Overview

Portugal’s economy is fully integrated into the European Union (EU). Fellow EU member states remain Portugal’s biggest trading partners and its largest investors.

The automotive sector in Portugal consists of 32,200 companies that manufacture automobiles and components, create 152,000 direct jobs, and generate a business volume of 33.7 billion euros, equivalent to 21% of the total fiscal revenues in Portugal. This sector accounts for 11% of total exports from Portugal. Portugal hosts over 220 automotive supplier companies and four major car manufacturers—Toyota/Salvador Caetano, PSA Peugeot Citroen, Mitsubishi Trucks, and Volkswagen AutoEuropa.

Interface and Industria 4.0 are two public programs with incentives to support innovation in the sector.

Automobile exports are a cornerstone of Portugal’s economy, with a well-established reputation for crafting high-quality vehicles. In 2022, over 96% of the country’s produced vehicles, over 300,000, were exported, affirming Portugal’s standing as a key player in automotive exports. Portugal’s success is attributed to its strategic location, technological investments, skilled workforce, and fiscal incentives. Apart from major brand factories, Portugal is home to numerous small and medium-sized enterprises specializing in manufacturing automotive components. As mentioned above, noteworthy are the fiscal incentives offered by the Portuguese government to foreign companies, fostering investments in this sector. As the global automotive industry shifts towards electrification and sustainable mobility, Portugal must align with these trends. Prioritizing the production of electric vehicles and researching sustainable technologies are focal points for Portuguese factories, aiming to tap into new export opportunities amidst the growing global demand for electric vehicles.

Automotive production is a significant industry in Portugal, with national importance for employment and exports. Annual vehicle output surpassed 340,000 units for the first time in 2019, mainly owing to the performance of the Volkswagen Group (Germany), the largest vehicle producer in Portugal. 2020 and 2021 suffered a slight decrease, 264,236 and 289,954 respectively. In 2022 the production level was up by 20% from 2020 and the number of units manufactured was 322,404. Source: OICA

Most passenger cars manufactured in Portugal are exported, and exports for 2021 accounted for over 90% of production and a total value of USD 4.21 B. Europe is the leading destination, especially Germany (21.1%), Spain (13.1%), United Kingdom (11.5%), Italy (9.7%), and France (9.11%). Source: OEC

Statistical information for the year 2023 confirms the importance that exports represent for the automotive sector since 97.7% of the vehicles manufactured in Portugal are exported to foreign markets. This contributes significantly to the Portuguese trade balance. The automotive sector englobes, passenger cars, SUVs, commercial vans, trucks, busses, motorcycles, bicycles (of which Portugal is the largest manufacturer in Europe) and components, parts and accessories. The automotive components industry has grown 200% over the past 15 years and presently, Portugal is supplying carmakers with batteries, glass, plastic molds, interiors, tires, metal works, cables and harnesses, car seats, and electronics. Source: ACAP

As per OEC’s latest statistics, the automotive parts and accessories segment is valued at USD 3.11B. 85% of the total automotive components produced in the country are exported and the main destinations of these parts are: Spain (46.1%), France (18.8%) and Germany (7,54%).

The automotive components industry is a steadily growing contributor to employment and GDP growth. In 2021 Portugal, with around 360 companies employed over 61,000 people and exported 85% of the produced components. This sector has grown 200% in the past 15 years. In 2021, the latest statistics available, it registered an annual turnover of approximately 10.7 billion euros, representing 5.6% of the country’s GDP. It also represents 8.8% of manufacturing industry employment and is one of the leading exporting sectors in Portugal, with 16.1% of all tradable goods. Portugal supplies carmakers with batteries, glass, plastic molds, interiors, tires, smart textiles, metal works, cables and harnesses, car seats, and electronics.

The automotive sector overall, is responsible for almost 8.5% of Portugal’s industry and 2.1% of the production of the Portuguese economy. It employs 0.7% of the population and accounts for 4.8% of the manufacturing industry. Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 0.66%, resulting in a projected market volume of US$4.89bn and Passenger Cars market unit sales should reach 84.80k by/in 2027.

Market Entry

The most effective way to enter the Portuguese market is to partner with a local company that can act as a local representative and provides insights about the local market environment and trends.

Barriers

The mandatory European approval and certification process can be challenging for U.S. vehicles and parts as they must meet European specifications when exporting to Portugal. There are no customs duties on imports from European Union (EU) countries. The VAT in Portugal is 23%. The VAT applies to all imports, including European and local suppliers.

