Overview

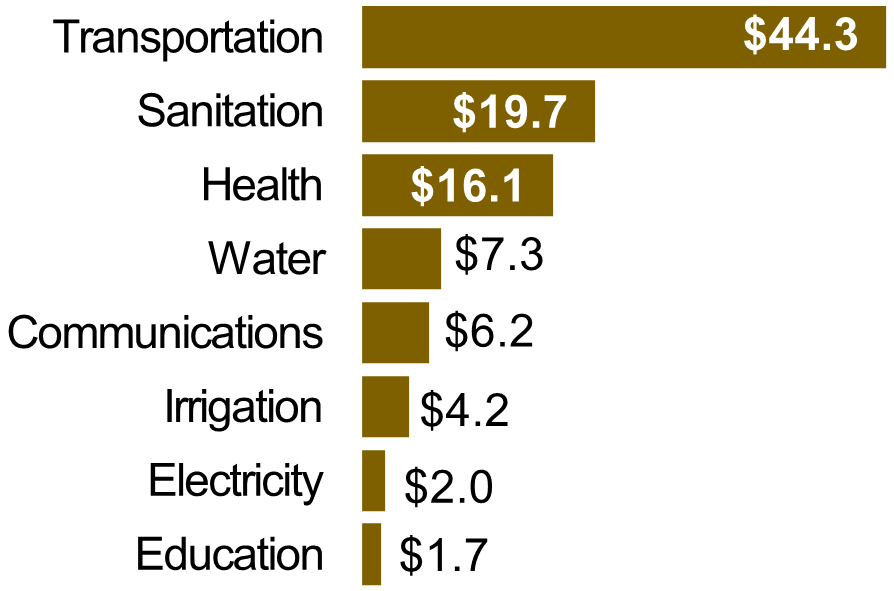

In 2019, Peru launched its most recent National Infrastructure Plan (PNIC), which seeks to fill a $110 billion long-term infrastructure gap from 2019 through 2038. The shortfall spans almost every sector including transportation (44 percent), sanitation (20 percent), healthcare (16 percent), water (nine percent), telecommunications (six percent), hydraulic (four percent), electricity (two percent), and education (2 percent). Within the PNIC, the GOP prioritized 52 infrastructure projects totaling $28.5 billion with a goal for completion by 2025. Two-thirds of the priority projects are in the transportation and communications sectors, and they include clearing the Amazon waterway, building a ring road around the Lima metropolitan area, expanding Jorge Chavez International Airport, improving broadband access in the Piura region, and enhancing irrigation systems in the La Libertad region.

Opportunities

Long-Term Infrastructure Gap (Billions USD)

Peru seeks robust investment in infrastructure, utilizing a variety of mechanisms to ensure continuity, including traditional public works, public-private partnerships (PPPs), Works for Taxes (OxI), and government-to-government (G2G) agreements. In 2022, the Government reduced the amount of money awarded through Works for Taxes by 26 percent, while the number of projects increased from the previous year, posing a challenge for the program. Peru utilizes PPPs in various projects from construction to operation to maintenance, with the property reverting to government control at the end of the contract. ProInversion, Peru’s investment agency, seeks to attract foreign investment, primarily in infrastructure, and lists all available PPP projects on its website.

Road Network

The National Road Network, managed by the Ministry of Transport and Communications (MTC) and Provías Nacional, involves studying, constructing, and maintaining a 25,530 km system of highways (built and planned) comprising 120 routes. According to the Peruvian Economics Institute (IPE), in the early 1990s, less than 25 percent of main highways were paved, which caused excessive transportation delays and numerous accidents.

To address this, Peru developed a concession model to improve the connectivity of logistics corridors. According to the Transport Infrastructure Investment Supervisory Body (Ositrán), since 2003, the GOP has awarded 16 road concessions leading to $4.8 billion in private investment and the construction of 2,163 km of highways and the initial development/maintenance of another 4,057 km. In the last three decades, these public-private partnerships helped double the percentage of the national road network that is paved to almost 84 percent.

Telecommunications

In Peru, there are thirty telecommunications companies responsible for transmitting telephone, internet, and television signals through a 13,500 km fiber optic network. 1,096 entities provide public telecom services. In the past five years, cellphone and internet subscriptions have risen by 33 and 46 percent, respectively. Ninety-five percent of households in Lima and 89 percent nationally now have at least one cell phone. 76 percent of Peruvians now have internet access versus just under 20 percent in 2012. Many projects are in the works, including a concession for high-speed internet broadband; however, the Government’s planned 5G spectrum auction has been delayed numerous times.

Water and wastewater

In Peru, municipalities manage the water sector but generally have difficulty maintaining water utilities. The infrastructure gap in water and wastewater is $15 billion. Therefore, the Government has developed a strategy to streamline processes and regulations regarding investment, financing, and management.

Challenges

Those wishing to implement projects in Peru face legal and regulatory hurdles, land access issues, and limited government capacity. High ministerial turnover, common even in stable times, can also stall projects. Taken together, these challenges raise doubts about Peru’s ability to meet its PNIC goals, as well as increase the risk of developers abandoning projects mid-construction. To bid on public infrastructure tenders, international firms not based in Peru must register with the National Registry of Suppliers (RNP) from the Supervising Agency of the Government Procurement (OSCE).

Resources

Expo Agua 2023

Oct. 4-6, 2023

Jockey Plaza Convention Center

Excon 2023

Oct. 18 -21, 2023

Jockey Plaza Convention Center