Overview

Brazil is the largest electricity market in Latin America, the world’s sixth-largest consumer electricity market and has the seventh largest electricity generation capacity in the world. The renewable energy sector accounts for 83% of the Brazilian electricity matrix, while the global average is around 25%. The renewable energy industry has continuously expanded over the years through private investment. Regulatory frameworks are being developed to develop new sustainable solutions in the coming decade to include green fuels, power storage, hydrogen, and offshore wind power projects. At the same time, Brazil is promoting policies toward a green transformation of the industrial sector, where the wide availability of renewable energy sources could play an important role in attracting international investment to the local manufacturing industry, including through green financing.

Brazil generates and transports electricity to over 88 million residential, commercial, and industrial consumers, more than the power produced by all other South American countries combined. Investments in the Brazilian electricity sector is expected to reach over $100 billion by 2029, including utility-scale generation, distributed generation, transmission, and distribution projects.

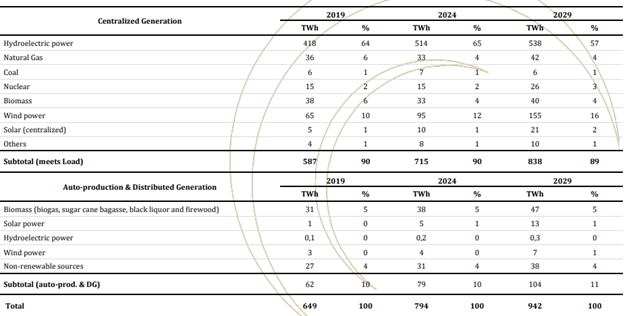

Brazil’s electricity matrix is one of the cleanest in the world and Brazil is committed to continuing its support for renewable energy projects. Large hydropower plants account for much of the domestic electricity generation, but continued expansion of hydropower is increasingly constrained by environmental concerns developing large projects typically in remote areas of the country. Solar projects (utility scale and distributed) will represent nearly 70% of all additional electricity in the coming years. Reliance on other sources for power generation is also growing, notably natural gas, wind (on-shore and off-shore) and bioenergy. The participation of wind generation is expected to reach 16% by the end of 2029, while solar generation is expected to double

SOURCE: EPE PDE 2029

Leading Sub-Sectors and Opportunities

Hydropower Generation

Hydropower has been the leading Brazilian energy source for electricity generation for several decades. This is due to its economic competitiveness and its potential at the national level. Brazil has a generating system with installed capacity of more than 150 GW, with most of the energy coming from hydro, due to Brazil’s abundance of powerful rivers. The Brazilian hydroelectric potential is estimated at 172 GW, of which more than 60% has been developed. Approximately 70% of the untapped potential is in more remote, protected areas of the country including the Amazon.

Thermal Power Generation

Thermoelectric power generation can use different fuels: natural gas, biomass, coal, nuclear, fuel oil and others. Depending on the type of fuel and the generation technology, they can fulfill different roles, from base-load generation to back-up generation for renewables or serving peak demand. Considering the relevance of hydropower in Brazil, thermal power plants have been operating significantly during periods of critical hydrological conditions. Besides that, with the increasing importance of wind and solar power plants in the power system, it is more likely that thermal power plants will act to compensate the generation variability of these sources in the short-term. In the case of bioelectricity, Brazil is the second largest producer globally of ethanol from sugarcane.

Wind Energy Generation

Wind power generation in Brazil is expected to reach 29 GW by the end of 2023, according to the Brazilian Wind Power Association (ABEEOLICA). Brazil has 890 wind farms operating across 12 Brazilian states. Of these, 85 percent are in the country’s Northeast region. By 2028, Brazil is expected to have over 44 GW of installed wind power capacity, accounting for 13.2 percent of the Brazilian electricity matrix.

