Filing Your Export Shipments through the Automated Export System (AES)

This electronic filing is referred to as Electronic Export Information (EEI) filing and is required when the value of the commodity classified under each individual Schedule B number is over $2,500, or if there exists a mandatory filing requirement, i.e., an export license is required. See Foreign Trade Regulation 30.2(a)(1)(iv)* The EEI is submitted to the Automated Export System (AESDirect) hosted on the Automated Commercial Environment (ACE) platform.

For information on how to register and access the ACE AESDirect filing portal, please refer to the following document.

Tips

Prior to exporting, you should acquire the Schedule B/HTS number for the commodity to be exported. This number can be obtained from the U.S. Census Bureau at 1-800-549-0595, option 2 or by visiting our webpage for the Schedule B search tool and steps.

EEI Filing Requirements

Filing of the EEI is required regardless of value or destination for the following shipments:

- valued over $2,500 per Schedule B number and is sent from one exporter to one buyer on one calendar day on one carrier; (According to the FTR Section 30.1(c), value is defined as the selling price in U.S. dollars plus inland and domestic freight, insurance, and other charges to the U.S. seaport, airport, or land border port of export);

- requiring an export license, regardless of value or destination;

- subject to the ITAR even if they are exempt from export licensing requirements regardless of value or destination;

- falling under “600 series” of the Export Control Classification Number (ECCN) for items enumerated in paragraphs “a to x”;

- requiring license exception-Strategic Trade Authorization (STA);

- destined for Cuba, Iran, North Korea, Sudan, or Syria (regardless of value);

- rough diamonds, regardless of value (HTS 7102.10, 7102.21 and 7102.31) and destination;

- used self-propelled vehicles;

Tips

If the exporter is sending baggage or containers with their personal or household goods valued over $2,500 to a foreign destination, other than Canada, they must file the EEI and provide the ITN to the carrier in accordance with the timeline.

If the exporter is sending goods through the U.S. Postal Service, they are required to file the EEI when the value of the commodity classified under each individual Schedule B number is over $2,500, or if the export requires a mandatory EEI filing requirement (see above). The exporter should submit the ITN or EEI filing exemption citation to the post office, if applicable.

EEI Filing Exemptions

- When the value of the commodity classified under each individual Schedule B number is $2,500 or less and mandatory EEI filing is not required.

- Shipments FROM the U.S. to Canada of ANY amount and mandatory EEI filing are not required.

- Shipments TO U.S. possessions, except those territories where EEI filing is required, i.e., between the US and Puerto Rico and from the US to the US Virgin Islands).

Tips

If your shipment is exempt from the EEI filing requirements, you must annotate the commercial document, i.e., air waybill, bill of loading, and invoice with the exemption citation. Annotate “NOEEI” followed by the Foreign Trade Regulation citation, i.e., “NOEEI 30.37(a)” for shipments when the value of each individual Schedule B number is $2,500 or less; “NOEEI; 30.36” for shipments to Canada, etc.

When to File

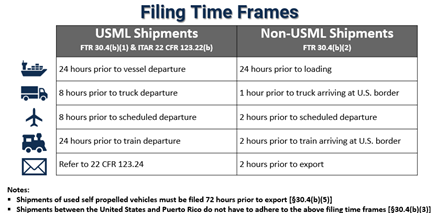

In most cases, the EEI filing must be made successfully prior to departure.

Who can do the EEI Filing

The filer of EEI for export transactions is either the USPPI, or the U.S. authorized agent. All EEI submitted to the AES shall be complete, correct, and based on personal knowledge of the facts stated or on information furnished by the parties to the export transaction. The filer shall be physically located in the United States at the time of filing, have an EIN or DUNS and be certified to report in the AES. In the event that the filer does not have an EIN or DUNS, the filer must obtain an EIN from the Internal Revenue Service.

You may file your EEI for your export transaction by accessing the ACE secure data portal located on the U.S. Customs and Border Protection’s website. First-time users will need to create an account and obtain a username and password prior to filing.

To learn more about the EEI filing in the AES, note these resources:

You may file your EEI for your export transaction by accessing the ACE secure data portal located on the U.S. Customs and Border Protection’s website. First-time users will need to create an account and obtain a username and password prior to filing.

To learn more about the EEI filing in the AES, note these resources:

- VIDEO series on the AESDirect system. These videos will help exporters to better understand the legal requirements for filing an AES, steps for submitting your Electronic Export Information (EEI) to AES, and the use of authorized agents as an option to filing the EEI;

- ACE AESDirect Resources, and the U.S. Census Bureau website;

- AESDirect User Guide for filing Electronic Export Information;

- For questions about your ACE account, call the ACE Account Service Desk at (866) 530-4172, option 1;

- General questions about EEI filings can be directed to the U.S. Census Bureau’s Trade Data Collection Branch at (800) 549-0595, option 1 or by email at askaes@census.gov;

- For questions about EEI Filing Requirements, call the U.S. Census Bureau’s Trade Regulations Branch at (800) 549-0595, option 3 or by email; at emd.askregs@census.gov;

- Learn more about the steps involved in AES Filing.