Overview

Table 1: Total Market Size - eCommerce Unit: USD millions

|

|

2019 |

2020 |

2021 |

2022 estimated |

|

Local Production |

Data Unavailable |

Data Unavailable |

Data Unavailable |

Data Unavailable |

|

Exports |

Data Unavailable |

Data Unavailable |

Data Unavailable |

Data Unavailable |

|

Imports |

Data Unavailable |

Data Unavailable |

Data Unavailable |

Data Unavailable |

|

Imports from the U.S. |

$ 2,603 |

$2,796 |

$ 3,100 |

$3,420 |

|

Market Size |

$176,008 |

$175,254 |

$ 188,136 |

$210,246 |

|

Exchange Rates |

Yen 110 |

Yen 110 |

Yen 110 |

Yen 110 |

Market size = local production + imports – exports

Data Sources: Ministry of Economy, Trade and Industry’s eCommerce Market Survey; Ministry of Internal Affairs and Communications Survey of Household Economy

Table 2: Japan eCommerce at a Glance

|

B2C eCommerce Market Size 2021 |

Japan’s Ranking in World eCommerce Market |

B2B eCommerce Market Size 2021 |

Increase in Online Sales of Goods Caused by COVID-19 |

Japanese Customers’ Principal Online Shopping Concerns |

|

USD $188.1 Billion |

4th Largest |

$3.4 Trillion |

32.2% |

PII and Safety |

Source: eCommerce Market Survey 2021 by Japan’s Ministry of Economics, Trade and Industry

Market Size and Growth Rate

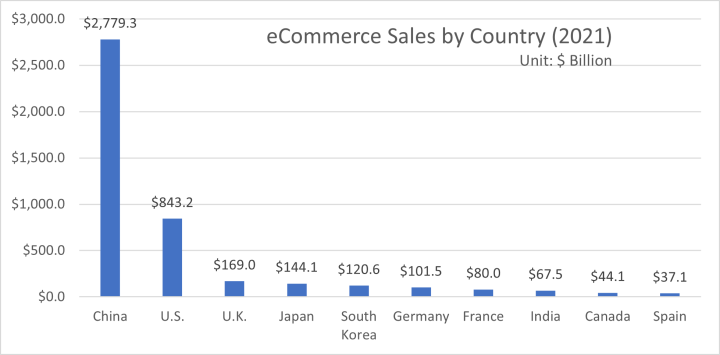

Japan is the world’s fourth largest eCommerce market after China, the United States, and the United Kingdom. In August 2022, Japan’s Ministry of Economy, Trade and Industry (“METI”) released its annual eCommerce Market Survey showing that Business-to-Consumer (“B2C”) eCommerce sales of goods grew by 8.6% in 2021 compared to the previous year, estimating the total B2C eCommerce market at USD $188.1 billion. Compared to pre-COVID 2019, B2C sales of goods grew by 32.2%.

The survey further reported that Japanese consumers engaged in USD $3.1 billion worth of cross-border online shopping from U.S. outlets in 2021, an increase of 9.3% from the previous year, indicating that Japanese consumers are buying more products not only from Japanese online stores but also from U.S. online retailers as well. Japan’s Business-to-Business (“B2B”) eCommerce market is estimated at $3 trillion based on the total of all commercial transactions between companies in all industrial categories in Japan.

Chart 1: 2021 Retail eCommerce Sales (in $Bn)

