Environmental Technologies Industry Overview

Environmental Technologies Industry Overview

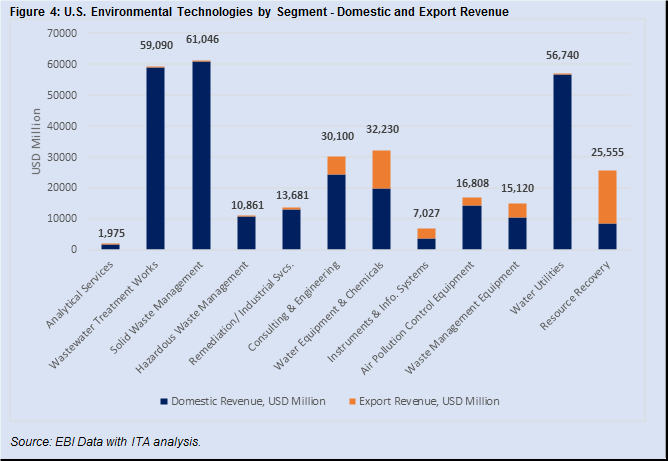

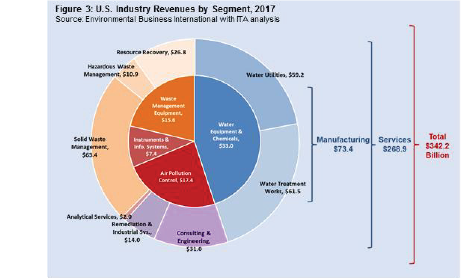

The global market for environmental technologies goods and services reached $1.12 trillion in 2017. The United States hosts the largest single market, accounting for approximately a quarter of the global market. The U.S. industry is a leader in the sector, yielding $342.2 billion of revenue in 2017. U.S. environmental companies exported $47.8 billion worth of goods and services and maintained a trade surplus of $26.9 billion in 2015 (the most recent year data were available). The U.S. industry for environmental technologies employs approximately 1.6 million people.

Understanding Global Environmental Markets

Before a government strategy to address the opportunities and challenges to environmental technology exports can be developed, a common definition of the environmental technology industry must be established. This is particularly important for environmental technologies, since the term could include any permutation of goods and services that might fall under the nebulous category of being environmentally friendly or beneficial. In practice, producers of environmental technologies have a clear definition for their sector. From an industry perspective, environmental technologies are defined as all industrial goods and services that:

- Foster environmental protection and physical resource efficiency in industrial settings;

- Generate compliance with environmental regulations;

- Prevent or mitigate pollution;

- Manage or reduce waste streams;

- Remediate contaminated sites;

- Design, develop and operate environmental infrastructure; and

- Afford the provision and delivery of environmental resources.

Environmental technologies generally are categorized by the three environmental mediums they are designed to protect or provide: water (blue), air (red), and soil (orange).

Rules Supersede Needs in the Global Market for Environmental Technologies

These markets are not driven by environmental needs, like the lack of potable water, nor are they driven by conservation philosophies, such as the desire to protect natural resources for future generations. Instead, markets for environmental technologies are driven by environmental regulations. Specifically, environmental markets develop in settings where the cost of non-compliance with environmental rules exceeds that of compliance. The health of a market is determined by a functional system of enforcement.

In the absence of enforcement, compliance failures negate the implementation and maintenance of environmental protection systems regardless of the scope of environmental challenges in a market. A recent example of this is air pollution control in China. The Chinese government passed its first air pollution control law in 1987 followed by revisions in 1995, 2000, and 2015. Weaknesses in the earlier statutes that fostered the absence of an effective enforcement mechanism led to China’s pervasive and widely reported air pollution problems. Data from the U.S. Embassy in Beijing show that from April 2008 to March 2014, only 25 days qualified as “good” air quality days using U.S. standards. The implication for export promotion is that needs-based approaches fail to accurately anticipate market opportunity. While regulatory enforcement incentivizes environmental markets, finance ultimately is the catalyst for market growth and development. Environmental technology markets fail to accelerate without resources to fund public-sector environmental infrastructure projects and private-sector environmental compliance requirements.

Resource Scarcity is an Emerging Driver of Environmental Technologies

Resource scarcity and the corresponding demand for resource efficiency are important drivers of environmental technology markets. Since environmental resources play an integral role in industrial production, their value as an input creates demand for technology that enables their efficient use and reuse. An example of this relationship is the boom in investment and development of water treatment and reuse technologies for the recovery of natural gas through hydraulic fracturing. The productive value of a cubic meter of water in the hydraulic fracturing process is estimated to be about $1.54. Comparatively, a cubic meter of water used in agriculture has a productive value of approximately $0.13, demonstrating that investments in water efficiency enhance profits for natural gas producers. Between 2005 and 2012, the Office of Energy and Environmental Industries at the International Trade Administration estimates that U.S. venture capital firms made $415.1 million in R&D investments for new treatment technologies aimed at promoting the reuse of produced water and better managing the cost of process water in extractive industries, based on publicly reported venture capital deals.