Solar Power Generation

In 2023, solar power, when including distributed generation, became the second largest source of electricity in Brazil, surpassing wind power. New long-term solar energy developments may potentially rival investments in wind power. Utility scale solar energy in Brazil increased 40.9% in 2021, while distributed generation from solar increased 84%. Investments in utility-scale solar energy projects that have already been approved amount to more than $20 billion. An additional $1 billion has been invested in solar distributed generation since 2012. This amount is expected to increase exponentially in the next several years.

Other Sources of Generation

While Brazil still has vast areas for the development of additional solar and onshore wind projects, several potential offshore wind projects have been announced. Implementation of these projects is dependent on further regulation and definition on bidding and leasing procedures by the Ministry of Mines and Energy (MME) and the National Electric Power Agency (ANEEL). If successful, these projects will greatly increase the potential to decarbonize Brazil’s industrial and transportation sectors, as well as potentially lead to green hydrogen exports.

Transmission

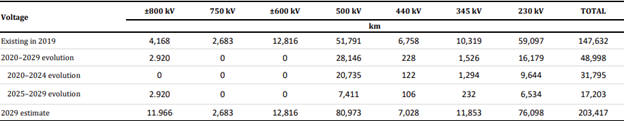

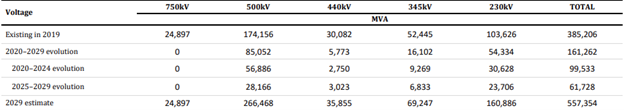

Brazil has an extensive and complex transmission system, reflecting the continental dimensions of the country, the spatial dispersion of production sources - especially hydraulic sources - and the distances between large load centers. Transmission has the essential role of integrating sources of production and consumption, often acting as a virtual generator. According to the 10-year expansion plan (PDE 2029) published by Brazilian Energy Research Agency (EPE), Brazil is expected to invest US$ 20 billion in the electricity transmission sector until 2029, of which US$ 14 billion in transmission lines and US$ 6 billion in substations.

Expansion of Transmission Line

Source: EPE PDE 2029

Expansion of Substations

Source: EPE PDE 2029

Distribution

Private firms owned by foreign investors prevail in this segment. Large international companies operating in this market include Spanish firm Ibedrola and Italian company ENEL. This segment sees annual investment of around $4 billion per year, 69% of which is in expansion, 19% in improvement and 12% in renewal of distribution networks. This power distribution sector is undergoing a technological revolution with the introduction of energy storage associated with the growth of distributed generation, mainly solar, plans for electrification of the transportation sector, and the expansion of a deregulated electricity market.

Specific sector opportunities include:

- Data analytics

- Control and automation systems

- Data loggers and acquisition systems

- Monitoring/testing/inspection systems

- Remotely operated vehicles

- Digital power plants

- High efficiency turbines capable of integrating with renewable resources.

- Rehabilitation/repair/maintenance/upgrading services.

- Weather instruments and meteorological equipment

- Microgrid solutions

- Residential, commercial, and industrial energy efficiency solutions

- Energy storage

- Distributed energy resources management and control

- Transmission and distribution automation

- Enterprise grid management

- Cybersecurity and incident response solutions

- Customer engagement solutions

- Smart metering: smart grid software and analytical packages; advanced metering infrastructure

- Electric vehicle infrastructure

- Vehicle-to-grid technology

- Off-grid solutions

- PV + Storage

- Hybrid Systems

- Blockchain

- Technical and environmental consulting services

- Engineering services

- Data and weather analytics

Resources

Key Associations and Government Agencies

- Brazilian Wind Power Association (ABEEOLICA)

- Brazilian Solar PV Association (ABSOLAR)

- Brazilian Association of Electric Power Distribution Companies (ABRADEE)

- Brazilian Association of Large Electric Power Transmission Companies (ABRATE)

- Brazilian Cogeneration Association (COGEN)

- Brazilian Energy Research Agency (EPE)

Major Trade Shows

- The Smarter E South America (Intersolar) Sao Paulo – August 27 – 29, 2024

- Brazil Windpower Show & Conference Sao Paulo - October 22 – 24, 2024

For additional information about Brazil’s electricity and renewable energy sectors, please contact: igly.serafim@trade.gov