Source: eMarketer

Consumption Pattern Changes During COVID-19

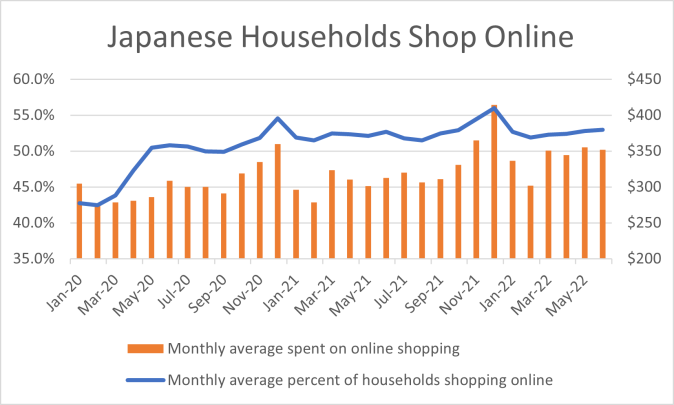

According to the Survey of Household Economy conducted by Japan’s Ministry of Internal Affairs and Communications (“MIC”), the number of Japanese households shopping online has grown steadily over the past four years: 35.9% in 2018; 39.4% in 2019; 44.4% in 2020; and 47.8% in 2021. MIC estimates that in December 2021, 56% of Japanese households shopped online. Although December is the busiest month in the Japanese retail industry, this is the highest number recorded in the survey. By comparison, a pre-COVID survey estimated that 49% of Japanese households shopped online in December 2019.

Another noteworthy trend is the rise of senior citizens shopping online. In 2020, 36.8% of households with heads of household older than 65 years old shopped online compared to. 26.3% in 2019.

As the B2C eCommerce market has expanded due to the COVID-19 pandemic, a current challenge involves the high redelivery rate. An estimated 20% of all delivered packages are redelivered, creating delivery burdens for logistics companies.

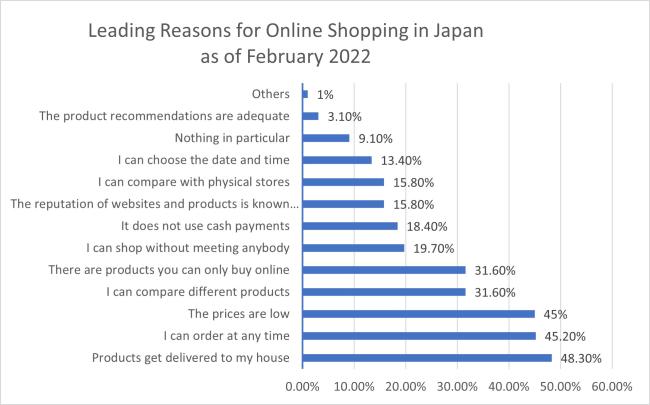

According to a February 2022 survey in Statista’s B2C Japan eCommerce report, the top three benefits of online shopping for Japanese consumers are: (1) goods are delivered to doorsteps (48.3% of respondents); (2) orders can be made at any time (45.2% of respondents); and (3) prices are lower (45% of respondents). The report predicts that the number of households that shop online will continue to increase after Japan’s COVID-19 measures abate.

Chart 2: Japanese Households Shop Online: 2015-2021

Chart 3: Japanese Households Shop Online: Jan. 2020-May 2022

Chart 4: Leading Reasons for ONline Shopping in Japan

Source: B2C eCommerce in Japan report by Statista

MIC’s 2021 Communications Usage Trend Survey showed that 88.6% of Japanese households have smartphones and that approximately 90% of Japanese individuals between the ages of 20 and 49 use smartphones to access the internet. With more Japanese residents using smartphones, an increasing number of consumers are naturally shopping online using mobile devices. As a result, according to METI’s 2021 eCommerce Market Survey, 52.2% of Japan’s online sales of goods were completed by smartphones. With more Japanese working remotely online following the pandemic, and the increased adoption of smartphones, the Nomura Research Institute expects that Japan’s eCommerce market will grow to $255 billion by 2026.

Rakuten, Japan’s largest online marketplace, stated that its gross merchandise sales (“GMS”) grew by 45.2% in 2020. With an 11.7% year-on-year growth, Rakuten enjoyed revenues of 5 trillion yen, approximately $45.5 billion in domestic eCommerce GMS by the end of 2021, with a GMS increase of 37.7% in food and beverage and an increase of 42.4% in home and life products.

During the COVID-19 pandemic, the concept of Buy Online Pick-up In Store (“BOPIS”) also gained in popularity with leading Japanese retailers offering BOPIS services to consumers that wanted to minimize time spent at physical outlets.

Popular eCommerce Payment Methods

-

Credit Cards, Convenience Stores, and Payment on Delivery

According to a survey conducted in 2020 by SB Payment Service, 78.5% of Japanese consumers used credit cards (including debit cards) for online purchases.

