Agricultural machinery and food processing equipment are not subject to U.S. sectoral sanctions or Russia’s “countersanctions” on agricultural products and are generally allowed to be sold without restriction. Russia’s agricultural market has immense potential, with 220 million hectares (544 million acres) and the potential to feed two billion people, according to the Food and Agriculture Organization of the United Nations (FAO). Four federal districts (the Central, North Caucasus, Urals, and Volga) produce 73% of agricultural outputs in Russia.

Russia’s agricultural revenues grew 4% in 2019 to $91 billion. Crop production increased by 6.1%, while livestock production increased by 1.6% compared to 2018. According to Russia’s Ministry of Agriculture, agricultural production will keep a positive trend in 2020 even given the Covid-19 pandemic and estimates growth in the range of 2-3%.

Grain harvest in Russia in 2019 increased by 6.5% compared to2018 and amounted to 120.6 million tons. In 2019, Russia was the world’s largest producer of barley; the third-largest producer and the largest exporter of wheat; the second-largest producer of sunflower seeds; the third-largest producer of potatoes and milk; and the sixth-largest producer of eggs and chicken meat.

In 2018, the Russian Government announced a $51 billion plan to boost domestic agricultural production, setting the ambitious goal of increasing food exports by 70 percent by 2024 (to $45 billion). The increase in exports could further drive growth in domestic meat and feed production.

According to the Russian Association of Specialized Machinery and Equipment Producers (“Rosspetsmash”) and Russian Customs statistics, the Russian agricultural equipment market in 2019 stayed at the same level as in 2018 and totaled about $3 billion. In quantitative terms the largest product groups manufactured in Russia were tractors, combine harvesters, and harrows. Overall, tractors and combine harvesters accounted for 54% of the total sales of agricultural machinery in Russia in 2019.

Russian Agricultural Machinery Market, 2016-2018

|

Indicators |

2016 |

2017 |

2018 |

|

Total market size, USD billions |

2.3 |

3.0 |

2.8 |

|

Y-O-Y market growth in current RUB prices, % |

+25 |

+16.7 |

-1.3 |

|

Sales of tractors for agriculture and forestry, thousand units |

11.3 |

11 |

10.5 |

|

Sales of combine harvesters, thousand units |

6.2 |

6.2 |

5.2 |

|

Share of imported machinery, % |

46 |

44 |

40 |

|

Ratio of agricultural machinery exports to domestic sales, % |

5.3 |

4.9 |

6.2 |

|

For reference: |

|

|

|

|

Number of agricultural machines, units per 1,000 hectares (2,471 acres) of arable land: |

|

|

|

|

Tractors |

3.3 |

3.1 |

3 |

|

Combine harvesters |

2 |

2 |

2 |

|

Machinery renewal rate, % |

|

|

|

|

Tractors |

3.3 |

3.6 |

3.4 |

|

Combine harvesters |

6.6 |

6.4 |

5.6 |

|

Exchange Rates (Ruble to $1) |

66.8 |

58.3 |

62.9 |

Source: Rosstat, Rosspetsmash, Ministry of Industry and Trade of the Russian Federation

The Russian government has made it a priority to increase domestic production of agricultural equipment and is providing manufacturers incentives to localize as part of its strategy to achieve the goals of having 80% of agricultural machinery used in Russia produced domestically, tripling overall equipment production, and increasing exports of agricultural equipment by a factor of 12 by 2030.

Since 2013, Russia has maintained several federal programs offering subsidies to local equipment producers. However, there have been concerns that not all manufacturers receive equal treatment under the law and certain foreign-headquartered producers are excluded from these programs, despite having localized manufacturing. Overall, from 2013 to 2019, the production of agricultural machinery in Russia increased 3.4 times, the share of locally produces machinery increased 2.2 times and amounted to 58% in 2019 (Source: Rosspetsmash).

Imports of Certain Categories of Agricultural Machinery to Russia in 2019

|

Category |

Total Imports, |

Imports from US, $ mln |

US Imports Share, % |

|

Tractors (HS Code 8701) |

1,131 |

69 |

5 |

|

Harvesting or threshing machinery (HS Code 8433) |

534 |

33 |

6 |

|

Agricultural, horticultural or forestry machinery of soil preparation or cultivation (HS Code 8432) |

391 |

38 |

10 |

Source: Russian Customs Statistics

However, Russia’s agricultural machinery market remains highly dependent on imports. In 2019, the share of the imported machinery accounted for 42% (2% growth from 2018). In the total number of tractors produced in Russia in 2019, the share of Russian brands was 51.1%. The rest 48.9% were tractors assembled in Russia from foreign-made parts, 26.9% of which were products of Minsk Tractors Plant (Belarus), 4,6% — of Kharkov Tractors Plant (Ukraine), and 17.4% belonged to foreign brands such as John Deere, Claas, Versatile, New Holland, Agrotron, Axion, and Xerion.