Similarly, the recycling industry is predicated on the price of materials and the cost of non-virgin materials as productive inputs. Historically, as the price of virgin materials has risen along with energy and other associated costs, the demand for recycled materials has grown along with the technologies required to produce them. This effect is compounded by the overall scarcity of materials.

Capital efficiency and the demand for industrial hygiene also can drive demand for environmental technologies. An example is the requirement for mercury removal in natural gas-fired power plants, since even low levels of mercury in the fuel stream can destroy heat exchangers and other essential equipment.

Demand for resource efficiency-driven environmental technologies is expected to increase as resource scarcity is compounded by demographic, social, and ecological trends, including climate variability, population growth, urbanization, per capita income growth, and changes in consumption patterns.

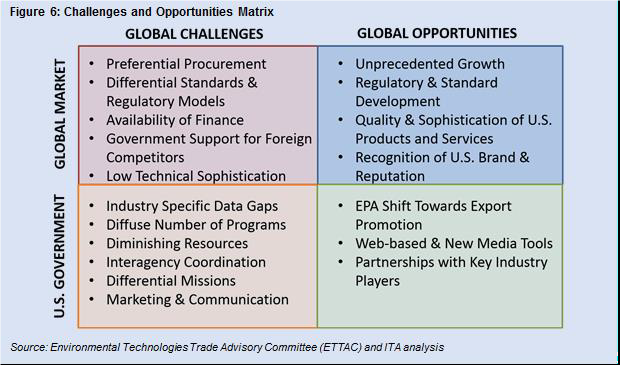

Challenges for U.S. Environmental Technologies and Services Abroad

The United States hosts a comparatively advanced and sophisticated environmental technologies industry. The U.S. brand is highly valued in global markets. U.S. environmental products are recognized for their excellence in innovation, engineering, and durability. Global buyers recognize the U.S. brand for the services associated with U.S. environmental technologies, which emphasize long-term business and engineering relationships over short-term sales opportunities. Despite the recognized excellence of the U.S. industry, companies face a variety of challenges in the international market.

1. Business Time Horizons

The time horizon for fostering a business relationship that leads to the sale of an environmental system typically is one to five years. For international markets, this translates into substantial corporate investment in time and resources to develop business partnerships. It also leads to statistics indicating relatively poor success in U.S. export promotion activities and a correspondingly diminished interest within government to support programs for the industry. The success horizon often exceeds the typical three-year limit for harvesting results from U.S. export programs.

2. Preferential Procurement Practices and Cost/Quality Trade-offs

The sophistication of U.S. products coupled with the cost of production in the United States has a corresponding effect on price. The high price differential for U.S. technologies and systems can negate competitiveness in low-income markets. U.S. products may also be passed over in the short-term for lower-cost and less durable alternatives despite the long-term operational cost competitiveness of U.S. products. Similarly, preferential procurement practices that favor domestic competitors or competitors from aid-donor countries can create an overall environment of unfair competition for U.S. companies.

3. Tariffs

Tariffs remain a substantial and limiting barrier to trade in environmental technologies. The United States Trade Representative (USTR) reports tariff peaks in environmental technologies among World Trade Organization (WTO) members of 20% for air pollution control, waste management and recycling, and monitoring and instrumentation products. Tariffs for water and wastewater products are as high as 21%. In many markets, high tariffs compound the price differential for U.S. environmental technologies, making U.S. products prohibitively expensive in many markets or eroding profitability of U.S. goods in export markets.

4. Standards, Regulation, and Certification

Beyond tariffs, substantial and often insurmountable barriers exist for U.S. companies with respect to different standards regimes, lack of regulatory compatibility, and failure to provide mutual recognition of product and professional certifications.

The United States drives innovation in part through its approach to standards, which emphasizes performance-based measures of conformity where practicable, and predicates standards and testing protocols on the principles of science, risk assessment, and cost-benefit analysis. This creates conflict in foreign markets that emphasize design-based standards models and utilize the precautionary principle in developing standards and regulation – an approach that eliminates the practicability of performance-based design, stymies innovation and narrows the field of applicable technologies to those developed within the destination market. It also imposes onerous additional fees for testing and conformity assessment to similarly performing technologies and equally rigorous professional certifications.

5. Data Gaps and Asymmetrical Market Information

Weak trade and market data have plagued the environmental technologies industry for some time. Neither the Harmonized Tariff System (HTS) nor the North American Industrial Classification System (NAICS) accurately address the breadth of technologies and services within the industry. Determining market size and opportunity is a persistent problem.

The U.S. market is large and, until recently, substantial enough to support the business aspirations of many U.S. environmental technology providers. Saturation of the U.S. market, however, coupled with explosive growth in emerging markets, makes international growth inextricably linked with companies’ growth. Small- and-medium-sized enterprises need to identify markets where their technologies are in demand and develop business relationships that will lead to future sales. The lack of market data makes it difficult to determine the best foreign market opportunities and makes it difficult for individual companies to discern where their specific products could be most in demand.

6. U.S. Government Resources and Coordination

U.S. agencies face a variety of challenges in promoting environmental exports. These challenges include a lack of resources needed to effectively conduct interagency coordination; different missions (which may subordinate export promotion as a priority); diminishing staff and budget resources for program implementation; and limited mechanisms to transmit market information to industry and individual companies.