Overview

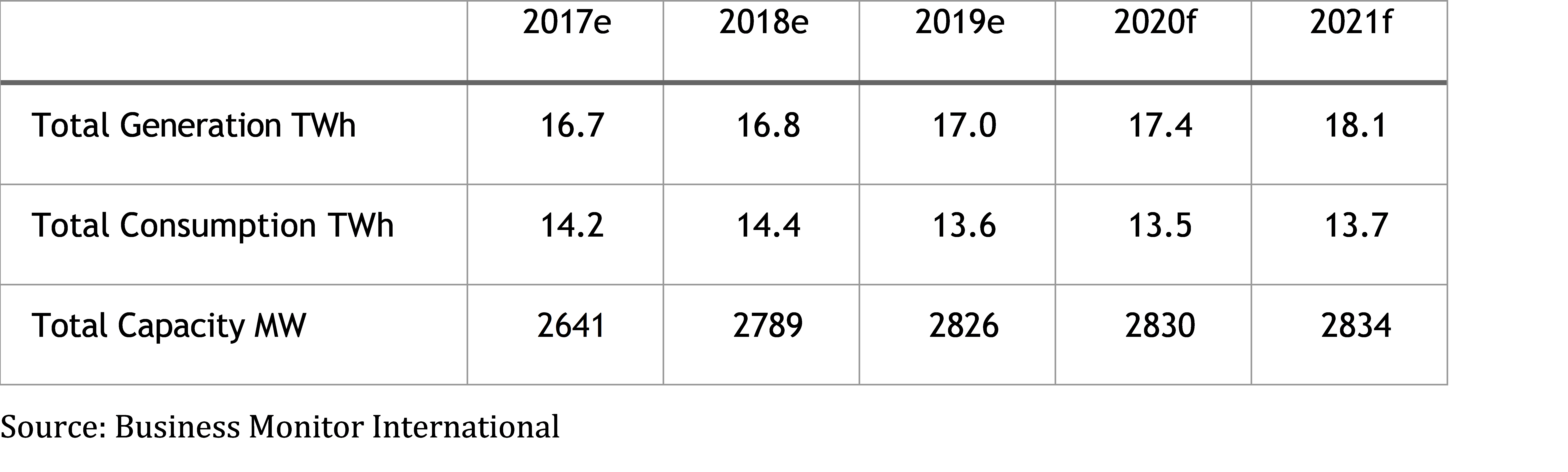

Mozambique has the largest power generation potential of all Southern African countries. Power Africa estimates that it could generate 187 gigawatts of power from coal, hydro, gas, wind, and solar. Most of the power currently generated is from hydroelectric projects, however, natural gas, and renewable energy sources will have a significant impact in the future, with natural gas expected to provide 44% of total energy generation in the next decade.

The government aims to achieve universal electrification by 2030. It has made significant strides to achieve this goal reaching from 34% in 2021 to 48% in 2022. The electric Utility EDM is delivering over 30,0000 new connection per year in addition to over 100,000 new off grid connections. The country struggles with an underdeveloped transmission and distribution network, lack of financing, and a complicated bureaucracy involved in developing new power projects. Near future energy demand will be driven by industrial and urban areas, as most of the population cannot afford current tariffs even though they are highly subsidized. To mitigate the cost of expanding the grid to rural areas, the Government of Mozambique has made rural electrification development a priority led by the Mozambique Energy Fund Institute (FUNAE), which focuses on small, off-grid projects of less than 10MW.

Electricidade de Moçambique (EDM) is the sole electrical utility in the country. EDM sells power at a loss being forced to subsidize tariffs to disadvantaged residential consumers, a strategy deemed unsustainable but politically popular. EDM is making considerable structural and operational changes, especially in loss reductions. This transformation could bring major opportunities for U.S. companies that provide automation technologies and other ICT solutions. According to national statistics a third of EDM’s customers, who are concentrated in the south of the country, generate 65% of EDM’s national revenue.

Mozambique is a net exporter of energy to countries in the Southern African Power Pool (SAPP) – South Africa being the largest importer. The government view energy exports as a key driver of the Mozambican economy, having passed a new electricity law that simplifies permitting and encourages IPPs activities. The government also passed a law exempting VAT on the import of electrification equipment.

The first Independent Power Projects (IPPs) in Mozambique came online in 2015. These projects have paved the way for future IPP negotiations and, more recently, the standardization of tendering documents. Given EDM’s weak financial capabilities, future IPPs will continue to rely on development banks for financing. EDM and Mozambique support the development of renewable energy projects, having launched public tenders for solar and wind projects, the country is also exploring battery storage solutions.

The largest power generation plant in the country is the Cahora Bassa hydro dam, operated by the government owned Hidroeléctrica de Cahora Bassa (HCB). HCB sells 65% of its existing generation to South Africa, and the remaining 35% is sold to the northern regions of Mozambique and to Zimbabwe. HCB’s operations are located on the Zambezi River in Tete Province.

Mozambique recently commissioned several gas thermal plants, the latest of which is a 420MW Combined Cycle Generation plant expected to start operating in 2024. According to BMI Research, gas-based generation is expected to increase by 18.1% annually through 2025. Mozambique’s first utility-scale solar power plant, a photovoltaic plant with a capacity of 40MW, was commissioned in Zambezia Province in 2019. There are numerous other renewable energy projects in development also expected to have significant growth over the next decade.

In May 2023 the government announced the strategic partner to develop the new 1500MW hydro powerplant Mphanda Nkuwa. This consortium is being led by French company EDF.

Mozambique has frequent power shortages mainly due to extreme weather events, forcing EDM to resort to expensive emergency power solutions. This creates another opportunity for U.S. companies providing emergency and backup generation solutions.

Finally, the government approved a new Electricity Law that simplifies permitting and concession processes for power generation projects particularly for off grid projects up to 10MW. This new law should boost private sector participation in power generation.

Power Africa is a market-driven, U.S. Government-led public-private partnership aiming to double access to electricity in Sub-Saharan Africa. It offers tools and resources to private sector entities to facilitate doing business in sub-Saharan Africa’s power sector. The Electrify Africa Act of 2015 Institutionalized Power Africa. Learn more about the full Power Africa toolbox or other opportunities offered by Power Africa.

Leading Sub-Sectors

· Supply of equipment and services:

· Turbines, engines

· Generators

· Cables and electrical components

· Substation components

· Transmission line components

· Engineering, procurement, and construction (EPC) services

· Financing and insurance services

· Solar panels and wind turbines

· Grid management software

· Smart metering systems

Opportunities

Mozambique’s domestic energy demand is increasing steadily and is expected to continue rising as the country industrializes. The Southern African Development Community (SADC) member countries are expected to have higher demand for power that could be met with Mozambican exports.

Transmission

The Mozambique-Zambia Interconnector will link the Mozambican and Zambian grids with two 400KV high-voltage alternating current (HVAC) lines at an approximate cost of $313 million.

The Mozambique – Malawi interconnector at cost of $154 million funded by the World Bank, the European Bank, and the German state-owned bank KfW will help connect Malawi to SAPP through the existing grid in Mozambique.

Generation

- Mphanda Nkuwa Dam will be located downstream from Cahora Bassa on the Zambezi River and will have a capacity of 1,500MW.

- The Renewable Energy Auctions Program in Mozambique (PROLER), developed with support from the European Union, is expected to conduct phased launches solar and wind project tenders in the 30-50MW range.

Distribution

- Theft monitoring systems

- Commercial and technical losses reduction solutions