Top 5 leading Russian manufacturers of agricultural machinery (as of April 2019):

- Rostselmash (Rostov-on-Don)

- St. Petersburg Tractor Plant (St. Petersburg)

- KLEVER (Rostov-on-Don)

- Eurotekhnika (Samara)

- ALMAZ (Rubtsovsk Plant of Spare Parts, Rubtsovsk)

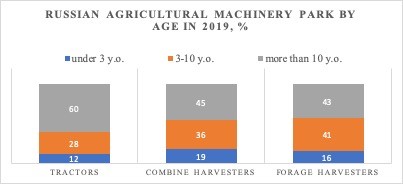

There is an acute need for modernized agricultural machinery in Russia, but equipment purchase growth is further constrained by high credit costs and geopolitical uncertainty. The government is attempting to compensate for these challenges and stimulate investment in capital purchases by offering various subsidies for strategically important subsectors, including meat and milk production.

Source: Ministry of Agriculture, Rosspetsmash

Food production and processing represent a key component of Russia’s economy. As of 2019, there were more than 22,000 food processing companies operating in Russia, employing an estimated 2 million people (Source: Agroprodmash-expo). Over the last three years, Russia’s food processing has grown by an annual average of five percent. Globally, Russia has the eighth largest market for packaged food products. In 2019, revenues from Russia’s food and drink processing sectors reached $102.4 billion. Food production turnover increased 6.5 percent from 2018, while the beverage sector increased 11.9 percent.

Russia’s growth is stimulating investment and innovation not only in equipment but also in product development. The fast-moving consumer goods (FMCG) segment has remained the most stable sub-sector with an 80% share of food products. Additionally, the demand for packaged products is expected to increase and reach 29 million tons by 2020.

Over the past 10 years, the import of food processing and packaging equipment has doubled in Russia and accounts for 87% of the market. The volume of imported food processing and packaging equipment in Russia (HS code 8438) amounted to about $557 million in 2019 including $16 million from the United States (Source: Statimex.ru).

The Russian packaging market consists of the following segments: metal (10%), glass (12%), soft plastic (21%), hard plastic (21%), paper, and cardboard (36%). There are currently more than 2,000 companies involved in the packaging process and about 900 companies involved in the production or distribution of packaging machinery. Russian food and food processing industry enterprises often buy equipment directly from manufacturers, and large businesses enterprises typically prefer new, imported equipment. Less expensive, second-hand models are often purchased by small- and medium-sized businesses.

Government policies in the food and agriculture sectors offer U.S. food processing and packaging technology providers new commercial opportunities. The domestic consumer goods and packaging industry is under pressure to improve its competitive edge and offset the decline in imports. The ban on imports of food from many countries, along with the Russian government’s import substitution policy, means that the Russian food industry will continue to develop and expand in a favorable competitive environment, incentivizing investment in modern technology for processing and packaging.

Leading Sub-Sectors

- Forage, irrigation, and soil preparation equipment including plows, harrows, cultivators, seeders, and fertilizer spreaders;

- Equipment for dairy livestock breeding, swine, and poultry production; milk processing and animal feed preparation equipment;

- Equipment for vegetable production including greenhouse technologies;

- Meat and poultry processing equipment (the highest demand is in turkey processing and packaging);

- Dairy processing and packaging equipment;

- Baking equipment, both for small bakeries and large bread-making factories.

Opportunities

- One of the biggest consumer markets in Europe with 144 million consumers;

- The Russian food industry will continue to develop and expand in a favorable competitive environment, incentivizing investment in modern technology for processing and packaging;

- Increasing sales of meat, fruits, and vegetables are driving corresponding equipment sales in these sectors.

Challenges

- High interest rates for purchasing agricultural equipment. Current interest rates for the purchase of foreign equipment from Rosselkhozbank, Rosagroleasing, and Sber (formerly Sberbank) vary from 11 to 20%;

- Reduction in government subsidies for agricultural producers;

- Low growth in foreign investments in the sector;

- An unstable demand for agricultural equipment, due to the financial instability of Russian farming enterprises; and

- A “utilization” fee introduced in February 2016, which imposes prohibitive fees for agricultural equipment older than three years.

Trade Events

U.S. firms interested in the Russian agricultural market may wish to consider setting up exhibitions at one of the key Russian agricultural trade shows or working with the U.S. Commercial Service to organize a booth at one. Such events often lead to direct sales and are powerful marketing tools that serve to reassure Russian buyers that the U.S. supplier is committed to establishing and maintaining a presence in the market. To be successful in the long term, it is important to remain connected with potential customers and use every opportunity to maintain a presence in the market.

Major agricultural trade shows in Russia (the dates can be moved, please check actual info on websites):

Meat & Poultry Industry Russia

March 15 – 17, 2022

Moscow, Russia

AgroSalon

October 4 – 7, 2022

Moscow, Russia

YugAgro

November 23 – 26, 2021

Krasnodar, Russia

RosUpak

June 7 – 10, 2022

Moscow, Russia

Agroprodmash

October 4 – 8, 2021

Moscow, Russia

Resources

RosSpetsMash, the Association of Russian Specialized Machinery and Equipment Producers

UNIPACK, major packaging industry web portal (https://www.unipack.ru/eng/)

Russian Customs Service (Russian Customs Service)

U.S. Embassy Moscow Agricultural Trade Office Contact:

U.S. Embassy Moscow