Leading Economic Indicators Aerospace Industry

Overview

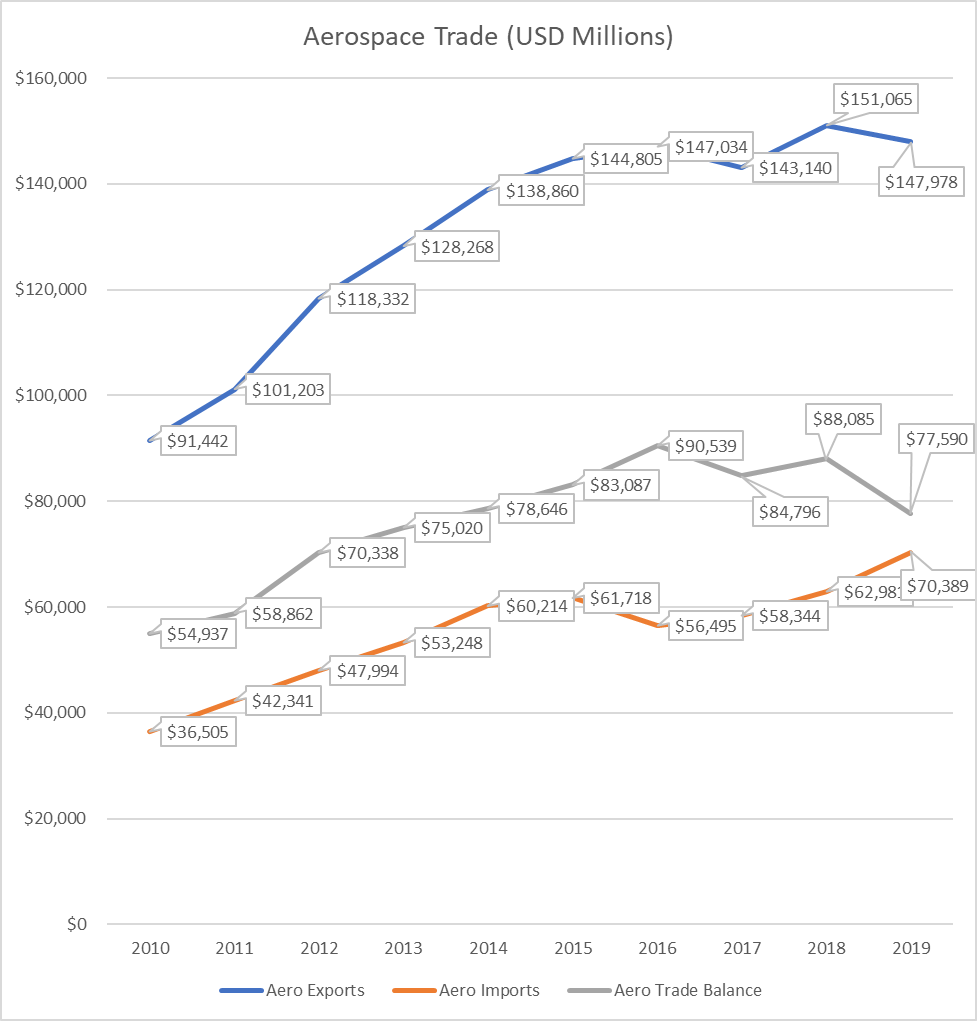

The U.S. aerospace sector continues to produce the highest trade balance ($77.6 billion in 2019) and the second highest level of exports ($148 billion) among all manufacturing industries. This predominant position has remained unchanged for decades, with aerospace exports having grown at an average rate of 5.31 percent over the last 10 years and the aerospace trade balance increasing at an average rate of 4.64 percent since 2010.

*To view the data in this chart in table form, view this page.

The top five export markets for U.S. aerospace products have been remarkably similar over the last 10 years, with China being the top market from 2012 to 2018, France as the top destination in 2010 and 2019, and the United Kingdom claiming that spot in 2011. Canada as well has been a top 5 market for U.S. aerospace products over the last decade (except in 2012), though they never have been the number 1 market. The other spots in the top 5 vacillated between Japan and Germany, with the United Arab Emirates making an appearance in the top 5 in 2012.

The top five aerospace suppliers to the U.S. have been much more consistent over the past decade, with France being the top supplier and Canada the second largest supplier since 2010. Japan was the third largest supplier this decade for all years except 2010 (when the United Kingdom took that spot). The fourth and fifth positions among the top five suppliers since 2010 were either Germany or the UK (again, except for 2010).

