Maritime Services

Maritime Services

Overview

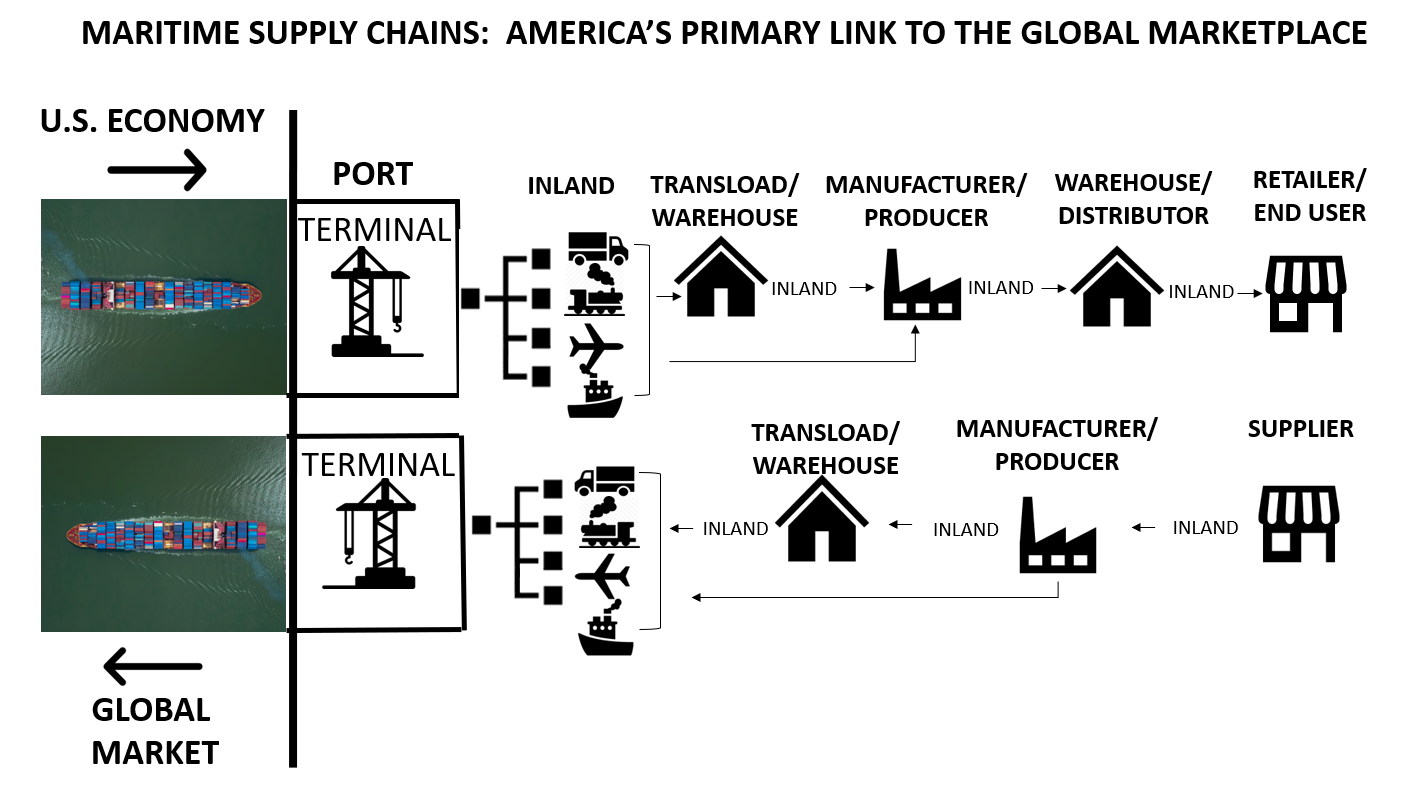

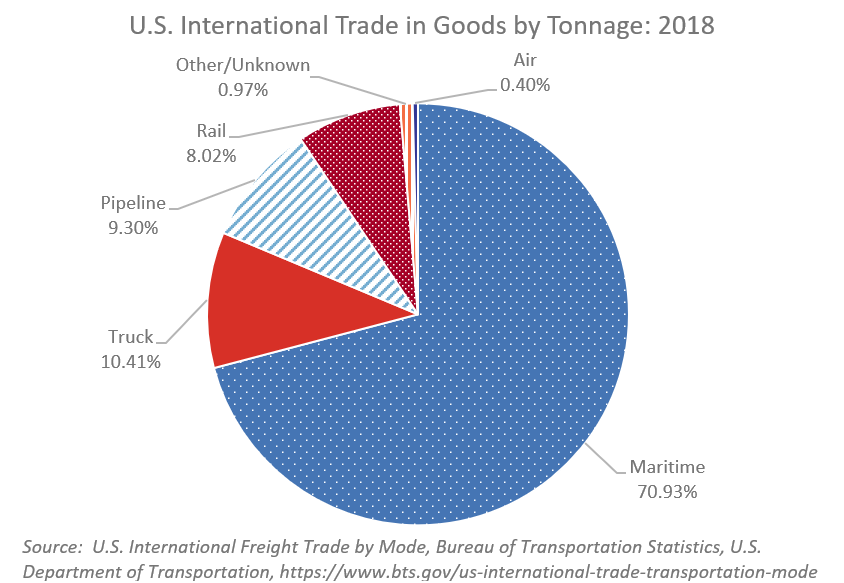

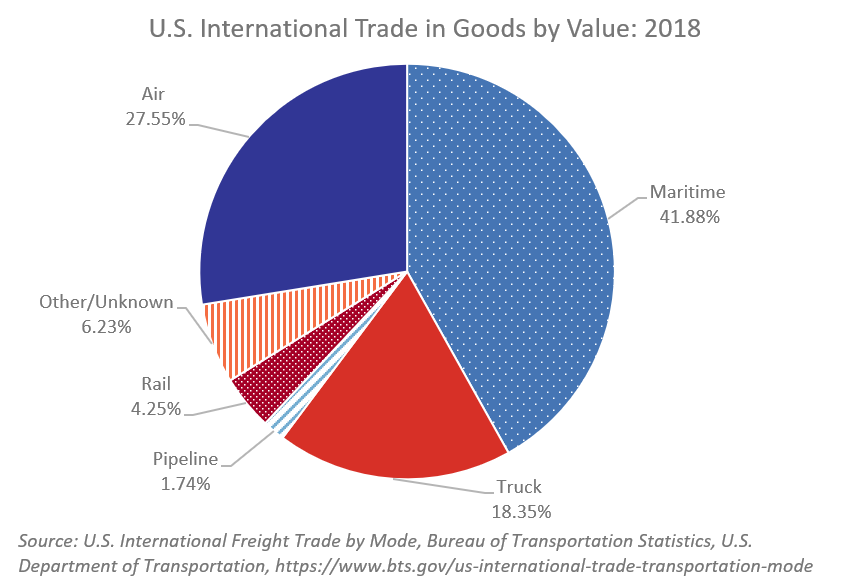

Maritime services, including waterborne transport and seaports, are crucial to America’s economy. These services are an integral element of the end-to-end supply chains that carry over 70% of our non-cross-border trade to and from our importers, exporters, and consumers. These supply chains - collectively called maritime supply chains - represent our largest trade in goods connection to the global marketplace.

Global and domestic crises have shown that any congestion, disruption, or halt at any stage in the maritime supply chain can shut down major U.S. industries, reduce jobs, stop the flow of vital goods, and limit our national economic growth. Recent examples include:

- Impacts of the 2020-2021 COVID-19 Pandemic: When the pandemic began in Asia in early 2020, maritime carrier cutbacks on routes to the U.S. caused severe shortages of crucial materials and components that factories needed for production. The resurgence of strong U.S. consumer, retail, and industrial demand in mid-2020 – particularly for e-commerce goods – caused a surge in inbound container volume that overloaded system capacity. This led to major vessel delays, harbor and port congestion, lack of warehouse space, sourcing problems, and cost increases for U.S. importers and consumers. It also caused shortages of maritime containers, available railcars, and other crucial equipment, further slowing U.S. goods movement and impeding exports of agriculture and other perishable products. These factors have led to uncertain financial prospects for maritime-dependent U.S. industry sectors until these demand-driven factors have eased.

