China Growth in Food and Beverage Franchises

Opportunities

-

Most F&B revenue in China is generated by non-franchised establishments, leaving an opportunity for growing franchised brands.

-

According to the China Chain Store & Franchise Association, China’s food and beverage (F&B) sector reached approximately $595 billion in 2019, a 7.8 percent increase over 2018.

-

U.S. quick-service restaurant (QSR) franchises in China remain strong but face increased competition from Chinese franchises in such categories as leisure drinks and “hotpot” restaurants serving takeout meals.

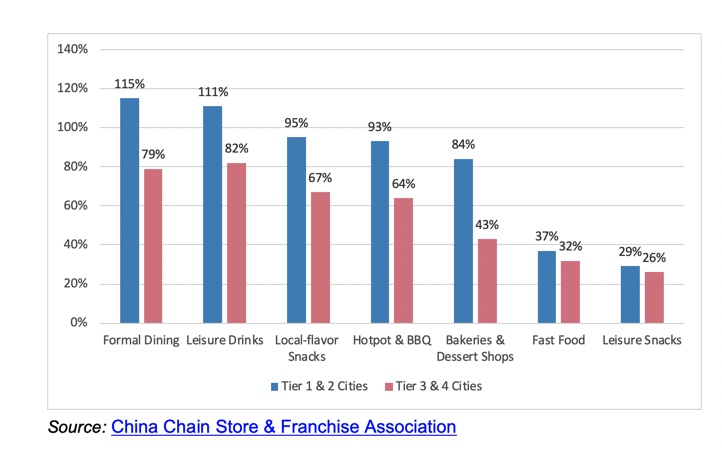

- Franchisors may find less competition in China’s smaller and less developed Tier 3 and Tier 4 cities.

-

The graph below compares the growth rate of new franchise stores between the larger and smaller cities in China. The stories are grouped by category: formal dining, leisure drinks, local-flavor snacks, hotpot and BBQ, Bakeries and desserts, fast food, and leisure snacks.

Annual Increase in New Franchised Stores in China: 2018-2019

Challenges

-

Economic Slow Down: The F&B restaurant sector is one of the industries hardest-hit by the COVID-19 pandemic. Almost all restaurants experienced a sharp revenue decrease in the first quarter of 2020.

-

Local Franchise Chains: Chinese brands have taken the majority of the market in the Leisure Drinks, Local-flavor Snacks, and Hotpot & BBQ subsectors.

Best Prospects:

- Bakeries and Desserts: Opportunities exist for U.S. bakery and dessert concepts, including breads, cakes, and sandwiches, in China’s Tier 3 and Tier 4 cities.

Additional Resources

Major Companies: Local and regional products and franchise brands gaining popularity in China.

- Bakeries & Dessert Shops: Paris Baguette

- Leisure drinks: Yidiandian Tea

- Leisure snacks: Zhengxin Chicken Steak

- Local-flavor snacks: Juewei Duck Neck

- Hotpot & BBQ restaurants: Xiaolongkan Hotpot and Haidilao

Leading Consumer Rating Apps: Chinese-language Android/iPhone apps that review restaurants.

- Dianping

- Koubei

- Meituan

Key Organizations: Chinese business associations.

Major Trade Shows: Events listed are supported by the U.S. Commercial Service China Office.