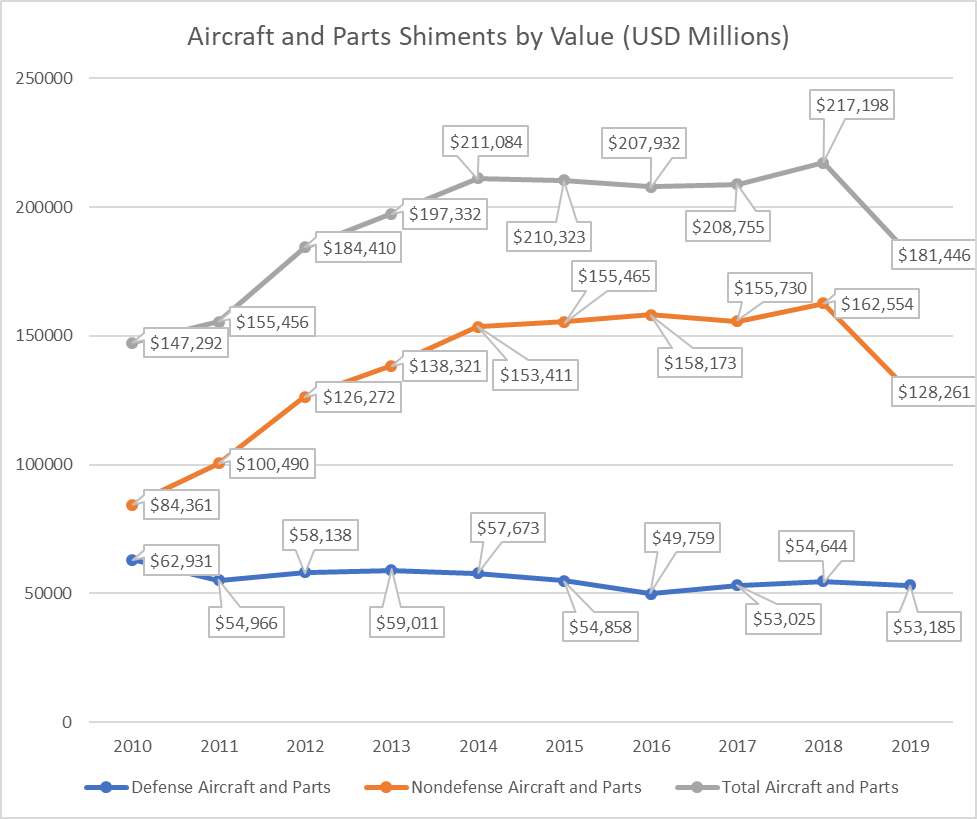

Taking a look at total shipments of U.S. aircraft and parts (M3 data), nondefense shipments rose from 2010 to 2018 before dipping (from $162 billion to $128 billion) in 2019. This trend resulted in an average growth rate of 5.21 percent since 2010. Defense aircraft and parts shipments remained relatively steady over the past decade with some decline (granting an average growth rate of -1.6 percent since 2010. For all aircraft and parts shipments, the average growth rate was about 3.03 percent since 2010.

*To view the data from this chart in table form, view this page.

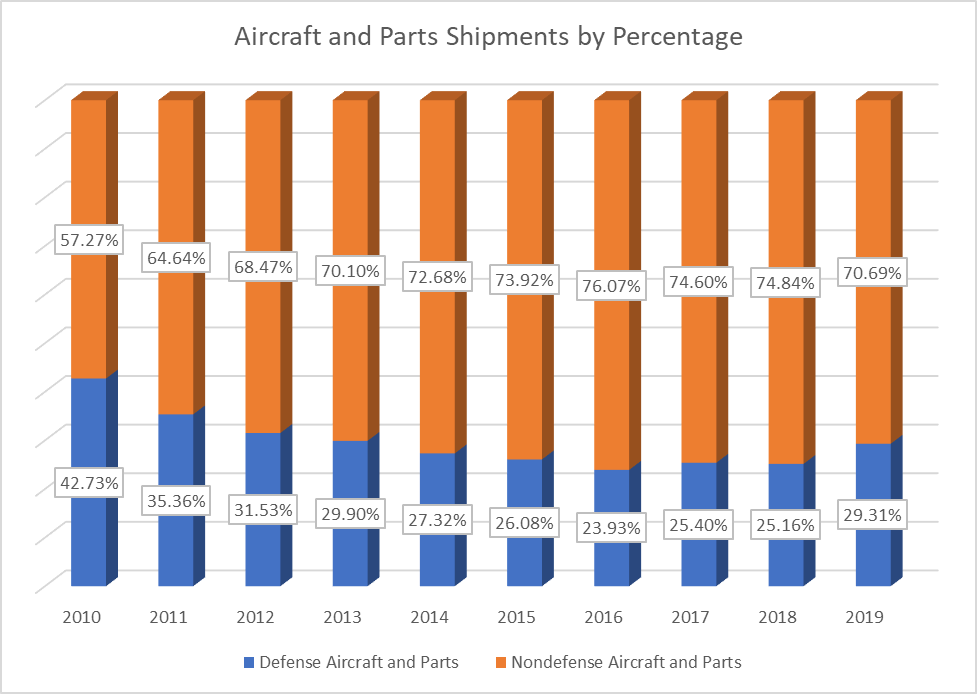

Since 2010, the percentage of nondefense aircraft and parts has increased vis-à-vis defense aircraft and parts for all years except 2017 and 2019.

*To View the data in this chart in table form, view this page.

Employment in the U.S. aerospace industry has been relatively consistent over the past 10 years, with direct employment ranging from 477,700 employees in 2010 to a high of 534,3000 employees in 2019 and growth averaging out at approximately 0.72 percent. Looking at production and nonsupervisory employees alone, that consistency is even more pronounced with an average growth rate of 0.08 percent, a low of 271,500 employees in 2014, and a high of 300,300 employees in 2019.