- U.S. Port-Labor Negotiations: Equipment and labor shortages during the 2014-2015 West Coast port slowdown resulted in major nationwide supply chain congestion that slowed or halted operations across many U.S. industries. The Department estimated at the time that the slowdown may have resulted in $5.5 to $11 billion in lost U.S. exports, $7.2 to $12 billion in lost U.S. imports, and a $7.8 to $12.1 billion loss in U.S. Gross Domestic Product.

Economic and Industry Significance

Maritime supply chains are the most cost-effective way to move large-volume, long-distance shipments between sources and end users. A vast range of goods and commodities travel globally through maritime services, including bulk and containerized raw materials, energy supplies, food and farm production, finished items, end user supplies, and consumer products.

Almost every U.S. industrial sector is dependent on maritime services for the continual flow of material they need to keep their plants operating, and to ship their products to overseas markets. This is particularly true for:

- Energy producers

- Industrial manufacturers

- Farmers

- Chemical and plastic producers

- Consumer goods industries

- Retailers

Notably, for most U.S. industries, fifty percent or more of their international trade in goods travels through maritime supply chains. This trade flow includes 66 percent of our import commodities, and 31 percent of our export commodities.

Maritime services also play a key role in transporting domestically-made goods and materials. The vast majority (80%) of these products are transported first throughout the U.S. by truck. But domestic coastal, river, and lake shipping is crucial for U.S. producers of heavyweight commodities and oversize shipments. These include:

- Crude petroleum

- Fuel oils

- Gasoline

- Grains

- Coal and coal products

- Fertilizer

- Minerals

Please click here to access the data for the charts in this report, and for additional information on maritime services and supply chains.

ITA Resources

Ian Cook

Maritime and Port Services

Ian.Cook@trade.gov

202.482.3701