Current Market Trends and Demand

Motorcycles

In Portugal, the revenue in the motorcycles market is projected to reach US$342.10m by year-end 2023, with current unit sales sitting at 29.52k. It is expected that the revenue experiences an annual growth rate of 5.28% per year between 2023 and 2027, resulting in a projected market volume of US$420.20m by 2027. Motorcycles market unit sales are expected to reach 35.92k motorcycles in 2027. The market’s largest segment is On-road Motorcycles with a projected market volume of US$268.60m in 2023. The volume-weighted average price of the Motorcycles market in 2023 is predicted to amount to US$11.59k.

With unit sales share of 32.7% in 2023, Honda Motorcycles maintains the highest market share in Portugal, 30.8%. U.S. motorcycles such as Harley-Davidson, Buell, Polaris /IPS are sold in Portugal at a smaller scale. Portuguese continue to look for other means of transportation such as scooters and motorcycles. The market 2023 structure for motorcycles, according to revenue is: On-road motorcycles, USD 268.60m, (unit sales 19.82k); Off-road motorcycles, USD 40.46m (unit sales 5.18k); and Scooters, USD 24.06m, (unit sales 3.53k).

| Table: Motorcyle Units Sales in Portugal (%) by Brand | ||

| Brand | Units % | Origin |

| Honda motorcycles | 32.70% | Japan |

| Yamaha | 13.70% | Japan |

| Other | 17.10% | |

| Keeway | 10.00% | China |

| BMW Motorrad | 6.10% | Germany |

| Sym | 5.80% | Taiwan |

| Piaggio | 3.80% | Italy |

| Kawasaki | 3.80% | Japan |

| KTM Motorcycles | 2.40% | Austria/USA |

| Suzuki Motorcycle | 2.40% | Japan |

| Kymco. | 2.00% | Taiwan |

Electric Vehicles and Hybrid Vehicles

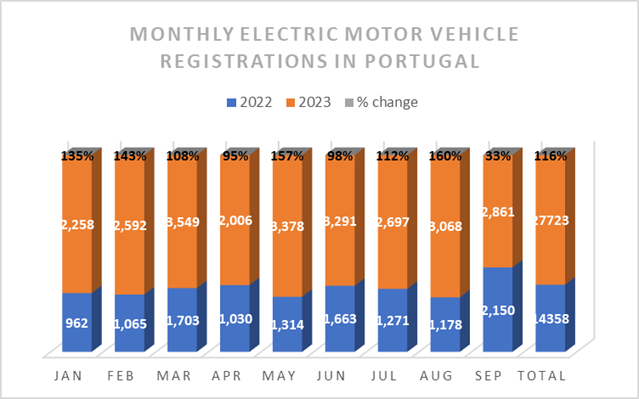

According to ACAP, Stellantis (the automaker that emerged from the merger of France’s Groupe PSA and U.S.-Italian Fiat Chrysler Automobiles), controlling 8 brands, namely Fiat, Peugeot, Opel, Citroën, Maserati and Jeep, continues to be the domestic market leader with a share around 30% in 2023 when it registered the sale of 4.937 vehicles in January, out of which 707 were electric vehicles with a share of 17.7% for Battery Electric Vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). Peugeot continues its popularity trend over the past three years, and positions itself as the best-selling brand in January 2023, with sales reaching 1.888 units and a market share of 11.2%. Peugeot is a favorite for the Portuguese consumer for passenger cars with a share of 9.1% and for light commercial vehicles with a share of 25.4%.

BYD (Build Your Dreams), the largest Chinese manufacturer of electric vehicles entered the Portuguese market in 2019 with the sale of 8 vehicles, 100% emissions-free, pure-electric 12 meter busses to the Coimbra Municipality. In May 2023 began its operations in Portugal through the Salvador Caetano Group with the launch of three 100% EV models: the SUV BYD Atto 3, the 7-seater SUV BYD Tang and the sporty sedan BYD Han. From May to September 2023, BYD sold 155 EVs. BYD is one of Tesla’s rivals.

However, Tesla has earned its place in the Portuguese market, as it officially entered the market in January 2017. The sales of Tesla cars in Portugal have been growing steadily but the growth of 878% in the months of January and February have proven its solidity in the market. More car buyers are choosing EVs since they are more cost-effective and the Tesla brand is the great winner. For the first two months of 2023, overall sales of EVs in Portugal increased by 140%.

