is necessary to have a well-designed market entry strategy to penetrate the Brazilian market.

Leading Sub-Sectors

Artificial Intelligence (AI)

The Brazilian Strategy for Artificial Intelligence (EBIA) aims to “contribute to the development of ethical principles for the progress and use of responsible AI; promote sustained investments in AI research and development; remove barriers to innovation in AI; encourage Brazilian AI innovation and development in an international environment; and promote an environment of cooperation between public and private entities and industry and research centers for the development of AI.” AI continues to mature in Brazil and is expected to exceed US$1b in spending in 2023 (33% increase year-over-year). Spending on Intelligent Process Automation (IPA) will exceed US$214m in 2023, an increase of about 17% from the previous year.

Security

According to ABES, security solution spending in Brazil will reach US$1.3b in 2023, representing a growth of 13% from 2022. IT and data security will continue to be a top priority. The Institutional Security Cabinet (GSI) instituted E-Ciber, Brazil’s National Cybersecurity Strategy, which provides guidance on cybersecurity, cyber defense, critical infrastructure, confidential information, and protection against data breaches. There is significant demand for cybersecurity solutions within all industries, representing a particularly promising opportunity for U.S. companies.

Internet of Things (IoT)

According to a study prepared by the Brazilian Association of Internet of Things (ABINC), in partnership with ISG Provider Lens, the total number of connected devices in Brazil could reach 27.1 billion by 2025. The study also notes that the market for services related to consultancy, implementation, and managed services for IoT has evolved and matured significantly since the publication of the Brazilian National IoT Plan.

Edge Computing

According to a report by Brasscom, the Brazilian Association of Information Technology and Communication Companies, the edge computing sector experienced a 16% increase, per year, between 2019 and 2023. The growth was primarily a result of advancement of 5G in Brazil.

Cloud

Cloud is a key element in Brazil’s IT infrastructure. In 2023, spending on Infrastructure as a Service (IaaS) plus Platform as a Service (PaaS) solutions will exceed US$4.5b, growing 41% from 2022. According to global research conducted by Gartner, cloud computing is expected to be used by 50 percent of companies by 2027.

Devices

The device market will represent 43.7% of all IT-based revenue in Brazil in 2023. The IDC estimates that the Brazilian devices market will generate a sum of US$21.5b in 2023, an increase of 1.1% from 2022. Despite its modest growth in 2023, the importance of devices for the total IT market in Brazil is significant. Smartphones will reach US$13b, computers US$5.8b, wearables US$882m, printers US$542m, and tablets US$464m.

Wearables

New wearable goods are always being introduced to anticipate trends and adapt to new consumer needs. This market is almost entirely based on retail sales to end users. According to IDC Brazil’s Tracker of Brazil Wearables in Q12023, wireless headphones increased with a growth of 45.3% in units sold. However, in terms of revenue, wearables (gray and official market combined) were estimated at US$180m, 19.7% less than in 2022.

Opportunities

By 2025, Brazil will be among the five largest markets in the world for smartphones, with approximately 200 million connections. The Government of Brazil has conducted several studies to improve the IT market and address challenges in Brazil’s adoption of its Digital Transformation Strategy. Their development of national strategies (such as the National IoT Strategy, the National Defense Strategy, the National Cybersecurity Strategy, the Digital Governance Strategy, the National Entrepreneurship and Startup Plan, and the National Artificial Intelligence Strategy) are designed to embrace the full potential of digital technologies to improve Brazilian productivity and competitiveness.

The creation of Brazil’s National Semiconductor Plan aims to promote the national semiconductor industry and the inclusion of Brazil in the international semiconductor supply chain. The plan has potential to stimulate and strengthen the existing IT industry, as well as attract new investors to the domestic market. The development of Brazil’s semiconductor industry may establish new avenues and resources for the U.S. semiconductor industry and create opportunities for U.S. companies in Brazil. Potential areas of focus may include cooperation on regulations, downstream production, and workforce development.

According to Brazilian regulations, IT products sold and used in Brazil must have a Certificate of Conformity issued by a Designated Certification Body (OCD), indicating compliance with federal regulatory requirements. This certificate must also be approved by Anatel, Brazil’s National Telecommunications Agency. The chosen OCD will examine the technical characteristics of the product and determine applicable certifications and approvals. Companies producing IT products should consult the list of OCDs designated by Anatel. Brazilian law requires manufacturers of imported products to have a local representative responsible for product supply and warranty within Brazil.

Resources

- Brazilian Association of Software Companies (ABES)

- Brazilian Association of Information and Communication Technology Companies (Brasscom)

- Ministry of Science Technology and Innovation

- The International Data Corporation (IDC) Brazil

- Gartner

- CISO Brazil

- Cybersecurity Summit

Contact Information

For more information, please contact the U.S. Commercial Service Industry Specialist at Patricia.Marega@trade.gov.

