FTA Tariff Tool User Guide

Using the FTA Tariff Tool

Using the FTA Tariff Tool to find tariff information for your product is quick and easy. Enter some information about what you’re trading, choose the product you’re interested in, and then get the results with tariff and rules of origin data.

Enter Your Information

You just need three pieces of information you probably already have:

- Are you importing or exporting the product?

- Which FTA partner are you trading with?

- What is your product’s HS code?

Importing or Exporting?

If you are importing goods from an FTA partner into the United States:

For importers, the U.S. International Trade Commission’s HTS Online Reference Tool is a useful tool for helping to determine the U.S. tariff classification of your product. Alternatively, the Census Bureau has developed a cross-reference of everyday terms to the more specific six-digit HS codes, along with phone support if the database does not work. However, please note that the tariff classification for imports is ultimately determined by U.S. Customs and Border Protection.

If you are exporting goods from the United States to an FTA partner:

If you are exporting, you will need to know the HS code for your product. The U.S. Census Bureau’s Schedule B Search Engine is a useful tool for determining where your product fits into the tariff nomenclature. While the Schedule B number for your product may not be identical to the HS code in the FTA partner country, exporters can use them to help approximate the HS code. The CustomsInfo Database is a useful tool for determining the FTA partner’s HS code for your product. However, please note, the ultimate classification of your good will be determined by the customs authority of the importing country.

FTA Partners

The U.S. has 14 FTAs with 20 countries which comprise about 40 percent of U.S. goods’ exports.

Your HS Code

The Harmonized System (HS) code is a standardized number used to classify a product and may vary in length by country. Globally, countries harmonize their tariff schedules to the first six digits of the HS code. Beyond the first six digits, countries are permitted to assign longer codes for further classification. For this reason, often the code assigned by the United States for a particular product is not exactly the same as the code assigned by an FTA partner.

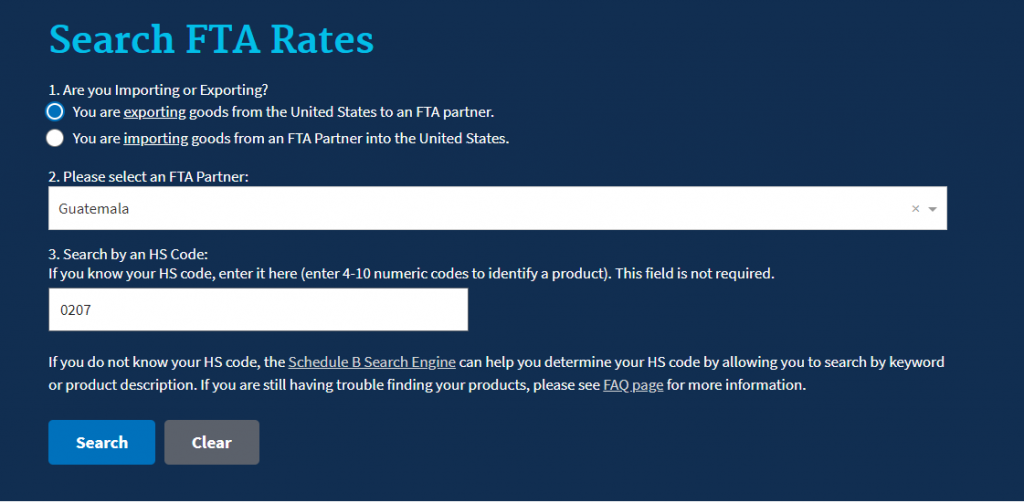

The Search Menu

On the “FTA Tariff Tool” search page, select the direction of trade (exports or imports), the name of the U.S. FTA partner, and the HS code of the product you are searching for.