Government benefits and incentives for the acquisition of 100% electric vehicles: €3,000 Incentive for the acquisition or leasing of an electric, light passenger vehicle, until the limit of 700 vehicles, through the Environment Fund and €6,000 Incentive for the acquisition or leasing of an electric, light goods vehicle, until the limit of 150 vehicles.

Source: ACAP

Achieving carbon neutrality by 2035 is a priority for the European Commission with the goal that as of 2035 all cars sold in the European Union will be zero-emission vehicles. The Portuguese government is currently developing a Carbon Neutrality Roadmap and has been introducing Low (and zero) emission vehicles for public transport fleets, with the goal that all bus fleets become zero emissions by 2034. This goal has contributed to the development of Mobi.E. The Mobi.E Network, or National Electric Mobility Network, is a network of 3,800 electric vehicle public charging stations for universal access and focused on the user. Currently, the network has 5,310 charging points nationwide, with more than 900 being fast or ultra-fast charging points, in other words, their power is higher than 22 kW. (Source: Mobi.E and Mobienetwork)

In 2020 close to 35,000 new alternative-fuel vehicles (AFVs) were registered in Portugal, according to the European Automobile Manufacturers Association (ACEA). The growth of new registrations slowed from 42.8% in 2019 to 38% last year, but the increase came from a high baseline and such vehicles accounted for 23% of all cars sold in 2020, compared with 10.8% in 2019. Of the total in 2020, 7,830 were battery electric vehicles (EVs), whereas sales of all chargeable cars (including plug-in hybrids) reached nearly 20,000 units, up by more than 55%. As in most of Europe, the Portuguese government unveiled a range of policy incentives in 2020 to promote a green recovery from the coronavirus in addition to previous measures.

In January, 2,405 electric vehicles were sold (100% electric and plug-in hybrid), considering all categories of light and heavy vehicles, representing a growth of 68.9% compared to the same month of the previous year. January 2022 marked 1138 electric vehicles (BEV - Battery Electric Vehicle) sold, which revealed buyers’ sustained interest in fully electric cars. These great sales numbers were attributed to strong demand from increasingly well-informed citizens. The recovery of economic activities, shaken by the pandemic, also allowed an increase in sales of light passenger vehicles with internal combustion engines (VCI), but a much lower increase than that of electric vehicles (EV). While VCI sales grew 20%, EV sales grew 69.3%, representing a market share of 15.4%. Plug-in hybrid vehicles (PHEV – plug-in hybrid electric vehicle) also registered growth, in this case of 7.4% compared to May 2021 and 93% compared to the same month of the previous year.

Aftermarket Accessories

The market for automotive accessories and specialty equipment in Portugal and distribution channels primarily consist of small importers. Although it is considered a small market compared to neighboring Spain, it is an ideal market for product acceptance studies, serving as a gateway to enter other European markets and Portuguese-speaking markets.

Acceptance of U.S. products and new technology in Portugal is very high and well-received by local companies. Over the past years, Portuguese have become fans of a wide range of products such as passive and active security systems, eco-friendly automotive solutions, diagnostic and testing tools, and car entertainment systems.

All products with cutting-edge technology can be placed in the Portuguese market. As a rule, Portuguese are ready to consider new products and pay extra money for something that is or seems to be unique and innovative.

Smaller Engines

Europe’s best-selling car models can be equipped with 3-cylinder engines of 1000cc or less. This is the measure brands take to meet emission limits for pollution gases and to contain the production and sales costs of the latest cars, thus providing more technology while maintaining comparable prices.

SUV

Revenue in the Small SUVs market segment is projected to reach US$1,329.00m in 2022, and segment unit sales are expected to reach 42.7K vehicles in 2026. This growth is expected as implementing new technologies in these cars will make them even safer, more comfortable, and more practical.

Gasoline engine VS Diesel engine

Diesel cars are losing market share. Portugal’s center-left Socialist Party has proposed a ban on all diesel and petrol-only cars in the country by 2035 in a bid to tackle its carbon emissions. According to ACAP - Associação Automóvel de Portugal (Automobile Association of Portugal), of the 22,041 new passenger cars sold in 2023, 40.6% have a gasoline engine and only 13.0% have a diesel engine. Despite that, the number of diesel-engine commercial vehicles is still overwhelming: 99.1% of the 38,454 cars in this market are diesel, and only 0.2% (90 vehicles) have a gasoline engine.

