Overview

Companies in Guatemala manufacture food products under the following categories:

- Beverages: juice concentrates powdered drinks and mixes, non-alcoholic beverages

- Preserved foods: canned fruits and vegetables, jams, jellies.

- Snacks: potato and corn chips, confectionary, nuts, seeds, and trail mixes

- Other processed foods: frozen products (tacos, tamales, pupusas), soups, condiments, sauces, bakery, deli meats, dairy products

In 2022, imports of consumer-oriented products from the United States totaled $708.4 million. The list of top 10 U.S. consumer-oriented products produced in Guatemala were:

Poultry Meat & Products ($175.6)Dairy Products ($93.3)Pork & Pork Products (80.2) Prepared Foods ($30.5) Beef and beef products ($62.9)Processed Vegetables ($62.8)Condiments & Sauces ($26.5) Fresh fruits ($19.9))Meat products NESOI ($15.3)Dog & Cat Food ($14.0)

The United States is Guatemala’s largest supplier of agricultural, food, fishery, and forestry products. In 2022, U.S. exports totaled $1.8 billion. U.S. exports of consumer ready products such as red meats, chicken, dairy products, fresh fruits, condiments, sauces, food preparations, and processed products such as baking materials are often used to improve the quality of the processed goods produced in Guatemala. Some processors use domestic inputs in processing, but consistent supplies are not available domestically and processors rely on the U.S. to supply these goods.

Guatemala is one of the major food processing countries in Central America. Domestic brands offer a wide variety of products that include shelf-stable, ready-to-eat meals such as canned and refried beans, tomato paste and sauce, soy-based ready meals, and instant noodle soups, among other products. These products are available to consumers not only in local supermarkets, but also at corner stores, and open-air-markets throughout the country. According to the Guatemalan Chamber of Food and Beverages (CGAB), in 2022, the food and beverage sector became the main productive sector with sales of $5,300 million, exporting around $2,521 million, the rest of the production is consumed locally.

The Guatemalan food processing industry exports to other countries as well and is one of the fastest growing sectors of the food industry. Among the most exported products during the second half of 2022 were different palm oils, accounting for $550 million; biscuits and bakery, prepared sauces, beverages, candies, carbonated and sugared water, preparations for soups and other parts of tuna, among other products.

U.S. food ingredient producers that want to enter the Guatemalan market may contact the local food processors directly or through local importers/agents/distributors depending on the type of product. The larger food processors usually prefer to import directly from the suppliers, while medium and smaller processors are sometimes not familiar with importing procedures and prefer to purchase inputs from a local distributor. The key to in the market is to match local prices with higher quality inputs as Guatemala is a price-conscious market. U.S. products are well known for their quality and safety; therefore, local food processors are looking for U.S. companies that can supply products that comply with these two important factors. Local companies prefer to establish long-term business relationships with U.S. suppliers that can offer good credit terms, customer service, and marketing support.

Overview of the consumer-oriented sector

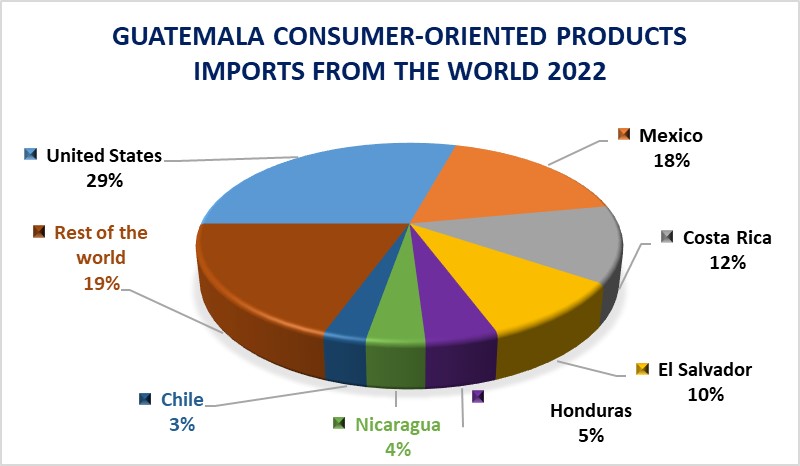

Main suppliers of consumer-oriented products to Guatemala:

Partner | January - December (Value: USD); 2022 |

World | $ 2,806,007,428 |

United States | $ 820,992,064 |

Mexico | $ 498,175,252 |

Costa Rica | $ 349,286,058 |

El Salvador | $ 277,011,740 |

Honduras | $ 130,945,398 |

Nicaragua | $ 105,029,069 |

Chile | $ 78,079,899 |

Rest of the world | $ 546,487,948 |

Source: Trade Data Monitor ((https://www.tradedatamonitor.com)

Leading Sub-Sectors

- Chocolate and Confectionary

- Condiments and Sauces

- Food preparations (protein concentrates, ingredients & beverage bases, baking inputs)

- Prepared/Preserved Meats

- Processed vegetables (French fries, canned vegetables)

- Dairy products (cheeses, whey protein, cream & powdered/condensed milk)

- Snacks (mixes of nuts, baked snack foods)

Processed meats

Since the pandemic, Guatemalan consumers have increased their purchases of processed meats, especially those products that have a longer shelf life such as canned tuna, canned beef, and canned chicken meat, as well as other ready-to-cook products. The larger beef and chicken meat processors adapted to new consumer demand for ready-to-cook products and expanded their production lines of products such as patties and breaded and seasoned meats. In Guatemala, meat sales are more typically made in butcher’s shops or at farmer’s markets, where products usually do not have a specific brand and prices are lower than those sold at grocery stores. As for chilled meats in grocery stores, ham and sausages are very popular, as they are considered proteins at affordable prices that are easy to prepare.

Bakery Products

Guatemala is the largest market in Central America for U.S wheat and is the only country in the region that produces wheat, estimated at 8,000 MT annually; however, the local production does not compete with wheat imports from the United States. Guatemala has an estimated per capita consumption of baked goods of 40 kg. Bread is one of the main products included in the Guatemalan basic food basket and consumers eat artisanal baked breads known as “pan frances” (French bread), and “pan dulce” (sweet bread) as products that complement daily meals. Bread is mostly sold through typical bakeries which are small, family-owned businesses and are usually located close to neighborhoods throughout the country. Other foodservice companies opened larger stores which are a combination of gourmet bakeries and restaurants that offer both services in one place.

Dairy Products In 2022, Guatemala’s imports of U.S. dairy products reached a record high of $93.3 million, an increase of 45 percent from 2021. The products with the largest sales in the Guatemalan market include milk (fresh, UHT, powdered); butter; cheese (processed, fresh); yogurt; cream (heavy cream, sour cream, etc.); ice cream; whey, and casein (for the dairy processing industry). Although purchasing power in Guatemala has been reduced due to the increasing food prices, products such as milk (fresh/powdered); cheeses (fresh); and cream (heavy cream); are within the 34 products included on the basic food basket.

Web Resources

U.S. Department of Agriculture, Foreign Agricultural Service in Guatemala: https://fas.usda.gov/

Search engine for USDA reports 2023: https://gain.fas.usda.gov/ which includes reports updated annually such as Food and Agricultural Import Regulations, Exporter’s Guide, Retail Report, and Food Processing Report.

Shows

2nd Convention of the Food & Beverage Industry: The second edition of the International Convention of the Food and Beverage Industry is a space where topics of interest to the sector will be presented with high-level international speakers to promote a favorable business industry. Companies will be able to consolidate their position in the national and regional market through the exposure of their brands, corporate image and the quality of their products. In addition, suppliers, marketers and investors, who want to generate new opportunities, will be able to use this space as a platform and boost their businesses to another level.

For more information visit https://convencionalimentosybebidas.com/

Feria Alimentaria: This is the largest food show in Guatemala with approximately 200 stands with local companies that exhibit and promote food products, services, packing, and equipment for the restaurant and hotel industries. The show is also used to address end consumers, introducing new products into the market. During the show there are chef competitions and cooking presentations.

For more information visit: www.feriaalimentaria.com

Contact Information

Interested parties may contact Agricutural Specialist Karla Tay at KayTM@state.gov