Choose the Product You’re Interested in

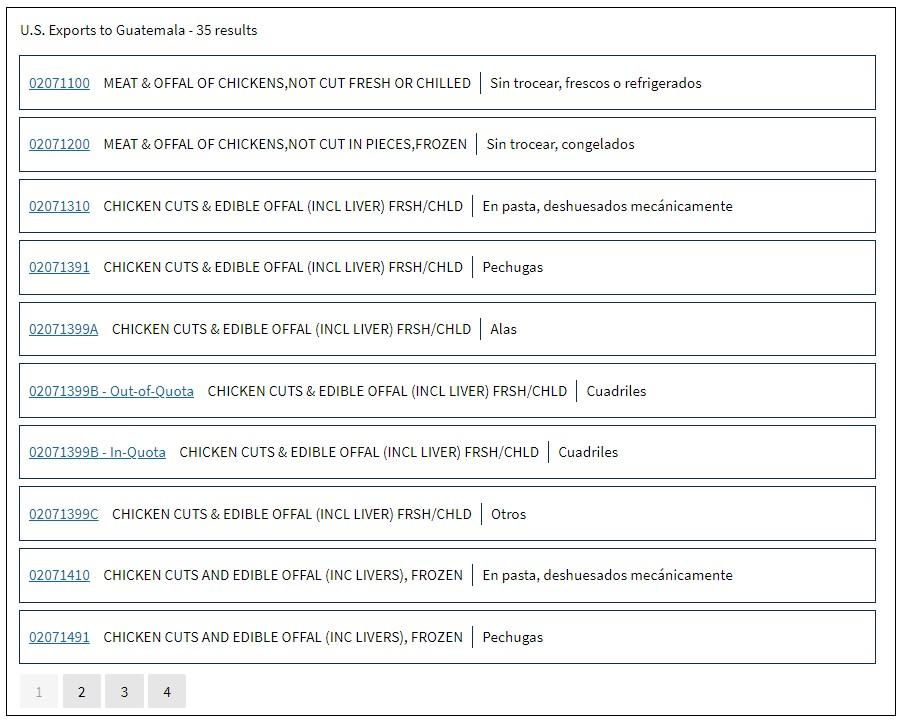

The search results show products that meet your initial search criteria.

The search results will display:

- The U.S. or FTA partner’s HS code

- A general subheading description for the group of products under which the product falls

- The national tariff line description.

NOTE: Subheading descriptions in English are added for reference. The national tariff line descriptions are based on the national tariff schedules of the FTA partners and can be in a different language. For goods subject to tariff-rate quotas, the in- and out-of-quota tariff information are displayed separately.

For more information, click on the link that applies to your product.

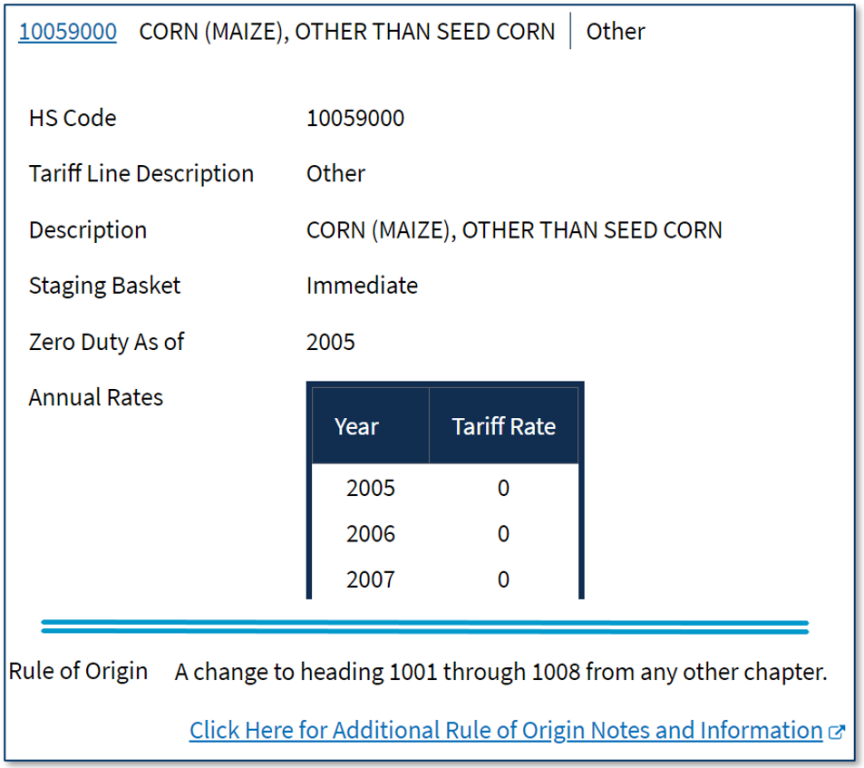

Get the Results with Tariff and Rules of Origin Data

Once you click on a product, the full HS code, description, staging basket, and product-specific rules of origin of the product are displayed.

The tariff phase-out schedule of the product from the base rate (pre-FTA tariff) to complete elimination will be provided in a table.

If you have any questions or comments about the FTA Tariff Tool or importing/exporting between the U.S. and a U.S. FTA partner, please contact FTATariffTool@trade.gov.

FTA Tariff Tool

This tariff search tool allows users to find tariff information on all products covered under U.S. Free Trade Agreements (FTAs).