Vietnamese Cold Chain Food Market

In 2019, Vietnam had 48 cold storage locations with a capacity of 600,000 pallets, 700 refrigerated trucks and vans, and 450 refrigerated container railcars. Cold storage facilities met only 30-35% of the demand for the preservation of food, agricultural, and aquatic products. In 2020, only 8.2% of domestic food producers used a cold chain system, while export manufacturers accounted for 66.7%. Additionally, distribution networks remain underdeveloped to provide a safe and efficient service creating a gap for potential suppliers to fill.

Although COVID-19 disrupted many industries, new cold storage facilities continued to be built and upgraded in late 2020 due to rising demand. Such development has in turn attracted multinational logistics companies to Vietnam, such as Lineage Logistics, to capture the rapidly growing Vietnamese market. With the current momentum, it is forecasted that the size of Vietnam’s cold chain market can reach USD 1.8 billion by the end of 2021.

What is the growth attributed to?

Agricultural GDP growth: Growth in production, export, and import.

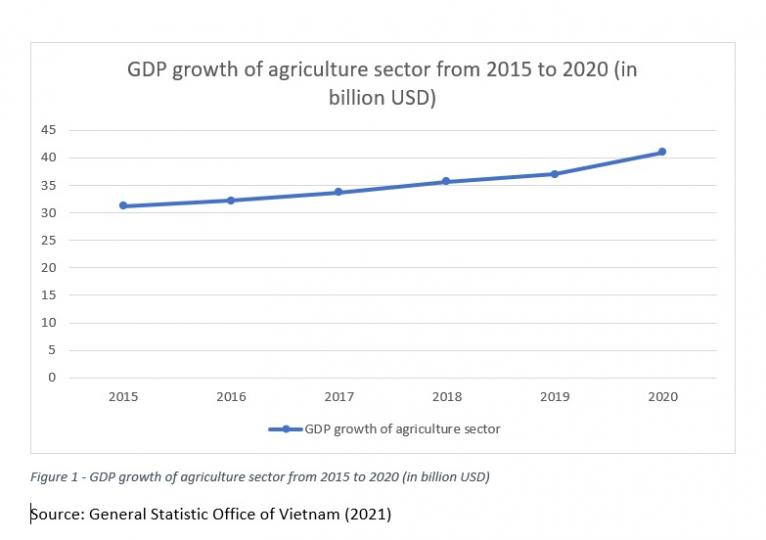

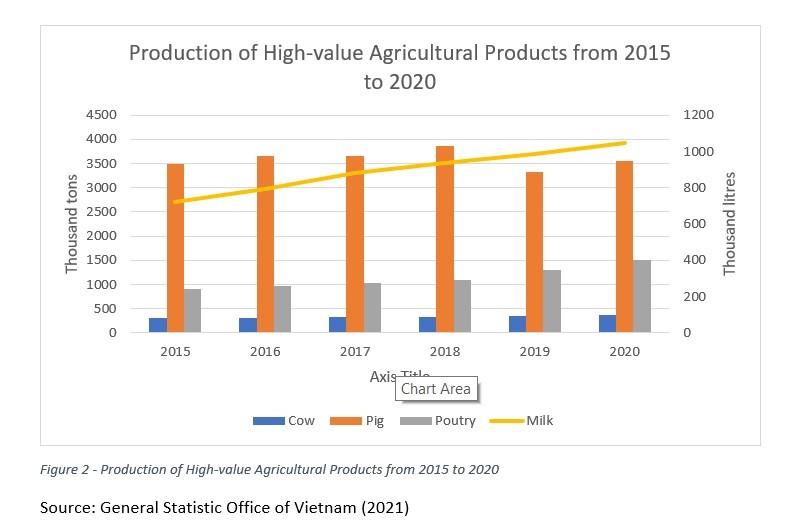

The real GDP growth of the agriculture sector in Vietnam grew approximately 5% annually to USD 41 billion in 20204, from USD 31 billion in 2015 (Figure 1). High-value and perishable agricultural products grew faster at the rate of approximately 3.2% per year for meat and approximately 11.7% per year for milk within the same period (Figure 2). Therefore, the demand for cold supply chain logistics grew accordingly.

A Shift to Modern Agriculture Model

Commercialization in agriculture production and the transformation of the farming system have created a solid base for long-term demand for cold-chain storage and transportation of products.

Post-harvest Losses

In Vietnam, post-harvest losses account for approximately 20-25% of losses, with an estimated total value of approximately USD 3.9 billion each year. With the Vietnamese government’s intention to reduce the rate of loss to less than 10%, the cold chain system comes as a convenient solution to extend the life cycle of perishable products.

The development of modern retail and fast-food services

Rapid urbanization, an emerging middle class, and rising food safety awareness all lead to higher demand for fast-food services and a modern retail food sector. For the past five years, while the number of traditional markets remains the same, the growth rate of modern retail and fast-food services has tripled and is continuing to increase. In the next five years, the retail market if forecasted to grow at an average of 7.3% per year, creating a growing need for cold storage and transportation services.

Additionally, the pandemic has amplified the demand for cold supply chains, as consumers have switched to online grocery shopping due to safety concerns. Therefore, the need to preserve food increased significantly.

Government policies related to the cold chain in Vietnam

Currently, there is no specific strategy or policy framework to promote cold chains. Instead, cold chain-related policies are scattered in various laws and regulations issued by different agencies. Overall, those policies encourage the development of cold supply chains to 1) ensure food safety, 2) contribute to better national logistic systems, and 3) reach and increase the high standard of agricultural products in Vietnam.

For more information, please contact Ngan Thai, Commercial Assistant at Ngan.Thai@trade.gov.