Overview

There are untapped potential opportunities for U.S. companies, products, modern technology, and equipment to explore this industry. Pakistan generates approximately 49.6 million tons of solid waste a year, which has been increasing more than 2.4 percent annually. Similar to many other developing nations, Pakistan faces a challenge in terms of waste management infrastructure, resulting in significant environmental issues. The majority of municipal waste is disposed of through burning, dumping, or burying in empty areas, posing risks to the overall health and well-being of the population.

According to government estimates, around 87,000 tons of solid waste are produced every week, with a majority coming from key cities. Karachi, the largest city in Pakistan with an estimated population of 20 million people, generates over 16,500 tons of municipal waste daily.

All major cities face enormous challenges on how to manage urban waste. Bureaucratic hurdles, lack of urban planning, inadequate waste management equipment and technology, and low public awareness contribute to the problem.

Existing Solid Waste Management System in Pakistan

Local and municipal governments are responsible for collecting waste throughout most of Pakistan’s major cities. In cities, about 60–70% of solid garbage is collected. The garbage collection fleet typically is comprised of open trucks, tractor/trolley systems, and arm roll containers/trucks for secondary collection and transfer. Handcarts and donkey pull-carts are used for primary collection. Some municipalities hire street sweepers and sanitary workers to augment other collection methods. They use wheelbarrows and brooms to collect solid waste from small heaps and dustbins, then store it in formal and informal depots.

Karachi makes use of three sanitary landfill sites, whereas Lahore, the country’s second-largest city, has two such sites. There are plans to construct appropriate landfill sites in other major cities as well. In several regions, solid waste is disposed of outside the boundaries of the urban areas.

Solid waste management capabilities and systems vary by province. In Punjab, Lahore is the only city with a proper solid waste management, treatment, and disposal system, which was outsourced to Turkish companies Albayrak and OzPak. Similar systems are planned for secondary cities in Punjab province. In Sindh, Sindh Solid Waste Management Board (SSWMB) aims to improve solid waste management services in 20 cities, and regularly announces tenders for a wide range of waste management projects in the province. In Khyber Pakhtunkhwa, the Water and Sanitation Services Peshawar (WSSP) is planning to build a sanitary landfill. Balochistan, Pakistan’s largest province by area but with a sparse population of 6.9 million, has no significant infrastructure for waste management.

Much of Pakistan’s solid waste is retrieved for recycling, primarily by scavengers, before it ever reaches disposal locations, and a large portion of the country’s solid waste never makes it to final disposal sites.

Solid Waste Generation in Major Cities

| City | Population in millions | Solid waste generation/day (in tons) |

| Karachi | 20,500,000 | 16,500 |

| Lahore | 10,000,000 | 7,690 |

| Faisalabad | 7,500,000 | 5,017 |

| Rawalpindi | 5,900,000 | 4,500 |

| Hyderabad | 5,500,000 | 3,973 |

| Multan | 5,200,000 | 3,680 |

| Gujranwala | 4,800,000 | 3,480 |

| Sargodha | 4,500,000 | 3,072 |

| Peshawar | 2,900,000 | 2,048 |

| Quetta | 600,000 | 716 |

Source: Mr. Saadat Ali, USCS Pakistan contact from Project Procurement International, Pakistan

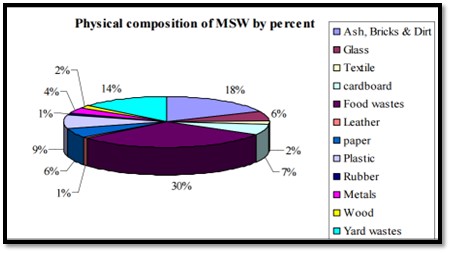

Composition of Municipal Solid Waste (MSW) in Pakistan

Source: United Nations Environment Programme, report on waste management in Pakistan

Ash, bricks, and dirt – 18%, Glass – 6%, Textile - 2%, Cardboard - 7%, Food wastes - 30%, Leather - 1%, Paper - 6%, Plastic - 9%, Rubber - 1%, Metal - 4%, Wood - 2%, Yard wastes - 14%.

Leading Sub-Sectors

Equipment: Waste collection and transportation

- Waste to energy plants and equipment

- Biofuel

- Waste recycling plants

- Industrial and municipal wastewater treatment machinery

- Chemicals: To remove waste odor for open landfill sites all over the country

- Instrumentation

- Biohazard waste equipment

Opportunities

The local market has shown moderate growth in terms of volume and FDI contribution over the past few years. Both the public and private sectors have or will initiate small- medium scale projects related to collection, transportation and management of municipal and industrial waste. According to industry experts, the local market will continue to offer sizeable business opportunities to local and foreign companies for the foreseeable future.

The National Electric Power Regulatory Authority (NEPRA) has announced a competitive upfront tariff of U.S. $.10007/kWh for waste-to-energy projects based on a 25-year operational period.

For potential tender opportunities, please check the following websites:

Resources

Private Power and Infrastructure Board

Environmental Protection Department

Other Resources

- Local industry contacts

- Sindh Solid Waste Management Board (SSWMB)

- Environmental Protection Agency (EPA)