2) Telecommunications

Overview

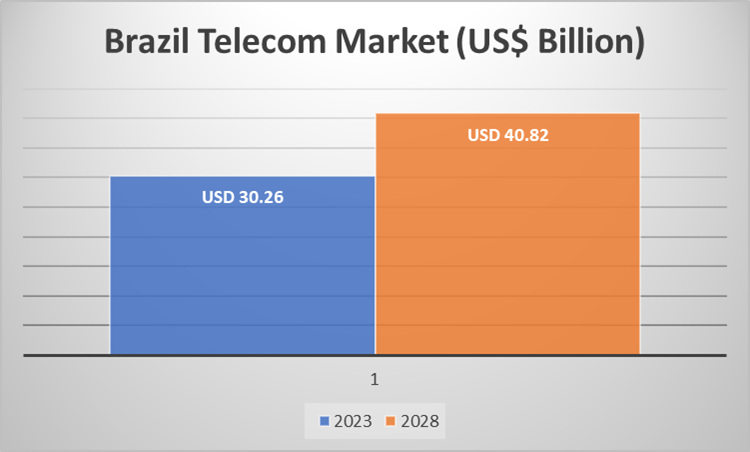

The size of the telecommunications market in Brazil is expected to grow from US$30.26 billion in 2023 to US$40.82 billion by 2028, according to a Mordor Intelligence Report.

According to Statista, Brazil is the fifth largest digital population in the world, with approximately 181.8 million internet users in January 2023. This number is expected to reach almost 190 million by 2027. The same study states that the average person spends 9 hours 32 minutes on the internet daily, across all devices, and about 5 hours 28 minutes on the internet daily via mobile phones.

Units: $ Billion / Source: Mordor Intelligence Report

Companies with know-how and technology in these areas are encouraged to establish partnerships with local Brazilian companies, as well as to participate in tenders and reverse auctions organized by the Brazilian government. To succeed in Brazil, U.S. companies must either be established in-country, or have a well-informed local representative. It is important to have a distributor or systems integrator that can offer post-sales and maintenance services, offering replacement parts and repairs. Whether introducing a product to the market independently, or entering with an existing local partner, it is necessary to have a well-designed market entry strategy to penetrate the Brazilian market.

Leading Sub-Sectors and Opportunities

5G

Brazil’s 5G spectrum auction was held in October 2021 and raised approximately US$8.5 billion. According to a recent study by Nokia and Omdia, deployment of 5G in Brazil could have a US$1.2 trillion economic impact and an increase in productivity of US$3 trillion by 2035. 5G spectrum auction winners are expected to meet various build-out obligations, including providing:

Coverage to 26 capital cities and the federal district by July 2022Coverage to all municipalities with >30,000 inhabitants by 20294G coverage to all towns with >600 inhabitants by 2028Deployment of optical fiber network backbone or backhaul networks to municipalities with >20,000 inhabitants by 2025, and to municipalities with <20,000 inhabitants by 2026Deployment of optical fiber networks covering federal highwaysDeployment of a private 5G secure network for exclusive use by the federal government

Brazil possesses a mature policy and regulatory environment for the telecommunications sector. The National Telecommunications Agency (Anatel) is the primary body responsible for regulating the sector.

According to the International Data Corporation (IDC), 5G will increase technologies like Artificial Intelligence (AI), big data & analytics, cloud, security, Augmented Reality (AR)/Virtual Reality (VR), robotics, and Internet of Things (IoT) by generating over US$25.5 billion in revenue in Brazil by 2025.

The Government of Brazil (GoB) continues to support the adoption and development of Open RAN. The government is helping drive telecommunications innovation and announced a US$12 million investment to develop an Open RAN competency center.

Additionally, the Government of Brazil’s (GoB) private government 5G network is currently being designed and presents potential opportunities for U.S. companies to participate. For the second phase of its development, the GoB expects to release a request for proposals (RFP) to contract the company that will construct the physical network, based on the design selected in the first phase. The GoB plans to have the network completed and running by 2026.

According to the Brazilian Association of Information Technology and Communication Companies, Brasscom, enterprise 5G and edge computing spending are likely to increase once 5G network services are introduced. According to the Mordor Intelligence report, the data center market in Brazil is projected to grow from US$2.1 billion in 2023 to US$3.03 billion in 2028. Brazil is the main data center market in Latin America, contributing around 50% of its investment to the region. Brasscom estimates US$86 billion in continued investment in mobile and connectivity projects in 2024. However, the cost of IT products will likely increase due to a potential year-long and global shortage of some components such as chips, semiconductors, and electronic components.

Mobile

According to a Deloitte report, Brazil will be among the five largest markets in the world for smartphones by 2025, with around 200 million connections. The GoB has conducted several studies to improve the information and communication technology (ICT) market and address challenges in Brazil’s adoption of its Digital Transformation Strategy.

The growing importance of mobile phones requires improvements in service delivery, particularly within developing countries, such as Brazil, where challenges and opportunities for expanding the existing infrastructure network are greater. Market expansion will require infrastructure investment and service improvements, and public investment has typically been required to service even the most remote areas of Brazil.

According to Brazilian regulations, ICT products sold and used in Brazil must have a Certificate of Conformity issued by a Designated Certification Body (OCD), indicating compliance with federal regulatory requirements. This certificate must also be approved by Anatel, Brazil’s National Telecommunications Agency. The chosen OCD will examine the technical characteristics of the product and determine applicable certifications and approvals. This is the list of Anatel approved OCDs. Brazilian law requires manufacturers of imported products to have a local representative responsible for product supply and warranty within Brazil.

Resources

Brazil’s Ministry of Communications (MCOM)

Brazilian Association of Software Companies (ABES)

Brazilian Association of Information and Communication Technology Companies (Brasscom)

The International Data Corporation (IDC) Brazil

Deloitte For more information, please contact the U.S. Commercial Service Industry Specialist at Patricia.Marega@trade.gov.