While credit cards are Japan’s most popular payment method, many Japanese residents pay for products ordered online at convenience stores. Japan has almost 56,000 convenience stores, and most of these outlets are open 24 hours every day of the week. Payment at convenience stores is a popular option for consumers who do not have credit cards and who are away from home during the daytime. After placing an order online, a consumer can receive a payment slip with a barcode or payment number from the vendor. The consumer can then go to the convenience store and pay for the ordered product at the counter by cash or pay at a payment kiosk. For example, Lawson’s Japanese convenience store has a payment kiosk called the “Loppi Machine.”

Payment on delivery is also popular; almost 12.4% of buyers use this payment method. Considered unique to Japan, payment on delivery involves the delivery service driver collecting payment for ordered product(s) at the time of delivery. There is a small charge for this service, usually $2.00-$3.00. Payment on delivery is principally used by consumers who do not have a credit card, prefer paying by cash, and who are generally at home during most of the day.

-

Japan’s Points System

Beyond eCommerce, Japan’s points system has become a popular method of payment that builds customer loyalty. The points system allows shoppers to earn points on purchases that can later be used towards discounted items. This payment method has been successful in Japan as it draws in more customers and incentivizes them to continue making purchases to earn more points and greater discounts. According to CCC Marketing’s 2017 survey on point cards, every consumer had on average 20.9 point cards in his or her wallet. The survey also reflected that more than 90% of these consumers use points to receive rewards.

A survey by private software developer JustSystems reflects that 46.8% of online shoppers in Japan say they prefer visiting specific eCommerce sites because they offer the ability to earn points. Online B2C platforms often run special time-limited campaigns and offer additional points to attract new customers. The resources for points reward programs are mostly funded by the online marketplace platform, but merchants must cover a portion of the expenses as well. For example, Rakuten charges merchants 1.0% of their sales so that profits can be used to fund points systems.

Cross-Border eCommerce

-

Global Cross-Border Market

Polaris Market Research reported in February 2022 that the size of the global cross-border B2C eCommerce market was valued at USD $764.73 billion in 2021 and is expected to grow at a compound annual growth rate (“CAGR”) of 26.2% until 2030, reaching a market value of USD $5.2 trillion.

Cross-Border eCommerce is certainly one of the ways U.S. businesses can expand their markets globally. As for why digital shoppers buy from foreign countries, a survey by PayPal Cross-Border Consumer Research listed the following top four reasons:

(a) better prices (72%);

(b) access to items not available in the purchaser’s country (49%);

(c) access to new and interesting products (34%); and

(d) high product quality (29%).

According to the same survey, top cross-border products among online shoppers include the following: clothing/apparel/footwear (68%); consumer electronics (53%); toys and hobbies (53%); jewelry/watches (51%); cosmetics (46%); and sports/outdoor equipment (40%).

2. Japan’s Cross-Border Market

Japan’s cross-border eCommerce market is still considered to be small in scale. METI’s 2021 eCommerce Market Survey estimates that cross-border eCommerce between Japan, the United States, and China approximated USD $3.4 billion in 2021. This is just 1.7% of Japan’s domestic B2C eCommerce market. Japanese cross border purchases from the United States were estimated at USD $3.1 billion in 2021, marking an increase of 9.1% from 2020.

Table 3: Japan’s Cross-Border eCommerce from U.S. and China

|

2019 |

2020 |

2021 |

|

|

From China |

$0.3 billion |

$0.3 billion |

$0.3 billion |

|

From U.S. |

$2.6 billion |

$2.8 billion |

$3.1 billion |

|

Total |

$2.9 billion |

$3.1 billion |

$3.4 billion |

Source: METI eCommerce Market Survey 2021

Cross-border eCommerce could be an option for U.S. companies to sell directly to Japanese consumers. In some cases, testing/licensing is not required if the items being shipped are for personal use and the quantity and size are limited. For example, shipments of certain cosmetics that are standard in size and less than 24 pieces per product do not require testing and licensing. Also, imported goods currently valued at less than USD $150, including shipping and insurance, are often exempt from customs duties. However, attracting Japanese consumers is key, and the International Trade Administration’s Global Market eCommerce Lab offers various information on Cross-Border eCommerce strategies: https://www.trade.gov/ecommerce.