Diesel was by far the most popular fuel type among the heavy commercial vehicle fleet in Portugal, representing over 99.8% of the trucks in the country. Battery electric vehicles were the most popular for heavy passenger vehicles such as buses and coaches, with around 127 fully electric vehicles of that type registered in the country.

In alternative engines to fossil fuels, sales of electric and plug-in hybrids are also noteworthy. There was an increase of 3.3% in electric/gasoline hybrids to 8545 units and almost zero growth in electric/diesel hybrids (+0.3% for 883 cars sold). On the other hand, plug-in/gasoline grew 1.8% to 4,653 vehicles sold; plug-in/diesel grew 0.4% to 1,145 units. As a result, pure plug-ins or hybrids increased the market share to 8.5%.

Leading Sub-Sectors

This industry is divided into three main groups:

Motor vehicles for all purposes, including tractors; parts and accessories; and chassis, bodywork, trailers, and semi-trailers. As for motorcycles, these are devided into

Main Competitors

U.S. exporters generally face intense competition from European and Chinese suppliers but are still well positioned as a supplier to the Portuguese automotive market.

Opportunities

Electric Drive Vehicles

The European Commission (E.C.) is proposing a reduction to zero of CO2 emissions from new cars sold in the bloc by 2035 in a plan that will effectively ban sales of vehicles with gasoline and diesel engines. The Portuguese support the E.C. proposal, and the industry will have to modernize and be ready for the new market needs.

The European Commission approved 20 billion euros ($22 billion) to incentivize consumers in the 27-nation bloc to buy environmentally friendly passenger cars.

Mobility Applications

Applications such as Uber, Cabify, or Taxify have gained a strong foothold in the disruptive automotive market. Portugal has embraced mobility apps, and usage in urban areas is increasing, especially for complementary transport such as electric scooters.

Batteries

The Batteries 2030 project, aiming for a lithium battery industry in Portugal with investments of 8.3 million euros, was presented in July 2021. The project will work in five areas: energy storage (particularly in manufacturing new generation lithium batteries), hydrogen, second-life battery cycle, decentralized energy production, and energy management platform. Of the 23 partners in this project, 14 are companies, and nine are scientific entities under the coordination of the INL – International Iberian Nanotechnology Laboratory. In July 2023 BatPower-The Portuguese Association for the Battery Cluster was created under INL’s coordination. The Cluster initially brings together 23 entities from across Portugal’s burgeoning lithium sector, together with other relevant industries, academia, and government. Its mission is to build a synergistic ecosystem of academic, research, and industrial institutions in Portugal, throughout the entire battery-related value chain, and work in synergy to create and deploy the next generation of high-performing, cost-effective, safe, and environmentally sustainable batteries for mobile and stationary applications, to support the national strategy for the energy transition and full decarbonization of the energy sector. Moreover, the Cluster will identify and enable opportunities (R&D+I, Business) to valorise the battery value chain. The founding members are Savannah Resources Plc (UK company); the renewable energy company, DST Solar; Galp, electrical equipment manufacturer; Efacec, technology and services group; Bosch and Prio, the owner of the largest private EV charging network in Portugal. Source: Financial Times

Resources

Automobile Association of Portugal

Portuguese Association of Automotive Suppliers

European Union Mobility and Transport

The Observatory of Economic Complexity (OEC) – Portugal

Key Government Regulatory Agencies

ACAP - Automobile Association of Portugal

AFIA - Portuguese Manufacturers Association for the Automotive Industry

MOBINOV - Automotive Cluster

BAPower - The Battery Cluster

INL – International Iberian Nanotechnology Laboratory

Leading Products – NAICS

- Automobiles & other vehicles, wholesale – 421110

- Motor vehicle supplies and new parts distributors – 421120

- Car dealer SIC code – 44110

- Gasoline service stations – 447110

- Recreational vehicle (RV) dealers – 441210

- Motorcycle dealers SIC code – 441228

- Passenger car rental businesses – 5322111

- Mechanic SIC code – 811111

Source :

https://acap.pt/site/uploads/paginas/documentos/8681E9A5-B9F30_1.pdf

https://observatorioauto.pt