Leading Sub-Sectors

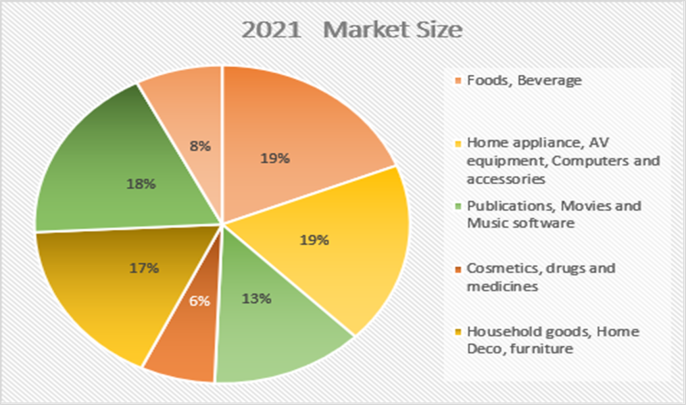

METI’s 2021 eCommerce Market Survey reports that the following products sold well online:

(1) food and beverage; (2) home appliances, including personal computer-related products and accessories; (3) apparel and fashion accessories; and (4) household goods and furniture. These four segments totaled more than $18 billion in sales, accounting for approximately 73% of the total market.

Table 4: Market Size of B2C eCommerce (Goods)

|

|

Sales in 2021 |

Growth |

EC Rate |

|

Food, Beverages, and Alcohol |

$22,908 |

14.1% |

3.77% |

|

Home Appliances, AV Equipment, PCs, and Accessories |

$22,349 |

4.7% |

38.13% |

|

Apparel and Accessories |

$22,072 |

9.4% |

21.15% |

|

Household Goods, Home Decor, Furniture |

$20,684 |

6.7% |

28.25% |

|

Total |

$120,786 |

8.6% |

8.78% |

Source: METI’s 2021 eCommerce Market Survey

Chart 5: Japan’s eCommerce Market Share by Category-2021 Market Size

Source: METI’s 2021 eCommerce Market Survey

Opportunities

Leading B2C eCommerce Platforms in Japan

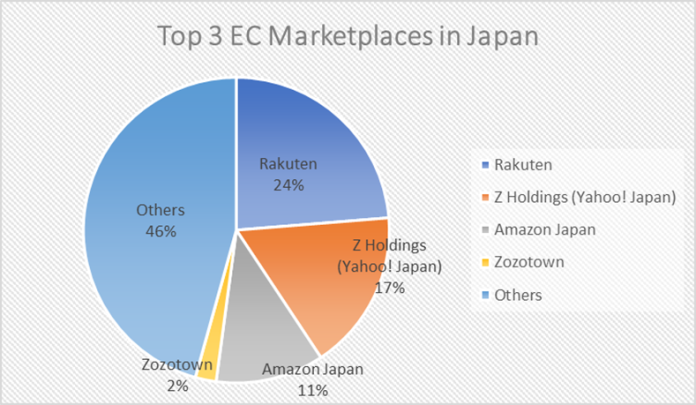

Rakuten, Amazon Japan, and Yahoo! Shopping are the major online shopping platforms in Japan.

Rakuten is the largest online shopping platform with more than 100 million registered members. Its gross merchandise sales (“GMS”) exceeded USD $45 billion in 2021. By comparison, in the same year, the GMS of Yahoo! Shopping was $8.9 billion, whereas the 2021 Q4 report of Amazon showed that net sales attributed to Japan including Amazon Web Service were $23 billion. (Amazon does not disclose its exact GMS figures).

Research shows that Japanese customers visit Amazon.co.jp with specific products in mind, whereas customers at Rakuten and Yahoo! explore various product categories. At this moment, only Fulfillment by Amazon (“FBA”) and Rakuten are options for U.S. companies to sell in the Japanese market without having a physical presence in the country.

Websites of the eCommerce platforms in Japan:

- Rakuten (https://www.rakuten.co.jp)

- Amazon Japan (https://www.amazon.co.jp)

- Yahoo! Shopping (https://shopping.yahoo.co.jp)

Options for Entering the Japanese B2C eCommerce Market

If you are new to the Japanese market, you will need to consider how you want to operate your business in Japan and develop strategies specifically for the Japanese market. For example, do you want to work with a Japanese partner? Or do you want to manage all business functions and establish a Japanese subsidiary in the future?

-

Cross-Border eCommerce

The option that requires the least resources and risks may be cross-border eCommerce, which is to receive orders from Japanese consumers at your U.S. establishment and ship the order directly to the consumers. By sending products directly to Japanese consumers, you may avoid certain Japanese testing and licensing import requirements that apply for goods shipped from the United States to a Japanese distributor. However, developing a strategy to attract Japanese consumers will be critical to your success. Offering language assistance, such as providing Japanese-language webpages and offering customer service in Japanese, will make it easier for Japanese online shoppers to do business with you.

-

Listing Products on Japanese Online Marketplaces

U.S. companies have two options for listing products on a Japanese online marketplace without a partner in Japan: Fulfillment by Amazon and Rakuten.

Amazon offers two selling plans. The first is a professional selling plan available for a USD $38 monthly subscription fee plus per-item referral fees. The second is an individual plan appropriate for sellers who want to list fewer than 50 items per month. There is no monthly subscription fee. Instead, individuals pay about USD $1.00 per item sold plus referral fees. There may be additional fees for order fulfillment, storage, and other optional services.

Rakuten charges a fixed registration fee as well as various service charges based on a company’s or individual’s volume of sales. In addition, marketing to bring Japanese customers to your product listing or digital storefront is essential.

We strongly recommend that U.S. companies consider these additional costs when they set a retail price for their products on the Japan online platforms. In addition, please note that if a U.S. company starts selling directly to Japanese consumers through eCommerce channels, it will be difficult to find a distributor later. One of a potential Japanese distributor’s major concerns in entering a commercial relationship with a U.S. seller will be end-user pricing and the impact on distributor mark-ups.

- Fulfillment by Amazon: https://sell.amazon.com/global-selling/japan

- Rakuten – Start selling in Japan: https://marketplace.rakuten.net/

3. Establishing Your Own Japanese Language Website and Online Store

U.S. companies may want to develop their own websites for the Japanese market to fully control their brand images, marketing, and business development strategies for Japan. However, U.S. companies need to make a strong commitment to the Japanese market as it will require significant time and resources. For example, U.S. companies need to hire someone in Japan or hire service providers to undertake the following activities:

- develop a localized website in the Japanese language;

- run necessary marketing campaigns, such as search engine optimization (“SEO”) campaigns;

- serve as an importer of record in Japan to carry out various duties like clearing Japanese customs;

- manage domestic logistics, including operations and costs for warehousing and fulfillment; and

- provide customer service to consumers.

Resources

Specified Commercial Transactions Act

U.S. companies interested in the Japanese eCommerce market are expected to abide by Japan’s sales rules and regulations. For example, Japan’s Specified Commercial Transactions Act, regulated by the Consumer Affairs Agency, applies to all B2C eCommerce businesses. The purpose of the Specified Commercial Transactions Act is to protect consumers from business operators’ illegal or malicious solicitations and requires sellers to clearly disclose the price of products, shipping costs, payment methods, and any other costs for which consumers are responsible. The Act also requires online sellers to list the seller’s name, company/store name, street address, phone number, and person in charge of the online business.

Detailed information about the Specified Commercial Transactions Act can be found at the following link: https://www.no-trouble.caa.go.jp/foreignlanguage/english/index.html

Additional Laws and Regulations

Imported products for resell in Japan must comply with all applicable Japanese laws and regulations. The following are examples of Japanese laws applicable to consumer goods:

- The Electrical Appliance and Material Safety Act (electrical appliances)

- The Household Goods Quality Labeling Act (textiles and apparel products)

- The Consumer Product Safety Act (electrical appliances, gas appliances, and general consumer products)

- The Pharmaceutical Affairs Act (medicine, cosmetics)

Directory of Business Service Providers

The American Chamber of Commerce in Japan has a directory of business service providers on its website. In addition, Amazon’s Service Provider Network also has listings of various service providers that can help U.S. companies sell online in Japan. Links to these resources are provided below.

U.S. Commercial Service Japan Contact

For more information about eCommerce developments in Japan and related opportunities for U.S. firms, please contact the U.S. Commercial Service at Office.Tokyo@trade.gov or Ms. Hirono Taki at hirono.taki@trade.gov.